Louisiana Assignment of Production Payment Measured by Value Received

Description

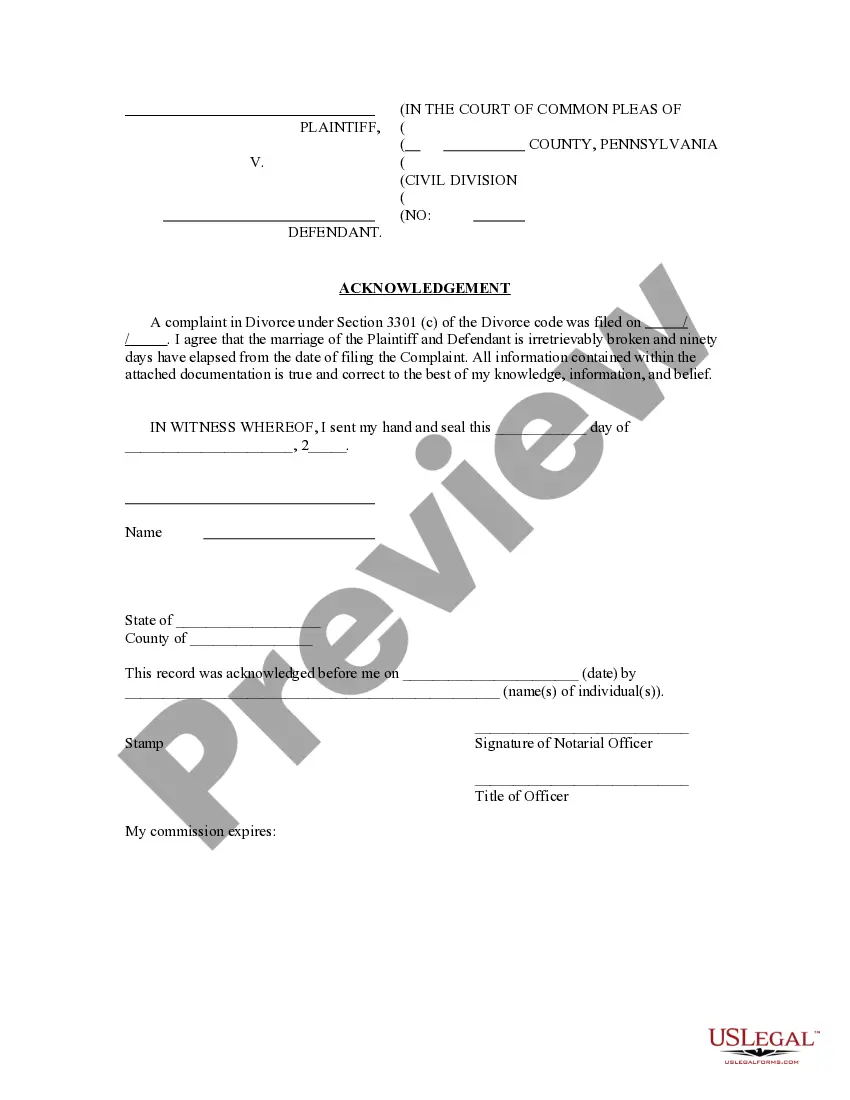

How to fill out Assignment Of Production Payment Measured By Value Received?

Choosing the best legal file format might be a have difficulties. Obviously, there are a lot of templates available on the net, but how can you find the legal develop you require? Utilize the US Legal Forms site. The service delivers 1000s of templates, like the Louisiana Assignment of Production Payment Measured by Value Received, which you can use for enterprise and personal requires. Each of the types are examined by experts and meet federal and state requirements.

Should you be already signed up, log in to the account and then click the Download switch to get the Louisiana Assignment of Production Payment Measured by Value Received. Utilize your account to check through the legal types you might have acquired formerly. Proceed to the My Forms tab of your own account and have one more copy from the file you require.

Should you be a whole new end user of US Legal Forms, here are easy guidelines that you should follow:

- Initial, be sure you have chosen the proper develop to your town/region. You can examine the shape utilizing the Preview switch and study the shape explanation to ensure it will be the best for you.

- When the develop is not going to meet your preferences, use the Seach field to obtain the proper develop.

- When you are certain the shape is suitable, click on the Purchase now switch to get the develop.

- Pick the pricing plan you would like and enter in the essential details. Make your account and buy your order using your PayPal account or charge card.

- Choose the data file structure and acquire the legal file format to the product.

- Total, modify and print and sign the acquired Louisiana Assignment of Production Payment Measured by Value Received.

US Legal Forms is the most significant collection of legal types in which you can discover different file templates. Utilize the company to acquire expertly-made documents that follow state requirements.

Form popularity

FAQ

R.S. 1(A) defines wages as all compensation paid for services performed by an employee for an employer, including the cash value of all compensation paid in any medium other than cash.

Buying mineral rights in Louisiana The 14 matching properties for sale in Louisiana have an average listing price of $253,348 and price per acre of $6,428. For more nearby real estate, explore land for sale in Louisiana.

A quick definition of production payment: A production payment is a type of agreement in the oil and gas industry where a person or company receives a share of the oil and gas produced from a property. This share is given without having to pay for the costs of production.

A volumetric production payment (VPP) is a means of financing used predominantly in the oil and gas industry wherein the owner of an oil or gas property sells a percentage of the total production for an upfront cash payment. It allows the issuer to monetize his/her assets without diluting his control on them.

A production payment is a type of agreement in the oil and gas industry where a person or company receives a share of the oil and gas produced from a property. This share is given without having to pay for the costs of production. The agreement ends once a certain amount of money has been paid to the person or company.

Dollar-Denominated Production Payments means production payment obligations of the Borrower or any Subsidiary Guarantor which are payable from a specified share of proceeds received from production from specific Properties, together with all undertakings and obligations in connection therewith.

Louisiana Mineral Rights are somewhat unique. Unlike other states, Louisiana mineral rights revert back to the original owner after 10 years from the date of sale or from the date of last production.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

26 U.S. Code § 636 - Income tax treatment of mineral production payments. A production payment carved out of mineral property shall be treated, for purposes of this subtitle, as if it were a mortgage loan on the property, and shall not qualify as an economic interest in the mineral property.

Production payments: A contractual arrangement providing a mineral interest that gives the owner a right to receive a fraction of production, or of proceeds from the sale of production, until a specified quantity of minerals (or a definite sum of money, including interest) has been received.