Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Are you in the location where you will require documents for both organizational or personal reasons almost every day.

There are numerous authorized document templates available online, but obtaining forms that you can trust is not straightforward.

US Legal Forms provides a wide array of form templates, such as the Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement, that are designed to meet federal and state regulations.

When you locate the appropriate form, click Purchase now.

Choose the pricing plan you prefer, complete the required information to create your account, and make the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and verify it is for the correct jurisdiction/county.

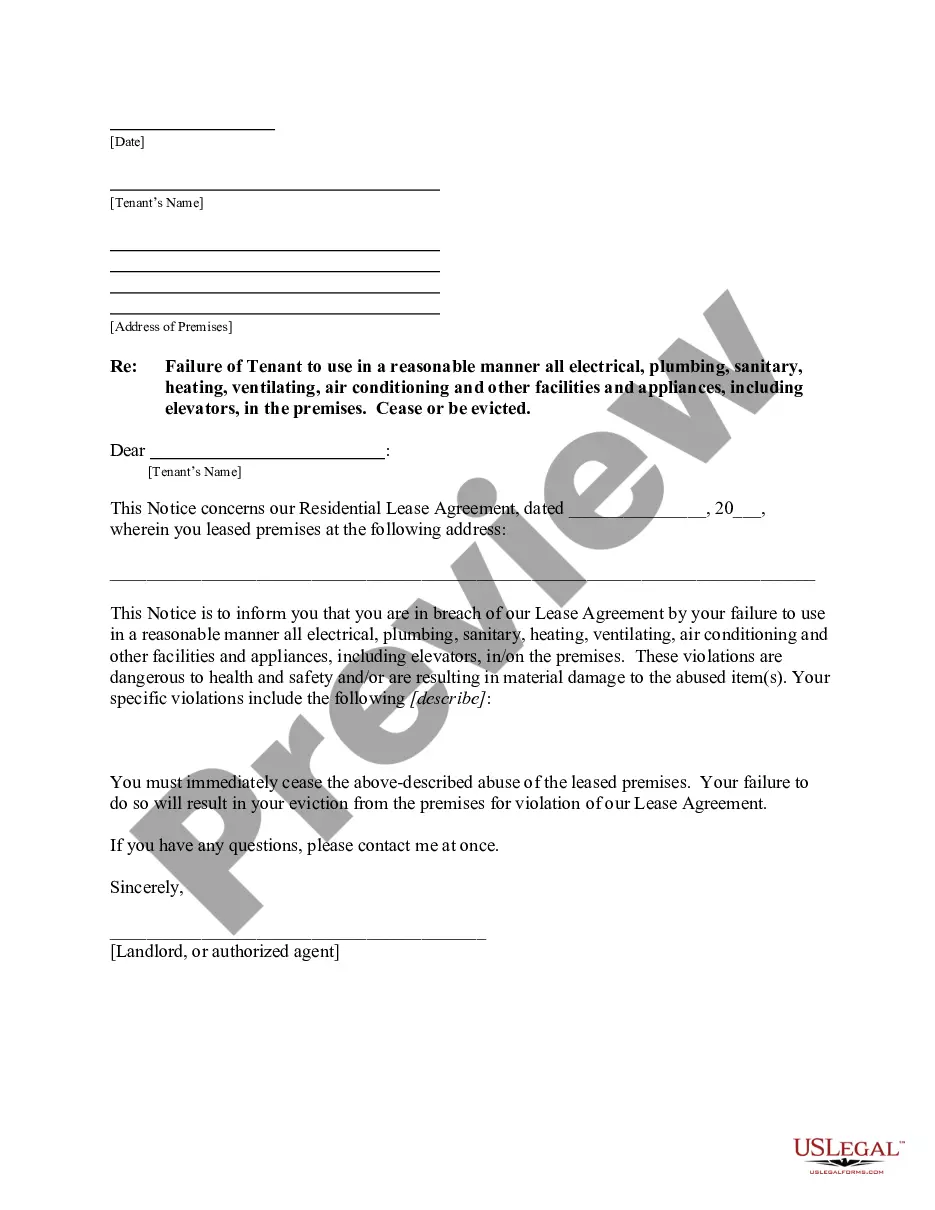

- Use the Preview button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that fits your needs.

Form popularity

FAQ

The deferred compensation plan for Louisiana State employees enables workers to set aside a portion of their salaries for retirement with potential tax benefits. This plan includes the Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement, allowing for flexible contributions. Employees have access to various investment options tailored to their retirement goals. It's a valuable tool for state employees wanting to enhance their retirement savings.

The Louisiana deferred compensation plan is a savings program designed for state employees, allowing participants to defer a portion of their salary to save for retirement. Under this plan, contributions can grow tax-deferred, thus providing a strategic approach to retirement funding. The Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement is integral to this plan, enabling customized benefits based on individual needs. This program suits those looking for supplemental retirement savings.

One downside of deferred compensation is the risk of losing access to your funds if your employer faces bankruptcy or financial difficulties. Additionally, the withdrawn amounts will be taxed as regular income at that time, which could lead to a higher tax bracket. Understanding these risks is crucial when considering the Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement. We recommend consulting with a financial advisor to evaluate your options.

Setting up a non-qualified deferred compensation plan begins with defining the eligibility criteria and the specific benefits you want to offer. First, engage with a legal or financial expert to create a structured Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement. Clear documentation and compliance with tax regulations are essential to avoid pitfalls. By leveraging UsLegalForms, you can gain access to templates and guidance tailored to ensure a successful implementation.

The 10 year rule for nonqualified deferred compensation refers to the requirement that participants must receive payments from their nonqualified defined benefit deferred compensation agreements within 10 years of the end of the plan year in which the compensation was earned. This ensures a timeline for payouts, helping both employers and employees manage their financial planning. By understanding this rule, you can better navigate your Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement. Utilizing platforms like UsLegalForms can guide you through these complexities.

The primary difference between a 401(k) and a deferred compensation plan is in their structure and contribution limits. A 401(k) plan has specific contribution limits and offers tax benefits at the time of saving, while a deferred compensation plan, such as the Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement, allows for larger, flexible contributions that are taxed later. Understanding these differences can help you choose the best savings strategy for your financial future.

Essentially, a nonqualified deferred compensation arrangement is an agreement between an employer and an employee, allowing the employee to receive part of their compensation at a later date. Unlike qualified plans, these arrangements, including a Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement, do not offer the same legal protections. However, they can provide unique advantages in managing your retirement savings strategy.

qualified deferred compensation arrangement is a type of compensation plan that allows employees to defer a portion of their income until a later date, typically during retirement. This form of agreement, such as the Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement, does not have the same limits as qualified plans like 401(k)s. Instead, it can provide additional savings opportunities for higher earners.

Participating in a nonqualified deferred compensation plan can be beneficial for a number of reasons. It allows you to save for retirement beyond the limits set by traditional retirement plans. Additionally, a Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement may offer flexibility and tailored benefits that suit your financial goals, making it a wise choice for those in higher income brackets.

Yes, nonqualified deferred compensation is considered earned income. When you receive payments from a Louisiana Nonqualified Defined Benefit Deferred Compensation Agreement, those payments are typically taxed as ordinary income in the year you receive them. This classification can affect your overall tax obligations, so it is important to evaluate your particular situation.