Louisiana Electrologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

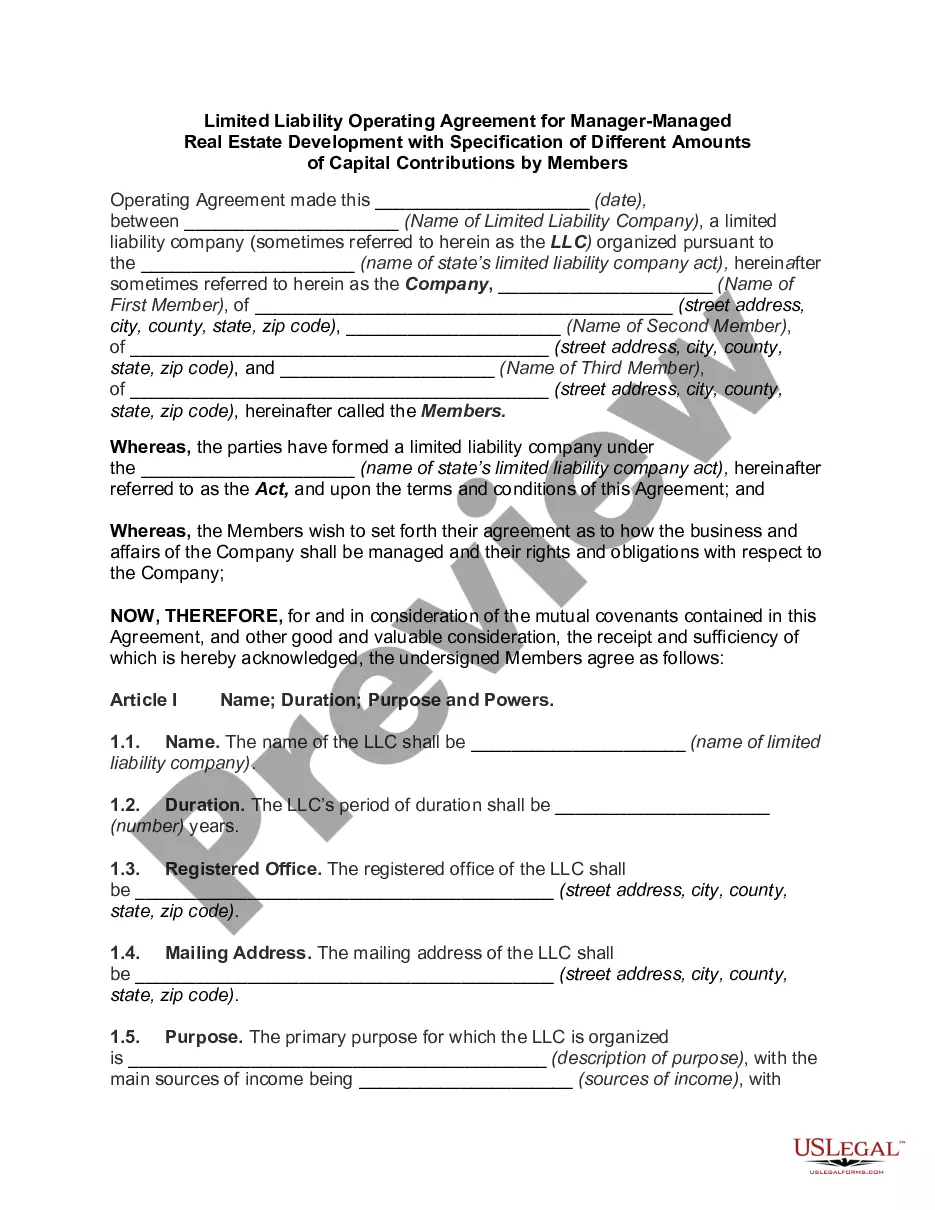

Locating the appropriate legitimate document template can be a challenge. Obviously, there are numerous designs available online, but how do you find the authentic form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Louisiana Electrologist Agreement - Self-Employed Independent Contractor, which can be utilized for business and personal purposes. All of the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Louisiana Electrologist Agreement - Self-Employed Independent Contractor. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account to retrieve another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple instructions you should follow: First, ensure you have selected the correct form for your city/state. You can preview the form using the Preview option and check the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to locate the correct form. When you are sure that the form is accurate, click the Get now button to obtain the form. Choose the pricing plan you require and enter the necessary information. Create your account and make the payment using your PayPal account or credit card. Select the document format and download the legal document template for your records. Complete, modify, print, and sign the acquired Louisiana Electrologist Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Use the service to obtain professionally crafted documents that meet state requirements.

The service provides a vast selection of templates, ensuring you find precisely what you need for your legal and personal documentation.

- locating.

- appropriate.

- challenge.

- numerous.

- authentic.

- utilize.

Form popularity

FAQ

An independent contractor typically needs to complete a W-9 form for tax purposes, along with an independent contractor agreement. Additional documents may include invoices for payment and any relevant licenses or permits. By utilizing a structured approach like the Louisiana Electrologist Agreement - Self-Employed Independent Contractor, you can ensure you have all the necessary paperwork in order. This preparation promotes a smooth contracting experience and protects both parties.

To fill out an independent contractor agreement, start by entering the names and contact information of both parties. Next, specify the services to be provided, payment amounts, and deadlines. Using a reliable template like the Louisiana Electrologist Agreement - Self-Employed Independent Contractor can help you ensure accuracy and completeness. This resource can simplify the process and help you avoid common mistakes.

Filling out an independent contractor form involves providing your personal information, the scope of work, and payment details. Be sure to specify the nature of your services to avoid confusion later. A well-structured Louisiana Electrologist Agreement - Self-Employed Independent Contractor can guide you through this process, ensuring you include all pertinent information. This clarity helps establish a strong working relationship with your contractor.

To write an independent contractor agreement, begin by defining the roles and responsibilities of both parties. Include essential details such as payment terms, duration of the agreement, and any specific project requirements. Utilizing a template like the Louisiana Electrologist Agreement - Self-Employed Independent Contractor can streamline this process. This approach ensures that you cover all necessary aspects while maintaining clarity and legal compliance.

Independent contractors must fulfill several legal requirements, including obtaining necessary licenses and permits for their work. Specifically, the Louisiana Electrologist Agreement - Self-Employed Independent Contractor requires compliance with state regulations. It's important to keep accurate records and ensure proper tax documentation to maintain your contractor status. Consulting legal resources can provide further guidance.

Creating an independent contractor agreement involves outlining key elements such as the scope of work, payment terms, and duties. For those using the Louisiana Electrologist Agreement - Self-Employed Independent Contractor, clarity is crucial to prevent future disputes. You can utilize platforms like uslegalforms to access customizable templates and simplify the agreement process effectively.

Louisiana law outlines specific criteria to classify workers as independent contractors. For the Louisiana Electrologist Agreement - Self-Employed Independent Contractor, individuals must demonstrate control over their work and work schedule. They should also provide their own tools and not rely on the hiring entity for direction. Meeting these criteria helps safeguard your status as an independent contractor.