Massachusetts Bylaws for Corporation

Description

How to fill out Bylaws For Corporation?

You can spend hours online looking for the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can obtain or print the Massachusetts Bylaws for Corporation from my service.

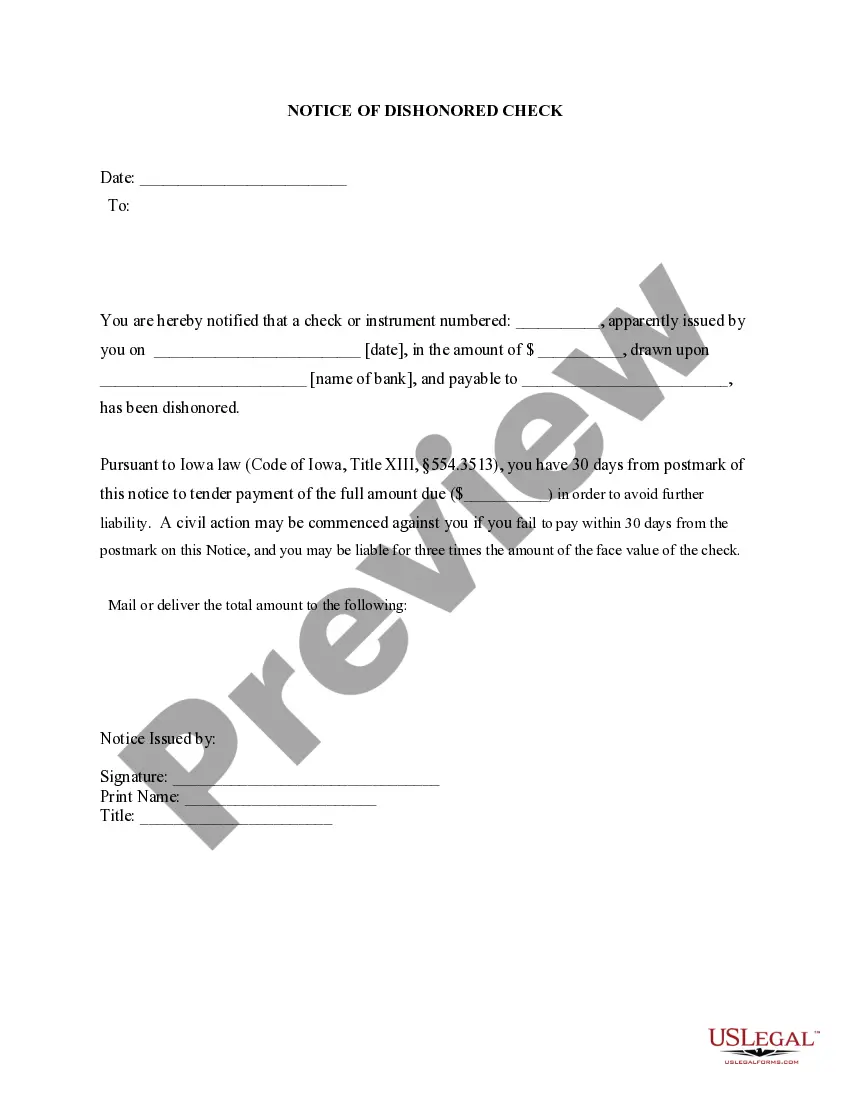

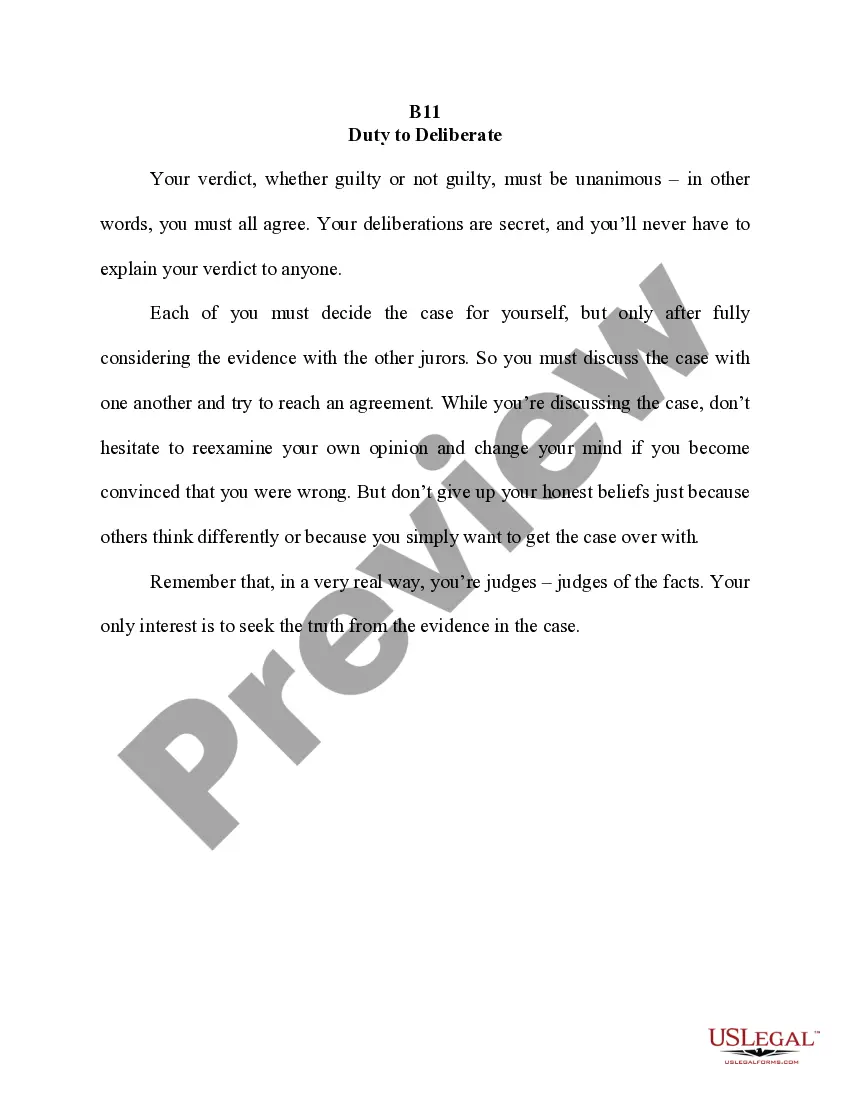

If provided, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Massachusetts Bylaws for Corporation.

- Each legal document template you purchase is yours permanently.

- To get another copy of a purchased form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the appropriate document template for the county/city of your choosing.

- Check the form details to make sure you have selected the correct form.

Form popularity

FAQ

Writing bylaws for a corporation involves several key elements. First, you should define the corporation's purpose, structure, and the roles of officers and directors. Additionally, include provisions for meetings, voting processes, and how to handle disputes. Using templates available on platforms like USLegalForms can streamline this process, helping you ensure your Massachusetts Bylaws for Corporation meet legal requirements and best practices.

To bring a corporation into existence, you must start by choosing a unique name that complies with Massachusetts regulations. Next, file the Articles of Organization with the Secretary of the Commonwealth. After that, create and adopt the Massachusetts Bylaws for Corporation, which outline the governance and operational procedures. Finally, obtain any necessary licenses and permits, ensuring your corporation is ready to operate legally.

Bylaws do not need to be filed with the IRS. However, they should be maintained in your corporation's records and kept up-to-date. Having clear bylaws can facilitate compliance with IRS regulations and assist in maintaining your corporation's good standing.

Company bylaws are generally considered internal documents and are not publicly disclosed. However, they may be shared with members and, in some cases, potential investors. Maintaining confidentiality helps protect the corporation's strategies and operations.

While bylaws are not submitted to a public office and thus not publicly available, they can be accessed by members of the corporation. This internal document plays a vital role in guiding the governance of the corporation. It’s advisable to keep them organized for members' reference.

Creating bylaws for your Massachusetts corporation involves several steps. Start by outlining the governance structure, including roles and responsibilities of your board and officers. Consider consulting services like US Legal Forms for templates and guidance, ensuring your bylaws align with state laws.

While bylaws themselves are not filed with the state and thus are not considered public records, they must be made accessible to members of the corporation. This ensures transparency within the organization. Members can request to review these bylaws whenever necessary.

If you fail to file your annual report for your LLC in Massachusetts, your company may face penalties or dissolution. The state mandates annual reporting as a means of keeping your business in good standing. It's essential to stay compliant to avoid complications or loss of your business entity status.

Yes, Massachusetts law requires corporations to adopt bylaws. These bylaws outline the corporation’s internal management structure, procedures, and processes. Not having bylaws can lead to legal complications and hinder effective decision-making within the corporation.

Bylaws for a corporation in Massachusetts are not typically filed with the state. However, they must be maintained in the corporation's records and made available to members upon request. This means that while they may not be publicly available, they play a crucial role in your corporation's governance.