Louisiana Sales Prospect File

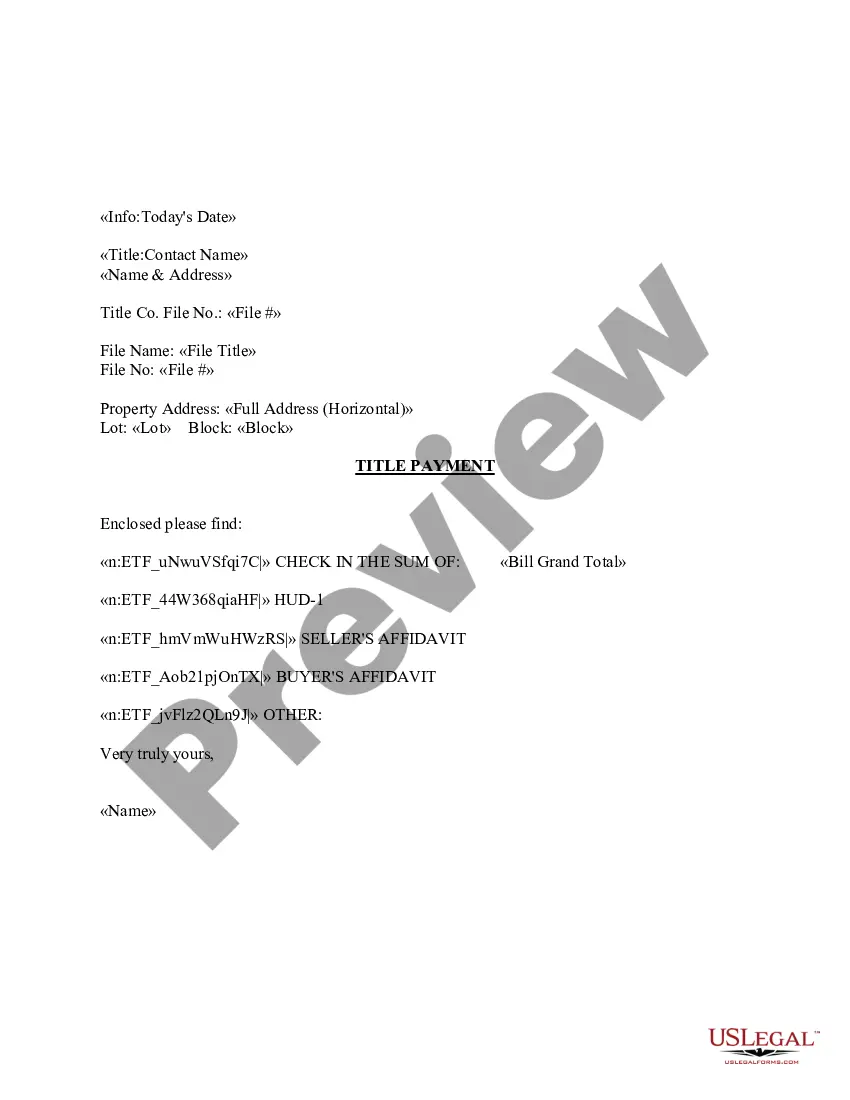

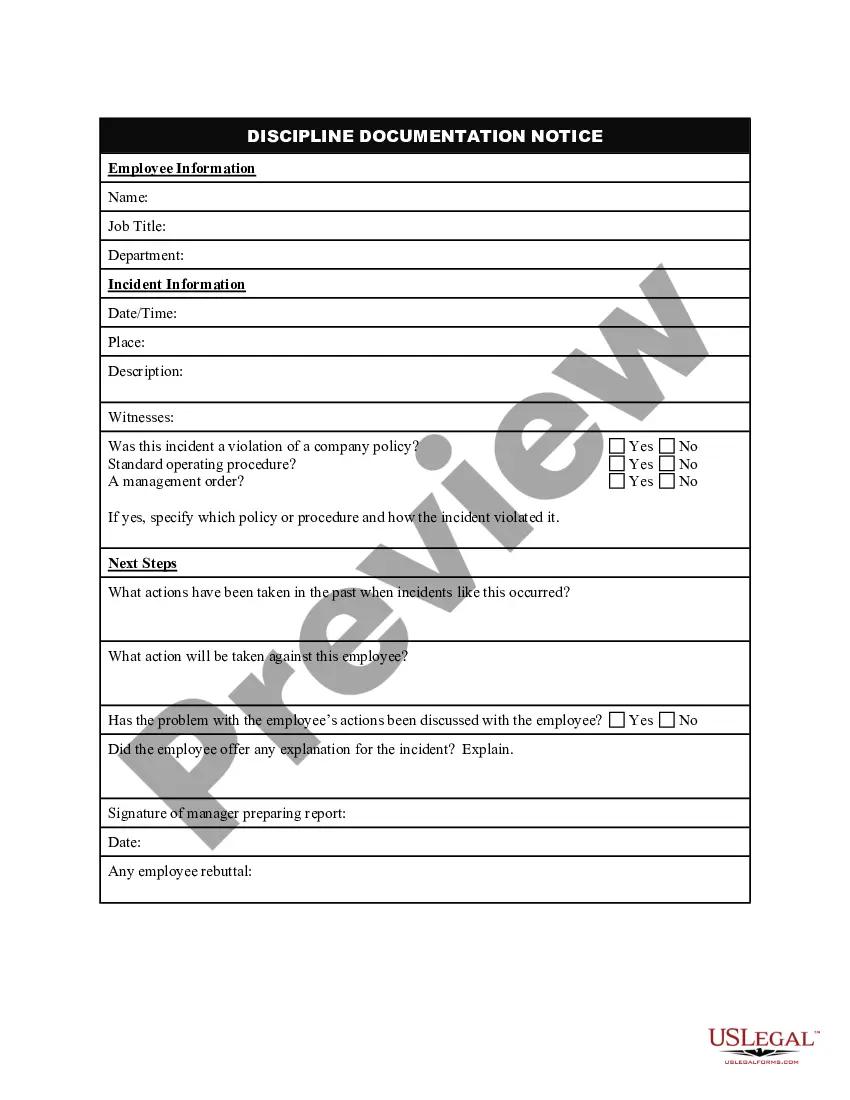

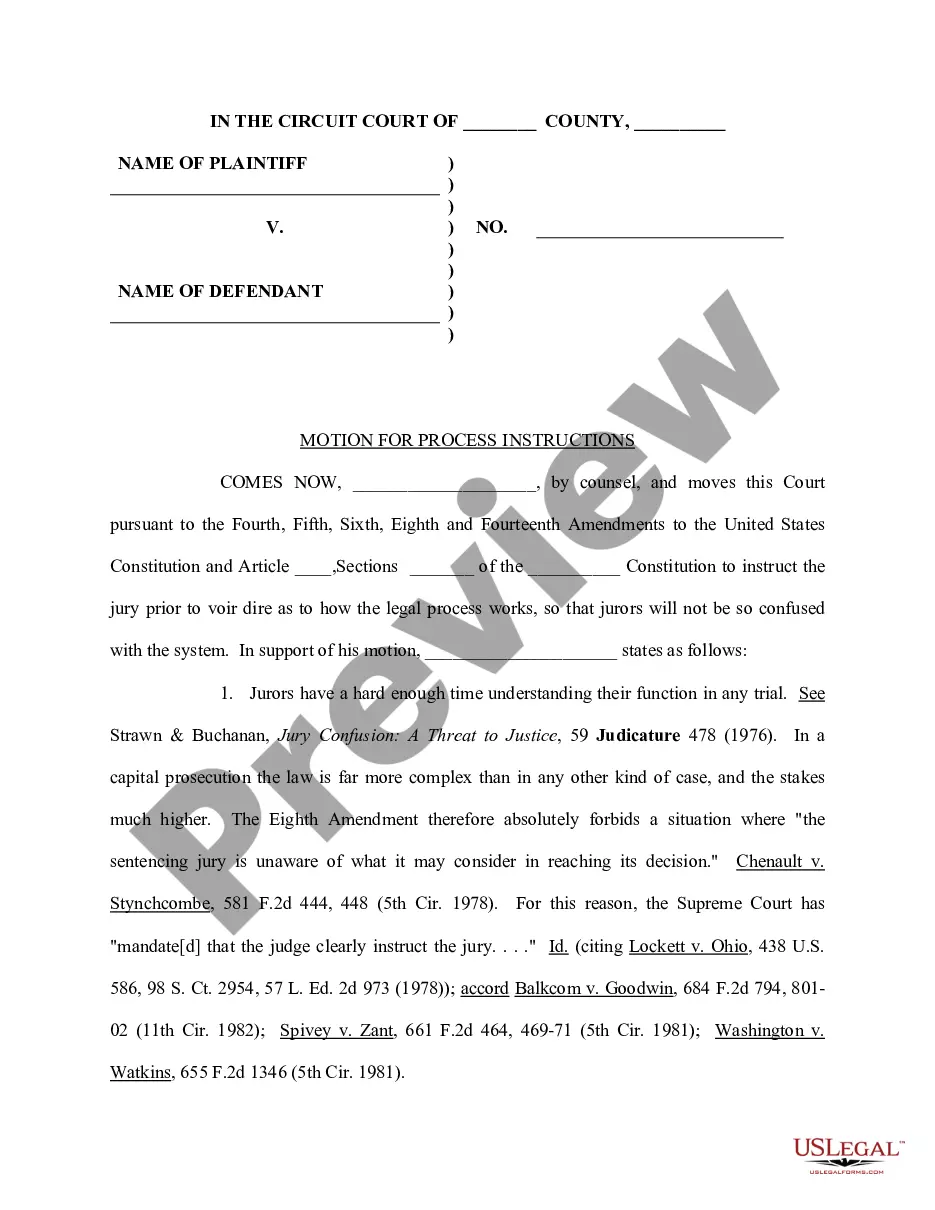

Description

How to fill out Sales Prospect File?

Selecting the optimal authorized document template can be challenging.

Indeed, there are numerous designs available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The service offers a multitude of templates, such as the Louisiana Sales Prospect File, suitable for both business and personal needs.

You can examine the form using the Preview button and review the form details to confirm it is the right one for you.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Louisiana Sales Prospect File.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new customer of US Legal Forms, the following are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/area.

Form popularity

FAQ

To verify your Louisiana sales tax exemption certificate, you can utilize the resources provided by the Louisiana Department of Revenue. You can either call them or use their online verification tools. Maintaining a Louisiana Sales Prospect File helps you have all pertinent information at your fingertips when needed.

You can obtain a Louisiana state sales tax ID number by registering your business with the Louisiana Department of Revenue. This registration process is available online and requires basic information about your business. By keeping an organized Louisiana Sales Prospect File, you can ensure that you have all necessary details to make this process as smooth as possible.

To verify your sales tax exemption certificate in Louisiana, you can contact the Louisiana Department of Revenue directly or check their online portal. They can confirm the validity of your certificate and provide details specific to your situation. Additionally, a Louisiana Sales Prospect File can help you keep track of all your exemption certificates for convenient access when verifying.

Yes, Louisiana sales tax exemption certificates can expire depending on the type. For example, certain certificates are valid for one year, while others may last longer. It's essential to check your certificate routinely, and maintaining a Louisiana Sales Prospect File can aid in monitoring these expiration dates.

If you need a copy of your resale certificate in Louisiana, you should contact the vendor from whom you originally received it. They can provide you with a duplicate or help you reissue one. Keep in mind that maintaining a Louisiana Sales Prospect File can assist you in tracking these important documents for future reference.

To obtain a sales tax certificate in Louisiana, you must first register your business with the Louisiana Department of Revenue. You can do this online through their website, where you will need to fill out the necessary forms. Once registered, you will receive your sales tax certificate electronically. Utilizing a Louisiana Sales Prospect File can streamline this process by ensuring you have all required documentation.

Recent sales tax rules in Louisiana emphasize compliance and reporting standards for businesses. These new regulations may include requirements for electronic filing and updated documentation. To simplify understanding and implementation of these rules, the Louisiana Sales Prospect File serves as a helpful guide for navigating the landscape of sales tax compliance.

The highest sales tax rate in Louisiana can reach around 10.75% in specific locations, combining state and local taxes. This high rate underscores the importance of knowing the exact rate in your jurisdiction. To stay updated and aligned with these rates, the Louisiana Sales Prospect File is an invaluable asset for your business.

In Louisiana, any business selling tangible personal property or certain services must collect sales tax. This requirement applies to local businesses and online retailers operating within the state. Leveraging the Louisiana Sales Prospect File can help clarify your obligations and ensure you do not overlook any important regulations.

In Louisiana, businesses typically need to file sales tax returns monthly, quarterly, or annually, depending on their sales volume. Larger businesses usually file monthly, while smaller businesses may qualify for quarterly or annual filing. Keeping your records organized and utilizing tools like the Louisiana Sales Prospect File can save you time and ensure compliance.