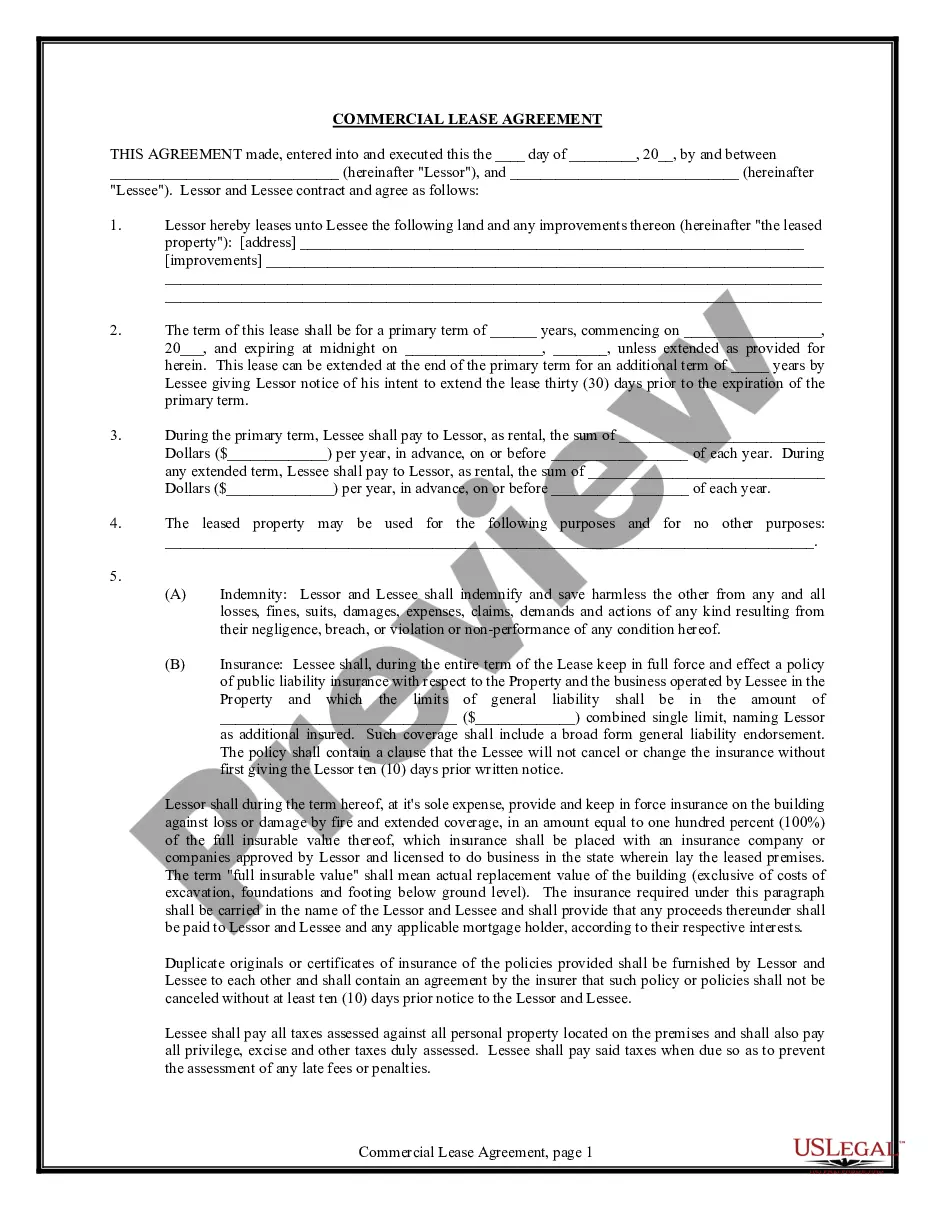

Massachusetts Commercial Building or Space Lease

Description

How to fill out Massachusetts Commercial Building Or Space Lease?

Greetings to the most extensive legal document repository, US Legal Forms. Here, you can discover any template, including Massachusetts Commercial Building or Space Lease forms, and preserve as many as you desire.

Create official paperwork in a few hours instead of days or even weeks, without the need to spend a fortune on a lawyer or attorney. Receive state-specific samples with just a few clicks and feel assured knowing they were prepared by our licensed attorneys.

If you are an existing subscriber, simply Log In to your account, and then click Download next to the Massachusetts Commercial Building or Space Lease you wish to obtain. Since US Legal Forms is an online service, you will always have access to your downloaded documents, regardless of the device you are using. Find them in the My documents section.

Once you’ve completed the Massachusetts Commercial Building or Space Lease, send it to your attorney for verification. It’s an additional step, but a crucial one to ensure you’re completely protected. Register with US Legal Forms today to access a multitude of reusable samples.

- If you do not have an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific document, verify its relevance in the state you reside in.

- Review the description (if available) to determine if it is the appropriate template.

- Explore more details with the Preview feature.

- If the document meets all your requirements, click Buy Now.

- To create your account, choose a subscription plan.

- Utilize a credit card or PayPal account to sign up.

- Download the document in the format you prefer (Word or PDF).

- Print the document and complete it with your or your business's details.

Form popularity

FAQ

To calculate the value of a commercial property using the Gross Rent Multiplier approach to valuation, simply multiply the Gross Rent Multiplier (GRM) by the gross rents of the property. To calculate the Gross Rent Multiplier, divide the selling price or value of a property by the subject's property's gross rents.

Any type of property, whether it's commercial or residential, can be a good investment opportunity. For your money, commercial properties typically offer more financial reward than residential properties, such as rental apartments or single-family homes, but there also can be more risks.

Typically, commercial space is evaluated at $X per square foot, and that rate times the rentable square feet for your space determines your monthly rent.

In the commercial leasing industry, $/SF/year or $/SF/yr means the rent per square foot per year.Let's say you receive a quote of $20/SF/year for a 1,000 square foot space. This would be calculated as $20 x 1000 square feet = $20,000 total (this is the cost for the total year).

To calculate the value of a commercial property using the Gross Rent Multiplier approach to valuation, simply multiply the Gross Rent Multiplier (GRM) by the gross rents of the property. To calculate the Gross Rent Multiplier, divide the selling price or value of a property by the subject's property's gross rents.

For commercial property investors, yields are typically much higher than residential property. Yields from commercial property can be anywhere from 5% to 10%. Meanwhile, residential property is known for yields between about 1% and 3%. The main reason for the difference is found in the lease agreement.

For office buildings that include retail space, the 2019 edition of Chain Store Age's annual survey of retail build-outs put the average cost at $56.53 per square foot.

Commercial properties are good investment opportunities to earn regular income as they offer high rental rates compared to residential properties.However, rental income and price appreciation depends on many factors such as current market trends, location, social and physical infrastructure.

Multiply the amount by the rentable square footage to determine your monthly cost. Divide that amount by your usable square footage to calculate your actual price per usable square foot. For example, if the rentable square footage is 1,130 and the price is $1 per square foot, your monthly lease amount is $1,130.