Louisiana Clauses Relating to Initial Capital contributions

Description

How to fill out Clauses Relating To Initial Capital Contributions?

US Legal Forms - among the most significant libraries of legitimate types in the USA - delivers a wide range of legitimate document layouts it is possible to download or print. While using site, you may get 1000s of types for organization and person reasons, categorized by groups, states, or keywords.You can find the newest versions of types such as the Louisiana Clauses Relating to Initial Capital contributions in seconds.

If you already possess a registration, log in and download Louisiana Clauses Relating to Initial Capital contributions through the US Legal Forms collection. The Acquire switch will show up on each form you view. You gain access to all in the past saved types inside the My Forms tab of your own account.

If you wish to use US Legal Forms initially, here are easy guidelines to help you get started out:

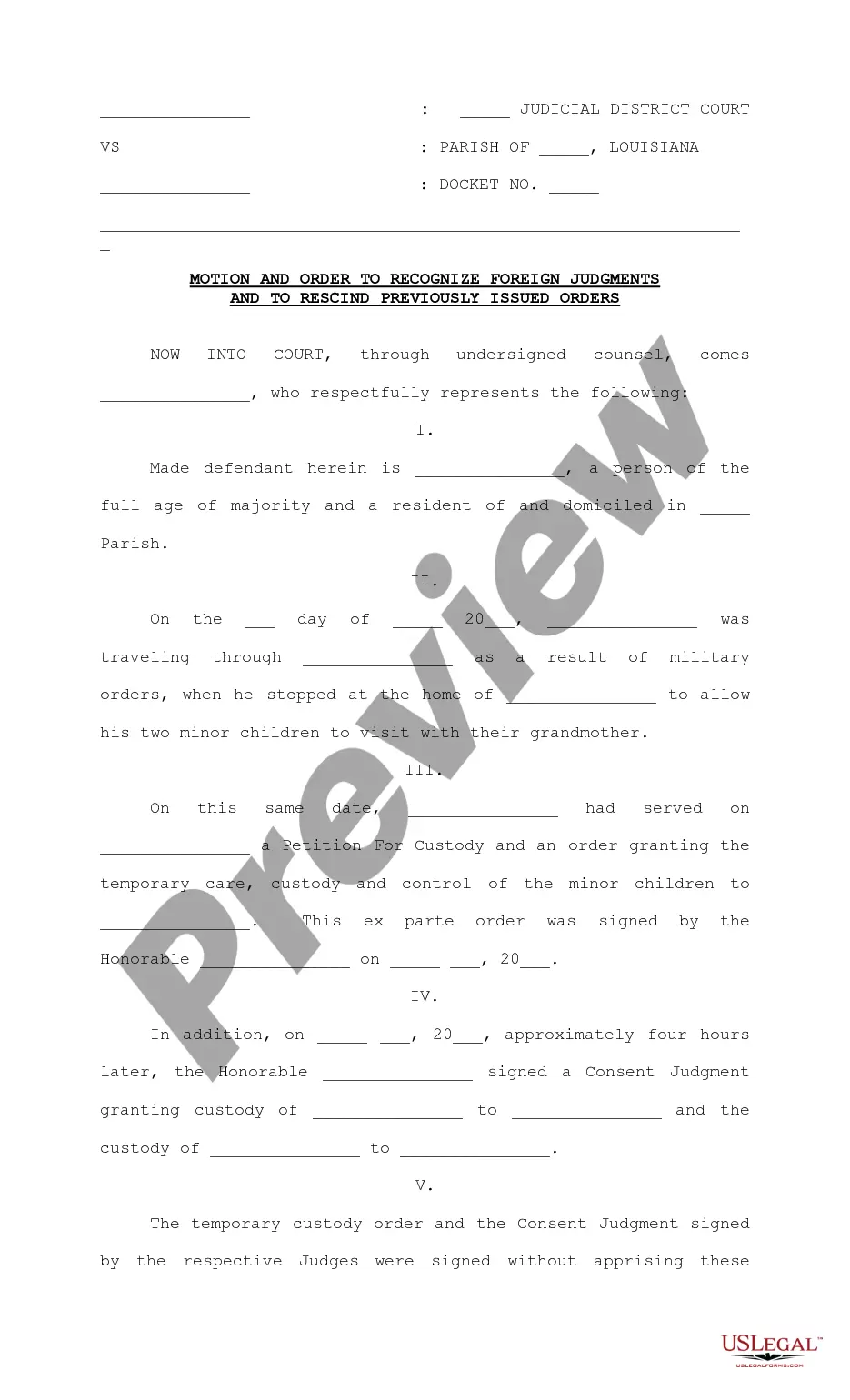

- Ensure you have picked out the proper form for the town/region. Select the Review switch to check the form`s content. See the form information to ensure that you have selected the proper form.

- If the form doesn`t satisfy your specifications, use the Search field near the top of the display to get the one that does.

- In case you are content with the form, confirm your choice by clicking on the Buy now switch. Then, opt for the costs strategy you favor and supply your references to sign up to have an account.

- Process the deal. Make use of your Visa or Mastercard or PayPal account to accomplish the deal.

- Pick the format and download the form on your system.

- Make modifications. Complete, edit and print and indication the saved Louisiana Clauses Relating to Initial Capital contributions.

Each and every format you included in your account lacks an expiry day which is your own permanently. So, in order to download or print one more duplicate, just proceed to the My Forms section and click on on the form you require.

Get access to the Louisiana Clauses Relating to Initial Capital contributions with US Legal Forms, by far the most extensive collection of legitimate document layouts. Use 1000s of skilled and status-certain layouts that meet up with your company or person needs and specifications.

Form popularity

FAQ

To establish an LLC, Louisiana requires that you complete and file the articles of organization limited liability company form (#365), available from the Louisiana Secretary of State. If your business address is located within the following parishes, you must file your articles of organization online: Ascension.

In Texas, an operating agreement isn't required to form a limited liability company (LLC). However, business attorneys, accountants and advisors agree that no LLC should form without one. An LLC operating agreement is a legally binding document that defines critical aspects of the LLC.

This clause should be used when one member contributed real property to the joint venture in exchange for membership interests and another member has contributed capital. The capitalized terms and section references used in this clause should be conformed to the relevant joint venture operating agreement.

Capital contributions are the money or other assets members give to the LLC in exchange for ownership interest. Members fund the LLC with initial capital contributions?these are usually recorded in the operating agreement. Additional capital contributions can be made at any time later on.

You can get an LLC in Louisiana in 3-5 business days if you file online (or 2-3 weeks if you file by mail). If you need your Louisiana LLC faster, you can pay for expedited processing.

Simply writing out a check for the amount you're supposed to contribute will do the trick. You should document it in the accounts as a contribution of added capital, and show how this increases your membership share of the LLC.

(3) ?Capital contribution? means anything of value that a person contributes to the limited liability company as a prerequisite for, or in connection with, membership, including cash, property, services rendered, or a promissory note or other binding obligation to contribute cash or property or to perform services.

For example, an owner might take out a loan and use the proceeds to make a capital contribution to the company. Businesses can also receive capital contributions in the form of non-cash assets such as buildings and equipment. These scenarios are all types of capital contributions and increase owners' equity.

How Much Does It Cost To Get an LLC in Louisiana? You need to pay the following filing fees to start your LLC in Louisiana: Domestic LLCs: $100. Foreign or out-of-state LLCs: $150.

Is an operating agreement required in Louisiana? There is no Louisiana law requiring LLCs to adopt an operating agreement. However, a written operating agreement is usually required to open a company bank account, and it can help you reinforce your limited liability status if you ever face a lawsuit.