Louisiana Allonge

Description

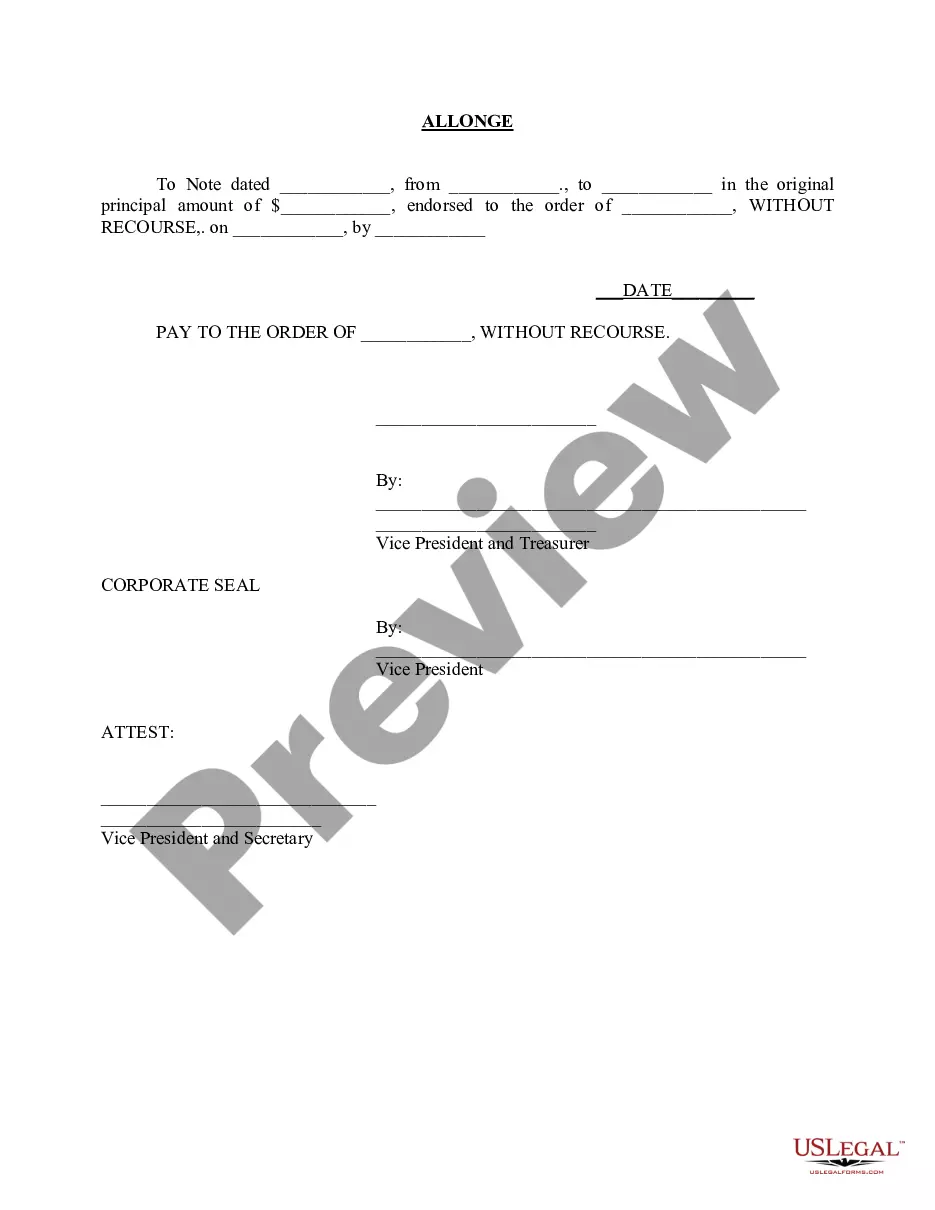

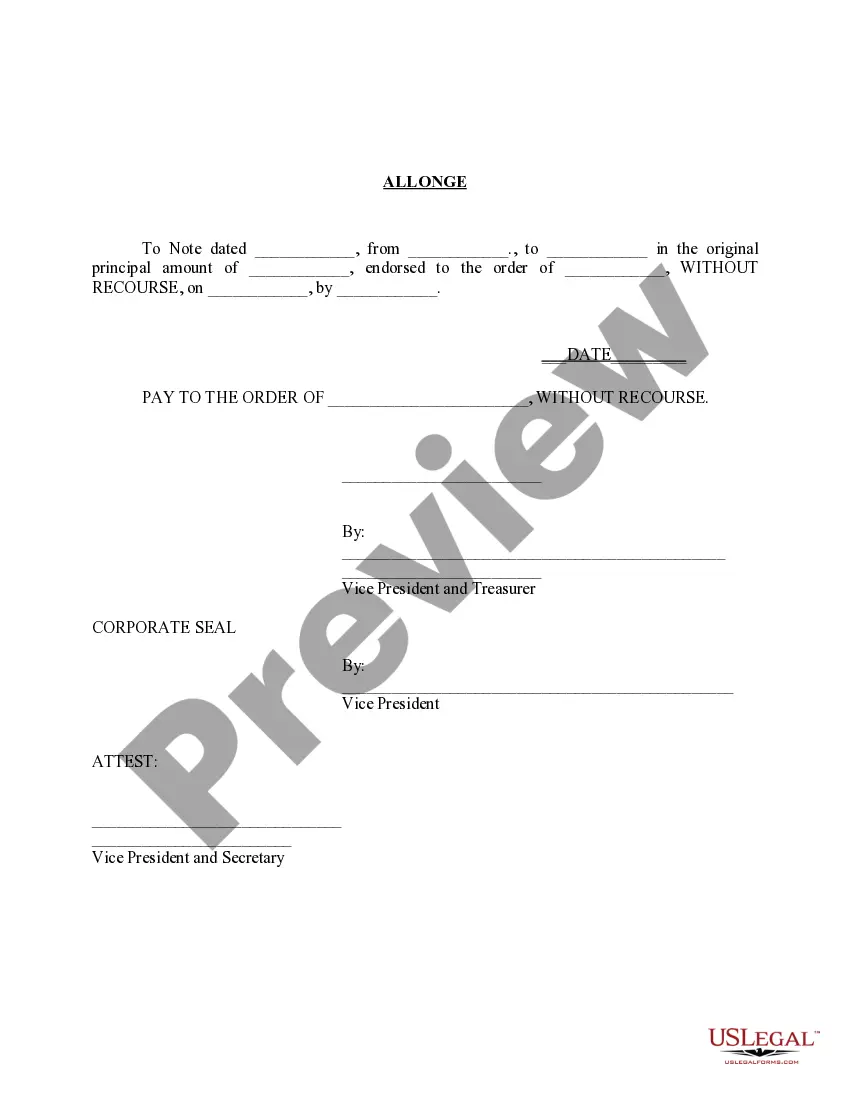

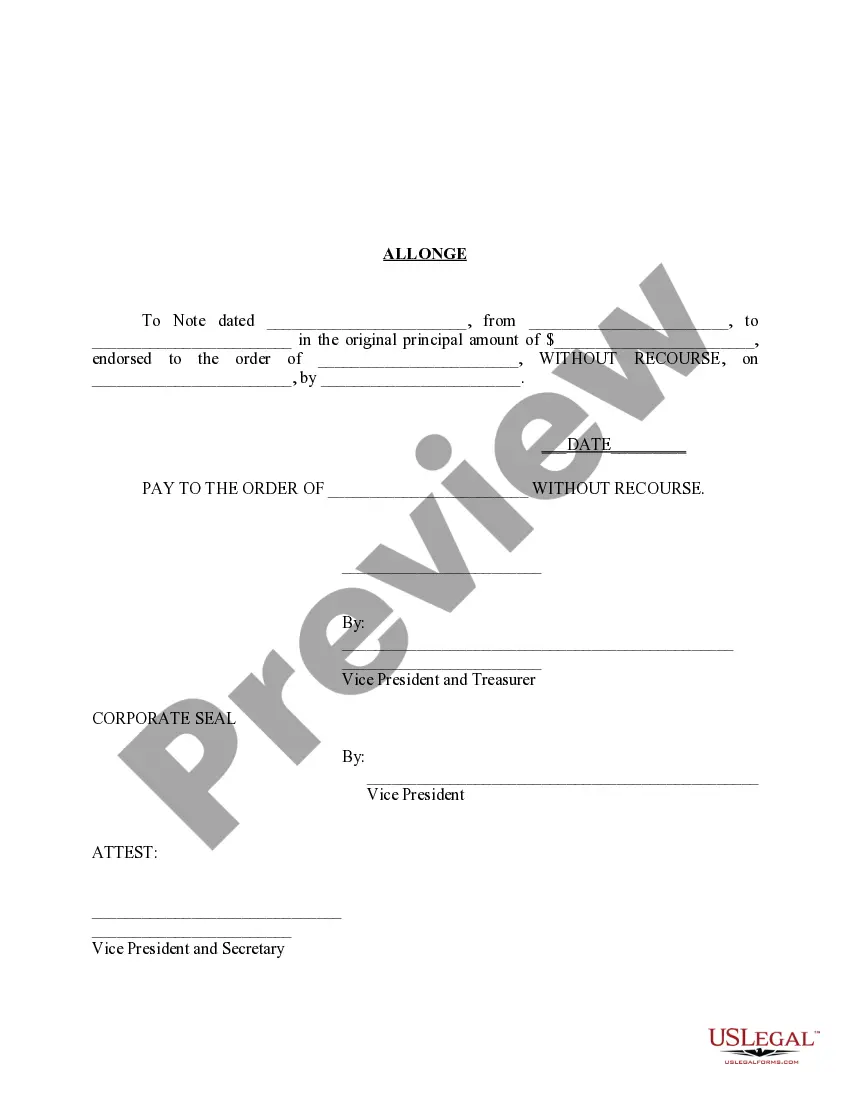

How to fill out Allonge?

Are you currently within a position where you require files for possibly company or individual reasons almost every day? There are a variety of legitimate record templates available on the Internet, but discovering types you can rely is not simple. US Legal Forms delivers thousands of develop templates, much like the Louisiana Allonge, which can be created to meet state and federal requirements.

In case you are presently familiar with US Legal Forms website and possess a free account, just log in. After that, you are able to obtain the Louisiana Allonge design.

If you do not have an profile and want to begin using US Legal Forms, adopt these measures:

- Discover the develop you will need and make sure it is for that right metropolis/area.

- Take advantage of the Preview button to check the shape.

- See the explanation to ensure that you have chosen the correct develop.

- In the event the develop is not what you`re searching for, take advantage of the Search field to find the develop that fits your needs and requirements.

- Whenever you get the right develop, just click Acquire now.

- Opt for the pricing plan you need, fill out the desired information to generate your money, and pay money for the order using your PayPal or Visa or Mastercard.

- Pick a practical paper structure and obtain your duplicate.

Find each of the record templates you have bought in the My Forms food selection. You may get a extra duplicate of Louisiana Allonge anytime, if required. Just click on the necessary develop to obtain or print the record design.

Use US Legal Forms, one of the most comprehensive selection of legitimate varieties, to conserve time as well as prevent errors. The assistance delivers expertly produced legitimate record templates which you can use for a range of reasons. Create a free account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

An allonge is a sheet of paper that is attached to a negotiable instrument, such as a bill of exchange. Its purpose is to provide space for additional endorsements when there is no longer sufficient space on the original instrument. The word ?allonge? derives from the French word allonger, which means ?to lengthen."

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

The Seller may use an Allonge to endorse a Note if the following conditions are met: The Allonge is permanently affixed to the Note. The Allonge references the Borrower's name, the property address and the original principal balance of the Note. The form of the Allonge, and its use, complies with all applicable laws.

An allonge is considered an extension of the instrument itself. The purpose of an allonge in most loan transactions is to transfer the negotiable instrument to the lender if there has been an event of default and the lender is enforcing its rights under the credit agreement.

An allonge to promissory note is different from an assignment. An assignment in this context is what gives a party the legal designation and right to move forward with legal action on a property, whereas an allonge is an endorsement that allows you to collect on the promissory note.

In order for the allonge to have legal enforceability, any new endorser must inscribe and sign their endorsement onto the allonge.