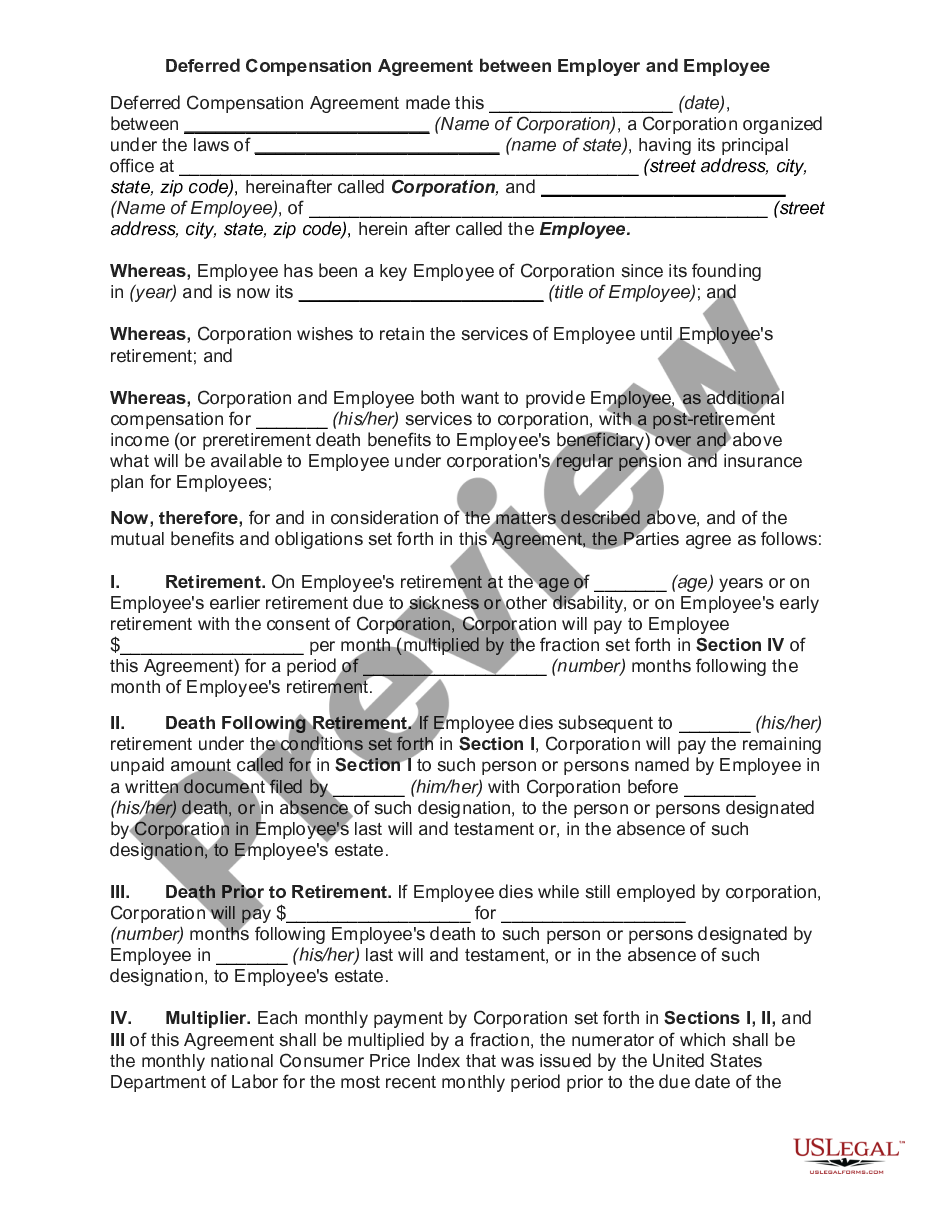

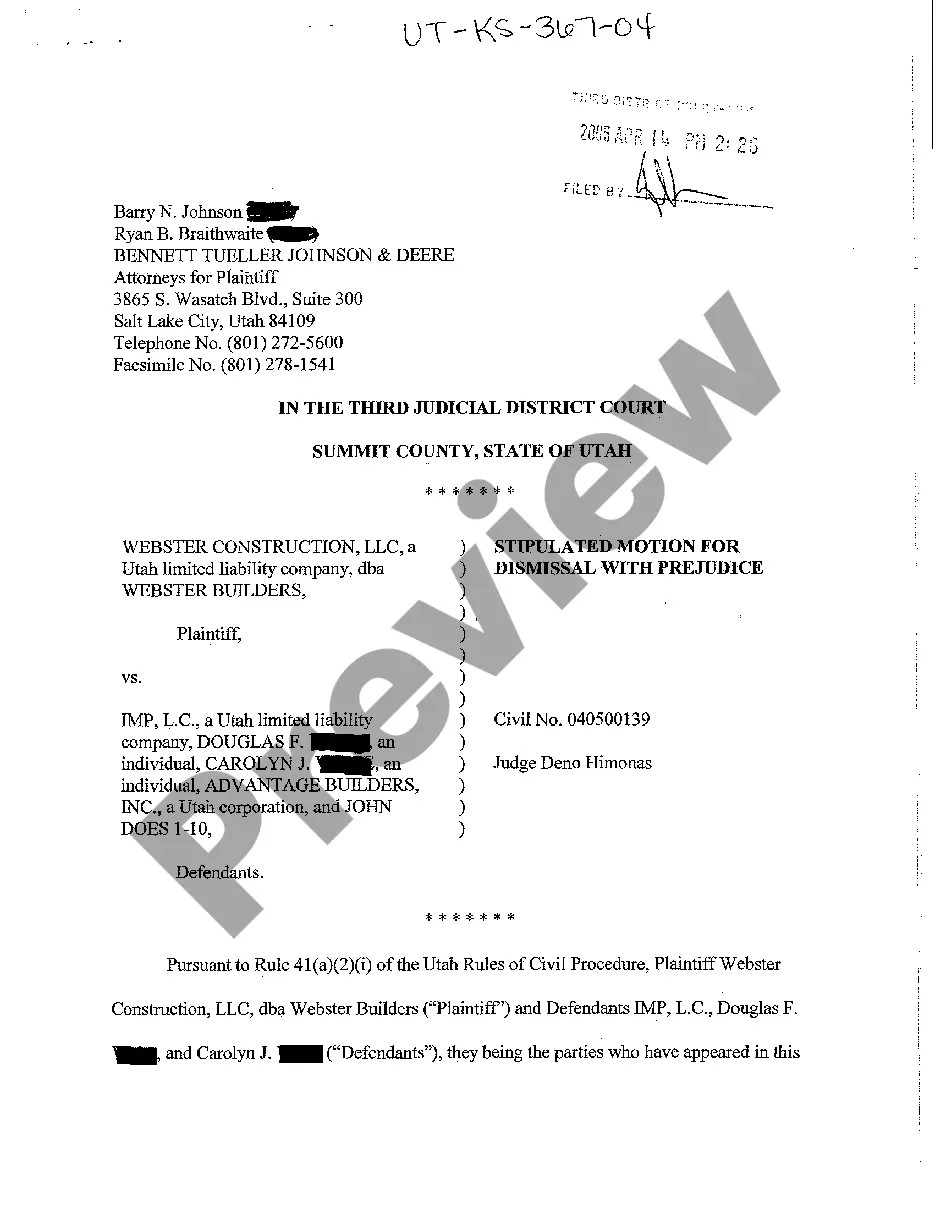

Massachusetts Agreement to Pay Compensation for Workers' Compensation

Description

How to fill out Massachusetts Agreement To Pay Compensation For Workers' Compensation?

You are invited to the largest legal document repository, US Legal Forms. Here, you will discover any template including Massachusetts Agreement to Pay Compensation for Workers' Compensation forms and retrieve them (as many as you require). Prepare official documents within hours rather than days or weeks, without incurring excessive costs on a lawyer.

Obtain your state-specific template with just a few clicks, and rest assured knowing that it was composed by our certified attorneys.

If you are already a registered user, simply Log In to your account and click Download next to the Massachusetts Agreement to Pay Compensation for Workers' Compensation you desire. Since US Legal Forms is online, you will continually have access to your downloaded materials, regardless of the device you are using. Access them in the My documents section.

Print the document and complete it with your or your company’s information. Once you’ve filled out the Massachusetts Agreement to Pay Compensation for Workers' Compensation, submit it to your attorney for validation. It’s an additional step but a necessary one to ensure you’re entirely protected. Register with US Legal Forms now and access thousands of reusable templates.

- If you do not have an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a form specific to your state, verify its validity in your jurisdiction.

- Review the description (if provided) to determine if it’s the appropriate template.

- Explore more options using the Preview function.

- If the template satisfies your requirements, simply click Buy Now.

- To create your account, choose a subscription plan.

- Utilize a credit card or PayPal account to register.

- Acquire the document in your preferred format (Word or PDF).

Form popularity

FAQ

All employers operating in Massachusetts are required to carry workers' compensation insurance for their employees and themselves if they are an employee of their company.The only exception is for domestic employees who must work at least 16 hours a week to be covered under a workers' compensation policy.

HR's Role in Workers' Compensation. When starting fresh or looking for a new insurance provider, your responsibility may be to secure and implement the new workers' compensation policies and procedures. The big emphasis sits with human resources to handle claims quickly and fairly to avoid lawsuits against the business

All employers operating in Massachusetts are required to carry workers' compensation insurance for their employees and themselves if they are an employee of their company.The only exception is for domestic employees who must work at least 16 hours a week to be covered under a workers' compensation policy.

Who Pays Workers' Comp? Regardless of the state you're in, employers pay for workers' compensation insurance. Your cost for workers' compensation is a percentage of your payroll. Unlike health insurance, there are no employee payroll deductions for workers' compensation insurance.

The employer is responsible for benefit costs, claim expenses, and medical and legal services. States that allow individual employers to form groups typically require the employers to be in the same business or have a minimum amount of workers comp premium.

The amount you will receive is a percentage of your wages at the date of injury. In many states, the percentage is 66 2/3%. Some states include in your wages the amount your employer contributes to your employee benefits.Time loss compensation benefits are paid on a periodic basis usually twice per month.

The answer is A) employers.Workers compensation is regulated by states and therefore the requirements vary by state. One common factor in almost all states is that employers are responsible for contributing to the workers' compensation funds.

Employers pay premiums, and when there is a claim, the insurance company checks to see what benefits are owed, and then pays the injured party. You, as the injured worker, are the injured party receiving the workers' compensation benefits.

Under Massachusetts workers' compensation laws, the following are the benefit amounts a disabled worker is entitled to: Total and permanent incapacity: Two-thirds of the worker's average weekly wage.Partial incapacity: 60 percent of the difference between the worker's weekly wage before the injury and after the injury.