Louisiana Irrevocable Trust Agreement Setting up Special Needs Trust for Benefit of Multiple Children

Description

How to fill out Irrevocable Trust Agreement Setting Up Special Needs Trust For Benefit Of Multiple Children?

You are capable of spending hours on the internet trying to discover the legal document template that complies with the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that are examined by professionals.

You can effortlessly download or print the Louisiana Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children from my service.

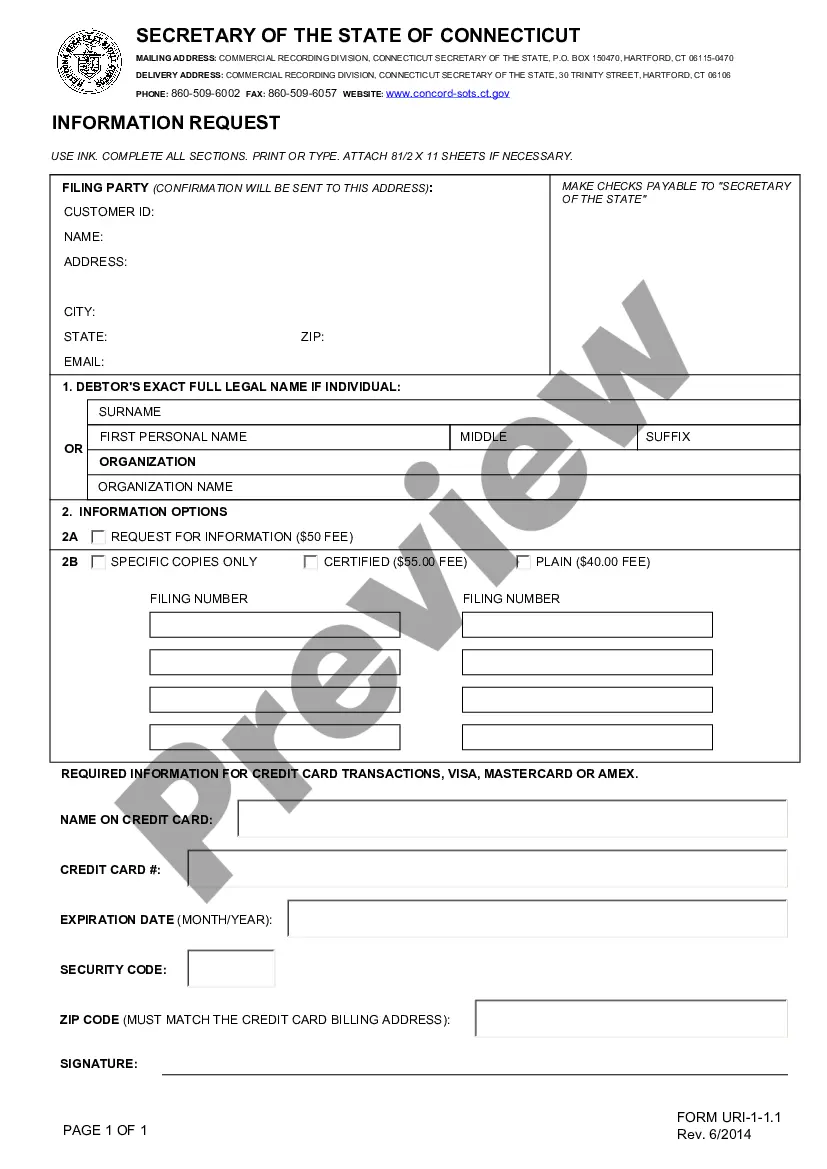

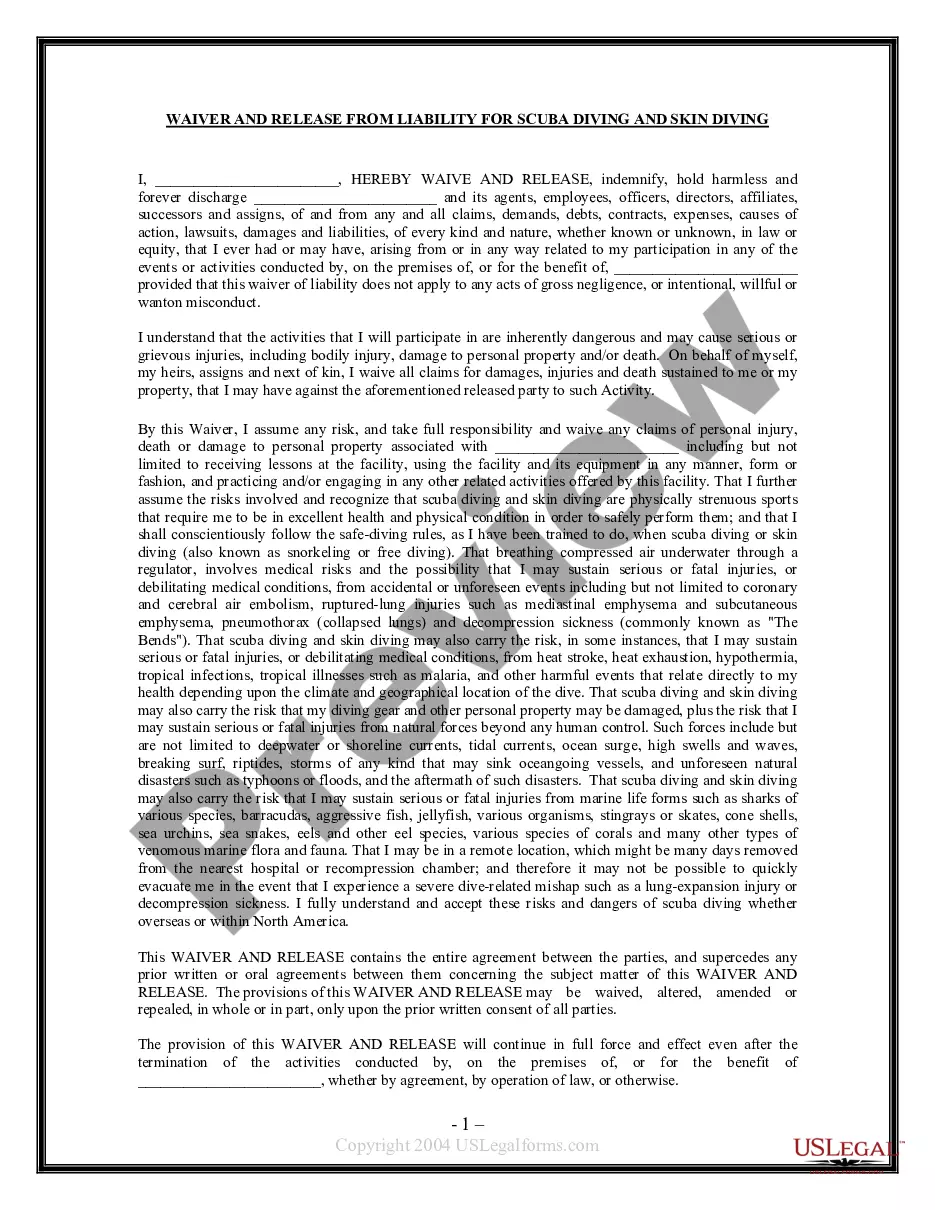

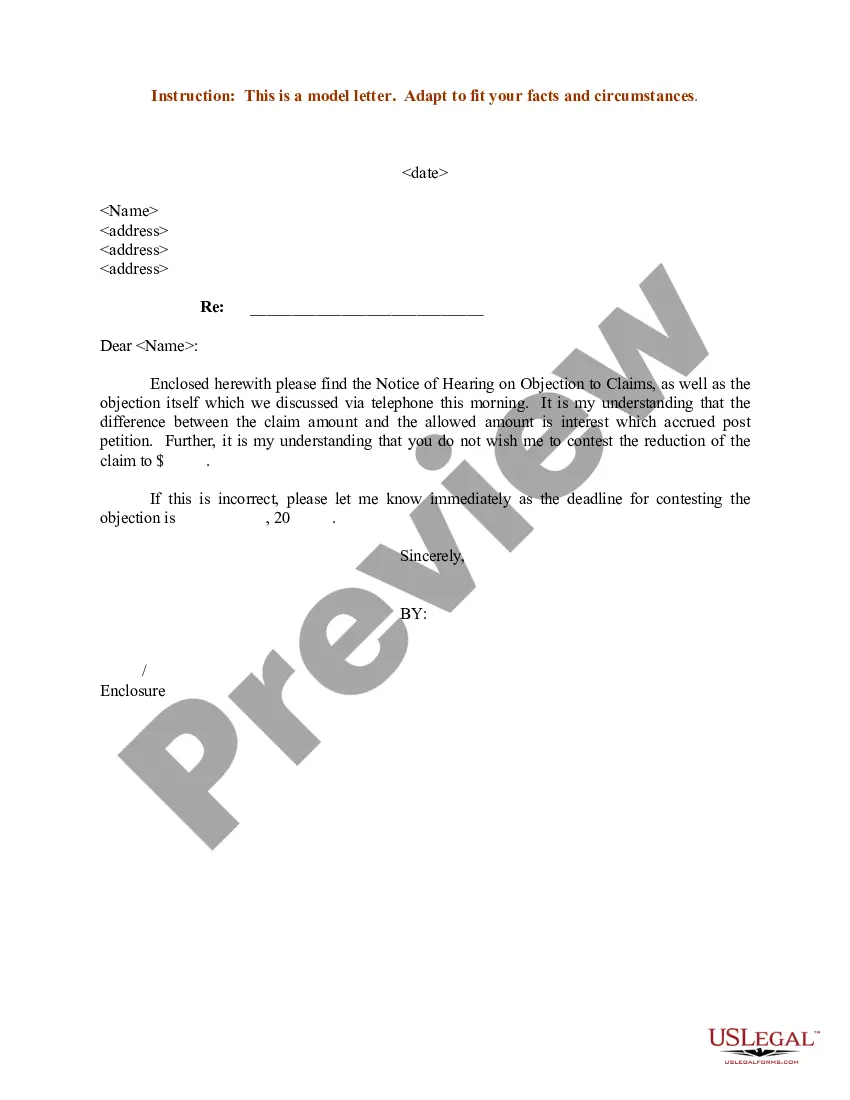

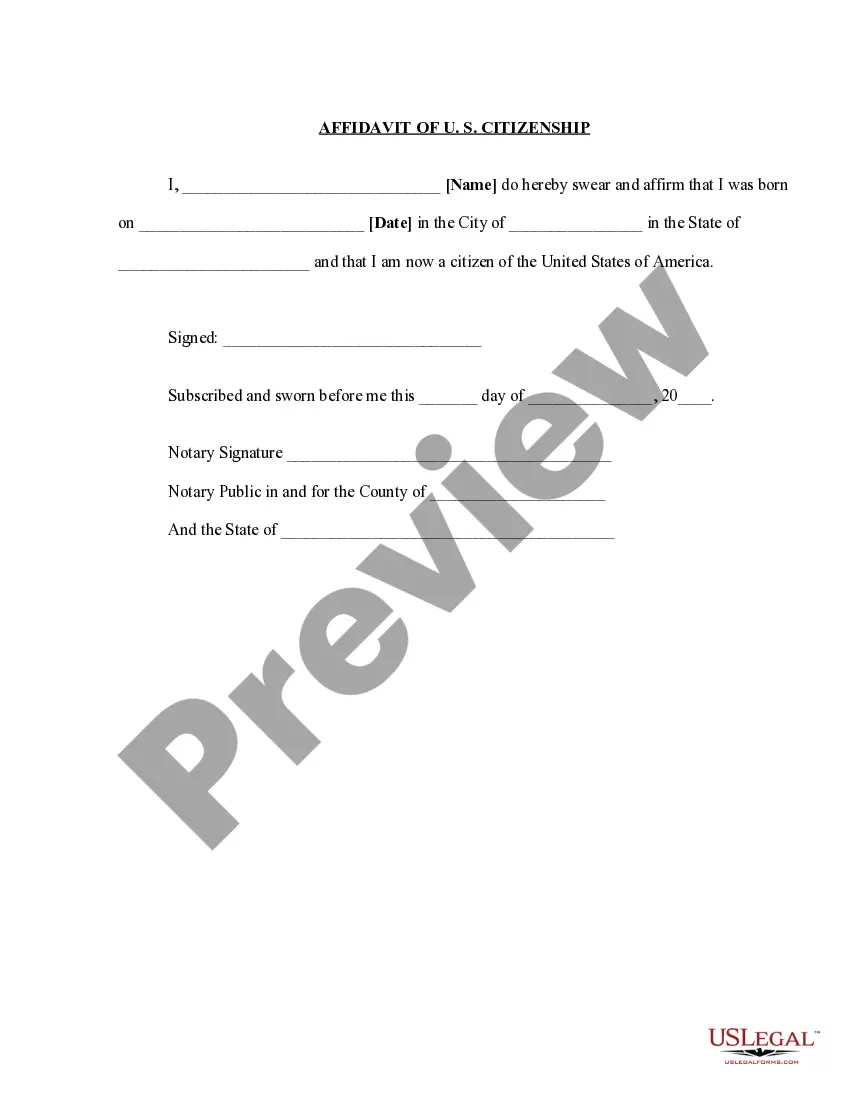

If available, take advantage of the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Louisiana Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of a purchased form, visit the My documents section and click on the respective option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Read the form description to confirm you have selected the correct form.

Form popularity

FAQ

So the special-needs trust is a type of trust that is used to provide assets and resources to take care of a person with a disability, while the living trust is a will substitute that I might use in place of having a will for my estate plan.

The term special needs trust refers to the purpose of the trust to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name supplemental needs trust addresses the shortfalls of our public benefits programs.

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.

Some of the benefits of utilizing an SNT include asset management and maximizing and maintaining government benefits (including Medicaid and Supplemental Security Income). Some possible negatives of utilizing an SNT include lack of control and difficulty or inability to identify an appropriate Trustee.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?31-Aug-2015

The major disadvantages that are associated with trusts are their perceived irrevocability, the loss of control over assets that are put into trust and their costs. In fact trusts can be made revocable, but this generally has negative consequences in respect of tax, estate duty, asset protection and stamp duty.

What You Need to Get Started:Choose an experienced attorney to prepare the Special Needs trust document.Select a Trustee to manage the investments of the trust, administration, monitor benefits and to receive and monitor distribution requests from the trust.Complete a Letter of Intent.

What is Special trust? A special needs trust is also called a supplemental needs trust in some jurisdictions, is a special trust that allows the disabled or physically challenged beneficiary to enjoy the use of an asset that is held in the trust for his/her benefit.

A special needs trust is a legal arrangement that lets a physically or mentally ill person, or someone chronically disabled, have access to funding without potentially losing the benefits provided by public assistance programs.

Yes, but be aware that a co-trustee can be held responsible for another co-trustee's breach of a fiduciary duty. Thus, it is important that all co-trustees pay close attention to everything that is done in the administration of the trust.