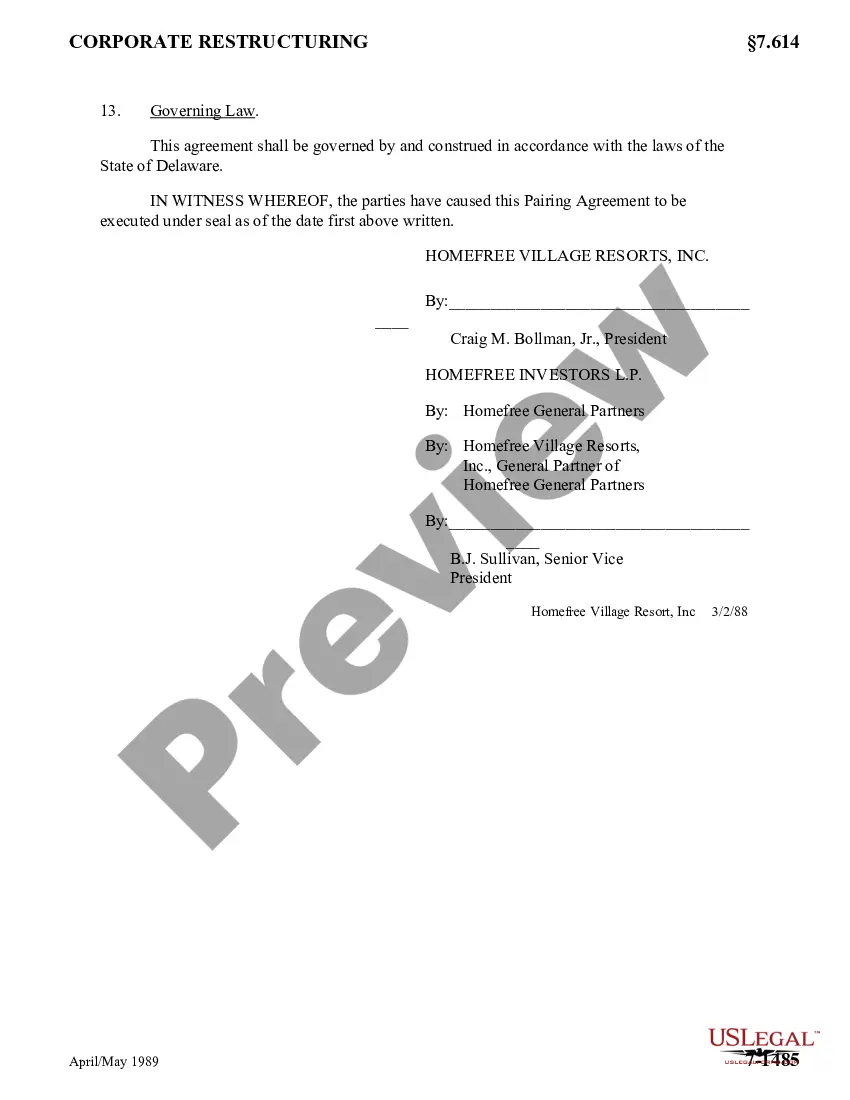

Louisiana Proposed Pairing Agreement

Description

How to fill out Proposed Pairing Agreement?

Are you presently inside a situation in which you need documents for possibly enterprise or individual functions virtually every working day? There are a variety of legitimate document layouts available on the Internet, but getting kinds you can rely is not straightforward. US Legal Forms provides a huge number of kind layouts, much like the Louisiana Proposed Pairing Agreement, which can be published in order to meet federal and state requirements.

Should you be presently familiar with US Legal Forms web site and get your account, basically log in. Following that, you are able to download the Louisiana Proposed Pairing Agreement design.

Should you not come with an profile and want to start using US Legal Forms, abide by these steps:

- Discover the kind you will need and ensure it is to the appropriate city/region.

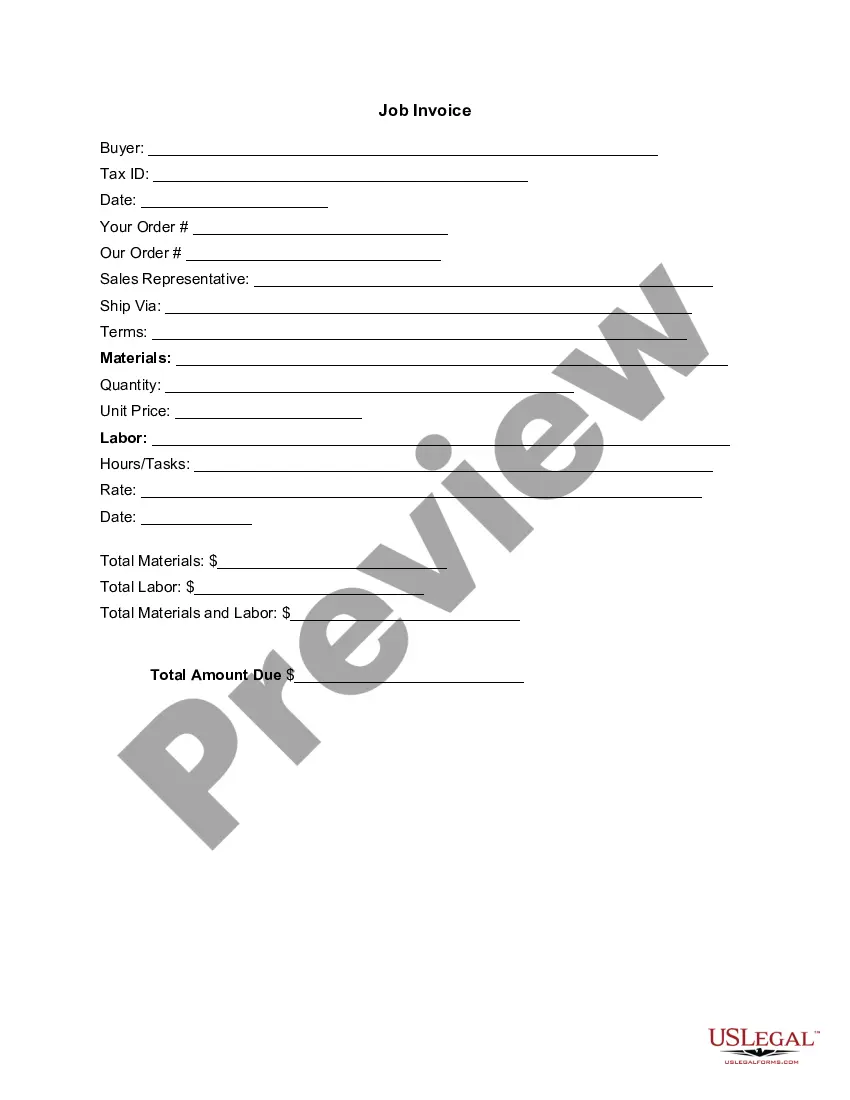

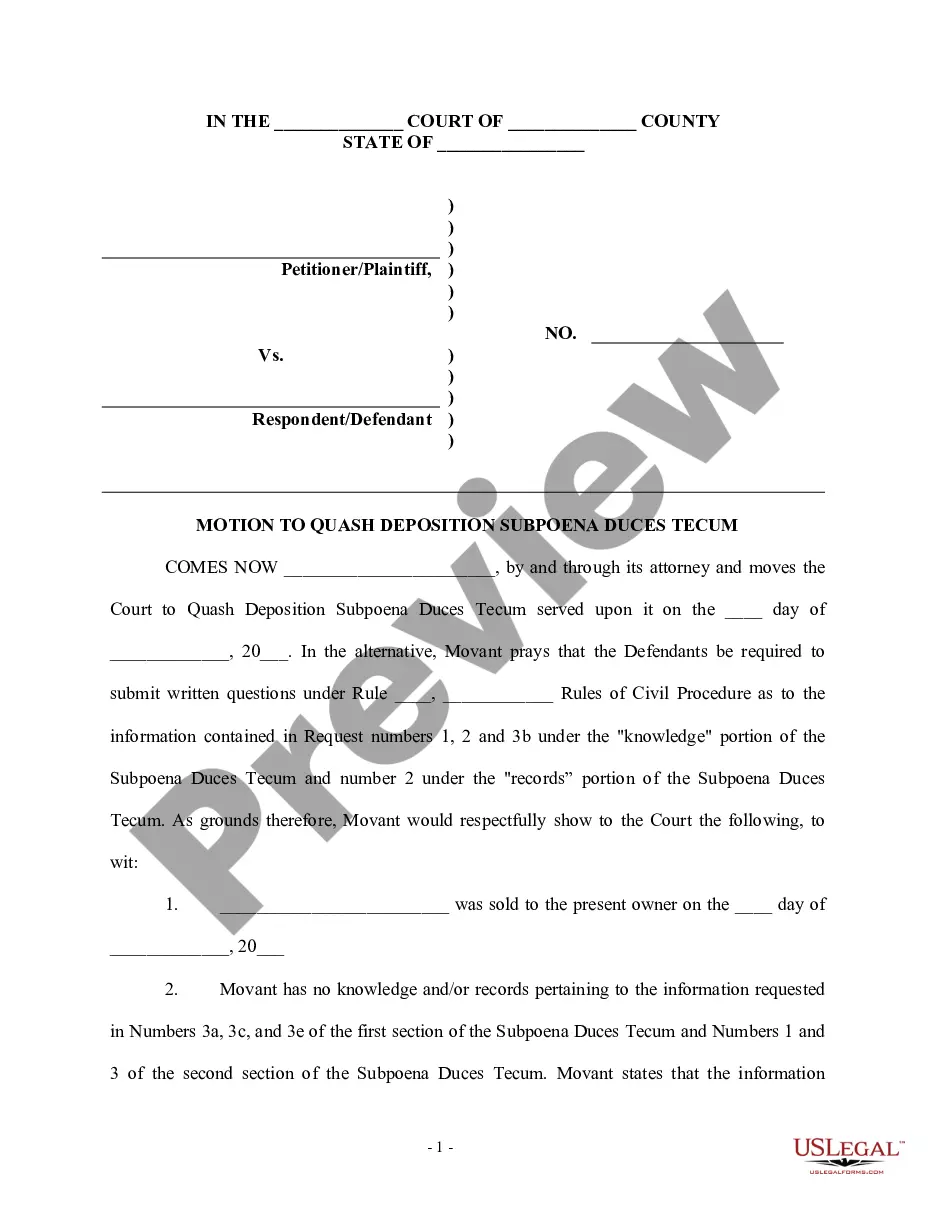

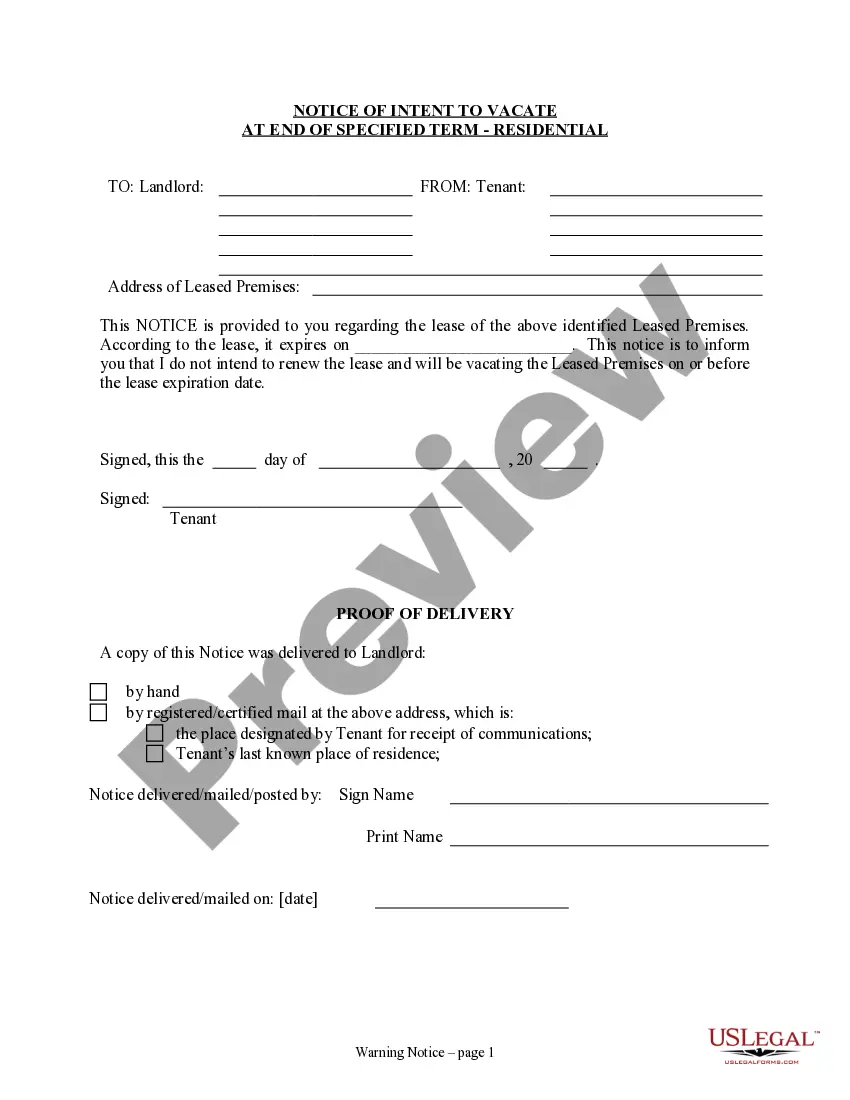

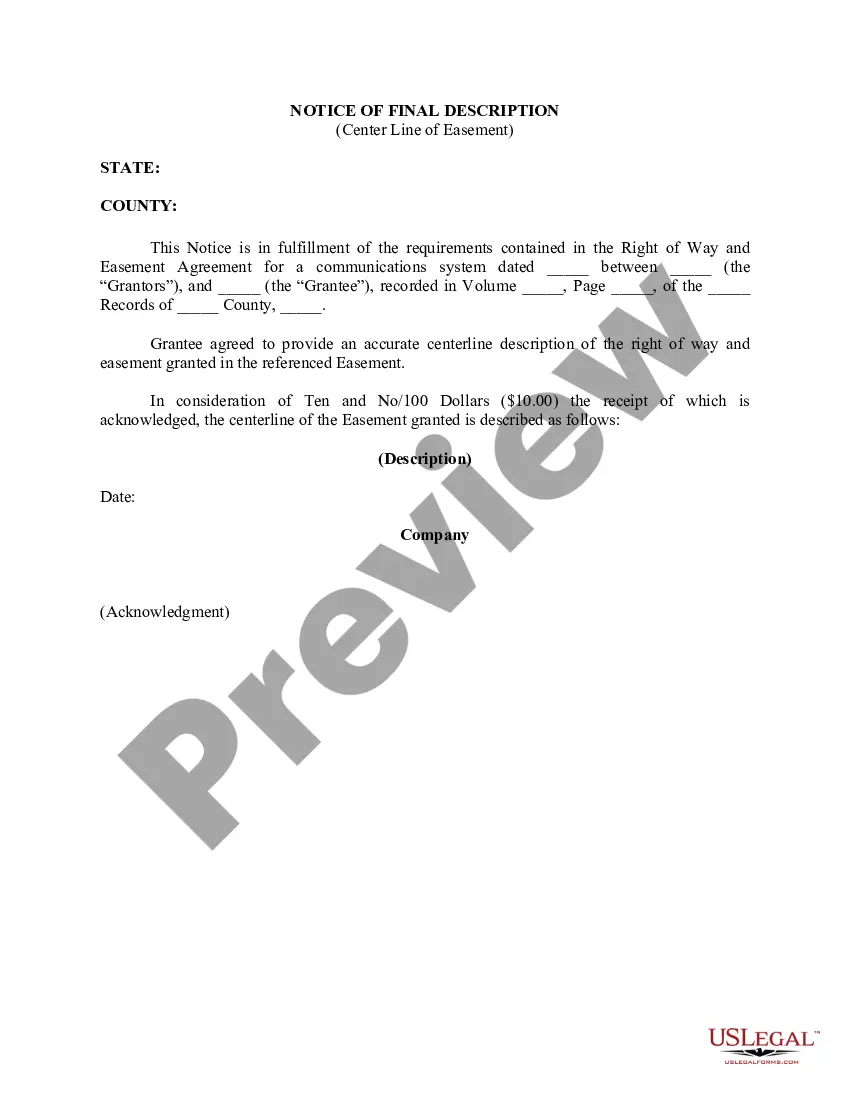

- Make use of the Preview switch to analyze the form.

- See the description to actually have chosen the proper kind.

- If the kind is not what you are searching for, use the Search discipline to find the kind that fits your needs and requirements.

- Whenever you get the appropriate kind, click on Buy now.

- Choose the pricing plan you want, complete the specified info to make your account, and pay for your order making use of your PayPal or credit card.

- Choose a hassle-free file file format and download your duplicate.

Find all of the document layouts you may have bought in the My Forms menu. You can aquire a additional duplicate of Louisiana Proposed Pairing Agreement at any time, if necessary. Just click on the required kind to download or print the document design.

Use US Legal Forms, by far the most substantial collection of legitimate varieties, to conserve efforts and avoid blunders. The support provides skillfully manufactured legitimate document layouts which can be used for an array of functions. Make your account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 1.85%. Public pension income is not taxed, and private pension income is partially taxed.

Louisiana has a combined personal and standard deduction of $4,500 for all filing status. You can also itemize your Louisiana deductions. When you prepare and eFile your Tax Return the eFile Tax App will apply the correct standard deductions for you or you can apply the itemized deduction method.

Residents with exempt income, interest income from obligations of other states and their political subdivisions, or residents 65 or over with annual retirement income taxable to Louisiana must use Schedule E to determine their Louisiana adjusted gross income.

Your Louisiana Income Tax ? Line 10 - Act 395 of the 2021 Regular Legislative Session reduced the income tax rates to 1.85%, 3.5%, and 4.25%. The lower rates are reflected in the tax tables.

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

If you are single, you should file Form IT-540, Louisiana Resident Individual Income Tax Return, reporting all of your income to Louisiana. If you are married and both you and your spouse are residents of Louisiana, you should file Form IT-540 reporting all of your income to Louisiana.

Partners who are corporations are required to file Form CIFT-620 to report any partnership income. Partners who are Louisiana resident estates and trusts are required to file Form IT-541 to report partnership income. Partners who are themselves partnerships are required to file all applicable Louisiana tax returns.

Supplemental. Income and Loss. Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources.