Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

If you wish to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the most significant collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

A range of templates for commercial and personal purposes are categorized by groups and states, or keywords. Use US Legal Forms to obtain the Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor with just a few clicks.

Every legal document template you obtain is yours indefinitely. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Stay competitive and download, and print the Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and then click the Download button to obtain the Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

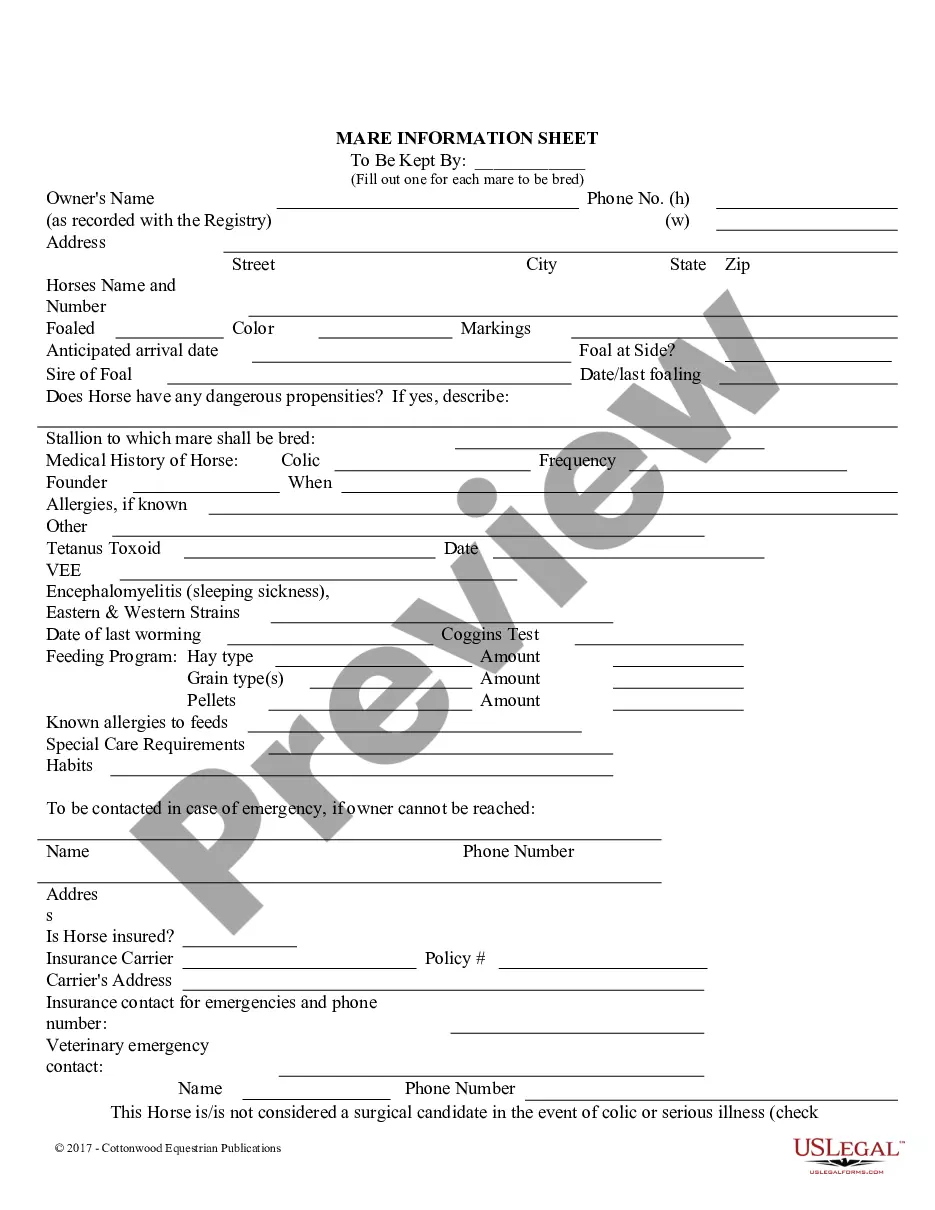

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to check the summary.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor.

Form popularity

FAQ

The compensation structure for an independent contractor often includes hourly rates or project-based fees. As a Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor, you can choose to bill clients directly for your services. It's essential to consider expenses, taxes, and insurance when determining your rates to ensure a sustainable income.

The hourly rate for an X-ray technician typically ranges from $25 to $40, depending on various factors. In Louisiana, self-employed independent contractors have the flexibility to determine their own compensation based on their skills and market demand. Understanding your worth as a Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor can help you negotiate better rates.

In Louisiana, the average hourly wage for x-ray technicians varies, but it generally falls between $25 and $35. Factors such as experience, location, and the type of facility can influence these rates. As a Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor, you may find opportunities to set your own rates, potentially increasing your earnings.

Proof of income for a Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor includes several documents. These may consist of bank statements, receipts, invoices, and tax returns. Keeping thorough records will help you verify your income and demonstrate financial stability when necessary.

Filling out a 1099 form as a Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor involves gathering specific information. You will need your Social Security number, the client's information, and the total amount earned. It’s crucial to ensure accuracy to avoid issues with the IRS.

Yes, a 1099 form is considered valid proof of income for a Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor. This form reports how much you earned from each client throughout the year. It is essential for tax purposes and can support your income claims when applying for loans or other financial products.

If you are a Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor, you can show proof of income through several methods. You may present 1099 forms, which report your earnings for the year, along with tax returns. Having a detailed accounting of your work will strengthen your proof of income.

To demonstrate proof of income as a Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor, you can use various documents. Common forms include bank statements, invoices, and contracts with clients. Additionally, maintaining organized records will make it easier to present your income when needed.

Yes, as a Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor, you are indeed considered self-employed. This classification means you are not an employee of a particular company but rather operate your own business. Being self-employed gives you the flexibility to manage your schedule and choose your clients.

Receiving a 1099 form typically indicates that you are self-employed. This form reports income earned as an independent contractor, which means you do not receive traditional employee benefits. As a Louisiana Self-Employed X-Ray Technician Self-Employed Independent Contractor, keep track of your income and expenses for tax purposes.