Massachusetts Restricted Endowment to Religious Institution

Description

How to fill out Restricted Endowment To Religious Institution?

If you require to compile, retrieve, or create sanctioned record templates, utilize US Legal Forms, the most extensive assortment of legal documents available online.

Employ the site's straightforward and user-friendly search to obtain the documents you seek.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, print, or sign the Massachusetts Restricted Endowment to Religious Institution.

- Utilize US Legal Forms to acquire the Massachusetts Restricted Endowment to Religious Institution with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to find the Massachusetts Restricted Endowment to Religious Institution.

- You can also find forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

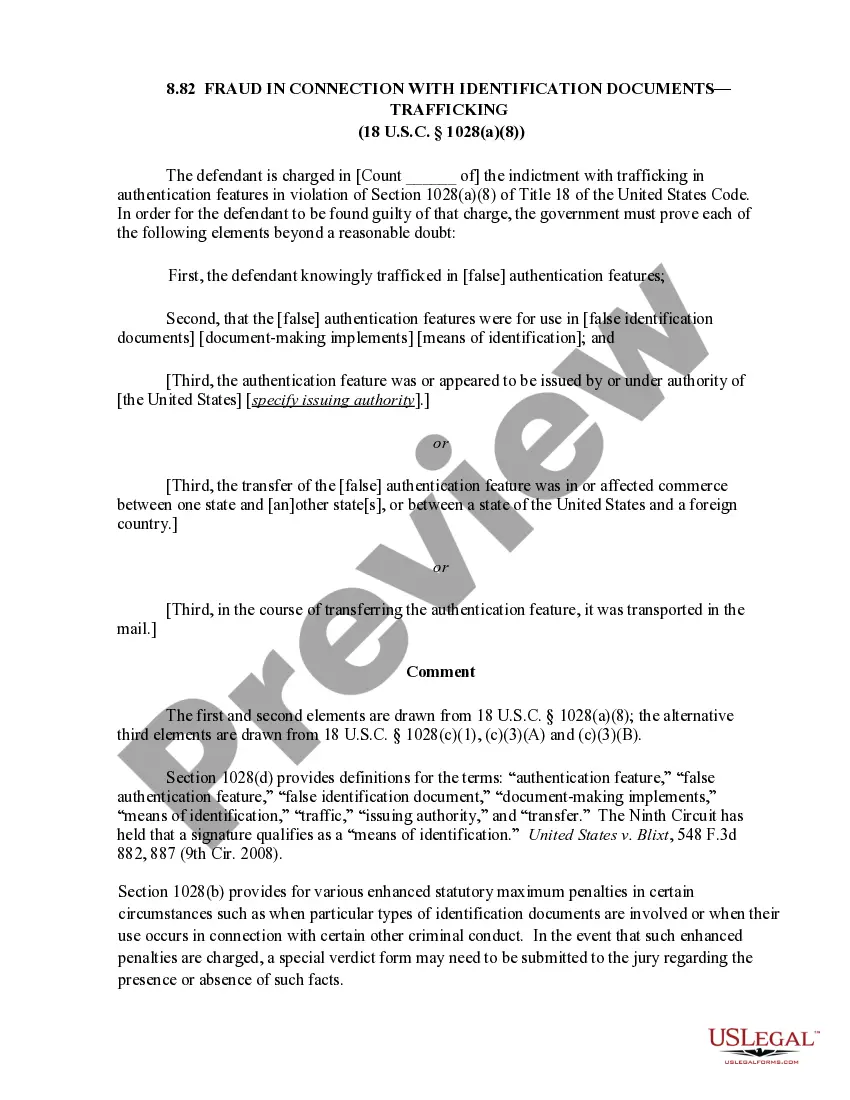

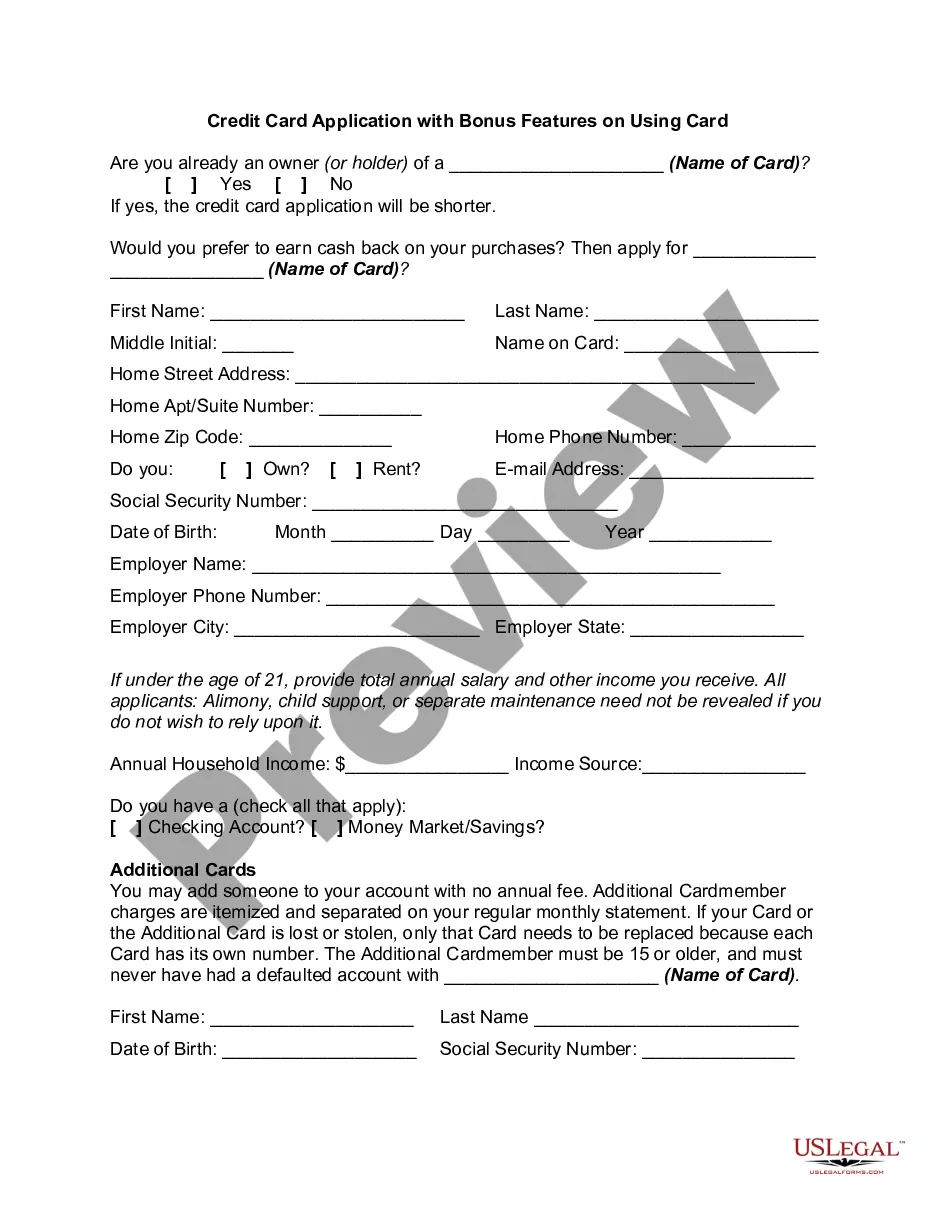

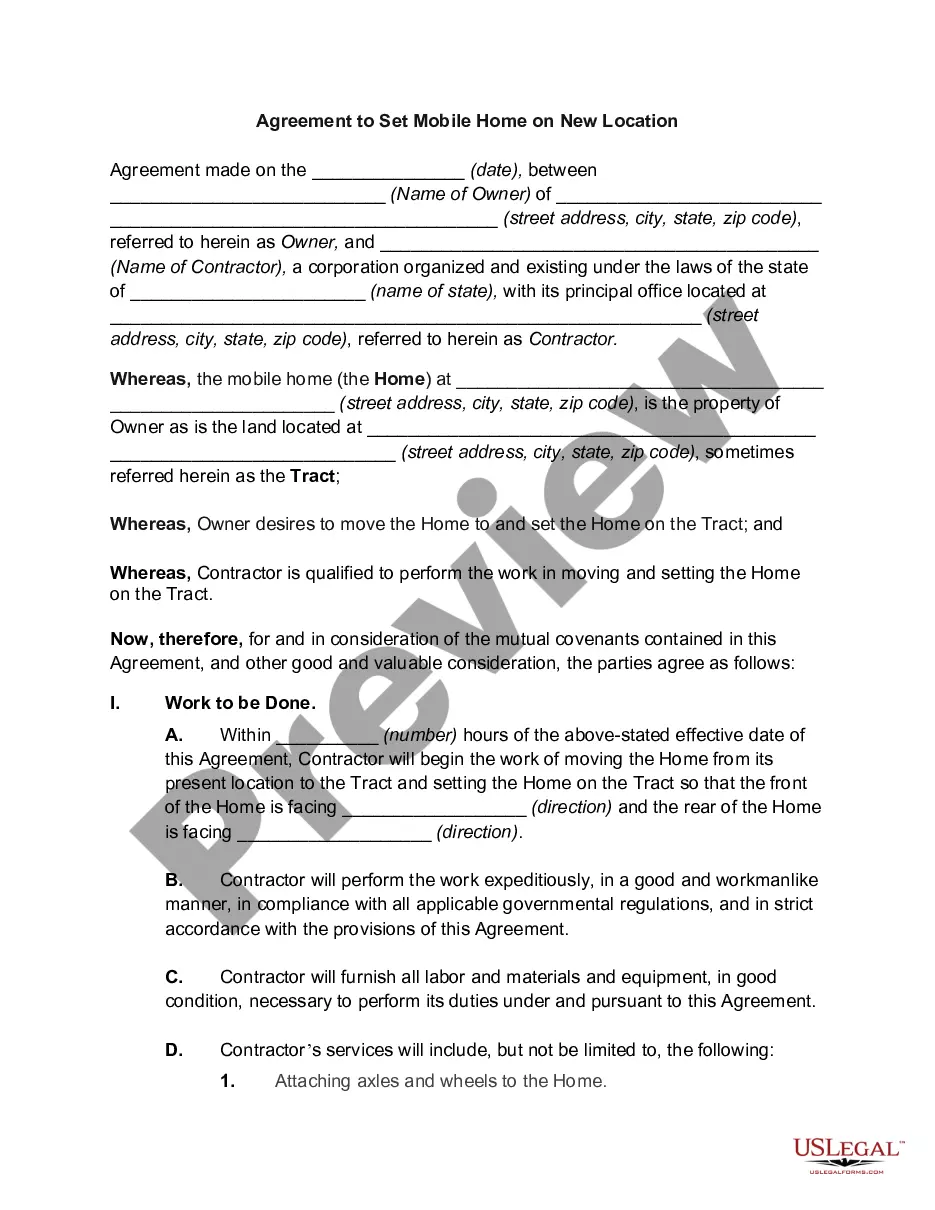

- Step 2. Use the Preview option to review the content of the form. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternate versions of the legal form format.

Form popularity

FAQ

The Upmifa endowment refers to the Uniform Prudent Management of Institutional Funds Act, which outlines the management of endowed funds, such as the Massachusetts Restricted Endowment to Religious Institution. This law allows institutions to spend from their endowed funds while ensuring long-term growth and sustainability. Essentially, Upmifa establishes guidelines that protect the principal amount of the endowment while enabling organizations to use a portion of the funds for their immediate needs. Understanding this act is crucial for religious institutions seeking to navigate the complexities of fund management.

The good funds statute in Massachusetts mandates that certain real estate transactions can only close with verified funds. This law aims to protect all parties involved in these transactions. For those managing a Massachusetts Restricted Endowment to Religious Institution, navigating this statute is essential to ensure that funds are handled properly during property dealings.

The Massachusetts Special Purpose Stabilization Fund serves to provide financial assistance for specific types of projects or needs within local governments. It can enhance financial stability, particularly for religious institutions like a Massachusetts Restricted Endowment to Religious Institution. Organizations looking to apply can utilize platforms like uslegalforms to streamline their application process and ensure compliance.

In Massachusetts, investment income is typically subject to state income tax. The tax rate can vary depending on the type of income, which is crucial for religious institutions managing a Massachusetts Restricted Endowment. Understanding these tax implications can help organizations strategize their investments and protect their financial health.

In Massachusetts, churches generally qualify for tax-exempt status as religious organizations. This exemption applies to property taxes and certain income tax aspects. Thus, if you are managing a Massachusetts Restricted Endowment to Religious Institution, your church can benefit from these tax advantages, aiding in the effective allocation of resources.

The Uniform Prudent Management of Institutional Funds Act (Upmifa) outlines several key factors for managing endowment funds responsibly. Among these factors are the purpose of the fund, the economic conditions affecting investments, and the investment policies of the institution. For those involved with a Massachusetts Restricted Endowment to Religious Institution, understanding Upmifa is crucial to ensure compliance and effective fund management.

The two fundamental types of endowments are restricted and unrestricted endowments. Restricted endowments come with specific conditions from donors, ensuring that funds are used for designated purposes. Unrestricted endowments allow organizations greater flexibility in using the funds as needed, which is crucial for the operations of initiatives, such as a Massachusetts Restricted Endowment to Religious Institution.

The three types of endowments include permanent, term, and quasi-endowments. A permanent endowment is held indefinitely with restrictions, while a term endowment lasts for a specific period before becoming unrestricted. Quasi-endowments are internally designated funds that an organization can decide to spend or reinvest, often related to a Massachusetts Restricted Endowment to Religious Institution.

Endowment funds work by investing the principal amount, allowing the organization to draw income from the earnings. Typically, a portion of the earnings is spent to support institutional goals while the rest is reinvested to grow the endowment. For instance, a Massachusetts Restricted Endowment to Religious Institution must ensure that it adheres to the donor's guidelines while effectively managing the fund's growth.

Restricted contributions are donations limited by the donor for specific purposes, while unrestricted contributions can be used freely by the organization. This distinction is crucial for organizations like those with a Massachusetts Restricted Endowment to Religious Institution, as these funds must be allocated according to the donor's intentions. Understanding these differences aids in effective financial planning and stewardship.