Louisiana Self-Employed Tour Guide Services Contract

Description

How to fill out Self-Employed Tour Guide Services Contract?

Are you presently in a position where you require documentation for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a plethora of form templates, such as the Louisiana Self-Employed Tour Guide Services Contract, designed to comply with federal and state regulations.

Select the pricing plan you desire, complete the required information to create your account, and finalize the purchase with your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Louisiana Self-Employed Tour Guide Services Contract anytime, if necessary. Click the desired form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Louisiana Self-Employed Tour Guide Services Contract template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

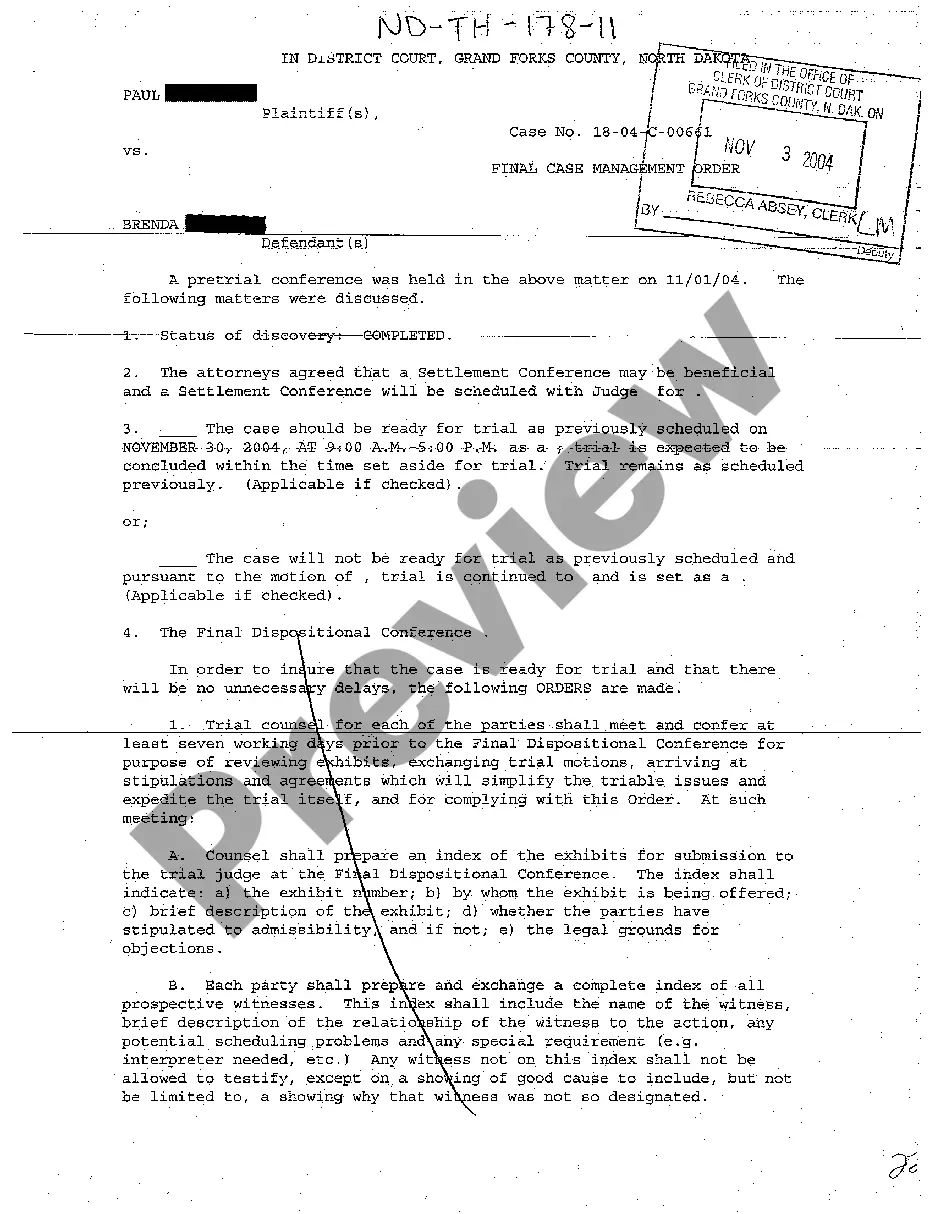

- Use the Review button to evaluate the document.

- Read the description to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search section to find the form that fits your needs and requirements.

- Once you locate the right form, click on Download now.

Form popularity

FAQ

An operating agreement is not required for LLCs in Louisiana, but it is strongly encouraged. This document helps establish the rules for your business operations and can be particularly beneficial for self-employed tour guides. By preparing a Louisiana Self-Employed Tour Guide Services Contract, you create a structured approach that enhances your business's credibility and functionality.

To be classified as an independent contractor in Louisiana, a person must demonstrate control over their work and have the ability to operate independently. This classification is important for self-employed tour guides as it affects taxation and liability. Drafting a Louisiana Self-Employed Tour Guide Services Contract can help clarify your status and ensure compliance with state laws.

Louisiana does not require an operating agreement for LLCs, but it is advisable to have one. An operating agreement can help you define ownership, management, and operational procedures, which is beneficial for self-employed tour guides. By utilizing a Louisiana Self-Employed Tour Guide Services Contract, you can create a customized agreement that covers all essential aspects of your business.

In Louisiana, an employment contract outlines the terms of the relationship between an employer and an employee. For self-employed tour guides, having a clear contract can help define roles, responsibilities, and compensation. This clarity is crucial, and incorporating elements of a Louisiana Self-Employed Tour Guide Services Contract can further solidify your business arrangements.

The two contract theory in Louisiana refers to the framework that recognizes both the contract for services and the contract for the delivery of results. This means that when you engage in self-employed tour guide services, you essentially enter into two agreements: one for the service and one for the expected outcome. Understanding this theory can help you draft a more effective Louisiana Self-Employed Tour Guide Services Contract.

If you do not have an operating agreement for your LLC in Louisiana, your business will be governed by default state laws. This can lead to misunderstandings among partners and unclear management roles, which may disrupt your self-employed tour guide services. Having a Louisiana Self-Employed Tour Guide Services Contract can provide a clear framework that suits your specific needs.

In Louisiana, operating agreements are not legally required for LLCs, but they are highly recommended. An operating agreement outlines the management structure and operating procedures of your business, which is particularly helpful for self-employed tour guides. By creating a Louisiana Self-Employed Tour Guide Services Contract, you can ensure clarity in your business operations and prevent potential disputes.

Freelance tour guides can earn a wide range of income based on their expertise and the tours they provide. On average, they may make anywhere from $30 to $100 per hour. A Louisiana Self-Employed Tour Guide Services Contract can help establish clear payment terms and protect your earnings.

Generally, you do not need a license to operate as a tour guide in Louisiana. Nevertheless, some cities may have specific licensing requirements. To navigate these regulations effectively, consider using a Louisiana Self-Employed Tour Guide Services Contract to ensure compliance with local laws.

While specific qualifications are not always required to be a tour guide in Louisiana, having a good understanding of the area's history and culture is essential. Many guides also benefit from local certifications or training programs. A Louisiana Self-Employed Tour Guide Services Contract can provide a framework for outlining any qualifications and expectations.