Louisiana Sample Letter Requesting Payoff Balance of Mortgage

Description

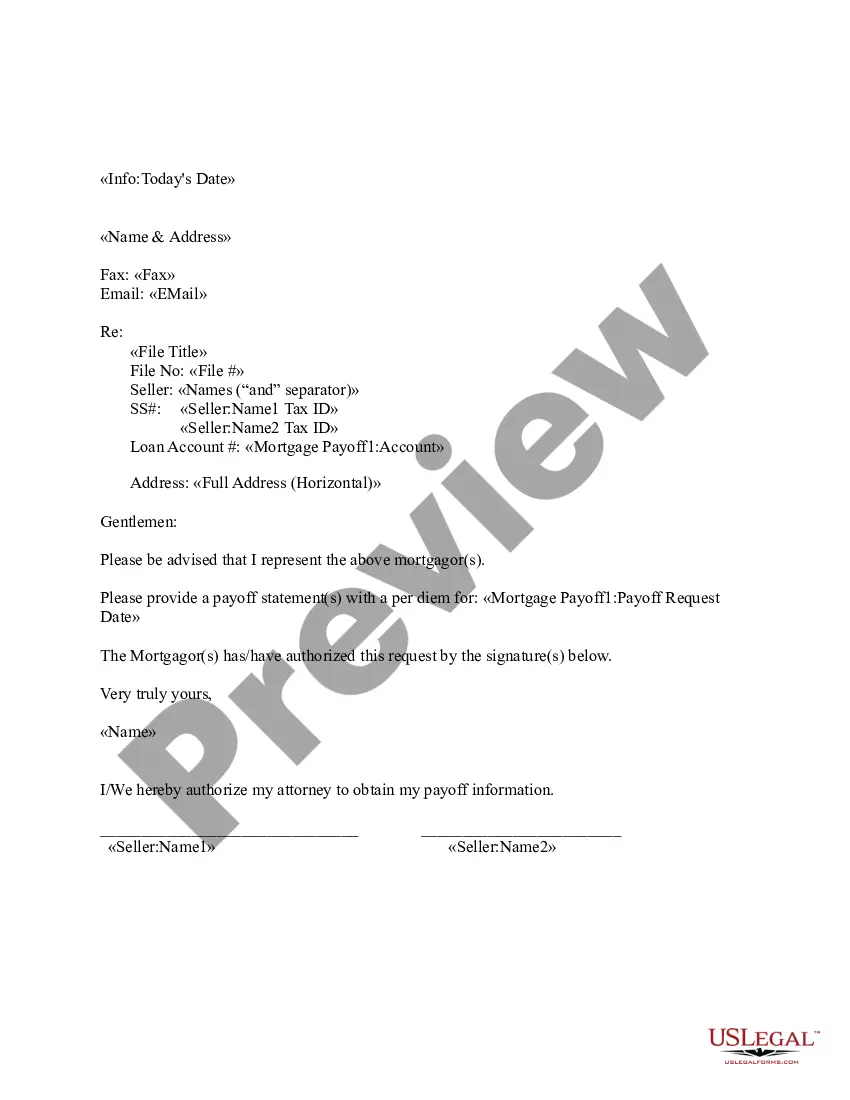

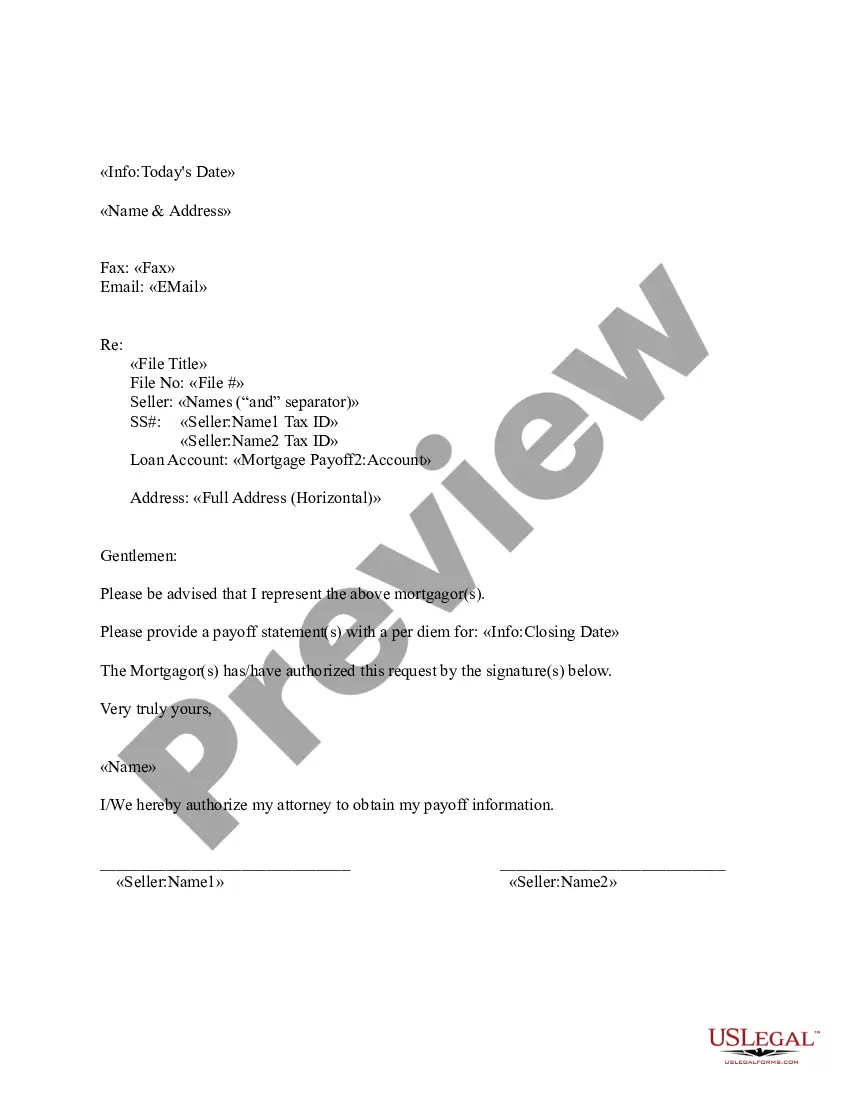

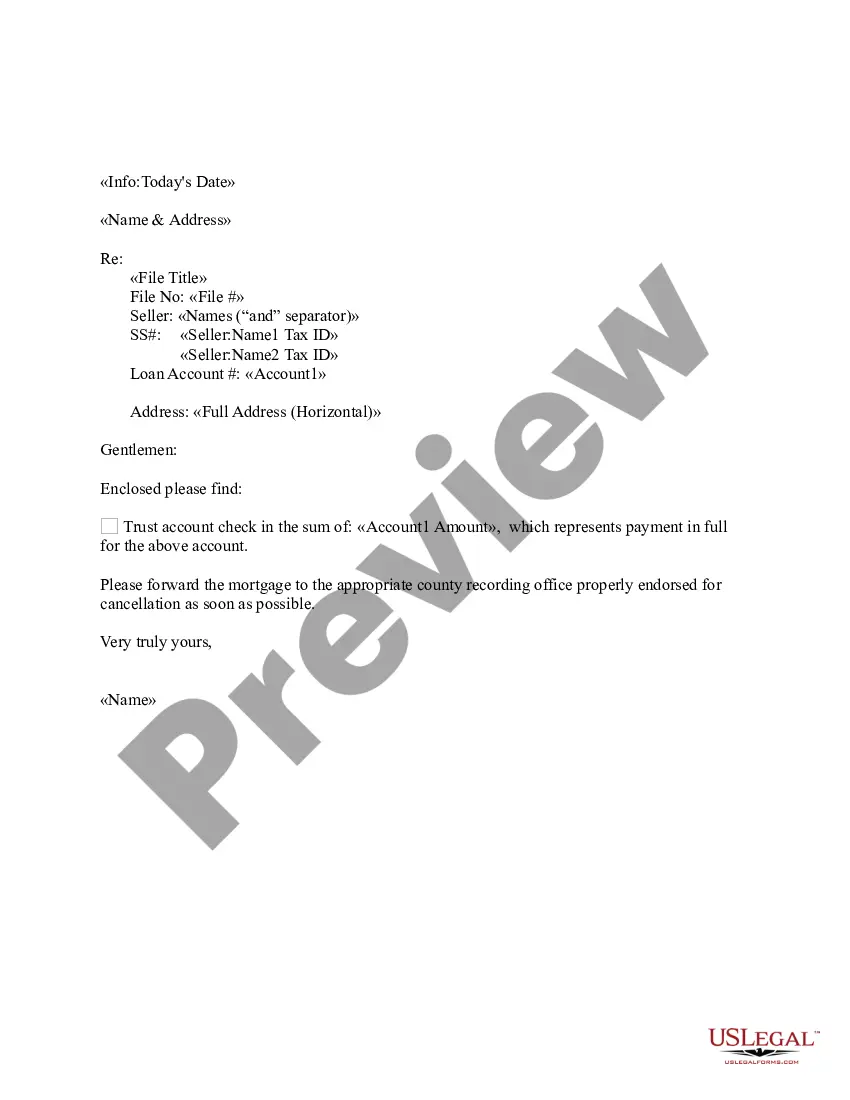

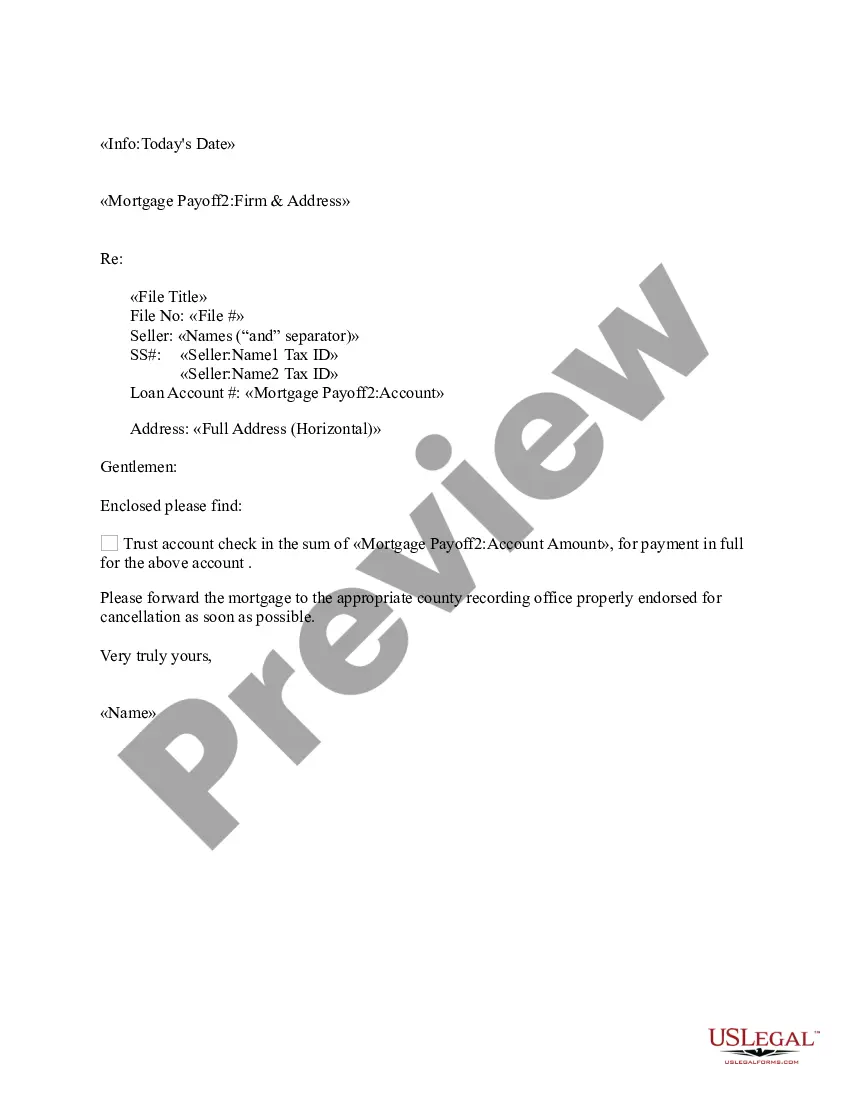

How to fill out Sample Letter Requesting Payoff Balance Of Mortgage?

If you want to comprehensive, acquire, or print legitimate papers templates, use US Legal Forms, the biggest selection of legitimate varieties, that can be found on the Internet. Make use of the site`s simple and hassle-free look for to discover the files you will need. Numerous templates for company and individual reasons are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to discover the Louisiana Sample Letter Requesting Payoff Balance of Mortgage with a few mouse clicks.

If you are currently a US Legal Forms consumer, log in for your bank account and click on the Down load button to have the Louisiana Sample Letter Requesting Payoff Balance of Mortgage. You can also access varieties you previously acquired within the My Forms tab of your respective bank account.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have chosen the shape for your appropriate area/country.

- Step 2. Utilize the Review method to examine the form`s content material. Don`t forget to read the outline.

- Step 3. If you are not satisfied using the develop, utilize the Look for field towards the top of the monitor to discover other versions in the legitimate develop format.

- Step 4. When you have located the shape you will need, select the Acquire now button. Choose the prices strategy you like and add your credentials to register for the bank account.

- Step 5. Procedure the financial transaction. You may use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the structure in the legitimate develop and acquire it on your product.

- Step 7. Comprehensive, modify and print or indication the Louisiana Sample Letter Requesting Payoff Balance of Mortgage.

Every legitimate papers format you buy is the one you have eternally. You might have acces to each and every develop you acquired inside your acccount. Select the My Forms portion and select a develop to print or acquire once again.

Compete and acquire, and print the Louisiana Sample Letter Requesting Payoff Balance of Mortgage with US Legal Forms. There are many skilled and express-distinct varieties you can use to your company or individual requirements.

Form popularity

FAQ

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions.

Your payoff amount is how much you will actually have to pay to satisfy the terms of your mortgage loan and completely pay off your debt. Your payoff amount is different from your current balance. Your current balance might not reflect how much you actually have to pay to completely satisfy the loan.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

It's the exact sum of money needed to pay off your loan, and it's probably different from your current loan balance, as it may include interest and fees that you owe but have not yet paid. 2 What's more, some lenders may have certain penalties or fees associated with requesting a payoff statement.

When you want to sell your car and you still have an outstanding loan, the buyer will request a loan payoff statement. The statement will include the name or the loan company, your account number, the payoff amount, the payoff data, per diem and the address for the payoff check.

What is a 10-day payoff and where can I get it? A 10-day payoff statement is a document from your lender that gives us the payoff amount to purchase your vehicle, including 10 days worth of interest. We need this document in order to finalize your trade-in or sale.

They're often used in refinancing, consolidation loans, debts in collections, and other situations wherein a lender wants to know how much must be paid to satisfy a loan. If you have debt and you want a payoff statement, you can request one by contacting whichever lender or creditor holds the debt.

How to Obtain a Payoff Quote. You can calculate a mortgage payoff amount using a formula. Work out the daily interest rate by multiplying the loan balance by the interest rate, then dividing that by 365. This figure, multiplied by the days until payoff, plus the loan balance, gives you your mortgage payoff amount.