Louisiana Investor Certification Form

Description

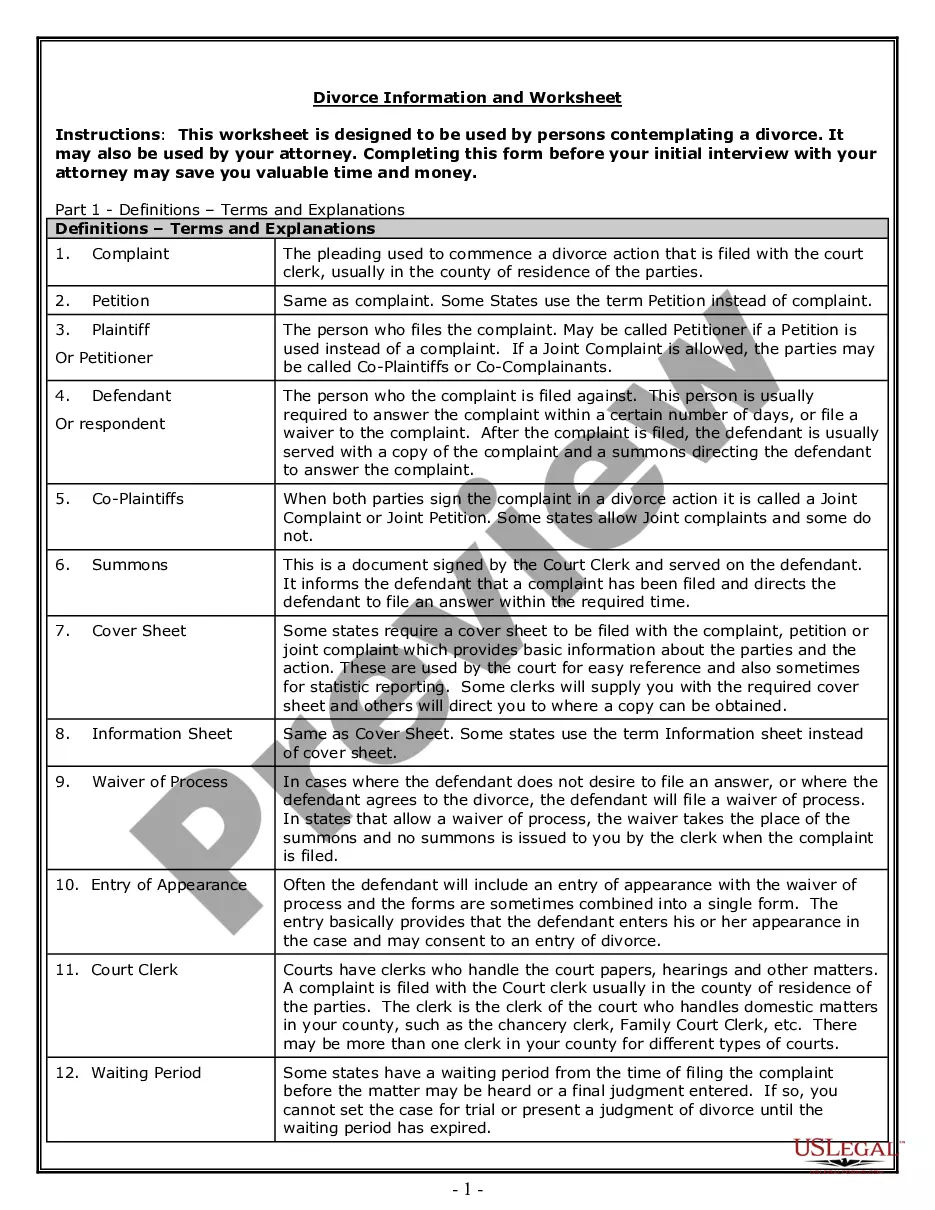

How to fill out Investor Certification Form?

If you wish to complete, obtain, or print legal papers web templates, use US Legal Forms, the largest variety of legal types, that can be found on the web. Make use of the site`s simple and easy convenient research to get the papers you will need. Numerous web templates for company and person reasons are categorized by categories and suggests, or keywords. Use US Legal Forms to get the Louisiana Investor Certification Form in a couple of mouse clicks.

Should you be currently a US Legal Forms consumer, log in to your profile and then click the Acquire switch to have the Louisiana Investor Certification Form. Also you can gain access to types you formerly downloaded inside the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for your right metropolis/nation.

- Step 2. Utilize the Preview solution to check out the form`s information. Never neglect to read the outline.

- Step 3. Should you be not happy together with the develop, make use of the Search field towards the top of the display to get other variations in the legal develop design.

- Step 4. After you have identified the form you will need, click on the Get now switch. Opt for the prices strategy you prefer and include your qualifications to sign up for the profile.

- Step 5. Method the deal. You may use your credit card or PayPal profile to finish the deal.

- Step 6. Pick the structure in the legal develop and obtain it on the device.

- Step 7. Complete, change and print or sign the Louisiana Investor Certification Form.

Each and every legal papers design you get is your own property eternally. You possess acces to each develop you downloaded inside your acccount. Go through the My Forms segment and choose a develop to print or obtain once more.

Remain competitive and obtain, and print the Louisiana Investor Certification Form with US Legal Forms. There are millions of specialist and state-specific types you can utilize for the company or person needs.

Form popularity

FAQ

Louisiana Revised Statute 1.1(F)(4) requires the electronic filing of all composite partnership returns. If tax credits are claimed on the composite return: ALL nonresident partners must be included on the return and on Schedule of Included Partner's Share of Income and Tax.

Hear this out loud PauseAll corporations and entities taxed as corporations for federal income tax purposes deriving income from Louisiana sources, whether or not they have any net income, must file an income tax return.

All nonresident partners who were partners at any time during the taxable year and who do not have a valid agreement on file with LDR must be included in the Louisiana Composite Partnership Return (See LAC 61:I. 1401).

Louisiana State General Business Corporation tax extension Form CIFT-620EXT is due within 4 months and 15 days following the end of the corporation reporting period. Form CIFT-620EXT grants an automatic 7-month extension of time to file Form CIFT-620.

Hear this out loud PauseRevised Statute 3 allows a six-month automatic extension of time to file the individual income tax return to be granted on request. If you know you cannot file your return by the due date, you do not need to file for an extension.

PART 2: CREDIT FOR CERTAIN DISABILITIES ? A credit of $100 against the tax is permitted for the taxpayer, spouse, or dependent who is blind, deaf, mentally incapacitated, or has lost the use of a limb. Only one credit is allowed per person.

Hear this out loud PauseA person who moves into Louisiana after the start of the succeeding year, and who files his federal income tax return for the prior taxable year using a Louisiana address, will receive the letter of inquiry from the department concerning Louisiana income tax liability, even though the person was not a resident of ...

Hear this out loud PauseDOMESTIC CORPORATIONS ? Corporations organized under the laws of Louisiana must file Form CIFT-620, Louisiana Income Tax and Louisiana Corporation Franchise Tax return each year unless exempt from both taxes.