Louisiana Covenant Not to Sue by Widow of Deceased Stockholder

Description

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

If you want to be thorough, download or print legal document templates, use US Legal Forms, the largest collection of legal forms available online.

Utilize the site's simple and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Louisiana Covenant Not to Sue by Widow of Deceased Stockholder with just a few clicks.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Louisiana Covenant Not to Sue by Widow of Deceased Stockholder. Each legal document template you receive is yours permanently. You have access to each form you downloaded within your account. Visit the My documents section and select a form to print or download again. Stay competitive and download and print the Louisiana Covenant Not to Sue by Widow of Deceased Stockholder with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click the Obtain button to get the Louisiana Covenant Not to Sue by Widow of Deceased Stockholder.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for your correct area/state.

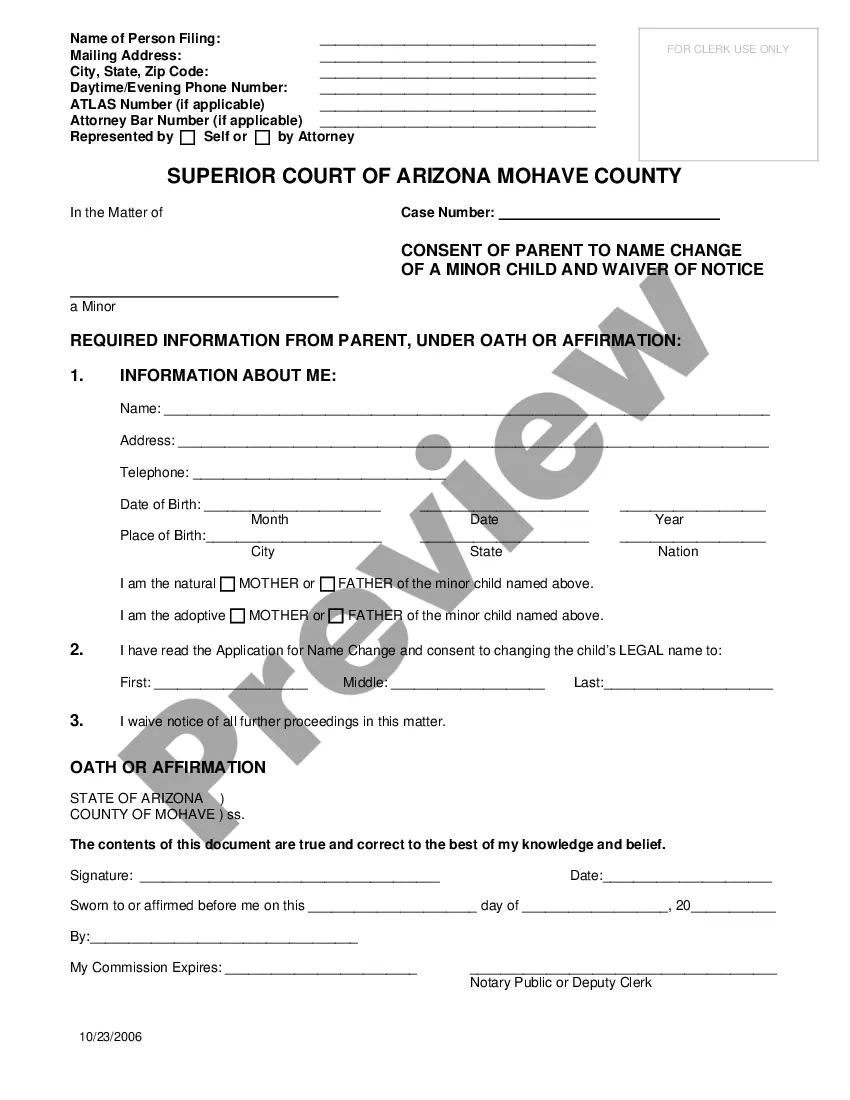

- Step 2. Utilize the Preview option to review the form’s contents. Don't forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for the account.