Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

If you require to complete, procure, or print sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online. Take advantage of the site's straightforward and convenient search to obtain the documents you need.

Various templates for business and personal purposes are categorized by types and regions, or keywords. Use US Legal Forms to retrieve the Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Download option to find the Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee. You can also access forms you previously downloaded in the My documents tab of your account.

Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Participate and acquire, and print the Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

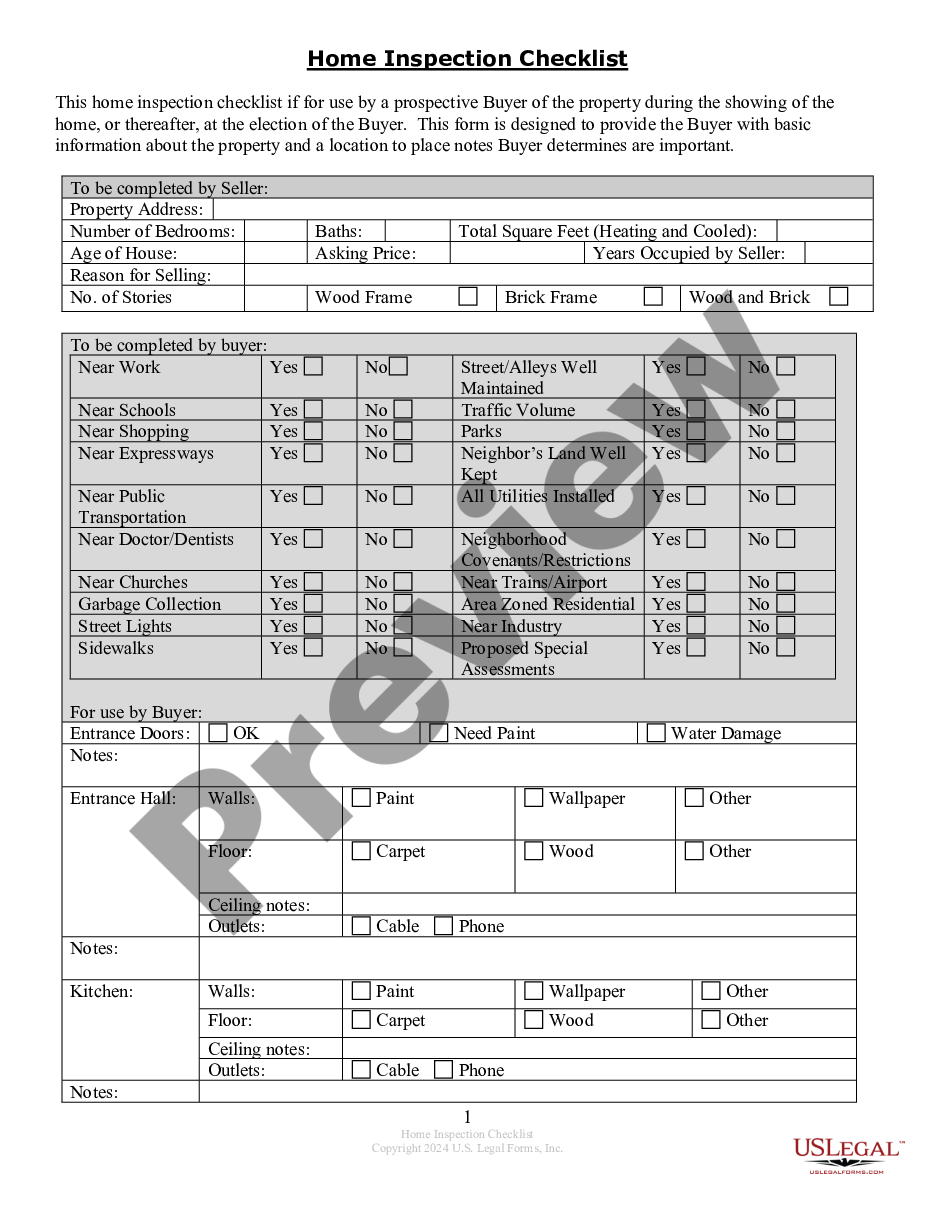

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review function to examine the form's details. Don't forget to check the description.

- Step 3. If you're not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you desire, click the Get now button. Choose the pricing plan you prefer and enter your information to register for the account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee.

Form popularity

FAQ

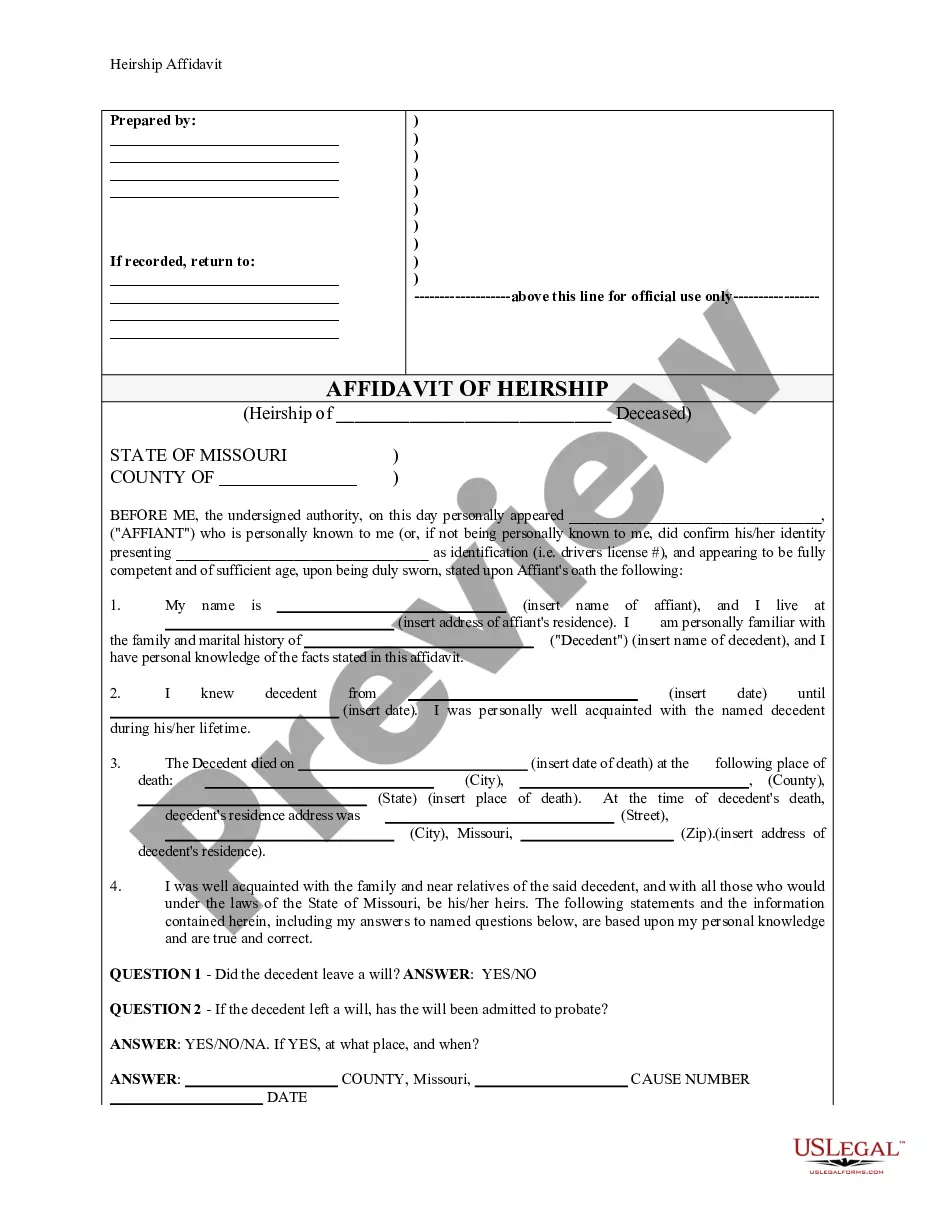

A wage authorization form is a document that gives consent for an employer to deduct specific amounts from an employee's paycheck. The Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee is an example of such a form, allowing employees to specify what deductions they wish to authorize. This form ensures that all deductions are both legitimate and agreed upon. Using this form, employees can maintain control over their payroll deductions, leading to better financial management.

Yes, Louisiana allows for itemized deductions on certain payroll deductions. These deductions may include contributions to retirement plans, insurance premiums, and other voluntary benefits. It’s important for employees to understand how the Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee can facilitate these deductions. By effectively using this form, employees can manage their deductions and take full advantage of their benefits.

Yes, payroll deductions must be approved by the employee in writing to ensure proper authorization. The Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee serves as this written confirmation. By completing this form, employees give clear consent for deductions to be taken from their wages. This process helps protect employees' rights and maintain transparency between employers and their staff.

An example of an optional payroll deduction is insurance premiums for supplemental health insurance plans. Employees often elect this type of coverage to enhance their existing health benefits. The Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee is a crucial tool to enable such selections and ensure they are processed accurately by your employer.

Common examples of optional deductions include union dues, charitable contributions, and health insurance premiums. It is important to review the specific deductions offered by your employer, as they can vary widely. Completing the Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee allows you to select which deductions you wish to authorize.

The form for payroll deductions is typically a standardized document that employees fill out to specify their desired deductions. In Louisiana, the Payroll Deduction Authorization Form for Optional Matters - Employee is specifically designed to capture information relevant to optional deductions. This form helps employers manage payroll more efficiently while accommodating employee preferences.

An example of an optional deduction includes contributions to a retirement savings plan, such as a 401(k). Employees can choose to set aside a portion of their salary for this purpose, which can lead to significant long-term savings. Utilizing the Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee simplifies this process and helps ensure that your savings are allocated correctly.

An optional deduction refers to a voluntary deduction from an employee's paycheck for various benefits or contributions. These deductions are not mandated by law, but rather based on employee choice. Completing the Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee is essential to formalize this choice and ensure accurate processing.

A payroll deduction agreement is a formal contract between an employer and an employee, outlining what deductions will be taken from the employee's wages. This agreement helps prevent misunderstandings and ensures compliance with workplace regulations. By using the Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee, you can establish these agreements efficiently and effectively.

An authorized deduction is a deduction from an employee's paycheck that has received explicit approval from the employee, typically documented in a formal agreement. This is crucial for maintaining trust and legality in payroll practices. The Louisiana Payroll Deduction Authorization Form for Optional Matters - Employee aids in creating a clear record of these authorized deductions.