This due diligence form lists certain documents, items and information which are required in order to complete the due diligence investigation with respect to the company's risk management procedures in business transactions.

Louisiana Insurance and Liability Coverage Due Diligence Request List

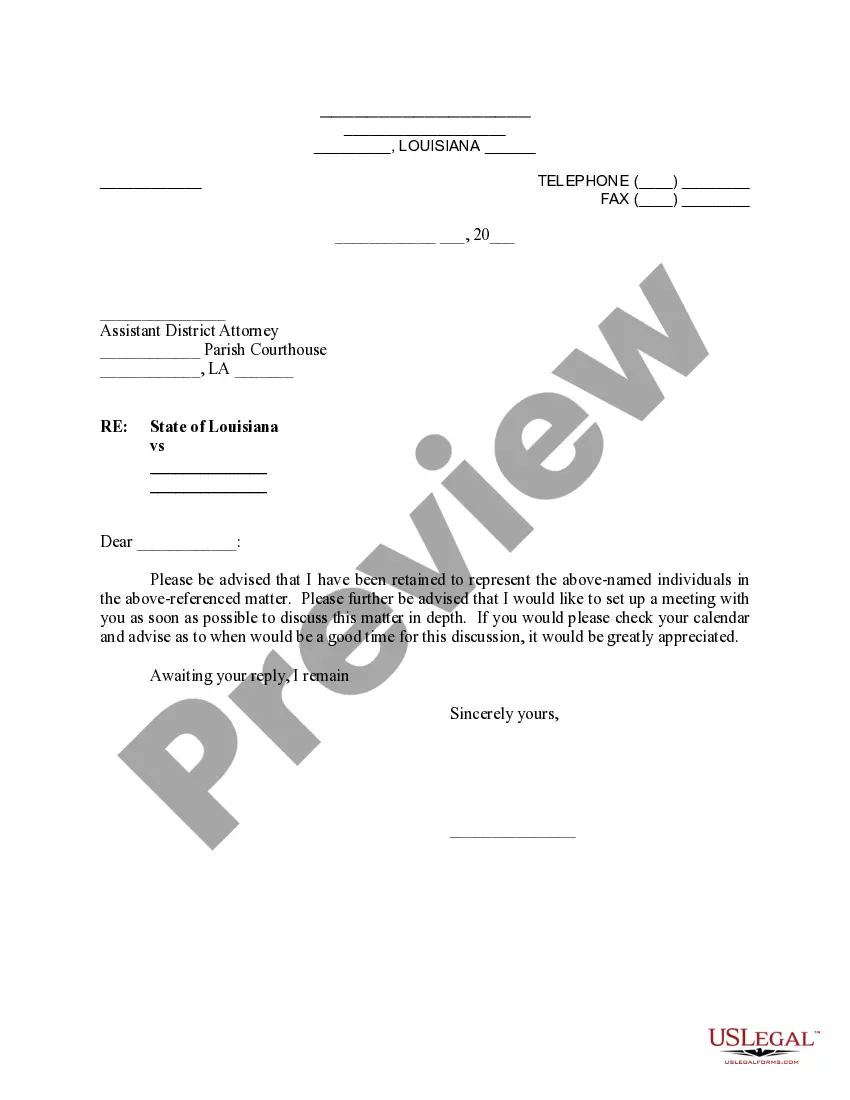

Description

How to fill out Insurance And Liability Coverage Due Diligence Request List?

US Legal Forms - one of the most important repositories of legal documents in the United States - offers a wide range of legal document templates that you can download or print.

By using the website, you can locate thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will be able to find the latest versions of forms such as the Louisiana Insurance and Liability Coverage Due Diligence Request List within moments.

If you already have an account, Log In and download the Louisiana Insurance and Liability Coverage Due Diligence Request List from the US Legal Forms library. The Obtain button will appear on every form you view. You can access all previously saved forms in the My documents tab of your account.

If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the payment plan you prefer and provide your information to register for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Select the format and download the form to your device.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the form's content.

- Read the form description to confirm that you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

Form popularity

FAQ

What Is Due Diligence? Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

During the due diligence process, an investor will request information about your company that will inform their investment decision moving forward. In addition to asking questions of you and key members of your management team during meetings or phone calls, they will provide you with a request list.

For example, in California, the terms of an insurance policy are confidential and proprietary between the insurer and insured.

Below, we take a closer look at the three elements that comprise human rights due diligence identify and assess, prevent and mitigate and account , quoting from the Guiding Principles.

What Does Insurance Due Diligence Involve? Review and analyze business profile (i.e. SEC reports, financial statements, annual reports, bylaws, market reports, minutes, etc.) to identify key risks.

Due diligence helps investors and companies understand the nature of a deal, the risks involved, and whether the deal fits with their portfolio. Essentially, undergoing due diligence is like doing homework on a potential deal and is essential to informed investment decisions.

Life insurance policies are not usually public record, but they can be found on sites that aggregate records of unclaimed money in each state.

A due diligence checklist is an organized way to analyze a company that you are acquiring through sale, merger, or another method. By following this checklist, you can learn about a company's assets, liabilities, contracts, benefits, and potential problems.

Once you fill out an online form on the policy locator tool, the NAIC will ask participating insurance companies to scour their records to see if they have a life insurance policy in the name of the deceased person you listed on the form. The companies will also look for policies that name you as a beneficiary.

Yes. C.R.S. § 10-3-1117(2). Effective January 1, 2020, insurers writing commercial or personal auto policies must disclose insurance policies to their insureds and reveal the liability policy limits to third-party claimants.