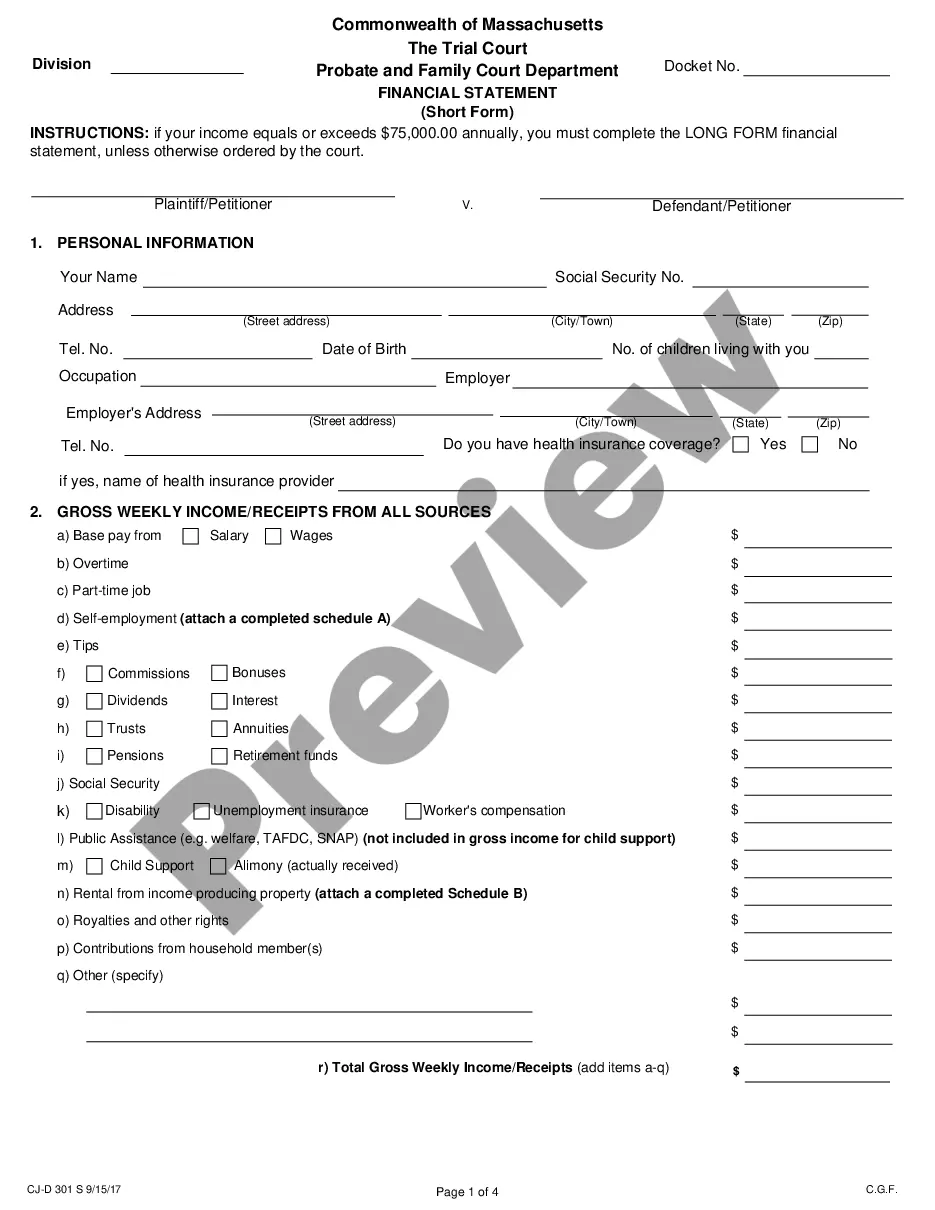

Massachusetts Financial Statement (Schedule B) is a document used to report financial information to the Commonwealth of Massachusetts. It is prepared by an individual or business when filing taxes with the state. It includes information about income, deductions, and credits, as well as information about a business’s assets, liabilities, and net worth. The information reported on the Financial Statement is used to determine the amount of taxes owed to the Commonwealth. There are two types of Massachusetts Financial Statement (Schedule B): the individual form and the business form. The individual form is used to report financial information for individuals, while the business form is used to report financial information for businesses.

Massachusetts Financial Statement (Schedule B)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Financial Statement (Schedule B)?

If you’re looking for a method to accurately fill out the Massachusetts Financial Statement (Schedule B) without enlisting a legal advisor, then you’ve come to the perfect place.

US Legal Forms has established itself as the largest and most esteemed collection of official templates for every personal and commercial situation. Each document you discover on our online platform is developed in alignment with federal and state laws, ensuring that your paperwork is correct.

One more fantastic aspect of US Legal Forms is that you never lose the documents you obtained - you can access any of your downloaded forms in the My documents tab of your profile whenever you require it.

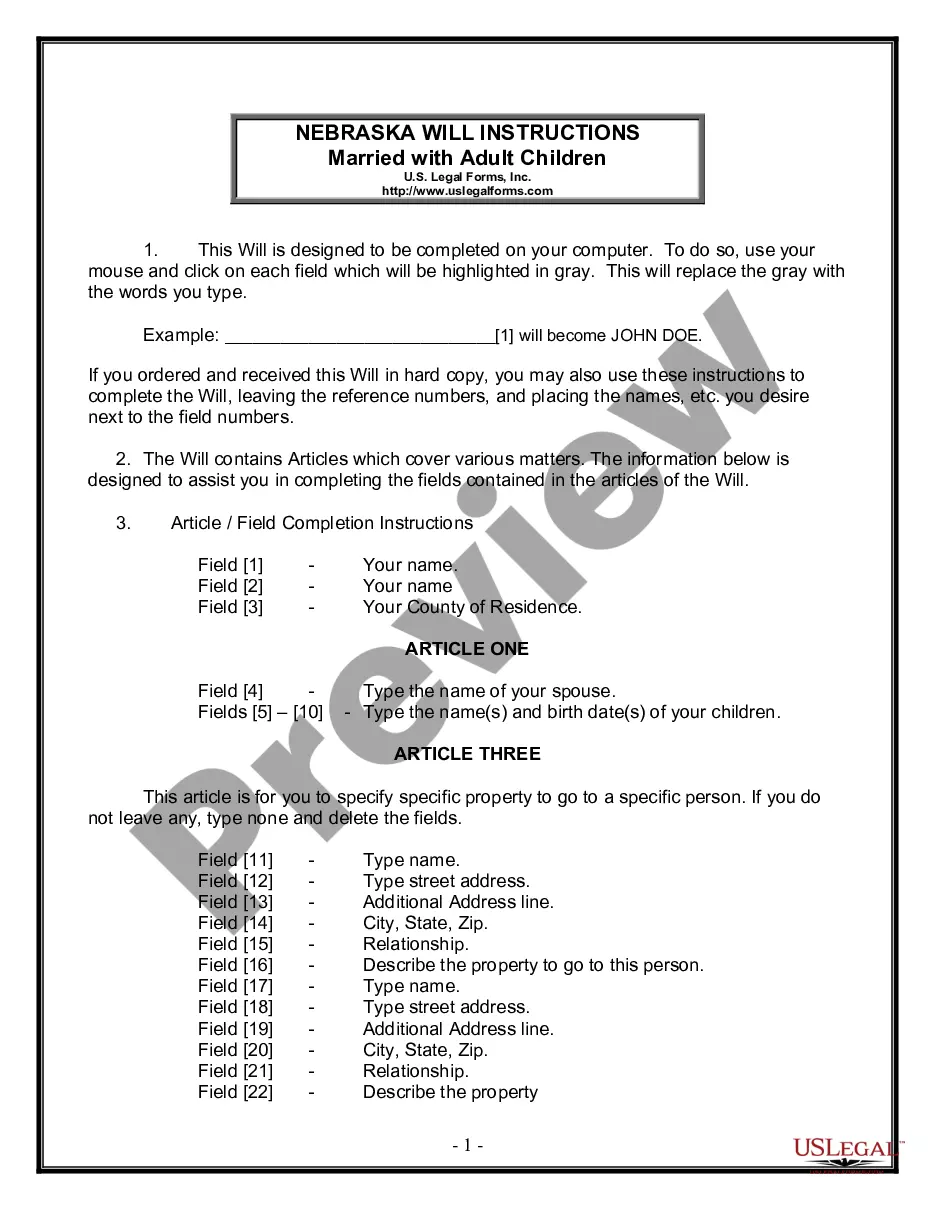

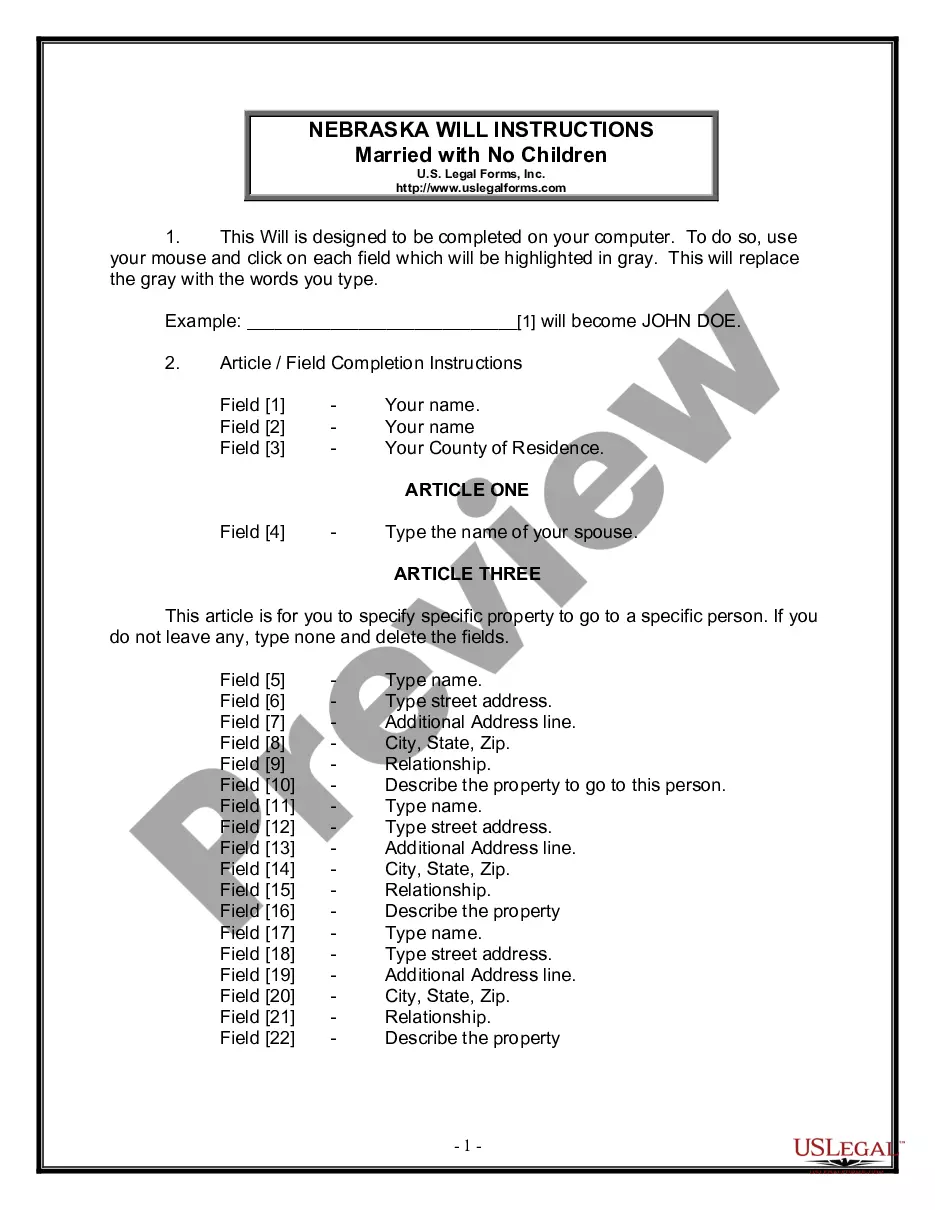

- Ensure the document displayed on the page aligns with your legal circumstance and state laws by reviewing its text description or browsing the Preview mode.

- Enter the document title in the Search tab at the top of the page and select your state from the dropdown to locate an alternative template in case of any discrepancies.

- Repeat the content verification and click Buy now when you feel assured that the paperwork complies with all requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you have not obtained one yet.

- Use your credit card or the PayPal option to settle the payment for your US Legal Forms subscription. The document will be available for download immediately after.

- Select the format you wish to save your Massachusetts Financial Statement (Schedule B) in and download it by clicking the appropriate button.

- Import your template into an online editor to complete and sign it swiftly or print it out to prepare your physical copy manually.

Form popularity

FAQ

Rule 401 in Massachusetts governs the admissibility of evidence in legal proceedings, establishing what can be considered relevant. When dealing with matters related to finances, including submissions like the Massachusetts Financial Statement (Schedule B), it is essential to ensure that all evidence complies with this rule. Understanding these regulations can help parties present their cases more effectively.

How To Fill Out the Personal Financial Statement Step 1: Choose The Appropriate Program.Step 2: Fill In Your Personal Information.Step 3: Write Down Your Assets.Step 4: Write Down Your Liabilities.Step 5: Fill Out the Notes Payable to Banks and Others Section.Step 6: Fill Out the Stocks and Bonds Section.

Tips to Help Ensure your Financial Statement is Accurate & Complete Do not estimate your monthly expenses.Make sure you account for all income.Report assets at their proper fair market value.Make sure all the assets and liabilities are accounted for.Update your financial statement.

FS stands for Financial Statement.

How To Fill Out the Personal Financial Statement Step 1: Choose The Appropriate Program.Step 2: Fill In Your Personal Information.Step 3: Write Down Your Assets.Step 4: Write Down Your Liabilities.Step 5: Fill Out the Notes Payable to Banks and Others Section.Step 6: Fill Out the Stocks and Bonds Section.

Massachusetts only has $41.5 billion of assets available to pay bills totaling $115.5 billion. Because Massachusetts doesn't have enough money to pay its bills, it has a $74 billion financial hole. To fill it, each Massachusetts taxpayer would have to send $28,100 to the state.