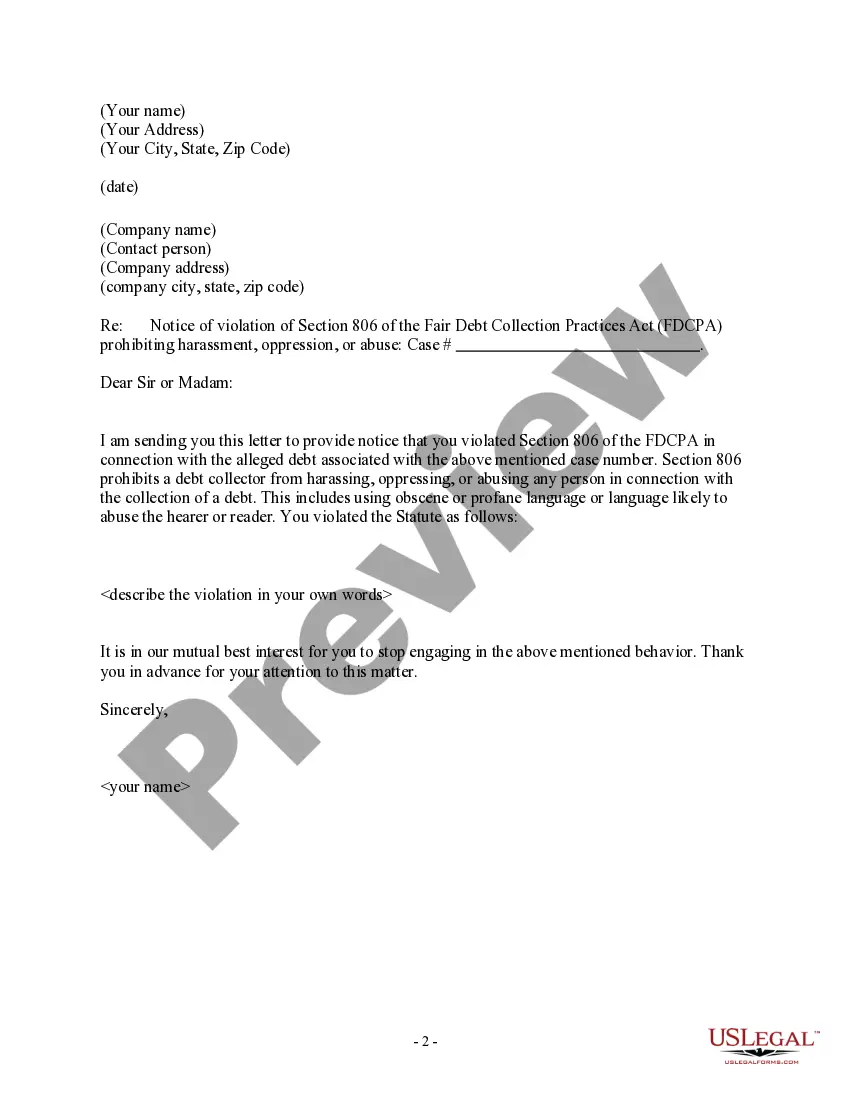

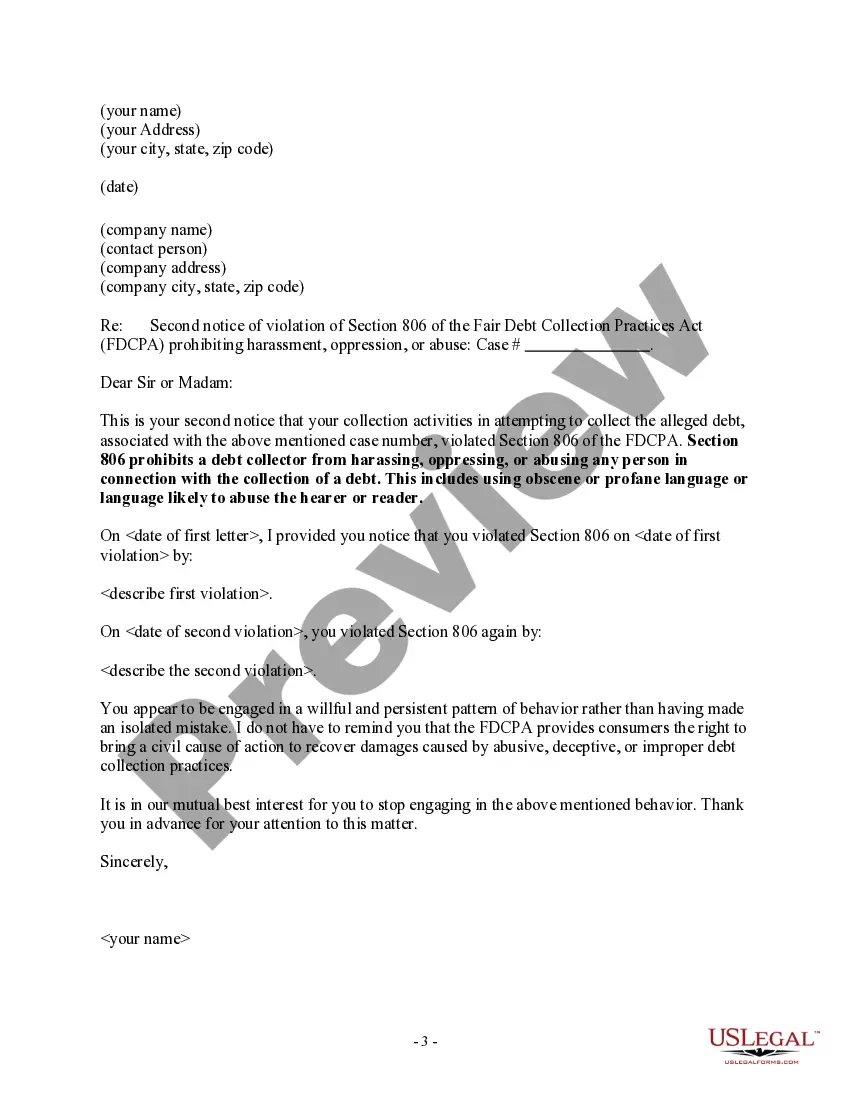

A debt collector may not use obscene or profane language or language likely to abuse the hearer or reader. This includes abusive language includes religious slurs, profanity, obscenity, calling the consumer a liar or a deadbeat, and the use of racial or sexual epithets.

Louisiana Notice to Debt Collector - Use of Abusive Language

Description

How to fill out Notice To Debt Collector - Use Of Abusive Language?

Are you currently situated in a position where you require documents for either business or personal purposes almost every day.

There are many legal document templates accessible online, but finding ones you can trust isn't straightforward.

US Legal Forms offers thousands of form templates, including the Louisiana Notice to Debt Collector - Use of Abusive Language, which are designed to comply with federal and state regulations.

Select a convenient file format and download your copy.

Access all of the document templates you have purchased in the My documents menu. You can obtain another copy of Louisiana Notice to Debt Collector - Use of Abusive Language anytime, if needed. Just click the desired form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Louisiana Notice to Debt Collector - Use of Abusive Language template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

- Utilize the Preview button to review the document.

- Examine the summary to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click on Acquire now.

- Choose the pricing plan you want, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

A debt collector can't harass you Now, for a few rules that apply to any debt collector, including collection agents. First, they can't communicate with you in a way that amounts to harassment. Harassment can include: using threatening, intimidating, or profane language.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.