Massachusetts Accounts Receivable - Contract to Sale

Description

How to fill out Accounts Receivable - Contract To Sale?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad selection of legal document templates you can download or print.

By using the website, you can find thousands of forms for business and personal uses, categorized by types, states, or keywords. You can obtain the most up-to-date versions of documents such as the Massachusetts Accounts Receivable - Contract to Sale in just moments.

If you already have a subscription, Log In and obtain Massachusetts Accounts Receivable - Contract to Sale in the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Massachusetts Accounts Receivable - Contract to Sale. Each document you added to your account does not have an expiration date and is yours indefinitely. So, if you want to download or print another copy, just visit the My documents section and click on the form you need. Gain access to the Massachusetts Accounts Receivable - Contract to Sale with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

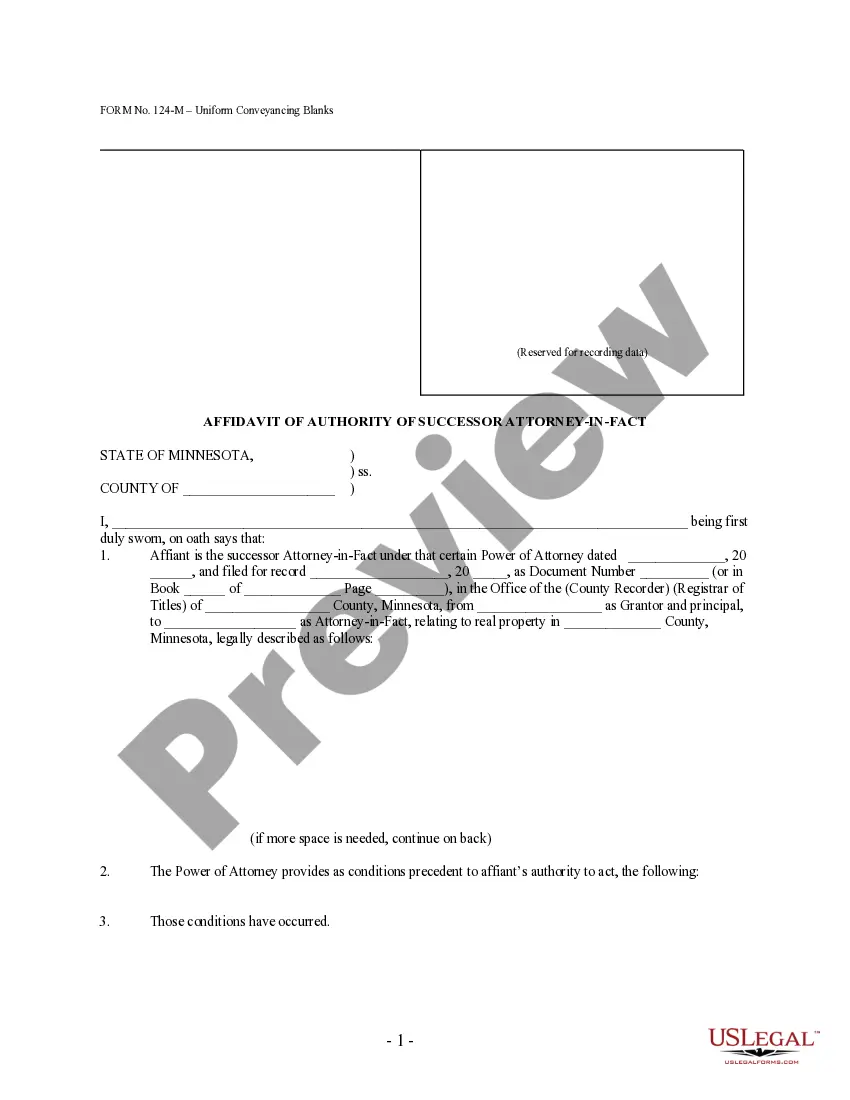

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Download now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

In Massachusetts, a contract is legally binding when it includes an offer, acceptance, and consideration. Each party must clearly understand the terms and agree to them willingly. Furthermore, the contract must be for a lawful purpose and, in some cases, must be in writing to be enforceable. If you are dealing with a Massachusetts Accounts Receivable - Contract to Sale, ensuring these elements are present will protect your interests.

With contract receivables, a business sells to a third-party finance provider the rights to receive the future contracted cash flows for delivered assets and services due under a new or existing contract that it has with one of its customers.

While all transactions are as unique as the parties involved, in most small business sale transactions the seller keeps the cash and outstanding receivables. They pay off the bills and any other outstanding payables and deliver the business free and clear of debt to the buyer.

The key difference between Contract asset and Account receivable is its conditionality i.e. Contract Asset is recognized in the Financial Statements when the right to receive the payment is conditional upon something other than just passage of time (having conditional right to receive payment).

An accounts receivable purchase agreement is a contract between a buyer and seller. The seller sells receivables and the buyer collects the receivables. An accounts receivable purchase agreement is a contract between a buyer and seller.

Factoring is when a company sells its accounts receivable to another company in exchange for cash in advance of the accounts receivable payment due date. The company pledges its rights to collect its accounts receivable to the Factor in exchange for a cash advance.

Factoring is simply selling your accounts receivables at a discount. While not for every business, it is a short-term solution ? typically two years or less ? for companies with an equally brief need for cash flow.

Most buyers don't take accounts receivable. Instead, they come with ample working capital. You'll have to offer them a debt-free company for them to finalize the deal. This translates to retaining accounts receivables and paying off payables.

Asset sales Normalized net working capital is also typically included in a sale. Net working capital often includes accounts receivable, inventory, prepaid expenses, accounts payable, and accrued expenses. Within IRS guidelines, asset sales allow buyers to ?step-up? the company's depreciable basis in its assets.

A receivable purchase agreement is a contract between a seller and a financial institution that allows the seller to sell unpaid invoices from buyers to the financial institution. This means that the seller can enable cash flow until payment is received from the buyer.