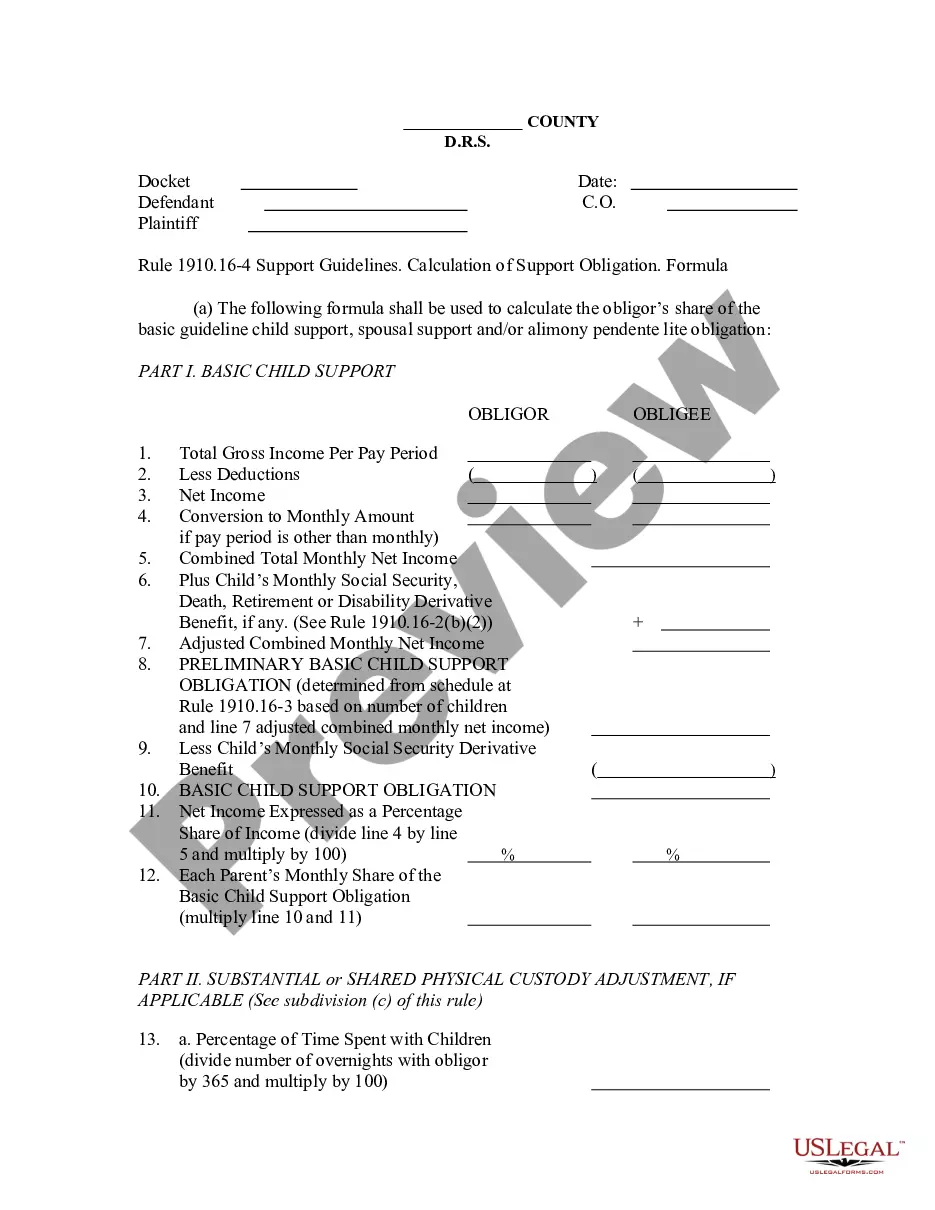

Pennsylvania Child Support Guidelines Worksheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Child Support Guidelines Worksheet: A form used by the probate family court to calculate child support obligations based on parents' financial statements and other relevant factors.

Massachusetts Family Court: A division of the state's court system that handles matters such as divorce, child custody, and child support. Massachusetts uses specific child support guidelines which can be detailed in worksheets specific to the state.

Step-by-Step Guide to Using the Child Support Guidelines Worksheet

- Access the Worksheet: Visit the Massachusetts family court website and find the 'Child Support Guidelines Worksheet' under the forms or resources section. Adjust your website security settings if necessary to access the PDF.

- Open PDF File: Click on the link to open the PDF file of the worksheet. Ensure your browser allows pop-ups from the site.

- Complete the Worksheet: Fill in the required fields based on your financial information and any other circumstances that might affect child support.

- Save PDF File: After completing the worksheet, save your progress by downloading the filled PDF to your device.

- Submit Application Online: If applicable, submit your completed worksheet online through the court's website or the designated online assistance resources.

Risk Analysis

- Incorrect Information: Filling out the worksheet inaccurately can lead to improper calculation of child support, potentially leading to legal disputes or financial hardship.

- Privacy Concerns: Ensure that the website security settings are correctly adjusted to protect personal and financial information when submitting the worksheet online.

Key Takeaways

Using the child support guidelines worksheet correctly is crucial for ensuring fair and accurate support payments. It's important to double-check all entered information and understand how the guidelines apply to your specific situation in Massachusetts.

How to fill out Pennsylvania Child Support Guidelines Worksheet?

Among countless paid and free samples that you’re able to find on the internet, you can't be sure about their accuracy and reliability. For example, who made them or if they’re skilled enough to take care of what you require these people to. Keep relaxed and utilize US Legal Forms! Get Pennsylvania Child Support Guidelines Worksheet templates developed by skilled legal representatives and get away from the costly and time-consuming process of looking for an attorney and then having to pay them to draft a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the form you are seeking. You'll also be able to access all of your previously acquired examples in the My Forms menu.

If you are using our service the very first time, follow the instructions listed below to get your Pennsylvania Child Support Guidelines Worksheet easily:

- Make sure that the document you discover applies in your state.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another template utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

Once you have signed up and paid for your subscription, you can utilize your Pennsylvania Child Support Guidelines Worksheet as often as you need or for as long as it remains active where you live. Edit it with your favorite editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

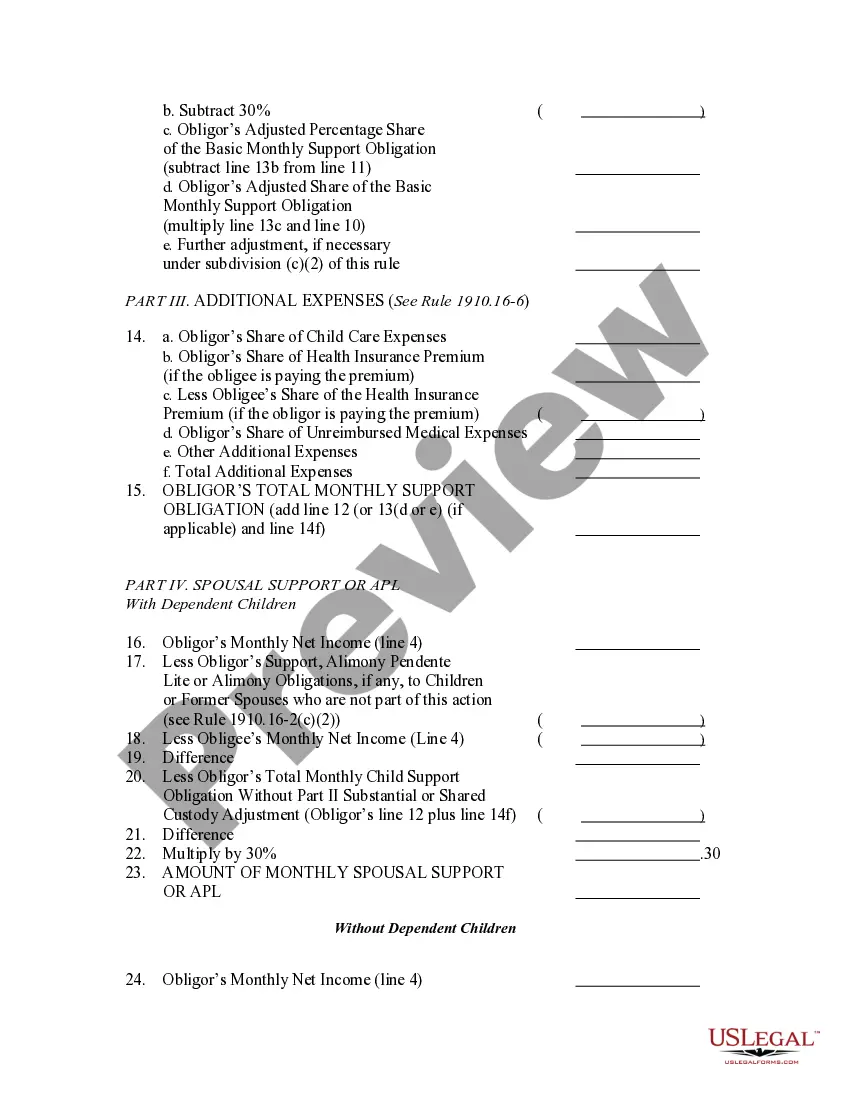

To determine the percentage of each parent's contribution to the combined monthly income divide each parent's individual net incomes by their combined net income. For the father ($5,000 / $8,000 = 58%) for the mother ($3,000 / $8,000 = 42%).

1910.16-3, the basic child support obligation shall be calculated initially by using the obligor's monthly net income only. For example, if the obligor has monthly net income of $1,100, the presumptive support amount for three children is $110 per month. This amount is determined directly from the schedule in Pa.

That is the basic child support obligation. To find out what the obligor owes the obligee, you multiply that number by the obligor's percentage of the combined monthly net income (58%). So, $1,795 X 58% equals $1,041.10. That is going to be the amount of child support that the obligor owes the obligee per month.

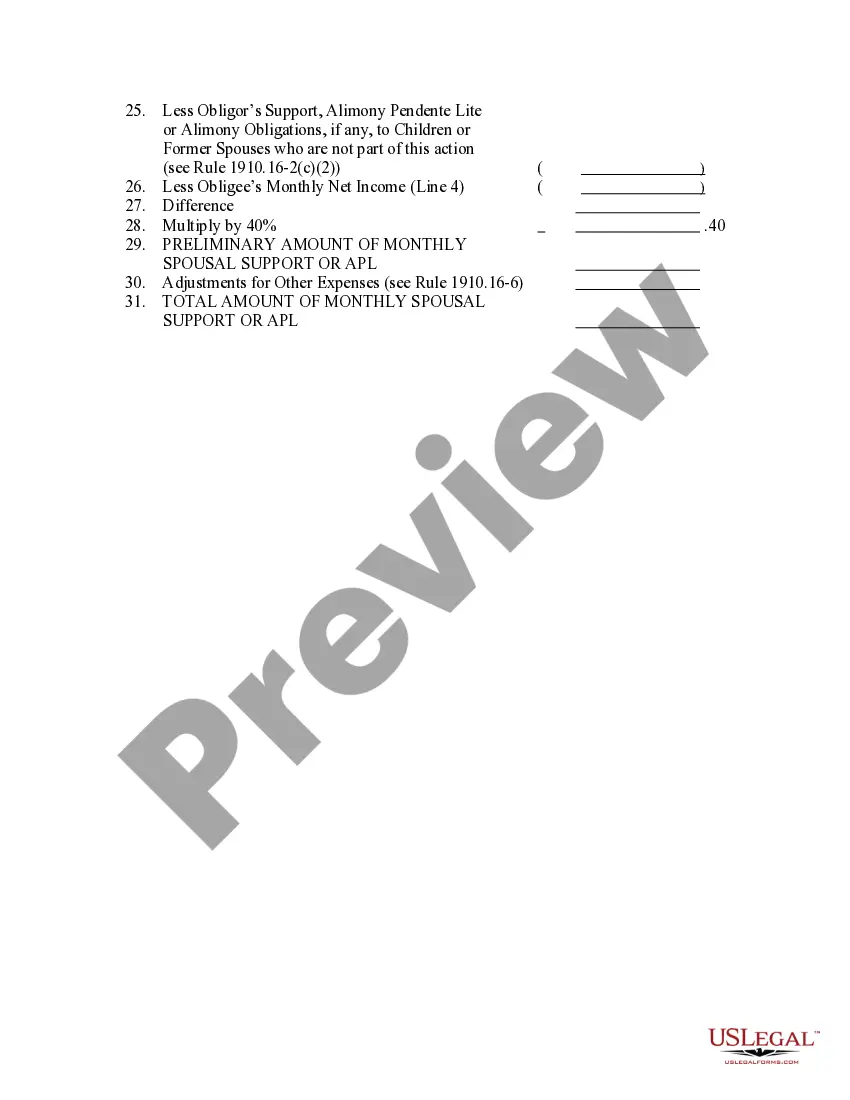

Child support awards in Pennsylvania are governed by statewide guidelines, established by the Pennsylvania Supreme Court. The support guidelines determine the amount of support a parent should pay, based on the parties' net monthly incomes and the number of children involved.

Child support may include medical support, payment of uncovered medical bills and contributions to child care costs. The Department of Public Welfare, Bureau of Child Support Enforcement, BCSE, administers the Pennsylvania Child Support Enforcement Program.These laws also govern how child support is collected.

Pennsylvania allows for parents to share custody of a minor child after a divorce, and in some cases, that custody is split equally, 50/50.In these situations, the higher-earning parent usually pays child support to the lesser-earning parent for the child's care.

Mother's monthly net income is $3,000 and father's is $4,500. Since father's portion of the monthly net income is 60%, father pays 60% of the monthly child support amount. The monthly child support amount is $1,729, per the child support guidelines, therefore, father's obligation is approximately $1,037.

In determining a parent's income for child support purposes, courts typically look at the parent's gross income from all sources. They then subtract certain obligatory deductions, like income taxes, Social Security, health care, and mandatory union dues.