Massachusetts Loan Modifications

Description

How to fill out Massachusetts Loan Modifications?

Greetings to the most extensive legal documents repository, US Legal Forms. Here you can locate any example including Massachusetts Loan Modifications templates and retain them (as many as you need). Create official documents within a few hours, rather than days or weeks, without incurring significant costs on an attorney. Obtain the state-specific template in just a few clicks and feel confident knowing that it was prepared by our state-certified legal experts.

If you are already a registered user, simply Log In to your account and then click Download next to the Massachusetts Loan Modifications you desire. As US Legal Forms is an online service, you will always have access to your downloaded forms, regardless of the device you are using. View them within the My documents section.

If you do not have an account yet, what are you waiting for? Follow our instructions below to get started.

Once you’ve completed the Massachusetts Loan Modifications, forward it to your legal professional for validation. It’s an extra measure but an essential one to ensure you’re completely protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific document, verify its validity in your state.

- Review the description (if available) to determine if it’s the appropriate example.

- Explore additional material with the Preview feature.

- If the document meets all your criteria, click Buy Now.

- To establish your account, choose a pricing plan.

- Utilize a credit card or PayPal account to register.

- Save the template in the format you prefer (Word or PDF).

- Print the document and complete it with your or your business’s information.

Form popularity

FAQ

A mortgage modification can involve changing the interest rate, extending the loan term, or even adjusting the principal amount owed. For instance, if you find your monthly payments too high, a lender may lower your interest rate under Massachusetts Loan Modifications. This can make a significant difference in your monthly budget, enabling you to manage your finances better. Exploring options like these can help you avoid foreclosure and maintain homeownership.

Applying for a loan modification in Massachusetts generally involves contacting your lender to discuss your situation and expressing your desire for a modification. You will need to provide financial documentation, such as income statements and expenses, to support your request. Following this, the lender will assess your application based on their criteria. For assistance with the process and to streamline your application, explore the resources available through US Legal Forms.

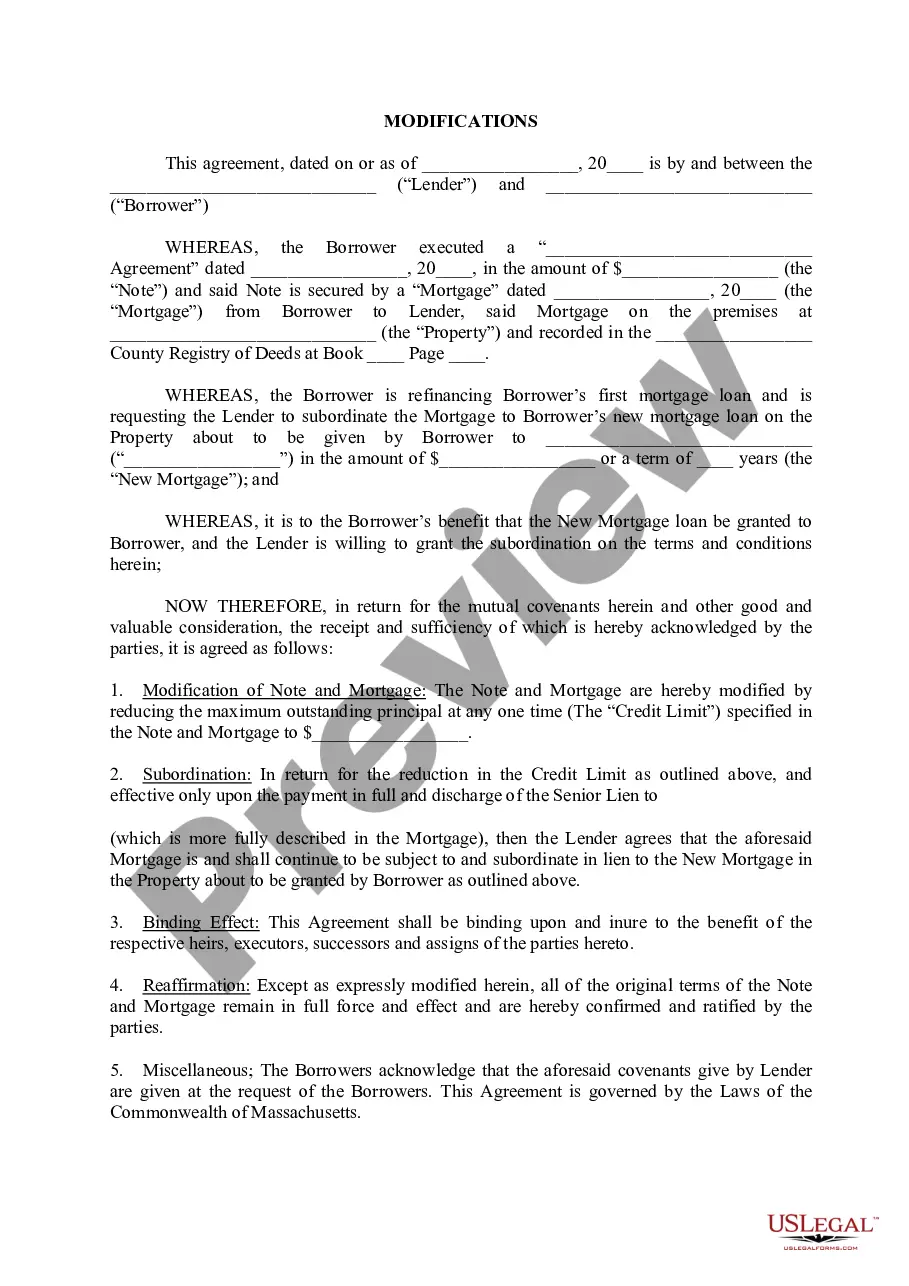

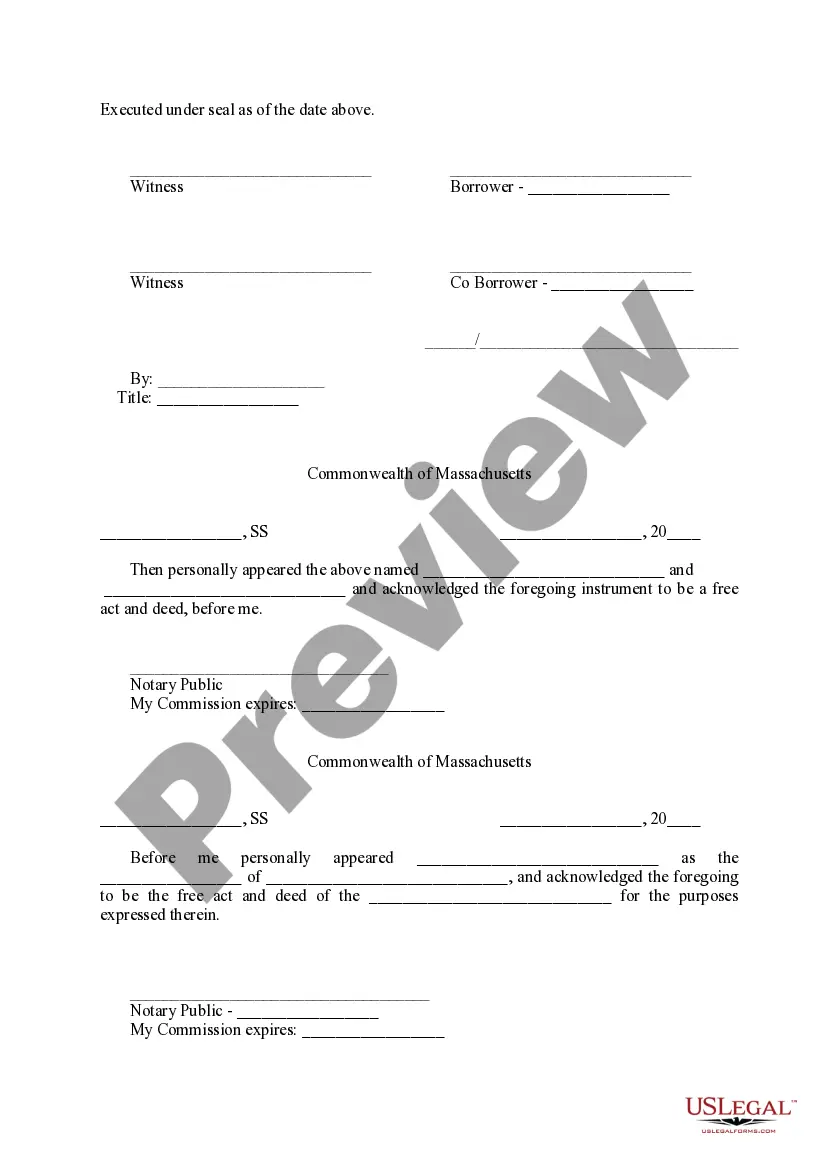

Loan modifications in Massachusetts are documented through a formal agreement between you and your lender, detailing changes to your loan terms. This documentation includes essential elements like reduced interest rates, extended loan terms, or altered payment plans. It is crucial to have this agreement thorough, as it serves as legal proof of the new conditions. Consider using US Legal Forms to access templates tailored for Massachusetts Loan Modifications.

In Massachusetts, loan modifications typically do not need to be recorded unless they alter the original mortgage terms significantly. However, it is wise to record the modification to protect your interests. This ensures that future buyers and lenders are aware of the new terms. Keeping an updated record contributes to your overall financial security.

The rules for loan modification in Massachusetts can vary widely based on the lender and specific loan type. Generally, you must provide proof of financial hardship, a comprehensive application, and possibly documentation of your income and expenses. Familiarizing yourself with the specific requirements can significantly ease the process. Those seeking assistance with Massachusetts loan modifications may benefit from platforms like uslegalforms, which can simplify the documentation needed.

While loan modifications offer benefits, they also come with some drawbacks. For instance, modifying your loan can negatively impact your credit score. Additionally, the process can be time-consuming and may require extensive documentation. It can be beneficial to understand the implications of Massachusetts loan modifications fully before proceeding, so you can navigate the complexities with confidence.

Several factors can disqualify you from obtaining a loan modification in Massachusetts. A history of missed payments, inadequate income documentation, or failing to demonstrate financial hardship can be problematic. Additionally, if you have been previously denied for a modification, it may affect your future applications. It is wise to consult professionals who can assist you in overcoming these hurdles.

A loan modification can be a good idea if you are struggling to make your monthly payments. It can provide you with lower payments or even a reduced interest rate, thus easing your financial burden. However, it is crucial to weigh the benefits against potential drawbacks. Consulting a trusted advisor about Massachusetts loan modifications can help you make an informed decision that best suits your needs.

No, loan modification and refinancing are two distinct processes. A loan modification changes the terms of your existing loan, while refinancing replaces it with a new loan. In the context of Massachusetts loan modifications, you typically adjust your payment terms to make them more manageable, without needing to qualify for a new loan as you would in refinancing. Understanding these differences can guide you in choosing the right option for your financial situation.

In Massachusetts, there is no strict limit on the number of loan modifications you can apply for in a year. However, each lender may have their own guidelines on this matter. It is important to note that repeated modifications may signal financial instability, which can impact your chances of approval. Always consider reaching out to experts who can assist you with Massachusetts loan modifications.