Louisiana Directors and Distributors Stock Option Plan

Description

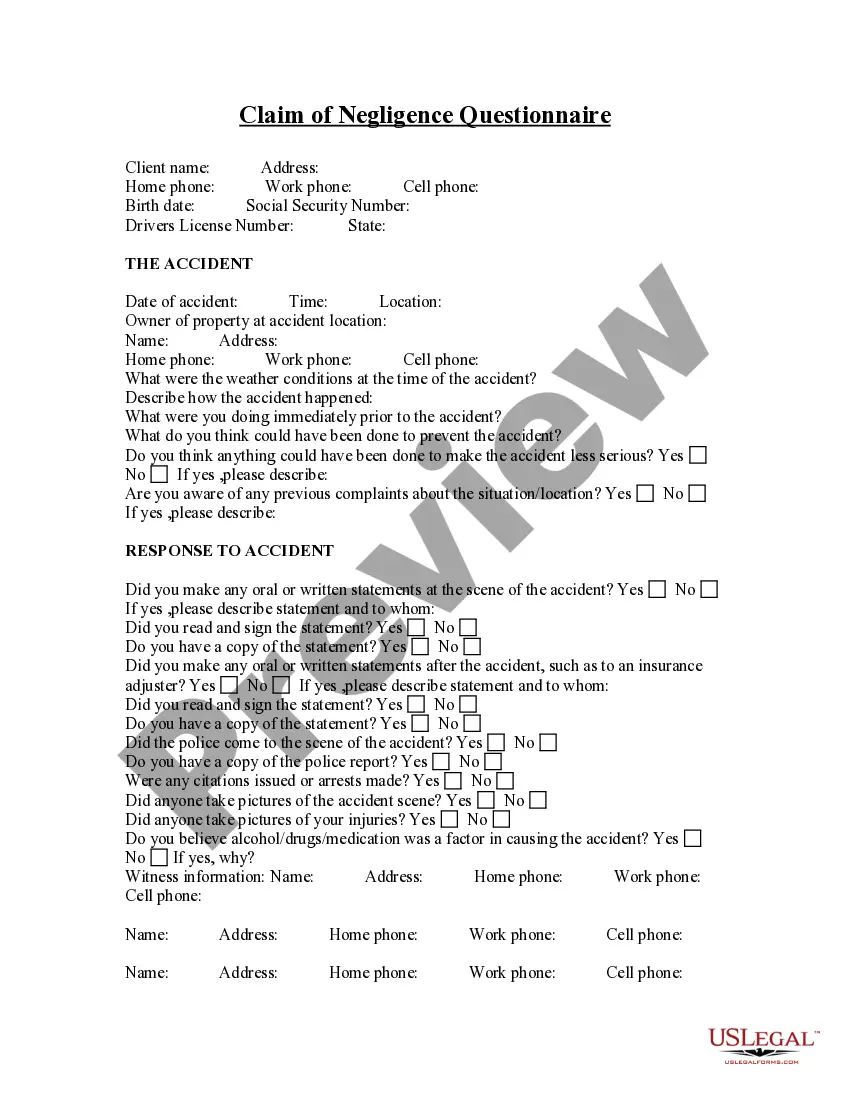

How to fill out Directors And Distributors Stock Option Plan?

Are you currently within a place that you will need papers for either enterprise or individual uses just about every working day? There are a variety of lawful file layouts accessible on the Internet, but discovering versions you can rely is not simple. US Legal Forms offers a large number of form layouts, just like the Louisiana Directors and Distributors Stock Option Plan, which are created to meet state and federal needs.

Should you be currently acquainted with US Legal Forms internet site and get a merchant account, merely log in. Following that, it is possible to down load the Louisiana Directors and Distributors Stock Option Plan design.

Should you not provide an profile and wish to begin using US Legal Forms, adopt these measures:

- Get the form you will need and ensure it is for that appropriate metropolis/area.

- Make use of the Review switch to examine the form.

- Read the outline to ensure that you have selected the correct form.

- If the form is not what you`re looking for, use the Look for field to find the form that suits you and needs.

- Whenever you find the appropriate form, simply click Purchase now.

- Opt for the rates prepare you desire, fill out the required details to generate your money, and buy your order making use of your PayPal or Visa or Mastercard.

- Select a practical paper file format and down load your version.

Locate every one of the file layouts you might have purchased in the My Forms food list. You can obtain a further version of Louisiana Directors and Distributors Stock Option Plan anytime, if necessary. Just click the required form to down load or print the file design.

Use US Legal Forms, the most comprehensive assortment of lawful kinds, to conserve some time and steer clear of errors. The service offers expertly created lawful file layouts that can be used for a variety of uses. Make a merchant account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

If you are buying stock from an option, you buy it at the option price, regardless of what the current price of the stock is. So if you are an employee with an option to buy 12,000 shares of stock at $1 a share, you will need to pay $12,000. At that point, you would own the shares outright.

Basics of Option Profitability A call option buyer stands to make a profit if the underlying asset, let's say a stock, rises above the strike price before expiry. A put option buyer makes a profit if the price falls below the strike price before the expiration.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Stock options aren't actual shares of stock?they're the right to buy a set number of company shares at a fixed price, usually called a grant price, strike price, or exercise price. Because your purchase price stays the same, if the value of the stock goes up, you could make money on the difference.

Options are a form of derivative contract that gives buyers of the contracts (the option holders) the right (but not the obligation) to buy or sell a security at a chosen price at some point in the future. Option buyers are charged an amount called a premium by the sellers for such a right.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

Stock options at private companies are often issued with a low strike price. This allows you a chance to buy shares for a low cost, which requires less cash up front. This is a good thing when you consider how your cash flow will be impacted by an exercise ? but this is only one thing to consider.