Louisiana Investment Transfer Affidavit and Agreement

Description

How to fill out Investment Transfer Affidavit And Agreement?

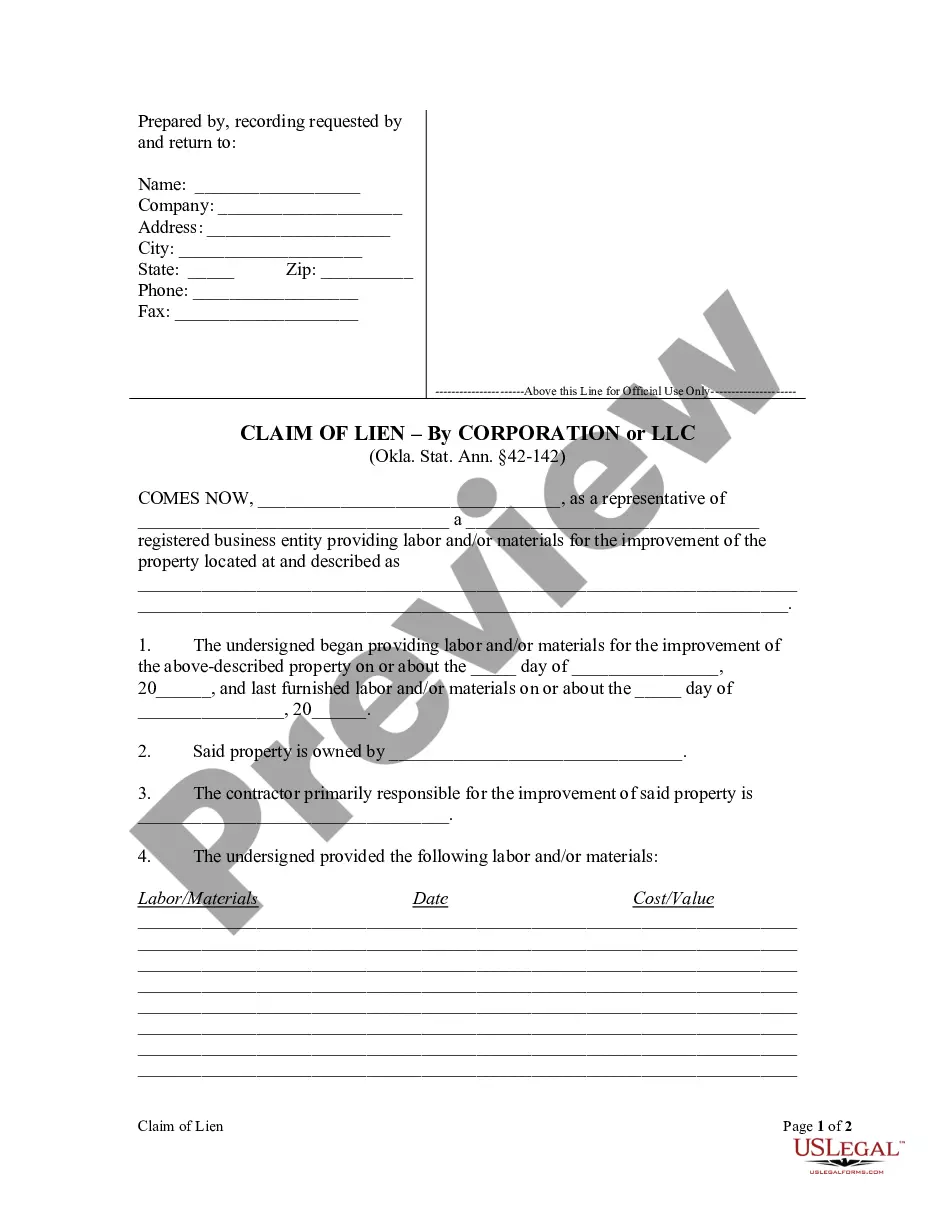

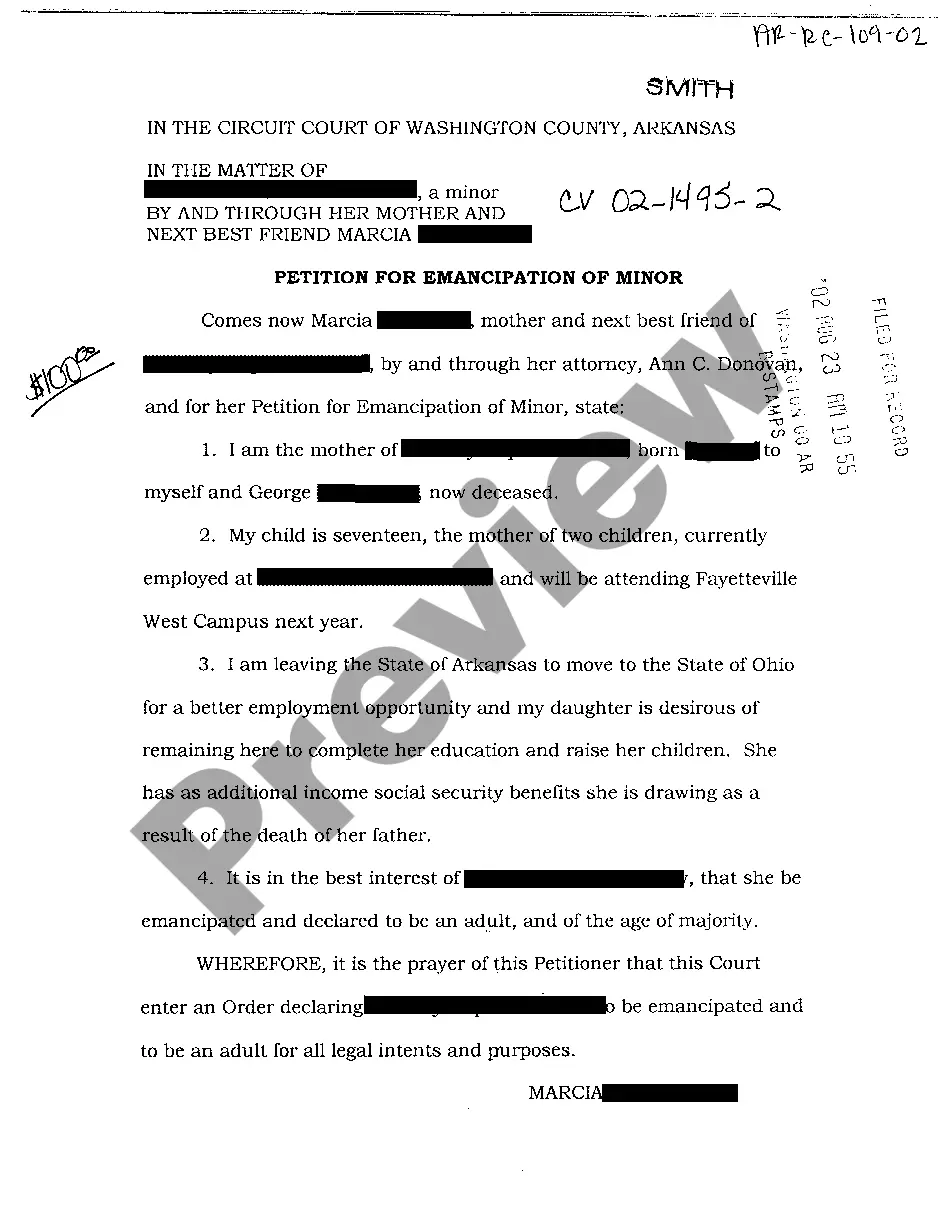

US Legal Forms - one of several largest libraries of legal kinds in the States - gives a wide range of legal file templates you can down load or produce. Using the website, you can find thousands of kinds for company and specific uses, sorted by types, states, or keywords and phrases.You can find the latest types of kinds much like the Louisiana Investment Transfer Affidavit and Agreement in seconds.

If you currently have a registration, log in and down load Louisiana Investment Transfer Affidavit and Agreement through the US Legal Forms catalogue. The Obtain button can look on each type you perspective. You have accessibility to all earlier delivered electronically kinds from the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, allow me to share easy instructions to obtain started:

- Be sure to have picked the right type for your city/region. Click on the Review button to examine the form`s information. See the type outline to actually have chosen the proper type.

- If the type doesn`t match your requirements, take advantage of the Search area near the top of the monitor to discover the one that does.

- If you are happy with the form, verify your decision by clicking on the Get now button. Then, pick the pricing program you want and supply your accreditations to sign up on an accounts.

- Process the financial transaction. Make use of credit card or PayPal accounts to complete the financial transaction.

- Find the format and down load the form in your gadget.

- Make changes. Complete, change and produce and signal the delivered electronically Louisiana Investment Transfer Affidavit and Agreement.

Every web template you added to your account lacks an expiry particular date and is your own property forever. So, if you wish to down load or produce yet another version, just go to the My Forms section and then click in the type you want.

Obtain access to the Louisiana Investment Transfer Affidavit and Agreement with US Legal Forms, one of the most extensive catalogue of legal file templates. Use thousands of specialist and condition-certain templates that fulfill your small business or specific requirements and requirements.

Form popularity

FAQ

If you are single, you should file Form IT-540, Louisiana Resident Individual Income Tax Return, reporting all of your income to Louisiana. If you are married and both you and your spouse are residents of Louisiana, you should file Form IT-540 reporting all of your income to Louisiana. General Information for Filing Your 2022 Louisiana Resident Individual ... louisiana.gov ? TaxForms louisiana.gov ? TaxForms

Louisiana Revised Statute 1.1(F)(4) requires the electronic filing of all composite partnership returns. If tax credits are claimed on the composite return: ALL nonresident partners must be included on the return and on Schedule of Included Partner's Share of Income and Tax. Instructions for Completing Form R-6922 Louisiana Composite ... louisiana.gov ? TaxForms louisiana.gov ? TaxForms

Residents with exempt income, interest income from obligations of other states and their political subdivisions, or residents 65 or over with annual retirement income taxable to Louisiana must use Schedule E to determine their Louisiana adjusted gross income. Tax Credits Schedule - Louisiana Department of Revenue louisiana.gov ? taxforms louisiana.gov ? taxforms

All nonresident partners who were partners at any time during the taxable year and who do not have a valid agreement on file with LDR must be included in the Louisiana Composite Partnership Return (See LAC 61:I. 1401). Partnership Tax - Louisiana Department of Revenue Louisiana Department of Revenue (.gov) ? CompositePartnershipT... Louisiana Department of Revenue (.gov) ? CompositePartnershipT...

Louisiana does not tax Social Security retirement benefits or income from public pensions, and it has some of the lowest property taxes in the country. Retirees will pay income taxes on income from retirement savings accounts, though there is an exemption available. The state has high sales taxes. Louisiana Retirement Tax Friendliness - SmartAsset smartasset.com ? retirement ? louisiana-retirement... smartasset.com ? retirement ? louisiana-retirement...

Annual Retirement Income Exclusion (R.S. .1(A))?Persons 65 years or older may exclude up to $6,000 of annual retirement income from their taxable income. Frequently Asked Questions - Louisiana Department of Revenue louisiana.gov ? faq ? Details louisiana.gov ? faq ? Details

You would not be required to file a tax return. But you might want to file a return, because even though you are not required to pay taxes on your Social Security, you may be able to get a refund of any money withheld from your paycheck for taxes. My only income is Social Security. Do I have to pay any taxes on my ... iowalegalaid.org ? resource ? my-only-inco... iowalegalaid.org ? resource ? my-only-inco...