Assignment of Mortgage by Individual Mortgage Holder

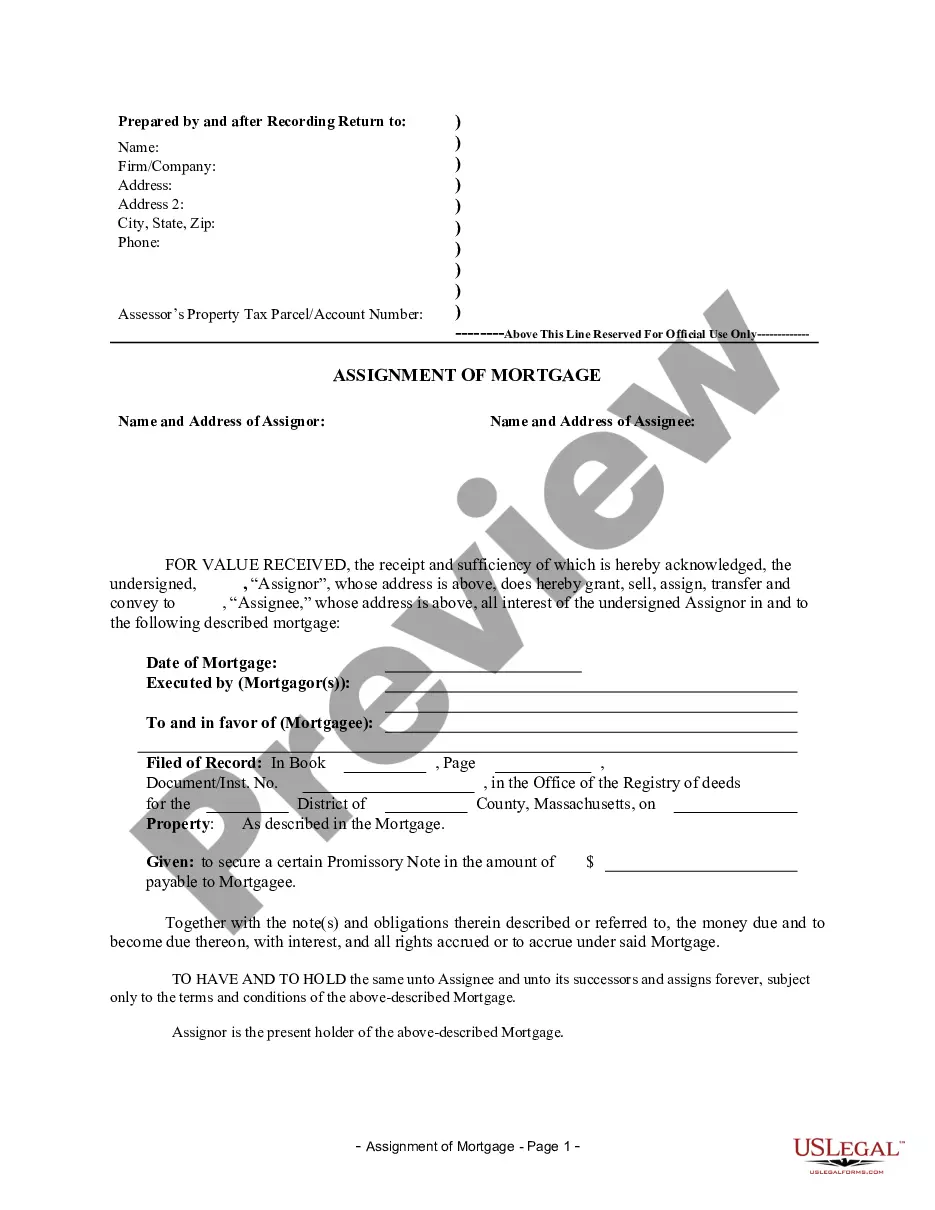

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Massachusetts Law

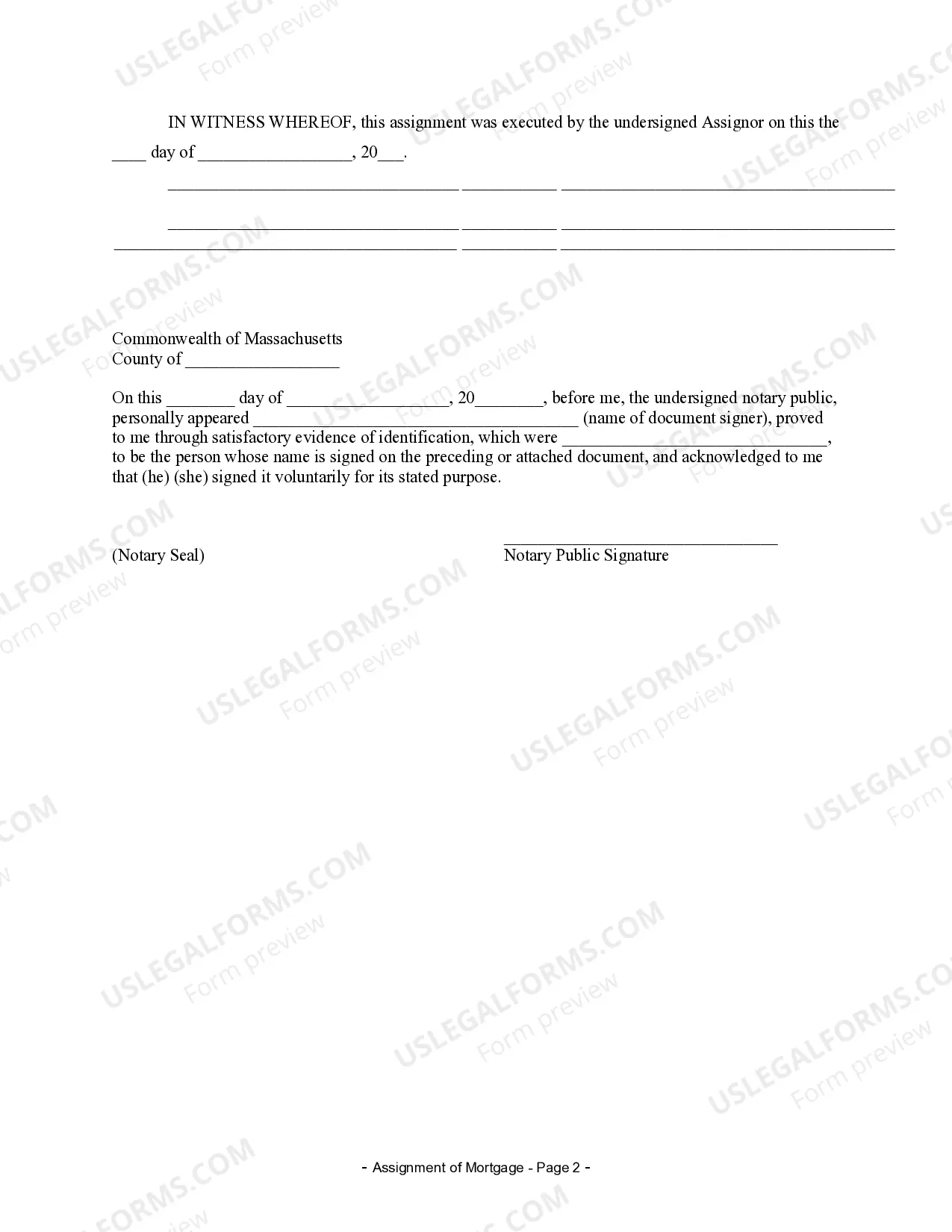

Execution of Assignment or Satisfaction: Must be signed by the mortgagee.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: None required. Mortgagee must record satisfaction within 45 days of payoff or suffer liability.

Recording Satisfaction: The recordation of a discharge duly executed and acknowledged by a mortgagee, mortgage holder, mortgage servicer or note holder shall constitute a discharge of the mortgage and a release of the lien created by such mortgage on the mortgaged premises (but see statutes below for details).

Penalty: If holder of satisfied mortgage does not record satisfaction of record within 45 days of final payoff, he shall be liable to borrower for actual damages caused by holder's failure to so record.

Acknowledgment: An assignment or satisfaction must contain a proper Massachusetts acknowledgment, or other acknowledgment approved by Statute.

Massachusetts Statutes

Chapter 183: Section 54. Method of discharge of mortgage.

Section 54. (a) For the purposes of sections 54 to 55, inclusive, the following words, unless the context otherwise requires, shall have the following meanings:—

''Authorized person'', a person authorized to act on behalf of another person by a written document signed by the person on whose behalf the person authorized thereby is acting. A photocopy, facsimile or scanned image of such document accompanying a request, demand or notice pursuant to sections 54 to 55, inclusive, may be relied upon by any recipient thereof acting in good faith.

''Bank confirmation of wire transmission'', for wired funds, a written confirmation of the same issued by the bank or other institution transmitting payment, including a written print-out by facsimile or other electronic transmission, that recites the beneficiary account number and other payee information prescribed in a payoff statement.

''Discharge'', a duly executed and acknowledged deed of release of a mortgage or other written instrument that, by its terms, discharges or releases a mortgage or the lien thereof or acknowledges payment or satisfaction of a mortgage or the debt or obligation secured by a mortgage or the conditions therein contained, or, in the case of a partial release, a duly executed and acknowledged instrument that, by its terms, discharges or releases a mortgage or the lien thereof from less than all of the property encumbered by the mortgage.

''Mortgagee'', the holder of record of a mortgage, or any successor in interest to the record holder, including as identified pursuant to subsection (i) of section 55 or by reference to other documents of record or to a database maintained by a governmental or quasi-governmental agency or entity; but, if the mortgage was properly assigned of record, mortgagee shall mean the last person to whom the mortgage was so assigned, or any such successor in interest thereto as so identified.

''Mortgage servicer'', the last person servicing a mortgage loan who is required under section 54D to provide a payoff statement with respect to the mortgage loan, whether or not appearing of record as the mortgagee.

''Mortgagor'', a grantor of a mortgage, the grantor's heirs, successors or assigns, or any other person who is an obligor of a note or other obligation secured by a mortgage.

''Note holder'', the holder of a note evidencing a debt or any other obligation secured by a mortgage; but, if the note holder is not the holder of record of the mortgage, the note shall contain the appropriate endorsements evidencing the transfer of ownership thereof to said holder.

''Payoff statement'', a statement in writing, including a written print-out by facsimile or other electronic transmission, issued at the request of the mortgagor or an authorized person on his behalf by a mortgagee, mortgage servicer or note holder indicating the amount of the unpaid balance of the mortgage loan, including principal, interest and other charges assessed pursuant to the mortgage loan, which may include the interest on a per diem basis with respect to the unpaid principal balance of the mortgage. A payoff statement shall include, where the context permits, a statement provided to the mortgagor or an authorized person on his behalf by a mortgagee, mortgage servicer or note holder, indicating the amount of the unpaid balance of the mortgage loan or other obligation that must be paid in order to issue a partial release of a mortgage.

''Person'', an individual, corporation, limited liability company, business trust, testamentary trust, partnership, association, joint venture, government, governmental subdivision or agency or other legal entity.

''Recordation'', ''recording'' or '' recorded'', a recording with the registry of deeds in accordance with this chapter, or registration with the registry district of the land court in accordance with chapter 185.

''Recording information'', the date of recording or filing of an instrument or document at a registry of deeds or registry district of the land court, and the applicable book number and page number, or the land court document number, as assigned by the register of deeds or assistant recorder of the land court.

''Servicing'', the receipt by a mortgage servicer of scheduled periodic payments and payoff monies from a mortgagor on a mortgage loan, and the allocation of the payments to principal, interest, municipal real estate taxes and other appropriate assessments and charges, all pursuant to the terms of the loan.

(b) A mortgage may be discharged by 1 of 2 or more joint holders of a mortgage or the mortgagee, mortgage servicer or note holder, or an heir, executor, administrator, successor or assignee thereof, but, the discharge shall comply with the requirements of subsection (b) of section 55. The discharge shall have the same effect as a deed of release, and may be recorded when duly executed and acknowledged or on proof of its execution in accordance with sections 34 to 41, inclusive, or on such other proof of its due execution by credible evidence in the form of corroborating documents or affidavits establishing the authenticity of the discharge and the execution thereof and, in that case, the discharge and the corroborating documents or affidavits may be recorded along with or as exhibits to an affidavit under section 5B that refers to the documents or affidavits. The recordation of a duly executed and acknowledged or proven discharge as provided herein shall be conclusive evidence that the mortgage has been discharged, notwithstanding the fact that the party signing the instrument may have assigned the note or other evidence of debt to another party, unless the assignment had been duly recorded before the instrument discharging the mortgage. If a discharge is executed by a person who is not the holder of record at the time the discharge is recorded, the recorded discharge shall become conclusive when an assignment of mortgage from the then record holder or holders to that person is thereafter recorded. A discharge shall contain the street address of the mortgaged property, the book number and page number or the land court document number and recording date of the mortgage, and the name of the original mortgagor; but, the failure to include the information shall not affect the validity of the instrument. This section shall apply notwithstanding section 3–116 of chapter 106

Chapter 183: Section 54A. Defective discharges of mortgages held by entirety; effect.

Section 54A. After the expiration of a period of ten years from the recording of a discharge or release of a mortgage held by husband and wife as tenants by the entirety and signed by only the husband or the wife, no steps shall be taken by action, entry or otherwise to foreclose or enforce such mortgage or the note or notes secured thereby, unless within such period the spouse who did not sign such discharge or release has recorded in the registry of deeds for the county or district where the mortgage is recorded a notice identifying the mortgage and the book and page of its recording and stating that rights of a tenant by the entirety may be claimed in the mortgage or the note or notes secured thereby. A reference to such notice shall be noted on the margin of the record of the mortgage.

Chapter 183: Section 54B. Deed of release, written acknowledgement of payment or satisfaction, release or assignment of mortgage; execution before officer entitled to acknowledge instruments; effect.

Section 54B. Notwithstanding any law to the contrary, (1) a discharge of mortgage; (2) a release, partial release or assignment of mortgage; (3) an instrument of subordination, non-disturbance, recognition, or attornment by the holder of a mortgage; (4) any instrument for the purpose of foreclosing a mortgage and conveying the title resulting therefrom, including but not limited to notices, deeds, affidavits, certificates, votes, assignments of bids, confirmatory instruments and agreements of sale; or (5) a power of attorney given for that purpose or for the purpose of servicing a mortgage, and in either case, any instrument executed by the attorney-in-fact pursuant to such power, if executed before a notary public, justice of the peace or other officer entitled by law to acknowledge instruments, whether executed within or without the commonwealth, by a person purporting to hold the position of president, vice president, treasurer, clerk, secretary, cashier, loan representative, principal, investment, mortgage or other officer, agent, asset manager, or other similar office or position, including assistant to any such office or position, of the entity holding such mortgage, or otherwise purporting to be an authorized signatory for such entity, or acting under such power of attorney on behalf of such entity, acting in its own capacity or as a general partner or co-venturer of the entity holding such mortgage, shall be binding upon such entity and shall be entitled to be recorded, and no vote of the entity affirming such authority shall be required to permit recording.

Chapter 183: Section 54C. Discharge of mortgage and release of lien; conditions of discharge where discharge is not executed by holder of record.

Section 54C. (a) The recordation of a duly executed and acknowledged or proven discharge by a mortgagee, mortgage servicer or note holder shall constitute a discharge of the mortgage and a release of the lien created by the mortgage on the mortgaged premises; provided, however, that a discharge executed by a mortgage servicer or note holder who is not the holder of record of such mortgage, but which discharge is not accompanied by the supporting documents required in subsection (b) of section 55 will operate as a discharge and release of lien as aforesaid only as to a mortgage encumbering a 1–to–4–family residential property and only where the discharge is accompanied or supplemented by the following:

(1) In the case of a mortgage servicer, an original or photostatic copy of the servicing agreement, power of attorney, servicing notice letter to the borrowers, written payoff statement issued to a mortgagor, closing attorney or settlement agent, including a payoff statement issued by facsimile or other electronic transmission, or other document evidencing the authority of the mortgage servicer to service the mortgage, which, if not already of record before the recording of the discharge, shall be duly recorded together with the discharge, or recorded after the discharge but attached to an affidavit pursuant to section 5B, which affidavit shall contain the recording information for the mortgage that is the subject of the discharge as well as for the discharge itself and which shall be indexed under the name of the mortgagors named in the mortgage and discharge. If the authority document contemplated by this section is a copy rather than an original, it shall contain or be accompanied by a certification by the mortgagee, mortgage servicer or note holder that it is a true copy of the original document or a certification by an attorney licensed to practice law in the commonwealth, who has seen an original of the document, that it is a true copy of the document. For purposes of this section, an original printout of a facsimile or other electronic transmission addressed to an attorney licensed to practice law in the commonwealth, or to the attorney's law firm, shall constitute an original document and may be recorded if certified by the attorney to be an original printout or, if a photostatic copy of the printout, it is certified by said attorney, either on the copy or in an accompanying affidavit, that it is a true copy of the original printout.

(2) In the case of a note holder who is not the holder of record of the mortgage, an original or photostatic copy of the note, with the endorsements thereon evidencing the transfer of ownership of the note to the holder, shall be duly recorded as an exhibit to the discharge or, if recorded after the discharge, the note shall be recorded as provided in subsection (h) of section 55 and marginally referenced to the discharge. If a copy of the note is recorded, the copy shall contain or be accompanied by a certificate duly executed and acknowledged by the note holder, that it is a true copy of the original document or be accompanied by an affidavit by an attorney at law licensed to practice in the commonwealth that the attorney has seen the original note with the endorsements thereon and the copy being recorded is a true copy thereof.

(3) In the absence of the supporting documents referred to in paragraphs (1) and (2), said discharge may be effected by the recording of:

(i)(A) an affidavit executed under the penalties of perjury by any mortgagor affirming the inability to obtain any of the documents, the payments made and the reasons why the payments were made to such mortgage servicer or note holder, and attaching thereto evidence of the payments in the form of 1 or more billing statements, a written payment history, annual principal and interest payment statement or other written acknowledgment of payment from the servicer or note holder; or

(B) in the event the mortgagor is no longer the record owner of the premises, an affidavit executed under the penalties of perjury by an owner of record for more than 1 year, other than the mortgagor, who purchased the premises subsequent to the recording of the mortgage, and whose recorded deed made no reference to the mortgage remaining outstanding, stating that the owner purchased the premises in good faith and for value in the belief that the premises were not encumbered by the mortgage; that the owner has not made any payments on account of the mortgage; and that no claims have been made against the owner under the mortgage subsequent to the purchase, and

(ii) an affidavit executed by an attorney licensed to practice law in the commonwealth who, pursuant to a payoff statement from the mortgage servicer or note holder, transmitted funds to the mortgage servicer or note holder sufficient to satisfy in full the outstanding balance of the loan secured by the mortgage or who has ascertained that the payment was made pursuant to a written payoff statement issued to another closing attorney or settlement agent, which affidavit shall certify that:

(A) neither the documents referred to in paragraphs (1) or (2) nor a confirmatory discharge duly executed and acknowledged by the mortgagee have been received, despite a written demand therefor sent by registered or certified mail to the servicer or note holder and the mortgagee at their last known addresses at least 30 days before the date of the affidavit;

(B) the written demand described the circumstances under which the payment in full of the outstanding balance of the mortgage loan in accordance with the payoff statement occurred and provided copies of any documentary evidence thereof; and

(C) the written demand informed the servicer or note holder and the mortgagee that, absent objection received in writing by certified mail within 30 days after the postmark date of the written demand, the affidavits authorized by this subsection will be recorded and will conclusively discharge the mortgage; and

(D) no written objection was received by the affiant within 30 days after the postmark date.

(b) If a document authorized or required to be recorded pursuant to this section contains any personal identifier numbers, such as social security or tax identification numbers, or any financial account numbers, such as checking, savings or investment account numbers, the numbers may be whited out, blackened out or otherwise obliterated so as to become illegible and the document shall be entitled nonetheless to recording, so long as the obliteration does not appear to substantially alter or change the content, tenor or nature of the document.

Chapter 183: Section 55. Liability for neglect or refusal to discharge; affidavits.

Section 55. (a)(1) A mortgagee, mortgage servicer or note holder who receives full payment and satisfaction of the conditions of a mortgage shall, within 45 days of receipt of payment, (i) cause to be recorded a duly executed and acknowledged discharge that conforms with subsection (b) and provide to the closing attorney, settlement agent or other person transmitting the payoff a copy of the discharge, together with the recording information therefor, or (ii) provide to the closing attorney, settlement agent or other person transmitting the payoff a duly executed and acknowledged discharge, also so conforming, which documents, in either case, shall be provided to the closing attorney, settlement agent or other person, irrespective of whether the mortgagee, mortgage servicer or note holder has withheld the fee for recording the discharge. Merely providing a copy of the discharge and evidence that the discharge was sent to a registry of deeds for recording shall not constitute compliance with this section unless the recording information required herein is noted on the copy.

(2) In addition to any other requirements under this section or section 54C, if the mortgagee, mortgage servicer or note holder elects to provide the discharge to the person transmitting the payoff and that person is someone other than a closing attorney or settlement agent, the discharge shall be accompanied by a transmittal letter that contains a statement in substantially the following form, in not less than 10–point boldface type:

ENCLOSED WITH THIS LETTER IS A DISCHARGE OF YOUR MORTGAGE AND OTHER DOCUMENTATION IF NECESSARY TO SHOW THAT WE WERE THE HOLDER OF YOUR MORTGAGE WHEN IT WAS PAID. THESE ARE IMPORTANT LEGAL DOCUMENTS.

IN ORDER TO RELEASE THE MORTGAGE FROM THE TITLE TO THE PROPERTY, YOU MUST RECORD THE DISCHARGE AND ACCOMPANYING DOCUMENTATION, IF ANY, AT THE SAME REGISTRY OF DEEDS IN WHICH YOUR DEED WAS RECORDED. ALL RECORDING FEES THAT WE ARE REQUIRED TO PAY UNDER MASSACHUSETTS LAW HAVE BEEN INCLUDED IN THE ENCLOSED CHECK. THE RECORDING FEE FOR THE DISCHARGE ITSELF, UNLESS PAID BY YOU WITH THE LOAN PAYOFF, IS YOUR RESPONSIBILITY.

IT IS IN YOUR BEST INTERESTS TO RECORD THE DISCHARGE AND ACCOMPANYING DOCUMENTATION AS SOON AS POSSIBLE. IF YOU ARE UNSURE WHAT TO DO, PLEASE SEEK THE ADVICE OF AN ATTORNEY OR A CLERK AT THE REGISTRY OF DEEDS.

(b) In addition to containing the mortgage reference information required in subsection (b) of section 54, such discharge shall be executed and acknowledged by the holder of the mortgage and the note or other obligation secured thereby or an authorized person or entity acting on behalf of the holder. If the holder is not the holder of record, the holder shall also specify by what means the holder became the holder of such mortgage and the note or other obligation secured thereby, and shall: (1) specify the recording information for the documentation on record in the registry district where the mortgage is recorded supporting the holder's status as such; or (2) record the documentation, along with the discharge, if the holder records the discharge; or (3) provide to the closing attorney, settlement agent or other person transmitting the payoff the recordable discharge and the documentation in recordable form necessary to establish the holder's status of record, such documentation shall include, but not be limited to: the note, any assignments, certificates of change of name or certificates of merger; provided, however, that, if the holder's status as such is based upon a corporate change of name or identity by any of the actions or events described in subsection (i) and the discharge refers to those actions or events as provided in said subsection (i), then the holder need not provide or record any further documentation in support of such actions or events. If the discharge is executed on behalf of a mortgage and note holder by a mortgage servicer, an attorney-in-fact under a power of attorney or other agent, the mortgage servicer, attorney-in-fact or other agent shall, in addition to the information and documents required of the mortgage and note holder, provide to the closing attorney, settlement agent or other person transmitting the payoff the recordable discharge and the documentation in recordable form necessary to establish the authority of the agent of the mortgage and note holder to act on behalf thereof, or the recording information for the documentation if already recorded in the registry district where the mortgage is recorded. Such documentation shall include, but not be limited to the servicing agreement, power of attorney or other written authorization from the mortgage and note holder to so act on behalf thereof. Any mortgage and note holder, servicer, attorney-in-fact or other agent for the mortgage and note holder who provides to the closing attorney, settlement agent or other person transmitting the payoff the documentation, rather than recording the same and providing the recording information to such person, shall also forward to the closing attorney, settlement agent or other person all recording fees established under sections 38 or 39 of chapter 262 necessary to record the documents.

(c)(1)(i) A mortgagee, mortgage servicer, note holder who has accepted full payment and satisfaction of the conditions of a mortgage in accordance with a payoff statement issued by the mortgagee, mortgage servicer or note holder, as the case may be, and who fails to record or provide to the closing attorney, settlement agent or other person transmitting the payoff a duly executed and acknowledged discharge of that mortgage, or partial release, or to provide such supporting documents required by this section or section 54C relative to such mortgage, within 45 days after the acceptance, shall be liable in damages to the mortgagor, as that term is defined in section 54, in an amount equal to the greater of $2,500 or the actual damages sustained by the mortgagor as the result of the failure, together with reasonable attorneys fees and costs, in addition to all other remedies available at law.

(ii) The liability set forth herein shall be limited, however, to actual damages sustained by the mortgagor if, within 30 days of receipt by certified mail, in-hand delivery, or overnight delivery of a written demand from the mortgagor or an authorized person on behalf thereof, the mortgagee, mortgage servicer or note holder provides or pays as demanded, a discharge in proper form complying with this section, including the necessary supporting documentation as required by this section or section 54C, and the required recording fees, plus actual damages as the mortgagor reasonably establishes are attributable to the failure to comply with said section 54C or this section.

(2) In the event that a mortgagee, mortgage servicer or note holder required to record or provide a discharge under subsection (a) elects to comply by sending the discharge and any required supporting documentation and recording fees to the closing attorney, settlement agent or other person transmitting the payoff, such mortgagee, mortgage servicer or note holder shall have no liability under this subsection, if: (a) it can reasonably demonstrate by documentation or other evidence from its files or business records with respect to the particular mortgage that the discharge and any required supporting documentation and recording fees were sent to the closing attorney, settlement agent or other person transmitting the payoff within the prescribed time period, or (b) in the event that the records are no longer available, compliance is reasonably demonstrated by showing that the mortgagee, mortgage servicer or note holder has established reasonable procedures to achieve compliance with its obligations under this section and that the procedures are routinely followed and have become an established business practice of the mortgagee, mortgage servicer or note holder; provided in either case, however, that the mortgagee, mortgage servicer or note holder provides to a mortgagor or an authorized person acting on behalf thereof a confirmatory discharge complying with subsections (a) and (b) within 30 days after receipt by certified mail or commercial overnight or in-hand delivery of a written demand therefor. In such case the mortgagee, mortgage servicer or note holder who reasonably demonstrates compliance with this paragraph shall be entitled to charge a reasonable fee for providing the confirmatory discharge and any required supporting documentation and shall not be responsible for any recording fees therefor.

(d) A closing attorney, settlement agent or other person who has received a discharge of a mortgage under subsection (a), provided that the discharge complies with the requirements of subsection (b), shall record the discharge within 45 days of the receipt. If the person fails to record the discharge within that time, he shall be liable in damages to the mortgagor, as that term is defined in section 54, in an amount equal to the greater of $2,500 or the actual damages sustained by the mortgagor as the result of the failure, together with reasonable attorneys fees and costs, in addition to all other remedies available at law. The liability set forth herein shall be limited, however, to actual damages sustained by the mortgagor if, within 30 days of receipt by certified mail, or in-hand delivery or overnight delivery of a written demand either to record the discharge or to provide it to the mortgagor or to another attorney closing a transaction on the mortgaged property, the person in possession of the discharge either records the discharge or provides it to the mortgagor or the other attorney making the demand, together with any recording fee previously withheld by the person from the mortgagor's funds.

(e) With respect to a mortgage on 1–to–4–family residential property, a mortgagee, mortgage servicer or note holder who has withheld the recording fee for the discharge from the mortgagor's account, but fails to record the discharge, shall, within 30 days after receipt of a written demand sent certified mail by the mortgagor or an authorized person on the mortgagor's behalf, return to the mortgagor or credit the mortgagor's account all fees charged or withheld for recording the discharge, together with interest at 6 per cent per annum. The mortgagee, mortgage servicer or note holder who fails to comply with this subsection shall be liable in damages to the mortgagor, as that term is defined in section 54, in an amount equal to the greater of the amount of fees charged to or withheld from the mortgagor and not refunded or credited, with interest thereon, plus $2,500, or the mortgagor's actual damages, together with reasonable attorneys fees and costs, in addition to all other remedies available at law.

(f) For purposes of this section, unless otherwise established, receipt of a notice, demand, request or payment shall be presumed to occur either on the fifth day after the postmark date, if mailed first class with postage prepaid, or on the receipt or delivery date if transmitted by registered or certified mail, or commercial overnight or in-hand delivery service, or, in the case of a wire transfer of funds, the date appearing on a bank confirmation of wire transmission, as the term is defined in section 54.

(g)(1) Notwithstanding the foregoing, if the mortgagee, mortgage servicer or note holder fails to record or provide to the closing attorney, settlement agent or other person transmitting the payoff a duly executed and acknowledged discharge of mortgage on 1–to–4–family residential property within 45 days from receipt of full payment or satisfaction of the indebtedness or other obligations secured by the mortgage, together with any supporting documentation required under subsection (b), or, if such discharge was provided but was not recorded and is no longer available, an attorney-at-law licensed to practice in the commonwealth may, on behalf of the mortgagor, the mortgagor's executors, administrators, successors, assignees or transferees, or a mortgagee thereof, execute and cause to be recorded in the registry district in which the mortgage is recorded, an affidavit that includes a description of the mortgage and any assignments thereof, including the parties thereto, the address of the mortgaged property and the recording information for the mortgage and any assignments, and that states:

(i) the affiant is an attorney-at-law in good standing and licensed to practice in the commonwealth;

(ii) the affidavit is made on behalf of and at the request of the mortgagor, the mortgagor's executors, administrators, successors, assignees or transferees, or a mortgagee thereof;

(iii) whether the affiant has been able to ascertain that the mortgagee, mortgage servicer or note holder has provided a written payoff statement with respect to the loan or other financial obligation secured by the mortgage;

(iv) the affiant has ascertained that the mortgagee, mortgage servicer, or note holder has received full payment of the indebtedness secured by the mortgage, and that the affiant is in possession of documentary evidence of the payment, which may include a check that has been negotiated by the mortgagee, mortgage servicer, or note holder, by a bank confirmation of wire transmission, or by other documentary evidence of full payment of the indebtedness secured by the mortgage, including written confirmation by the affiant or another attorney in good standing and licensed in the commonwealth of an oral acknowledgement by the mortgagee, mortgage servicer or note holder of full payment, or an affidavit under section 5B by the closing attorney, settlement agent or other person transmitting the payoff describing the circumstances of the payoff and certifying that the person has not received from the mortgagee, mortgage servicer or note holder to whom the payoff was transmitted any notification that the payment has been rejected or that there is any other objection to the adequacy of the payment and that the payoff transmittal has not been returned to the person as undeliverable or for any other reason, without being retransmitted to and received by the mortgagee, mortgage servicer or note holder to whom payment was sent;

(v) more than 45 days have elapsed since such payment was received by the mortgagee, mortgage servicer or note holder;

(vi) the affiant or, if different, the closing attorney, settlement agent or other person transmitting payment, has not been provided either a discharge of mortgage or the recording information that evidences a recorded discharge in compliance with subsections (a) and (b), or, if provided, the discharge has not been recorded and is otherwise unavailable for any reason; and

(vii) the affiant has given the mortgagee, mortgage servicer or note holder to whom the payoff was sent at least 45 days' notice in writing by certified mail that the affiant intends to execute and cause to be recorded the affidavit, which notice shall refer to this subsection and state that the affidavit will be recorded and will discharge the mortgage unless, within 45 days after receipt of the notice, the mortgagee, mortgage servicer or note holder either has complied with the requirements of subsections (a) and (b) and demonstrated the same by written notice to the affiant, has provided the affiant a confirmatory discharge or has notified the affiant in writing that the payment was inadequate and specifying the reason and amount of the inadequacy. The notice shall be accompanied by copies of the proposed affidavit, the documentary evidence of payment and the payoff statement, if available, or contain a statement that a payoff statement is not available.

(2) Notwithstanding paragraph (1), a closing attorney or settlement agent who transmits a payoff in the amount prescribed in a payoff statement and in accordance with instructions provided therein may include therewith a notice of intention to record a discharge by affidavit in accordance with this subsection, to which reference shall be made to inform the recipient of the provisions thereof, which notice shall state:

(i) that payment is being made in accordance with the enclosed payoff statement;

(ii) that within 45 days from receipt of the payment, either a discharge of the mortgage or the recording information that evidences a recorded discharge in compliance with subsections (a) and (b) shall be provided by the recipient of the payoff to the closing attorney or settlement agent;

(iii) that failure to so provide or record a proper discharge within the 45 days shall expose the mortgagee, mortgage servicer or note holder to liabilities and remedies under this section and shall, in addition, entitle the affiant to execute and cause to be recorded an affidavit discharging the mortgage in accordance with this section;

(iv) that a copy of the proposed affidavit, including therewith a description of the mortgage and any assignments thereof, including the parties thereto, the address of the mortgaged property and the recording information for the mortgage and any assignments, is enclosed with the notice; and

(v) that the affidavit will be recorded and will discharge the mortgage unless, within 45 days after receipt of the notice, the affiant receives from the mortgagee, mortgage servicer or note holder a written notice of objection to the payoff, specifying any inadequacy in payment or any other reason for objection.

The notice of intention to record said affidavit pursuant to this paragraph (2) may be sent by regular mail, certified mail or by commercial overnight or in-hand delivery service. If payoff funds are transmitted by electronic transfer, a bank confirmation of wire transmission shall accompany the notice.

(3) In the case of a notice under either paragraphs (1) or (2), if the payoff was made and the notice was sent to a servicer or a note holder who was not a mortgagee, a like notice shall be sent to the mortgagee at its last known address, and the mortgagee may object to the recording of the affidavit and discharge of the mortgage only if the mortgagee provides credible evidence to the affiant, within 45 days after receipt of the notice, that it is the true holder of the note, debt or other claim or obligation secured by the mortgage and that the payoff was inadequate, specifying the reason for the inadequacy, or that payment was erroneously made to someone who was not the proper holder of the note, debt or other claim or obligation secured by the mortgage and who was not acting properly on behalf of the mortgagee in receiving the payment. If such like notice is required to be sent under this paragraph, the affidavit, in addition to the requirements otherwise set forth in this subsection, shall also recite compliance with this paragraph.

(4) In the case of a discharge by affidavit recorded pursuant to paragraph (2), an assignee of the mortgage being discharged whose assignment does not appear of record before the date the payoff was made, shall not have any right to the notice provided in said paragraph (2) or the like notice provided in paragraph (3), nor shall the assignee have any standing to object to or challenge the discharge as against a bona fide purchaser, mortgagee, lienholder or encumbrancer without notice, even if the assignment to the assignee is recorded before the recording of the affidavit.

(5) The affiant may record an affidavit in accordance with this subsection, unless, within the time periods set forth in paragraphs (1), (2) and (3) the mortgagee, mortgage servicer or note holder has given the affiant written notice of objection to the payoff, specifying any inadequacy in the payment or any other reason for objection. The affidavit shall be accompanied by a copy of the notice provided to the mortgagee, mortgage servicer or note holder but need not be accompanied by the documents enclosed with such notice.

(6) In the event that the affiant is notified of an objection, the affidavit may not be recorded until the affiant determines that the mortgagor has complied with any request made by the mortgagee, mortgage servicer or note holder for additional payment, or that any other objection has been satisfied, at least 15 days before the date of the affidavit without further objection being raised by the mortgagee, mortgage servicer or note holder, and the affidavit shall be amended to include a copy of the written notice of objection and certify to such compliance or satisfaction with no further objection being made, at which time, the affidavit may be recorded without further notice to the mortgagee, mortgage servicer or note holder.

(7) The affidavit shall also include the names and last known addresses of the mortgagor and the record mortgagee, mortgage servicer or note holder, the date of the mortgage and the mortgage recording reference, as well as that of any recorded assignment of the mortgage. Further, if the mortgagee to whom notice is required to be sent pursuant to paragraphs (1) to (3), inclusive, of this subsection is a successor as defined in section 54, the affidavit shall also name the original mortgagee, if no longer the record mortgagee, as well as such successor mortgagee, and include the last known address for such successor mortgagee and a brief description of how the successor mortgagee's identity and last known address were determined, such as by reference to other documents of record, including a recorded document containing the recitals set forth in subsection (i) or by reference to a database maintained by a governmental or quasi-governmental agency or entity. Failure of the affiant to include such information in an affidavit, or to certify a copy of any notice required to be attached thereto as a true copy, shall not affect the validity of the affidavit or its effect as a discharge.

(8) The affidavit, when so recorded, shall constitute a discharge of the mortgage and a release of the lien created by the mortgage on the mortgaged premises in favor of a bona fide purchaser, mortgagee, lienholder or encumbrancer for value without notice, but, nothing in this section shall preclude a mortgagee, mortgage servicer or note holder from collecting any deficiencies or other payments for which an obligor may be personally liable.

(9) A person who causes an affidavit to be created in accordance with this subsection knowing that the information or statements contained therein, or in any documentary evidence relied upon therefor, or that the copy of any notice or document attached thereto or relied upon therefor is false, shall be punished by a fine of not more than $5,000 in addition to all other remedies at law, both civil and criminal and, in the event of civil liability to anyone damaged thereby, attorneys fees and costs shall be awarded in addition to any award of damages.

(h) In addition to the provisions of this section and sections 54 and 54C, a mortgage encumbering a 1–to–4–family residential property may be discharged by recording the original note secured by the mortgage, if the note is marked paid by the holder thereof as evidenced by the endorsements thereon. If not otherwise in recordable form, the note may be recorded as an attachment or exhibit to an affidavit under section 5B.

(i) When a change in the name or identity of a corporate mortgagee or mortgage note holder is caused by or results from one or more mergers, consolidations, amendments to charter or articles of incorporation, or conversions of articles of incorporation or charter from federal to state, from state to federal, or from one form of entity to another, or from acquisition of assets of a failed institution by or from a government regulatory authority, a mortgage discharge, assignment, partial release or mortgage note that is otherwise recordable and that recites within the body of the instrument the fact of any merger, consolidation, amendment, conversion or acquisition of assets causing the change in name or identity, the mortgage discharge, assignment, partial release or mortgage note shall be accepted for recording in the appropriate registry of deeds or for registration with the appropriate registry district of the land court without further evidence of the corporate merger, consolidation, amendment, conversion or acquisition. The recital in the instrument shall be conclusive in favor of any bona fide purchaser, mortgagee, lienholder or encumbrancer for value relying in good faith thereon.

(j) Liability established under this section against multiple parties shall be joint and several.

(k) If any document authorized or required to be recorded pursuant to this section contains personal identifier numbers, such as social security or tax identification numbers, or financial account numbers, such as checking, savings or investment account numbers, the numbers may be whited out, blackened out or otherwise obliterated so as to become illegible and the document shall be entitled nonetheless to recording so long as the obliteration does not appear to substantially alter or change the content, tenor or nature of the document.