Louisiana Travel Expense Reimbursement Form

Description

How to fill out Travel Expense Reimbursement Form?

Selecting the optimal legal document format can be a challenge.

Clearly, there are numerous templates available online, but how do you find the legal document you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Louisiana Travel Expense Reimbursement Form, which can be employed for business and personal purposes.

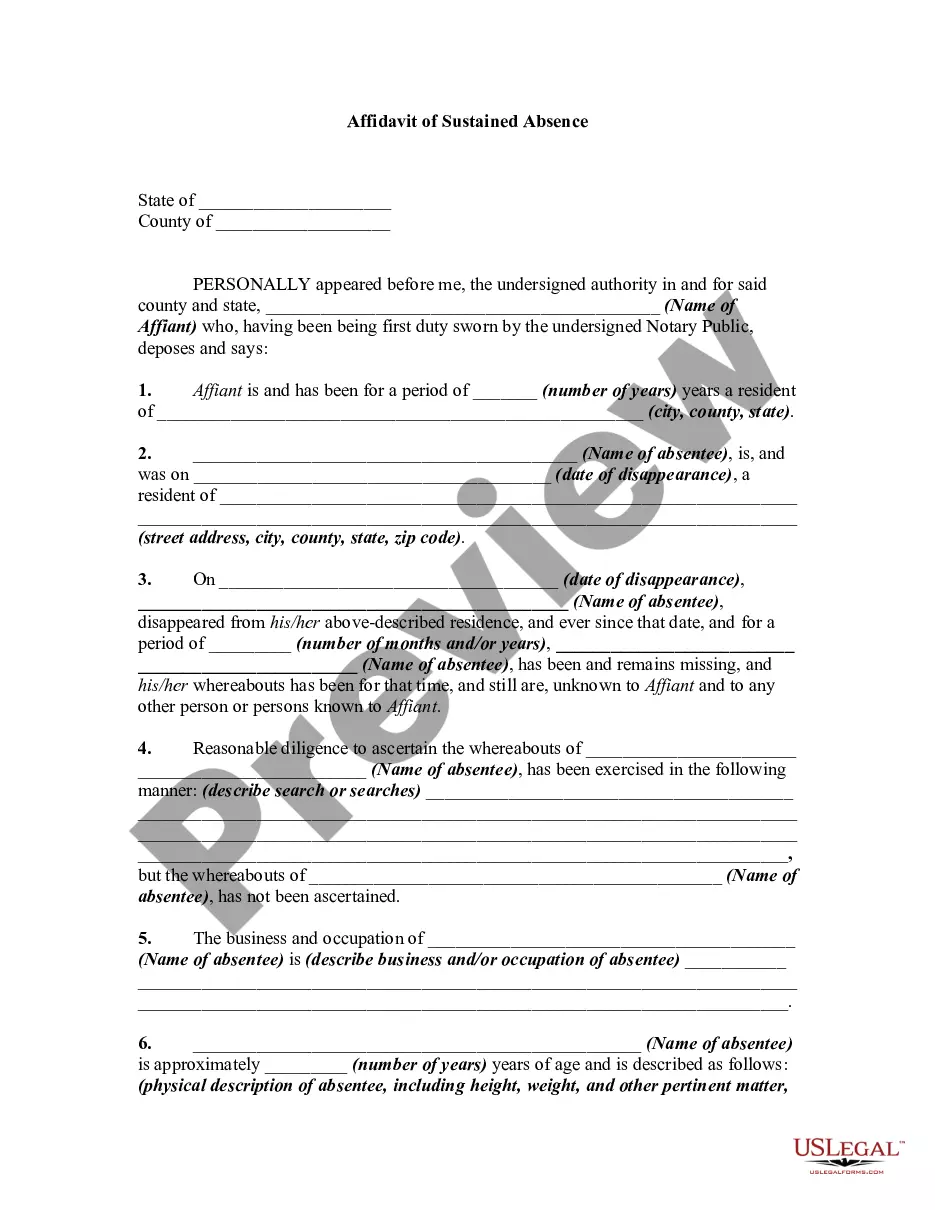

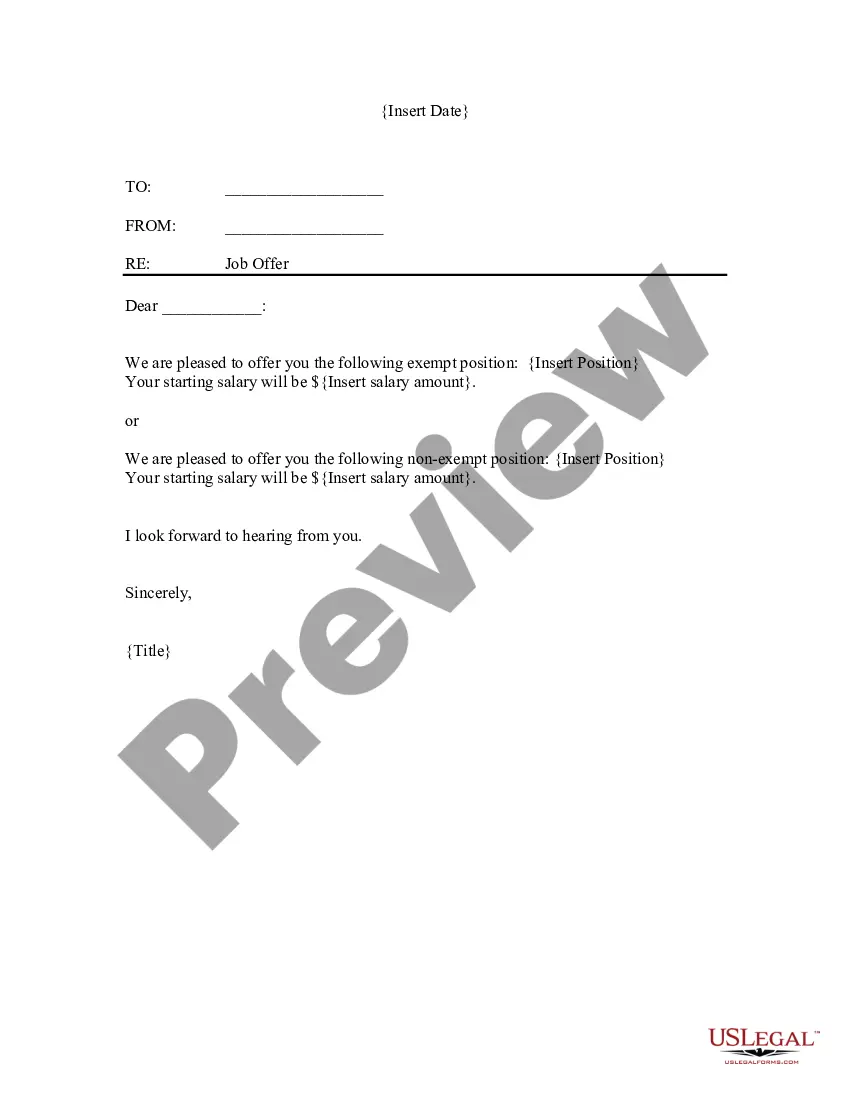

First, ensure you have selected the correct document for your jurisdiction/area. You can browse the document using the Preview option and read its description to confirm it is suitable for you.

- All the documents are reviewed by professionals and comply with federal and state regulations.

- If you are already a member, Log In to your account and click on the Download button to access the Louisiana Travel Expense Reimbursement Form.

- Use your account to search for the legal documents you have purchased previously.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

This travel must be overnight and more than 100 miles from your home. Expenses must be ordinary and necessary. This deduction is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses) plus any parking fees, ferry fees, and tolls.

Companies spend around 10% of their revenue on business travel-related expenses. This was reported in the New York Journal and given how significant the percentage is, it's critical that companies are strategic about managing their business travel expenditure.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.

The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses from employee wages under an accountable plan; or (2) employers can consider all payments to employees as wages under a non-accountable

Travel reimbursement is the way employers pay their employees back for expenses they have incurred during business-related travel. Such expenses can range from airfare to mileage, event registration, parking, and meals. Depending on your travel policy, employees may need to pay for these first.

57.5 cents per mile for business miles (58 cents in 2019) 17 cents per mile driven for medical or moving purposes (20 cents in 2019) 14 cents per mile driven in service of charitable organizations.

Reimbursable travel expenses include the ordinary expenses of public or private transportation as well as unusual costs due to special circumstances.

I want to state that I visited (Location) for (Personal/ Professional work). This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent.

The IRS allows business travelers to deduct business-related meals and hotel costs, as long as they are reasonable considering the circumstancesnot lavish or extravagant. You would have to eat if you were home, so this might explain why the IRS limits meal deductions to 50% of either the: Actual cost of the meal.

Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business. These expenses can include fuel costs, maintenance and vehicle depreciation. Mileage reimbursement is typically set at a per-mile rate usually below $1 per mile.