Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

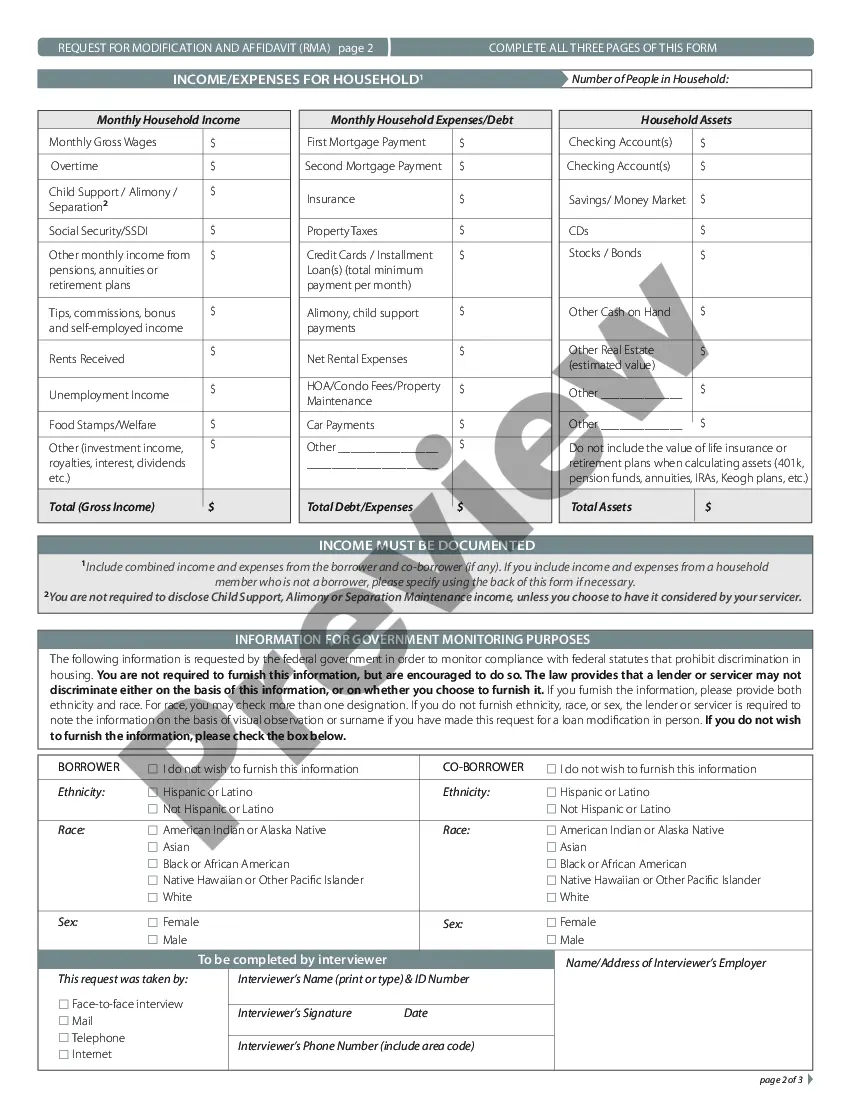

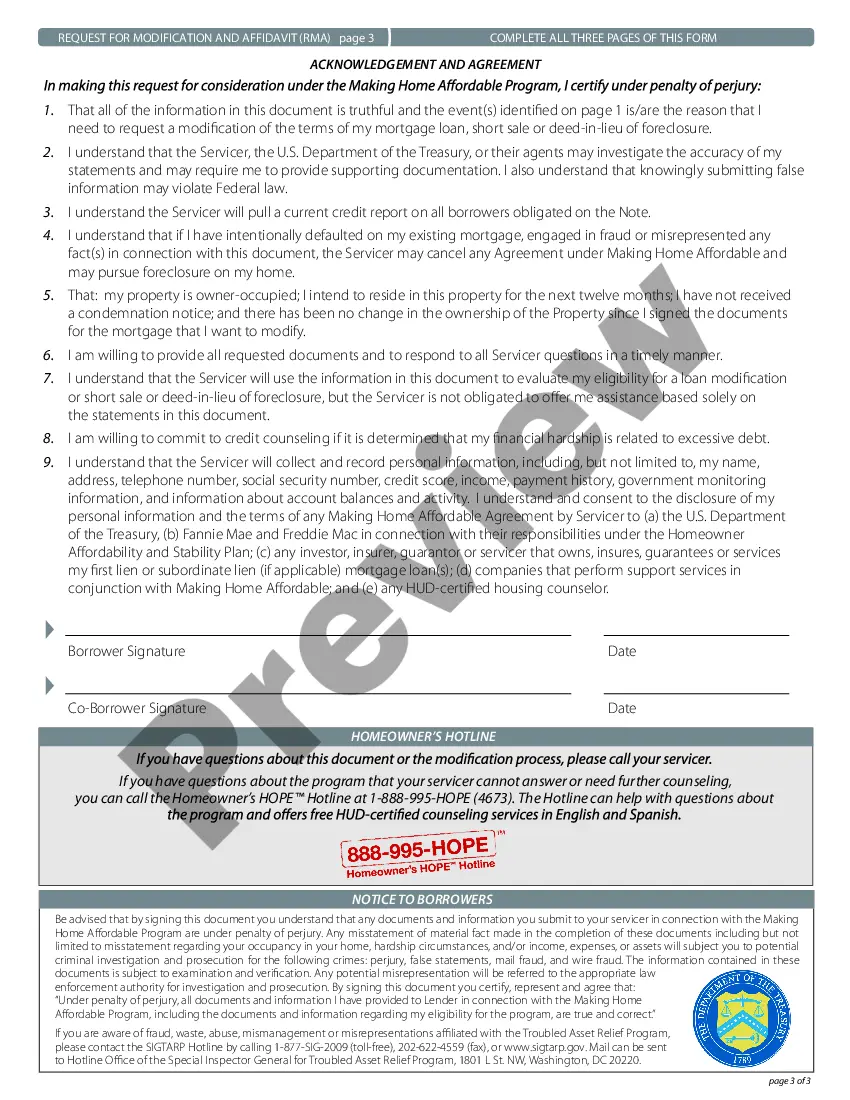

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates for you to download or print. By utilizing the website, you will access thousands of forms for business and personal use, categorized by types, jurisdictions, or keywords. You'll find the latest editions of documents such as the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP in just moments.

If you already possess a monthly subscription, Log In and retrieve the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you wish to utilize US Legal Forms for the first time, here are straightforward guidelines to help you get started: Ensure you have selected the correct form for your state/region. Click on the Review button to examine the form’s details. Check the form description to confirm that you have selected the correct document. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the document, confirm your choice by clicking the Purchase now button. Afterward, choose the payment plan you prefer and provide your information to create an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Select the format and download the document to your device. Edit. Fill out, modify, and print and sign the downloaded Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- Each template you add to your account has no expiration date and is yours to keep indefinitely.

- Therefore, if you wish to download or print another copy, simply return to the My documents section and click on the document you need.

- Access the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize a vast array of professional and state-specific templates that meet your business or personal requirements and needs.

- Feel free to reach out for assistance if needed.

Form popularity

FAQ

No, the Home Owners' Loan Corporation (HOLC) is no longer in operation today; it was dissolved in the 1950s. However, many of the concepts introduced by HOLC influenced modern loan modification programs, including the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. While HOLC is part of history, current programs continue to aim at providing support for homeowners. To find effective solutions, consider utilizing resources like US Legal Forms to navigate available options.

Yes, Congress passed several mortgage relief programs, including the Home Affordable Modification Program. The program aims to help homeowners in states like Louisiana by offering the Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. This initiative enables struggling homeowners to modify their loans, making payments more manageable. Understanding these programs can empower you to seek the assistance you need.

Yes, HAMP modifications are still available for eligible homeowners seeking assistance. The Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can provide significant relief to those facing financial difficulties. By applying for a loan modification, you can potentially reduce your monthly mortgage payment and avoid foreclosure. To explore your options, consider using platforms like US Legal Forms for straightforward guidance in your application process.

Getting approved for a loan modification can be straightforward if you follow the right steps. Factors such as your financial situation, documentation accuracy, and compliance with the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP significantly influence approval chances. While some applicants may face challenges, providing thorough information and seeking assistance can greatly improve your outcome. Remember, platforms like US Legal Forms can help ensure you have everything in order to present your case effectively.

To apply for a loan modification, you need to start by gathering necessary financial documents such as your income statements, bank statements, and hardship letters. Next, you can submit these documents along with the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP through your lender's official channels. It's important to ensure that you meet all eligibility requirements, as this can streamline the process. Using a platform like US Legal Forms can provide templates and guidance to help you complete the application correctly.

RMA stands for Request for Mortgage Assistance, which is a crucial step in accessing loan modification options. This form is typically submitted to your lender to start the process of modifying your mortgage. To understand how to fill out the RMA accurately and effectively, consider using resources available through the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

HAMP modification refers to the process of changing your mortgage terms through the Home Affordable Modification Program, making it easier to afford your payments. This modification may involve reducing the interest rate or extending the loan term. For detailed information and steps to apply, look into the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP on the US Legal Forms platform.

HAMP stands for the Home Affordable Modification Program, established to assist struggling homeowners. It helps modify existing mortgages to provide lower monthly payments and stabilize homeownership. Understanding HAMP is crucial, and the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is a great resource for you to leverage.

A mortgage loan modification can be a good idea if you face financial difficulties and need a more manageable payment. It allows homeowners to adjust their loan terms to avoid foreclosure. To explore your options, consider the tools provided by the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP for further clarity.

A HAMP loan modification adjusts your mortgage payments to make them more affordable, helping you avoid foreclosure. This program reduces monthly payments by extending repayment terms or lowering interest rates. If you are considering this option, the Louisiana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP provides valuable information to help you navigate the process.