Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers

Description

How to fill out Sample Executive Stock Purchase Agreement Between Pic N Save Corporation And Purchasers?

US Legal Forms - one of the foremost collections of legal documents in the United States - provides a broad selection of legal templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers in moments.

If you currently hold a monthly subscription, Log In to retrieve the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers through the US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved documents from the My documents tab in your account.

When you are content with the form, verify your selection by clicking the Buy now button. Then, select your preferred pricing plan and enter your credentials to register for an account.

Process the purchase. Use your credit card or PayPal account to finalize the transaction. Select the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the saved Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers.

Each template you save in your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you need.

- If you are using US Legal Forms for the first time, here are some straightforward instructions to get you started.

- Ensure you have chose the correct form for your area/state.

- Click the Review button to examine the content of the form.

- Read the form details to confirm you have chosen the right document.

- If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

Form popularity

FAQ

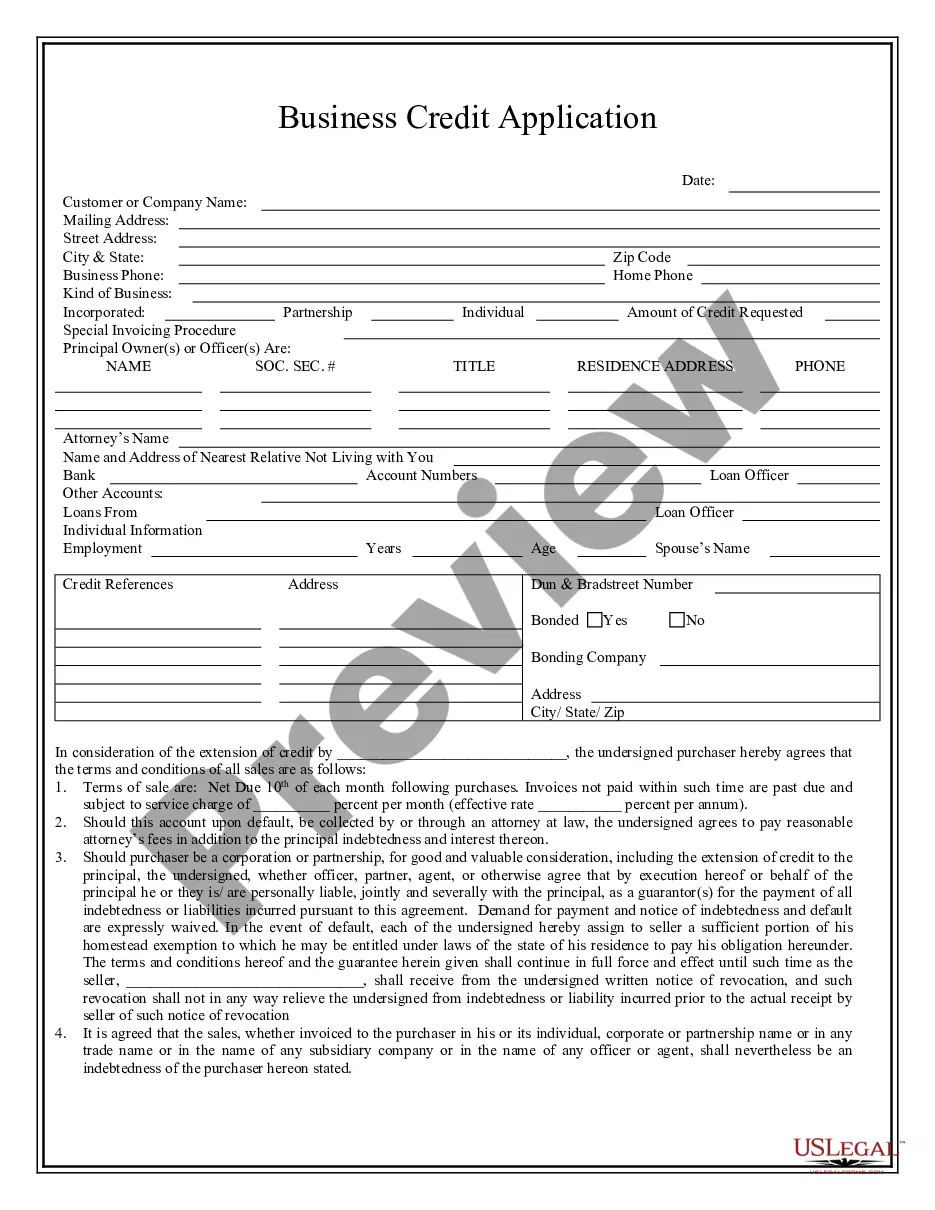

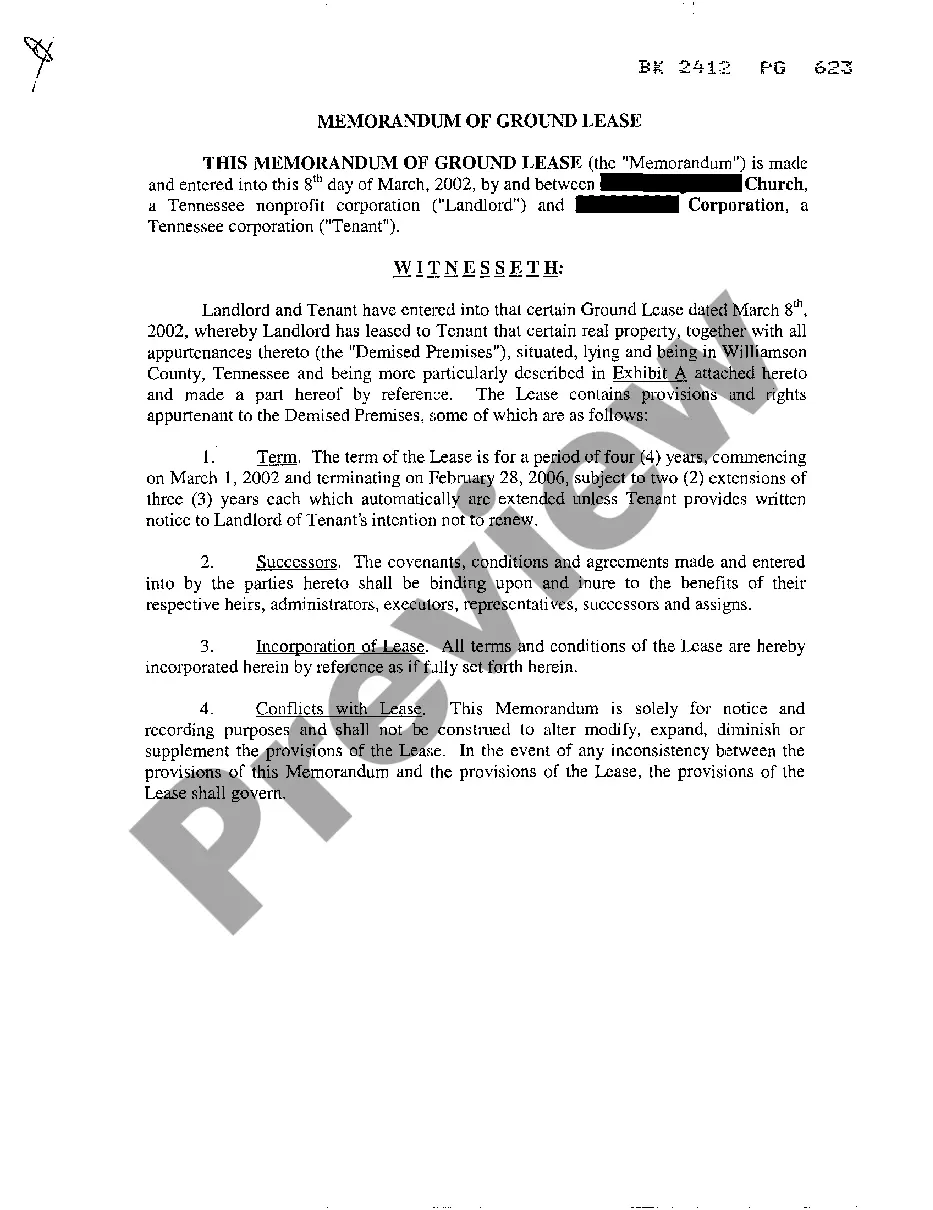

A stock transfer agreement is a legal document that outlines the terms and conditions under which ownership of stock shares is transferred from one party to another. In the context of the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers, this agreement specifies the responsibilities and rights of both the seller and the buyer during the sale of shares. It ensures a smooth transaction by addressing payment terms, stock evaluation, and other critical details. By using uslegalforms, you can access templates and resources to craft a stock transfer agreement tailored to your specific needs.

Writing an agreement between a buyer and seller involves outlining key terms that both parties must understand and agree upon. Start by clearly stating the identities of the buyer and seller along with a detailed description of the items being purchased. Incorporate essential components such as payment terms, delivery methods, and any contingencies that may apply. For those seeking a structured template, the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers can serve as an excellent foundation.

A stock purchase agreement usually includes several key clauses that address critical aspects of the transaction. In the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers, you can expect to find clauses that cover representations and warranties, conditions precedent, and indemnification. These clauses work together to protect the interests of both parties by clearly defining their rights and obligations. By utilizing a well-structured agreement, you can prevent disputes and enhance the smooth execution of the stock transfer.

In general, any individual or entity with a strong understanding of corporate law can draft a shareholder agreement. However, it is highly advisable to hire a legal professional who specializes in this area to ensure compliance with Louisiana laws. A well-drafted agreement, such as the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers, can effectively outline the rights and responsibilities of shareholders while protecting all parties involved. Consider using US Legal Forms for templates and legal guidance to simplify the drafting process and enhance clarity.

A pro seller short form stock purchase agreement is a simplified document that facilitates the sale of stock with minimal legal jargon and complexity. It provides essential details such as the seller's and buyer's information, stock specifics, and payment terms. This type of agreement is particularly useful for quick transactions requiring clarity and efficiency. Utilizing a Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers can streamline the process while ensuring all necessary terms are clearly defined.

You can write your own purchase agreement, especially for straightforward transactions. Using templates like the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers can serve as a helpful guide. Just be sure to include all critical elements and clearly state the terms to avoid any misunderstandings.

Typically, anyone can write a purchase agreement, including individuals and business owners. However, for agreements like the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers, involving significant transactions, it is often wise to consult a lawyer. They can provide professional insight to ensure the agreement meets all legal requirements and protects your interests.

Yes, a purchase agreement can be handwritten, provided it contains all the necessary details and is clear. However, using a typed version, such as the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers, can help avoid confusion. Remember to ensure both parties sign the agreement, whether it is handwritten or typed.

It is possible to draft a contract without a lawyer, especially for simple agreements. However, for more complex matters like the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers, legal guidance is advisable to ensure compliance and clarity. If you choose to draft your own, make sure to understand the necessary legal requirements.

Similar to previous answers, a share purchase agreement generally does not need notarization to be recognized legally. Although notarization is not a requirement, it can bolster the agreement's integrity and deter disputes. For those handling the Louisiana Sample Executive Stock Purchase Agreement between Pic N Save Corporation and Purchasers, consulting with a legal professional is advisable to assess the necessity of notarization.