Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - offers a diverse selection of legal document templates that you can obtain or create.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor within moments.

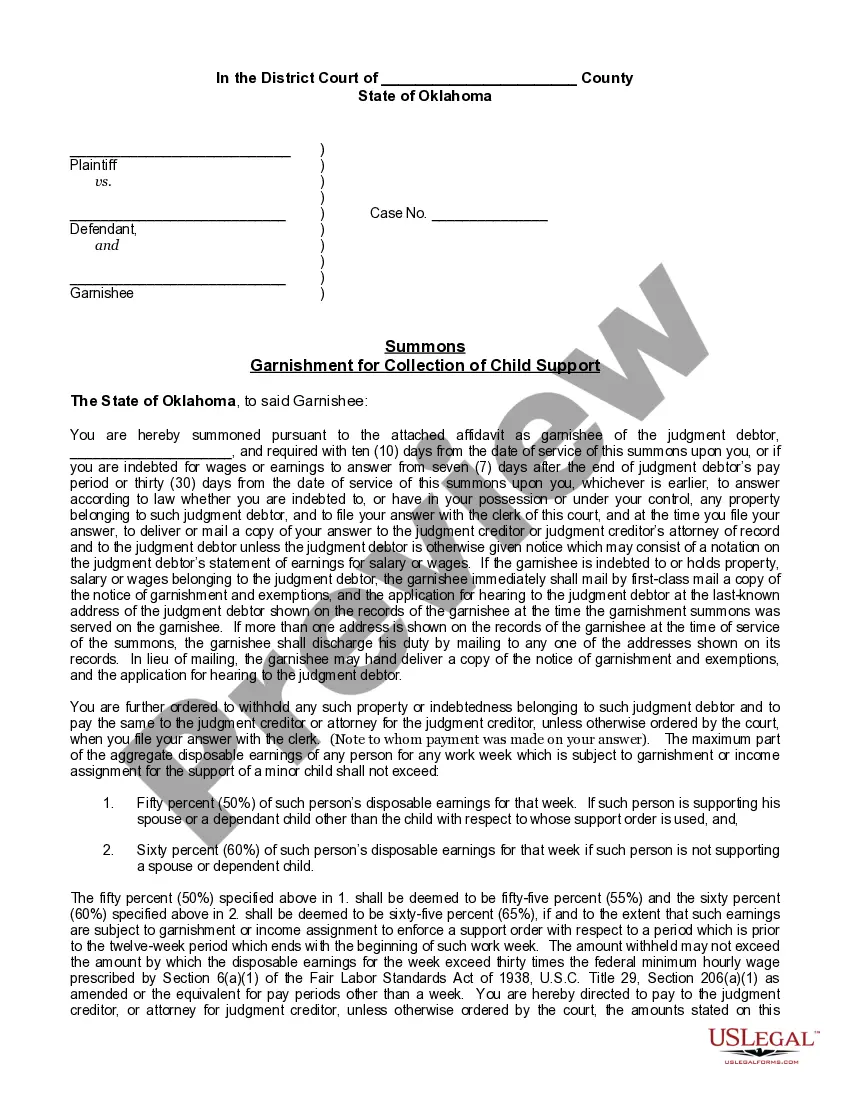

Click the Preview button to review the contents of the form.

Check the form description to confirm that you have chosen the appropriate template.

- If you have a subscription, Log In and obtain the Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor from the US Legal Forms library.

- The Download button will appear on every template you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some basic instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Independent contractors do not typically need to be on payroll. Instead, they invoice clients for their services based on the agreed terms. A Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor allows contractors to operate independently while still maintaining a professional framework. This arrangement can benefit both the contractor and the hiring entity by fostering a clear relationship without the complexities of payroll.

A basic independent contractor agreement includes key elements such as scope of work, payment terms, and duration of the contract. This clarity within a Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor is vital to prevent misunderstandings. Every agreement should also specify confidentiality and termination clauses to safeguard both parties' interests. Utilizing uslegalforms can simplify drafting an effective agreement.

Legal requirements for independent contractors can vary by state. Generally, they must complete their tasks per the agreement terms, manage their taxes, and follow specific state regulations. For those under a Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor, it’s crucial to understand local laws governing independent work. Compliance ensures your operation is legal and helps avert potential issues.

Independent contractors are typically not on payroll in the traditional sense. They usually receive payments based on the terms of their contract, rather than a fixed salary. However, independent contractors may still have contracts that outline payment schedules and conditions, such as in a Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor. This approach maintains independence while ensuring clarity of payment and responsibilities.

Yes, self-employed individuals can and should have contracts in place. A contract outlines the terms of engagement and protects the rights of both parties. In the case of a Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor, your contract serves to clarify expectations, deliverables, and payment terms, ensuring a smooth working relationship. Always consult legal resources to draft a well-structured agreement.

When employing an independent contractor, you should gather specific paperwork to ensure compliance and clarity. The Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor is critical, as it covers vital terms of the work arrangement. Additionally, remember to collect a W-9 form for tax filing purposes and any other relevant documentation to ensure your hiring process is smooth and legally sound.

Creating an independent contractor agreement involves outlining essential terms clearly. Begin by defining the project's scope, payment schedule, and deadlines. A Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor can serve as a helpful template that ensures you cover all necessary aspects, protecting both parties throughout the working relationship.

To hire an independent contractor in Louisiana, you will need specific paperwork to formalize the arrangement. Start with the independent contractor agreement, such as the Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor, which details scope, payment, and timelines. Additionally, you may want to request a completed W-9 form from the contractor for tax purposes.

When working as a self-employed independent contractor in Louisiana, it is essential to complete several forms. Primarily, you should fill out the W-9 form to provide your taxpayer information. Additionally, if applicable, a Louisiana Payroll Specialist Agreement - Self-Employed Independent Contractor ensures clarity in your working relationship. This agreement can outline payment terms, project expectations, and responsibilities.