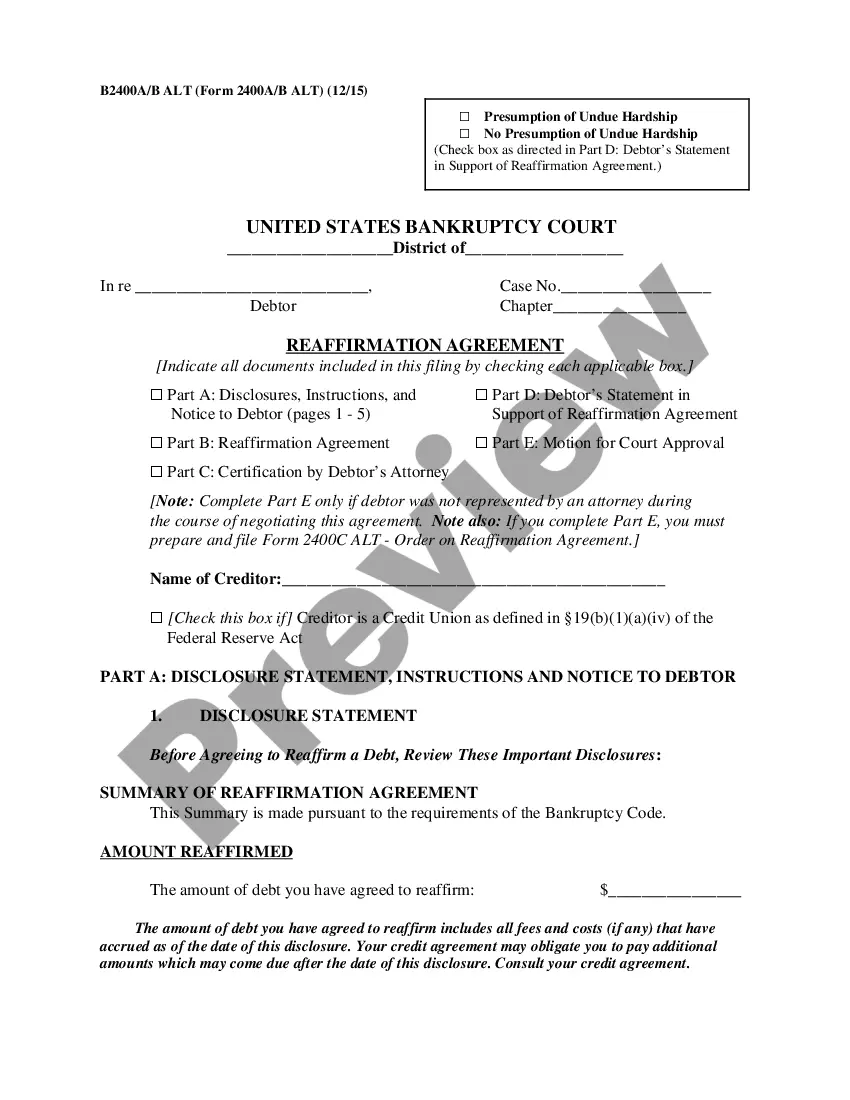

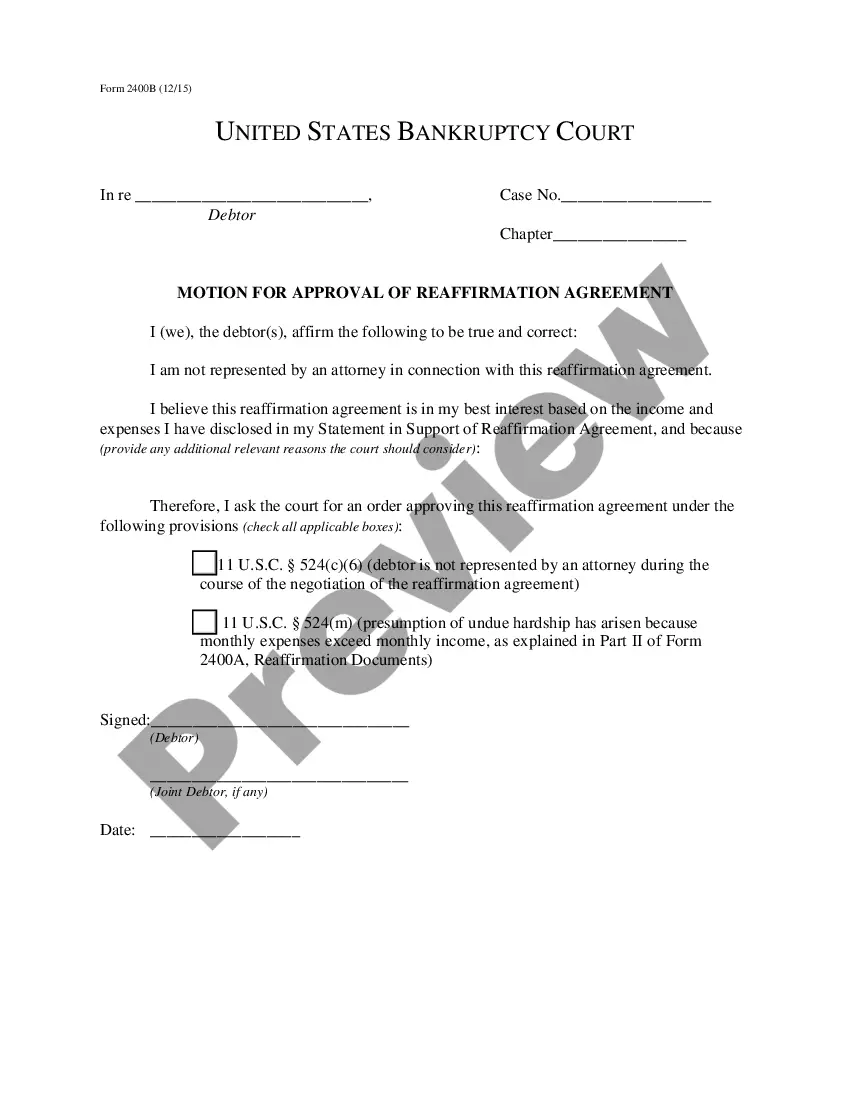

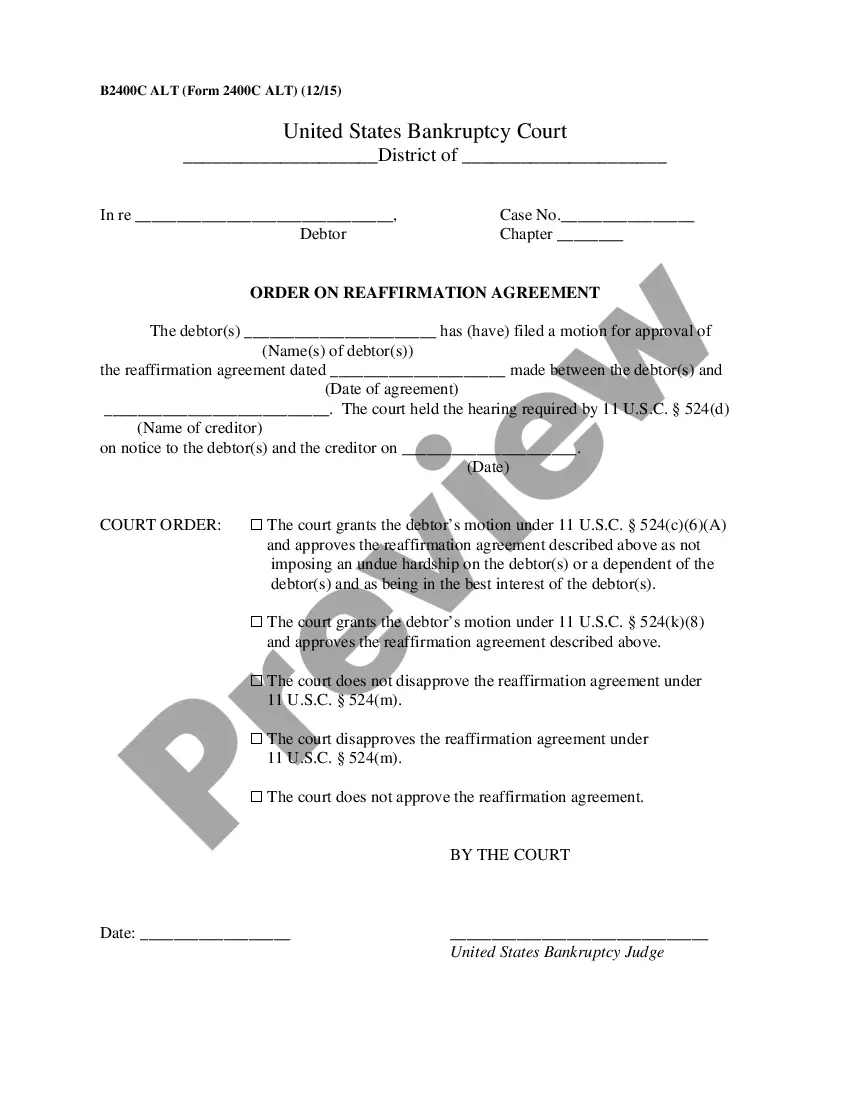

Louisiana Reaffirmation Agreement, Motion and Order

Description

How to fill out Reaffirmation Agreement, Motion And Order?

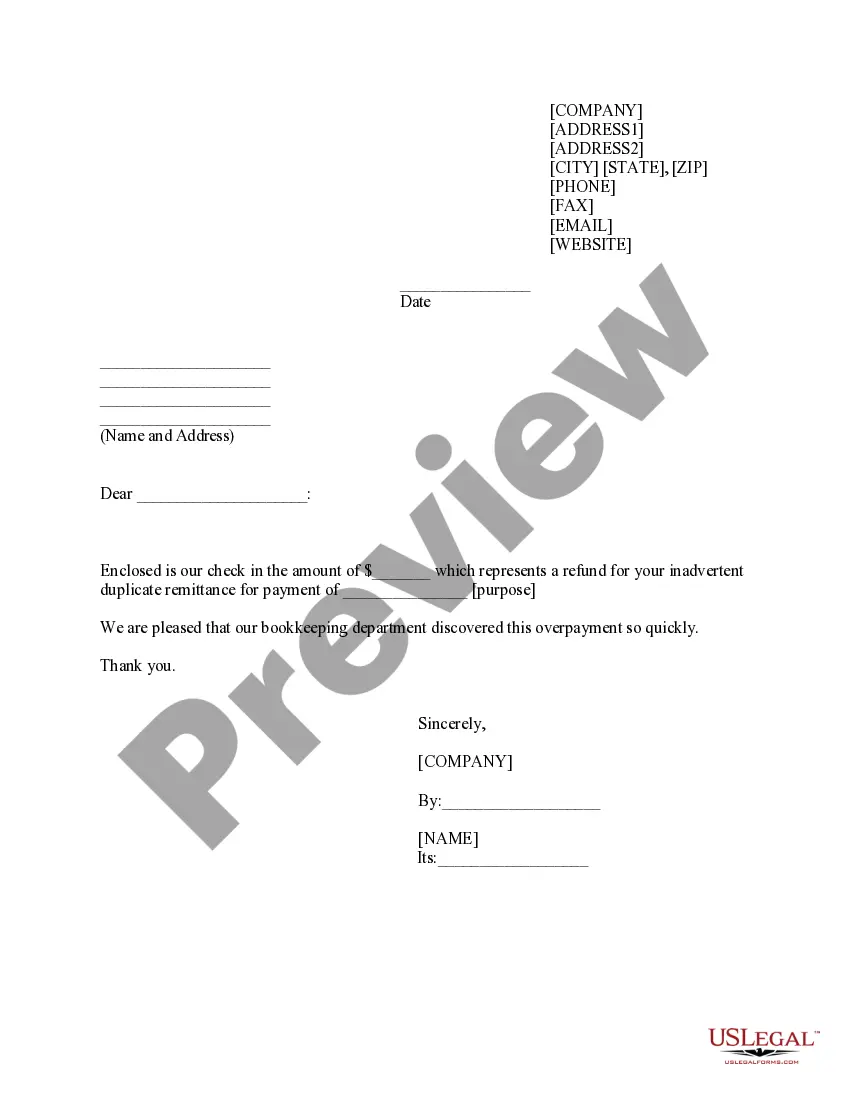

Discovering the right authorized record format can be a battle. Naturally, there are tons of templates available online, but how can you find the authorized kind you need? Utilize the US Legal Forms site. The assistance offers a huge number of templates, like the Louisiana Reaffirmation Agreement, Motion and Order, that you can use for business and private requires. Each of the types are inspected by experts and meet up with federal and state specifications.

In case you are currently listed, log in for your profile and click on the Down load option to have the Louisiana Reaffirmation Agreement, Motion and Order. Make use of your profile to search throughout the authorized types you have acquired in the past. Visit the My Forms tab of your profile and have an additional copy of your record you need.

In case you are a fresh user of US Legal Forms, listed below are basic recommendations for you to follow:

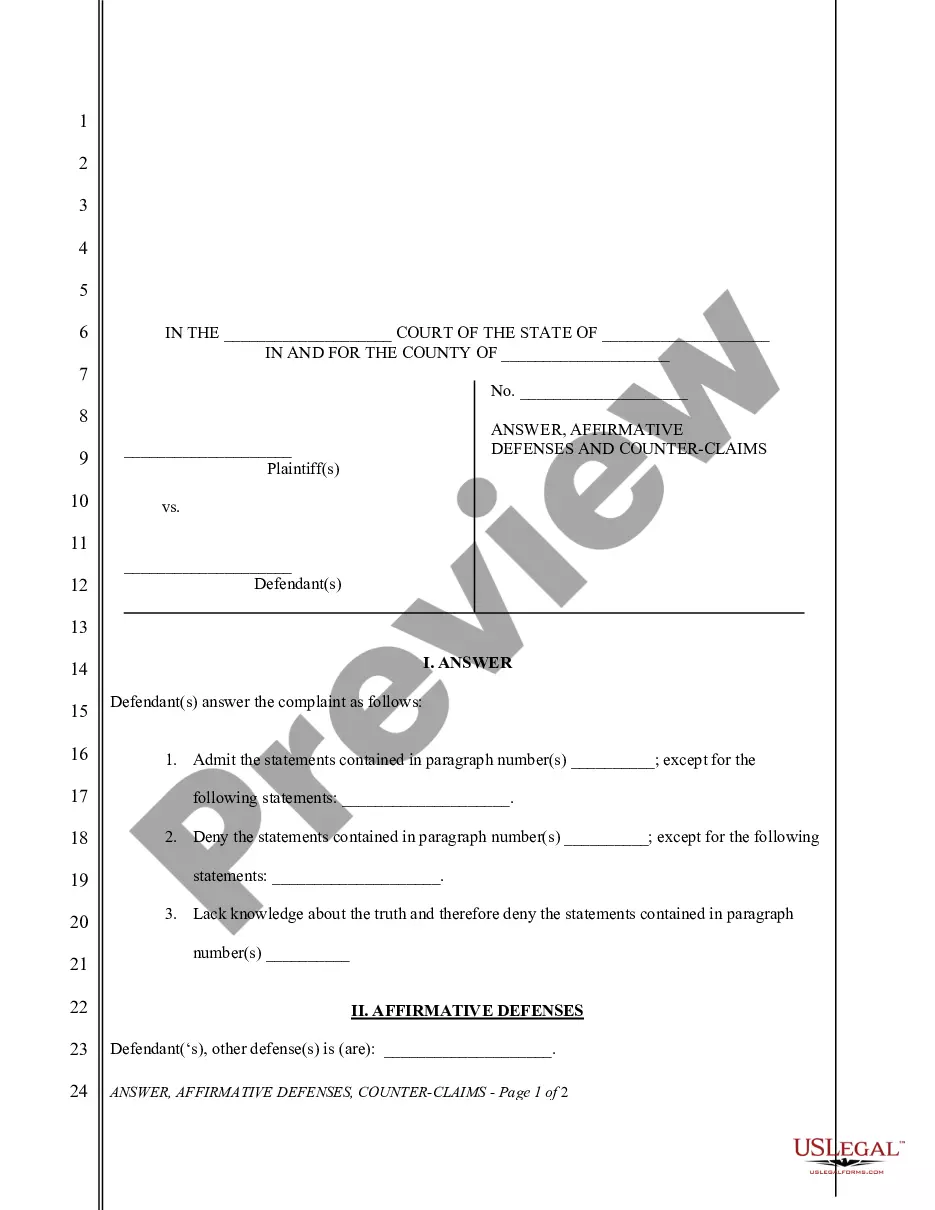

- First, be sure you have selected the appropriate kind for your town/county. You may look through the form making use of the Preview option and study the form description to guarantee this is the best for you.

- If the kind is not going to meet up with your expectations, utilize the Seach field to obtain the correct kind.

- Once you are certain the form is suitable, click the Buy now option to have the kind.

- Opt for the costs program you desire and enter the required details. Build your profile and purchase an order making use of your PayPal profile or Visa or Mastercard.

- Opt for the submit format and down load the authorized record format for your product.

- Complete, change and produce and indicator the attained Louisiana Reaffirmation Agreement, Motion and Order.

US Legal Forms is definitely the biggest library of authorized types where you will find various record templates. Utilize the service to down load expertly-made documents that follow status specifications.

Form popularity

FAQ

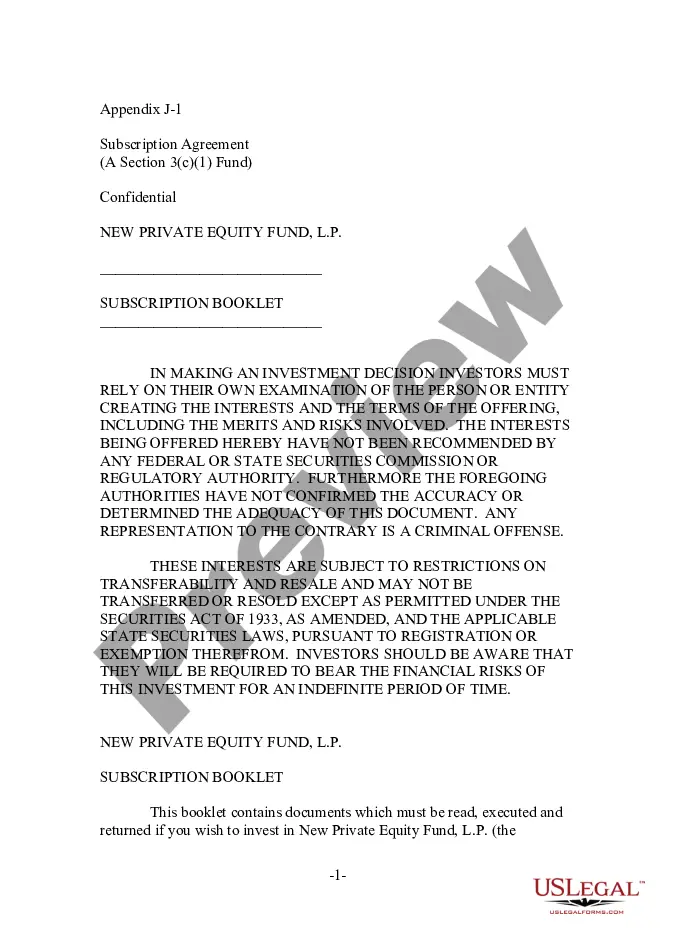

A reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. In return, the creditor promises that, as long as payments are made, the creditor will not repossess or take back its collateral.

Reaffirmation agreements are strictly voluntary. A debtor is not required to reaffirm any of his or her debts. If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

After you have entered into a reaffirmation agreement and all parts of this form that require a signature have been signed, either you or the creditor should file it as soon as possible.

In this article, you'll learn that lenders sometimes agree to new terms when completing a reaffirmation agreement, including lowering the amount owed, interest rate, or monthly payment. A local bankruptcy lawyer can help you with the negotiation process.

Creditors holding a security interest that they want to protect post-bankruptcy will request that a Reaffirmation Agreement is signed. They will prepare it and provide it to your attorney's office for review.

Reaffirmation is an agreement by a debtor, to a lender, to repay some or all of their debt. Debtors make reaffirmation agreements purely voluntarily. When a borrower reaffirms a debt, this is noted by credit reporting agencies, which then register that the person will make regular on-time payments.

Reaffirming puts you personally on the hook for the debt, even after your discharge. The Court may not approve the reaffirmation if it is not in your best interest. The agreement is voluntary for you and for the creditor?the creditor may refuse to offer a reaffirmation.

Making a reaffirmation agreement can be helpful if you want to stay in your home or you need to keep driving your car during a bankruptcy settlement. However, this type of agreement means you are still responsible for some sort of payment on the loan.