Louisiana Approval of deferred compensation investment account plan

Description

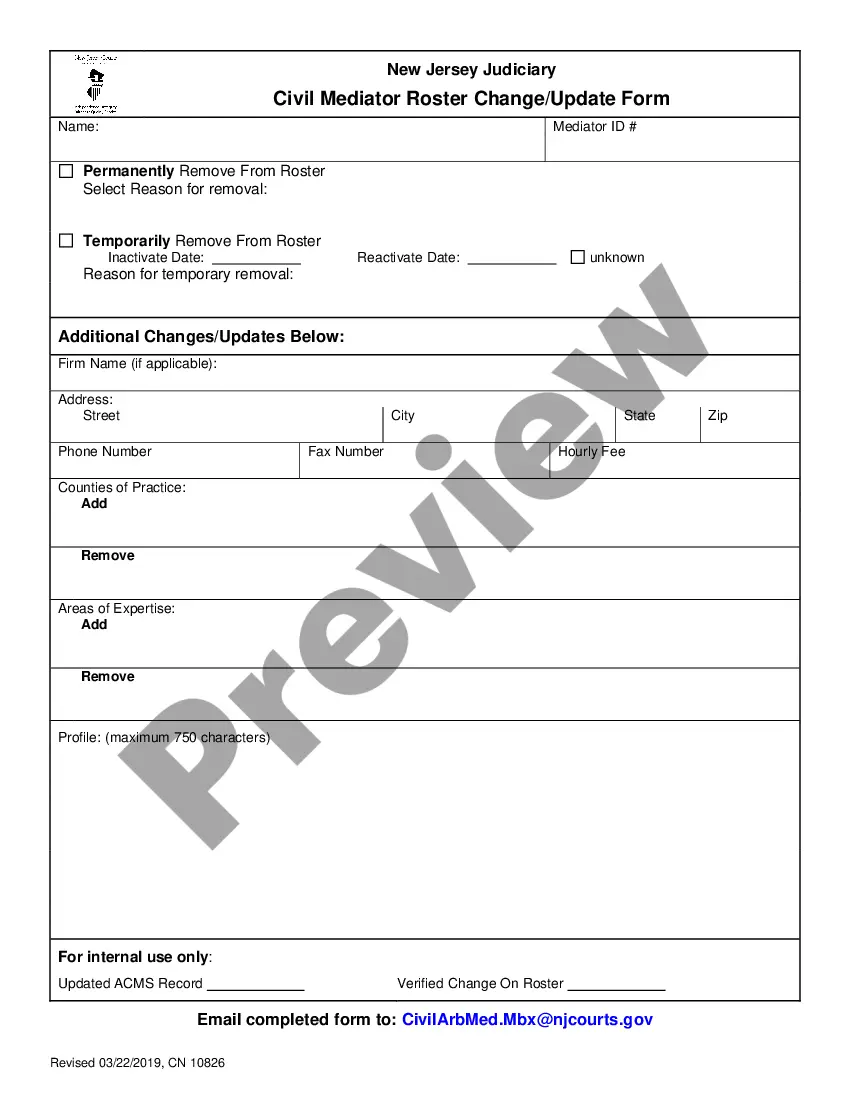

How to fill out Approval Of Deferred Compensation Investment Account Plan?

Have you been inside a position the place you will need documents for either enterprise or specific functions nearly every time? There are a variety of lawful document layouts accessible on the Internet, but locating ones you can trust isn`t straightforward. US Legal Forms offers a large number of form layouts, like the Louisiana Approval of deferred compensation investment account plan, that happen to be composed to fulfill federal and state demands.

If you are currently knowledgeable about US Legal Forms website and get a merchant account, simply log in. Next, you are able to download the Louisiana Approval of deferred compensation investment account plan web template.

If you do not provide an bank account and want to start using US Legal Forms, abide by these steps:

- Find the form you want and make sure it is for the appropriate city/area.

- Use the Preview option to review the shape.

- See the explanation to actually have chosen the proper form.

- In case the form isn`t what you are looking for, use the Look for discipline to discover the form that fits your needs and demands.

- Once you obtain the appropriate form, click Acquire now.

- Choose the pricing strategy you need, complete the necessary information and facts to generate your bank account, and pay money for your order using your PayPal or credit card.

- Pick a convenient file format and download your version.

Get each of the document layouts you possess bought in the My Forms menu. You can get a additional version of Louisiana Approval of deferred compensation investment account plan at any time, if needed. Just go through the necessary form to download or print out the document web template.

Use US Legal Forms, by far the most substantial collection of lawful types, to conserve some time and steer clear of mistakes. The assistance offers skillfully manufactured lawful document layouts that you can use for a variety of functions. Make a merchant account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

Investing your deferred compensation Your plan might offer you several options for the benchmark?often, major stock and bond indexes, the 10-year US Treasury note, the company's stock price, or the mutual fund choices in the company 401(k) plan.

You can request a loan by logging in to your DCP account, completing a Loan Application Form, or calling the Service Center at 844-523-2457.

The Bottom Line. If you have a qualified plan and have passed the vesting period, your deferred compensation is yours, even if you quit with no notice on very bad terms. If you have a non-qualified plan, you may have to forfeit all of your deferred compensation by quitting depending on your plan's specific terms.

Deferred compensation plans don't have required minimum distributions, either. Based upon your plan options, generally, you may choose 1 of 2 ways to receive your deferred compensation: as a lump-sum payment or in installments.

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds.

When you contribute to the DCP, the amount of tax you pay is figured after your contribution, so you may pay less in taxes now. The amount you contribute will be automatically taken out of each paycheck and deposited in your 457 account. Once you terminate service (e.g., retire, leave employment, etc.)