Louisiana Holiday Vacation Policy

Description

How to fill out Holiday Vacation Policy?

If you require extensive, obtain, or create certified document templates, utilize US Legal Forms, the largest variety of legal forms, which can be accessed online.

Take advantage of the site's simple and convenient search to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, select the Purchase now option. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the Louisiana Holiday Vacation Policy in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click on the Download button to obtain the Louisiana Holiday Vacation Policy.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the form’s content. Be sure to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

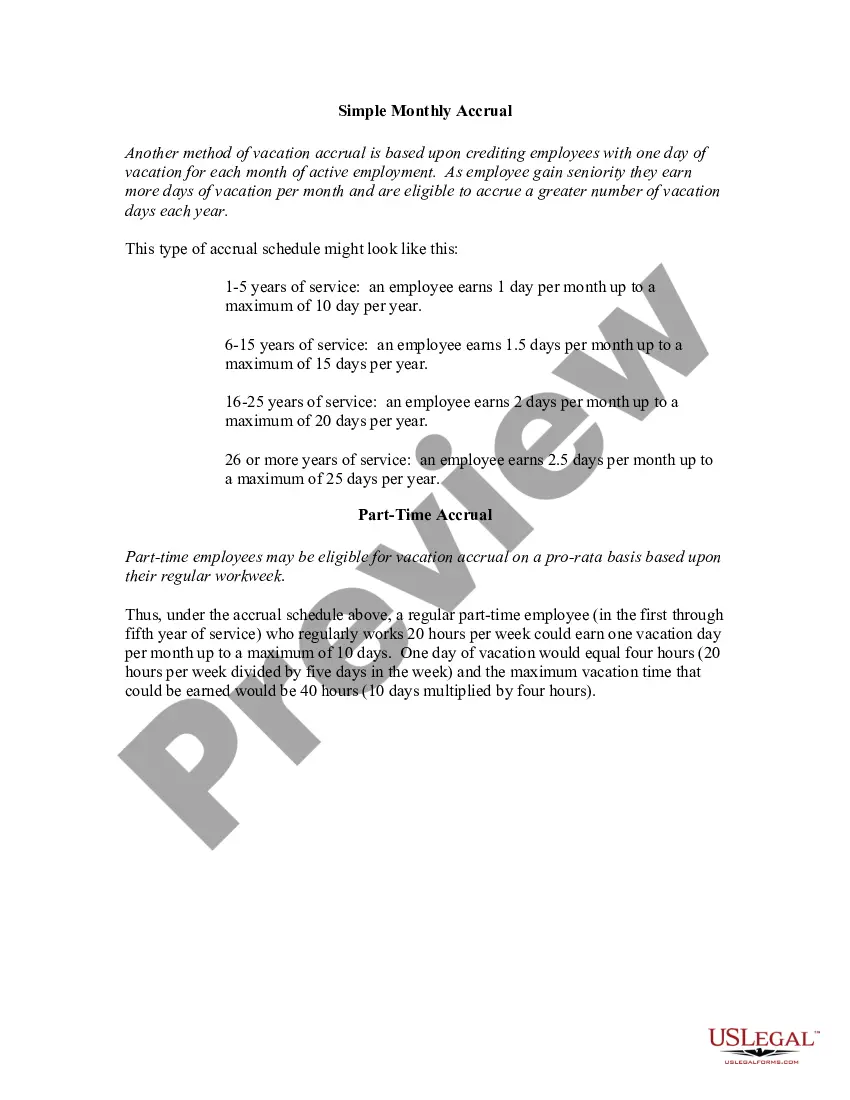

3. Calculate vacation pay based on hourly workX (hours weekly) x 52 weeks (total weeks in a year) = X (yearly hours worked)X (yearly hours worked) X (standard hours of PTO per year) = X (yearly hours worked after PTO)X (yearly hours worked after PTO) X (standard hours of PTO per year) = X (yearly hours worked)More items...

According to the Bureau of Labor Statistics, on average American workers receive 10 days of paid time off per year, after they've completed one year of service. That time doesn't include sick days and holidays. While the number goes up or down a bit, depending on industry and region, 10 is the national average.

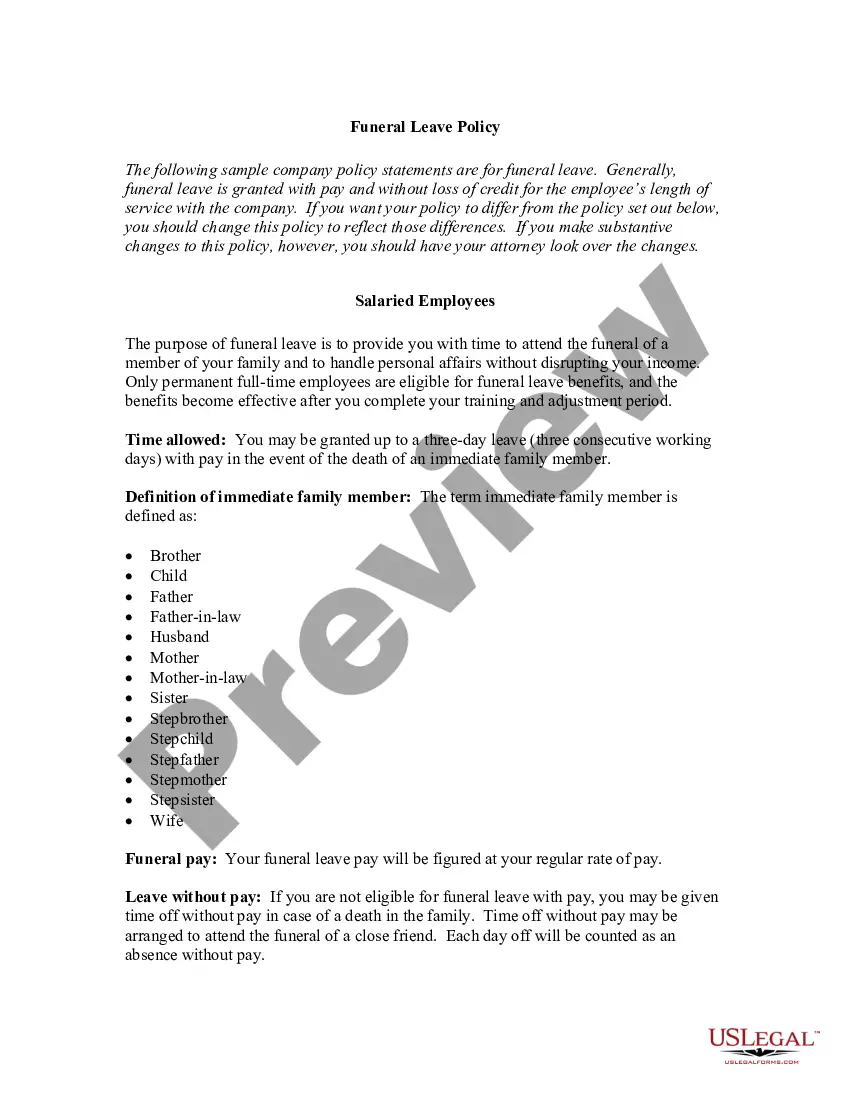

Mandatory time off, or minimum PTO, is a policy where employers require employees to take at least a certain number of days off from work each year. While away from work, employees receive their regular wages. A mandatory time off (MTO) policy accompanies paid time off or unlimited paid time off policies.

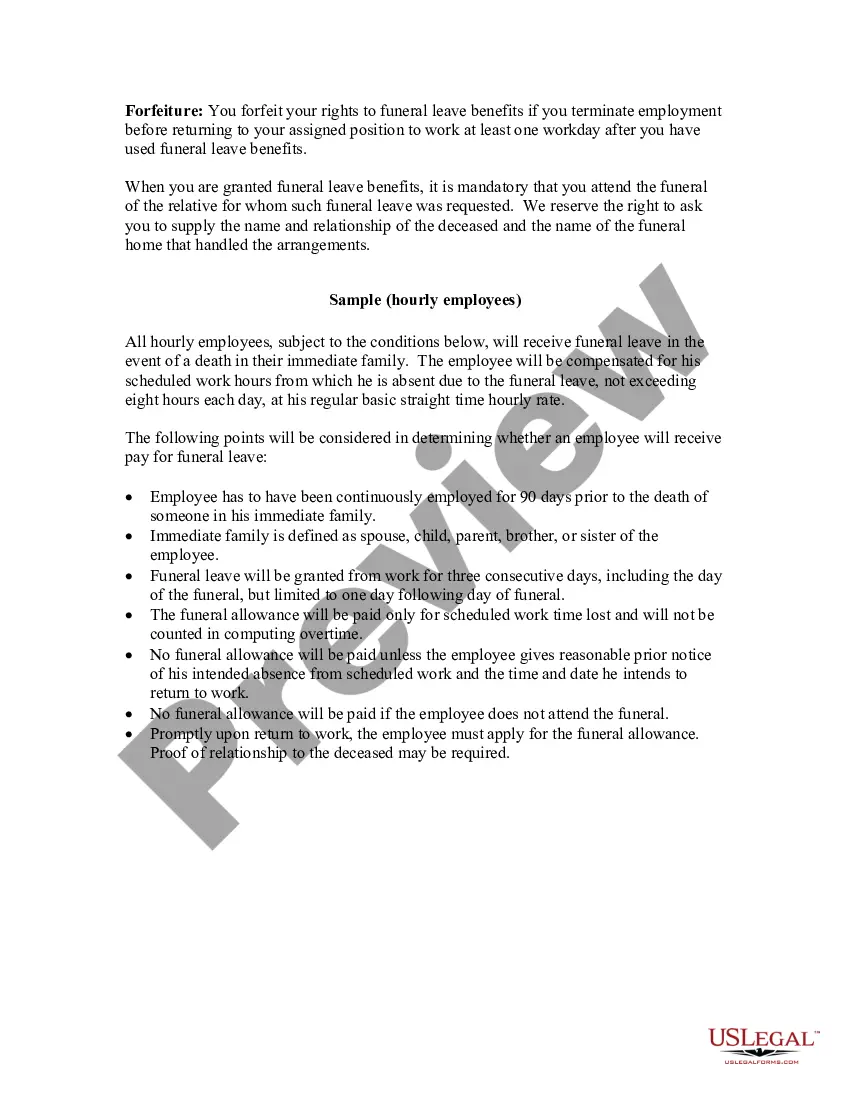

In conclusion, there is no legal requirement that either party give two weeks notice of termination. Failure to do so may be a breach of unwritten rules, but in almost all cases there is no legal remedy.

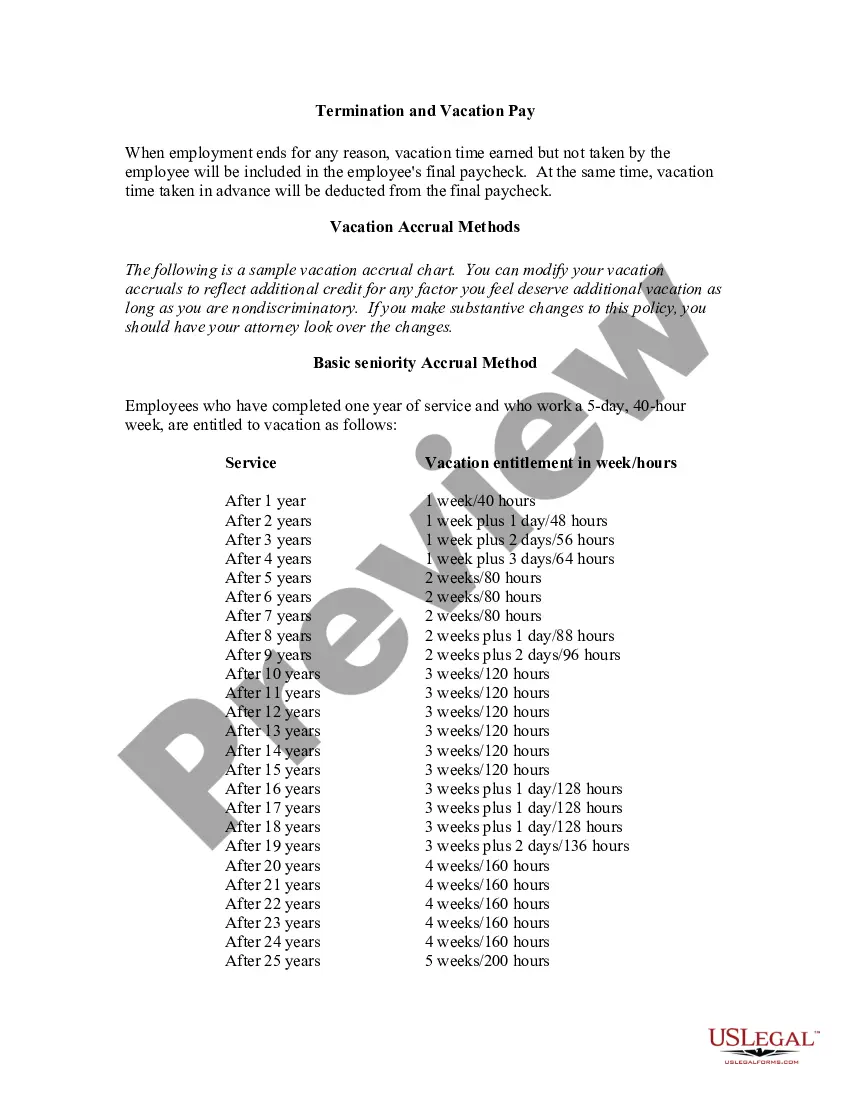

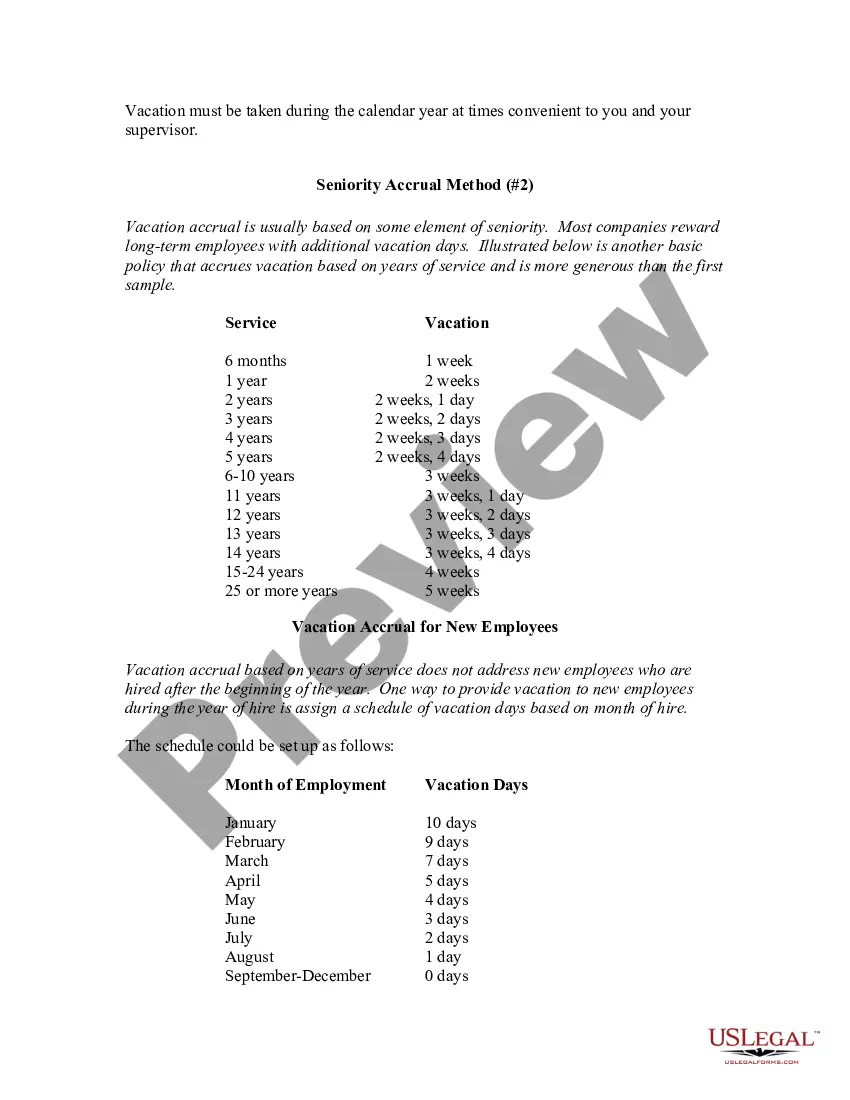

The number of vacation days granted each year may vary by length of service. In 2021, more than onethird of private industry workers received 10 to 14 days of paid vacation after one year of service. After 10 years of service, 33 percent of private industry workers received between 15 and 19 days of paid vacation.

Add the number of hours earned in the current accounting period. Subtract the number of vacation hours used in the current period. Multiply the ending number of accrued vacation hours by the employee's hourly wage rate to arrive at the correct accrual that should be on the company's books.

Yes. Under IRS rules, lump sum payments are considered supplemental wages and are subject to Social Security and Medicare taxes even if your maximum contribution limit is greater than your vacation payout. Any federal income tax withheld will be at the IRS supplemental wage tax rate of 25%.

While Americans workers are entitled to up to 12 weeks of unpaid vacation via the federal Family and Medical Leave Act, there is no federal law regulating paid vacation minimums. This means that it's up to state laws to regulate and more often, up to businesses.

A mandatory vacation policy is a policy that requires employees to take a set amount of vacation days per year. While most organizations offer their employees paid time off (PTO), some companies mandate employees to use this PTO.

Employers can include bank holidays within your minimum annual leave entitlement of 5.6 weeks a year (28 days for a full time worker).