Louisiana Term Royalty Deed for Term of Existing Lease

Description

How to fill out Term Royalty Deed For Term Of Existing Lease?

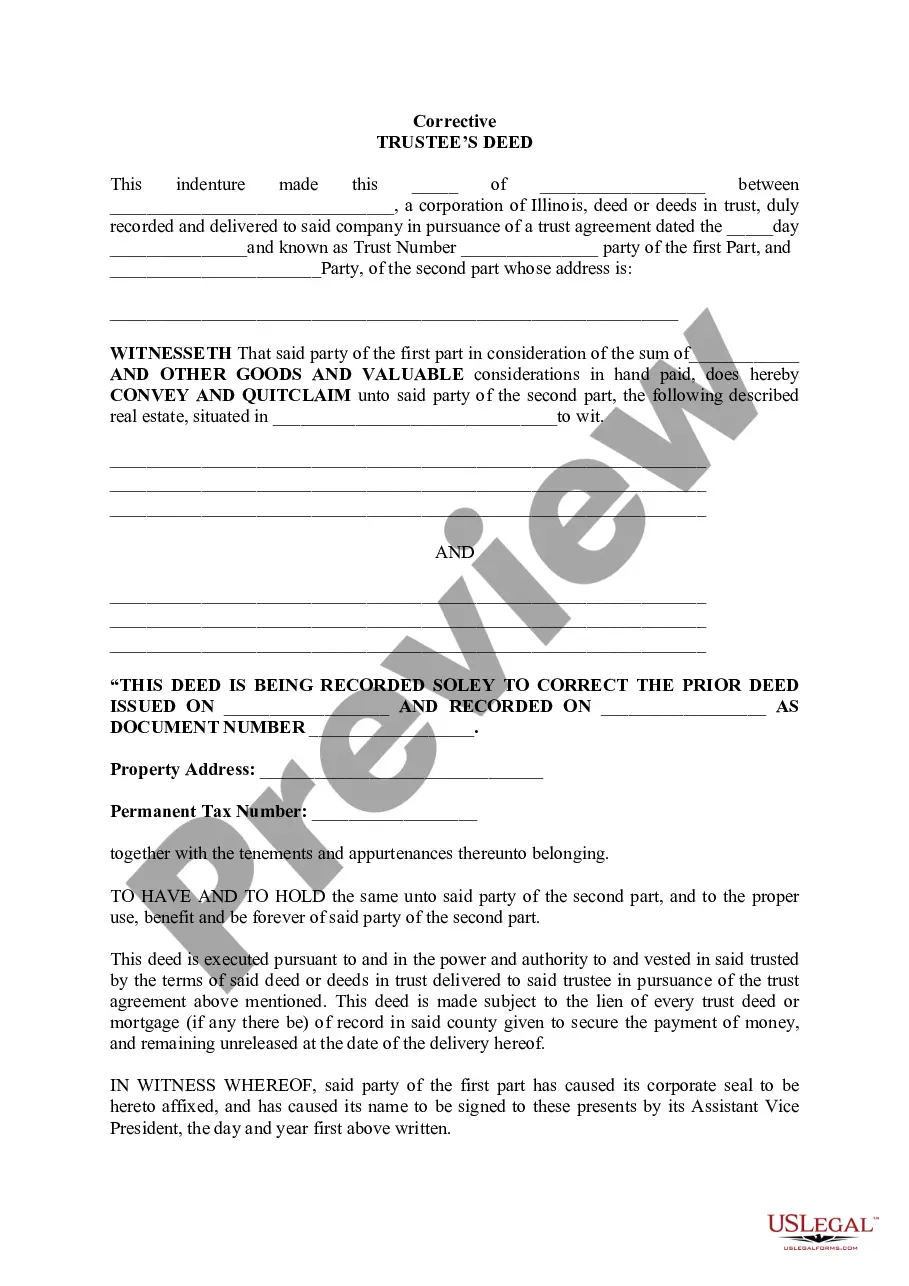

If you need to full, download, or print out legitimate record web templates, use US Legal Forms, the greatest selection of legitimate types, which can be found on the web. Make use of the site`s basic and hassle-free look for to obtain the papers you will need. Various web templates for business and personal uses are categorized by types and says, or key phrases. Use US Legal Forms to obtain the Louisiana Term Royalty Deed for Term of Existing Lease with a couple of mouse clicks.

In case you are previously a US Legal Forms consumer, log in in your profile and click on the Down load switch to get the Louisiana Term Royalty Deed for Term of Existing Lease. You may also entry types you in the past acquired from the My Forms tab of your profile.

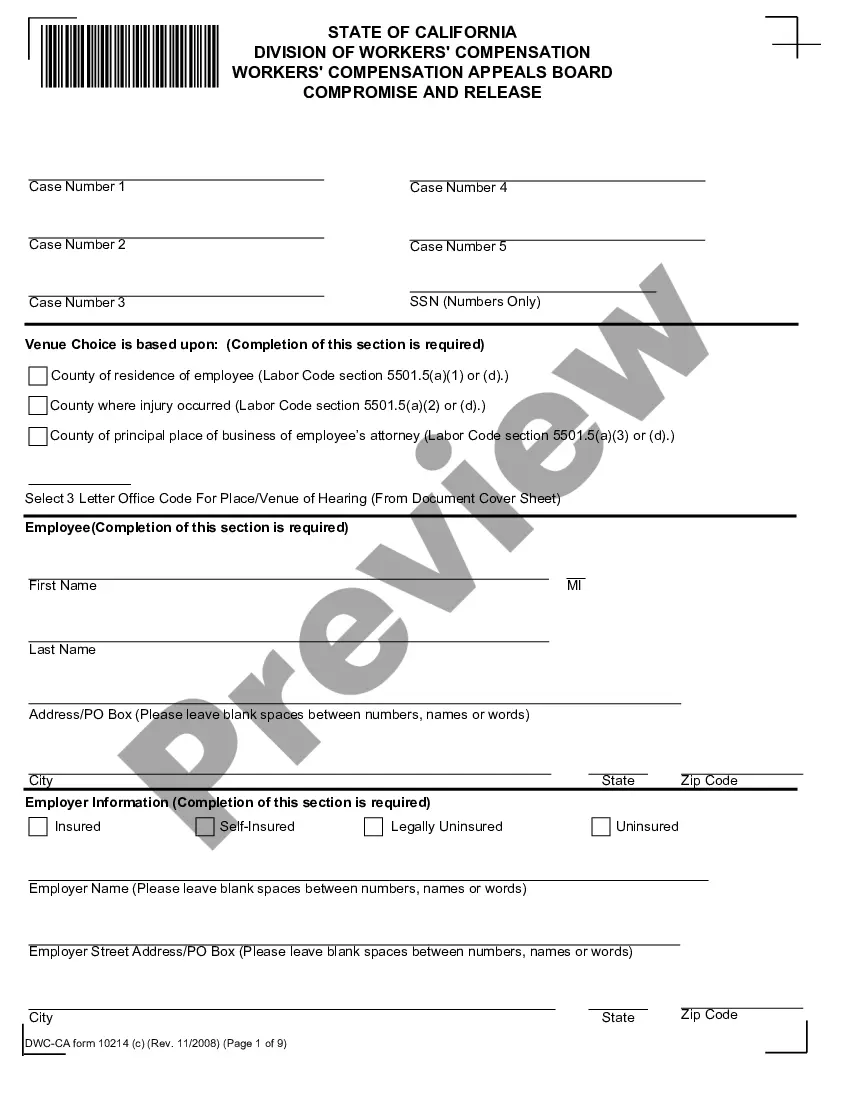

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for your correct area/nation.

- Step 2. Make use of the Review solution to look over the form`s articles. Do not overlook to learn the information.

- Step 3. In case you are not happy with all the kind, make use of the Lookup field near the top of the display to discover other variations of the legitimate kind template.

- Step 4. After you have identified the form you will need, go through the Purchase now switch. Opt for the rates plan you like and add your accreditations to sign up to have an profile.

- Step 5. Approach the purchase. You can utilize your credit card or PayPal profile to finish the purchase.

- Step 6. Select the structure of the legitimate kind and download it on the system.

- Step 7. Total, modify and print out or indication the Louisiana Term Royalty Deed for Term of Existing Lease.

Each legitimate record template you purchase is your own property forever. You possess acces to each kind you acquired inside your acccount. Click on the My Forms area and pick a kind to print out or download once again.

Compete and download, and print out the Louisiana Term Royalty Deed for Term of Existing Lease with US Legal Forms. There are many specialist and state-certain types you can use to your business or personal demands.

Form popularity

FAQ

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

The units of measure that we use to determine just how much right to the minerals you own in a tract of land is the Net Mineral Acre (or NMA) or the Net Royalty Acre (or NRA). This is different than the ?gross acreage? which refers to the total amount of acreage in a tract of land (basically the surface footprint).

Selling means that you can receive a large cash payment upfront, regardless of minerals found on your land. A company who leases your land may deplete the mineral supply substantially before returning the land back to you. Selling reduces overall risk of handling mineral rights.

The net royalty acre is a term that explains the mineral royalty interest in one-eighth of 8/8 in one acre of land. Simply put, this is the number of mineral acres if leased at a 12.5% royalty.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold].

Net Density: This refers to the number of dwelling units per net developable acre (total acreage of developable portions of the site) within a given land area.

Net acres is the amount of leased real estate that a petroleum and/or natural gas company holds, pertaining to a company's true working interest. Net acres can be calculated on a per-project basis by multiplying the gross acres by the percentage of ownership.

A net royalty normally means that post-production costs will be deducted from the royalty owner's royalty prior to distribution. A gross royalty normally means that post-production costs will not be deducted from the royalty owner's royalty prior to distribution.