Louisiana Promissory Note with Payments Amortized for a Certain Number of Years

Description

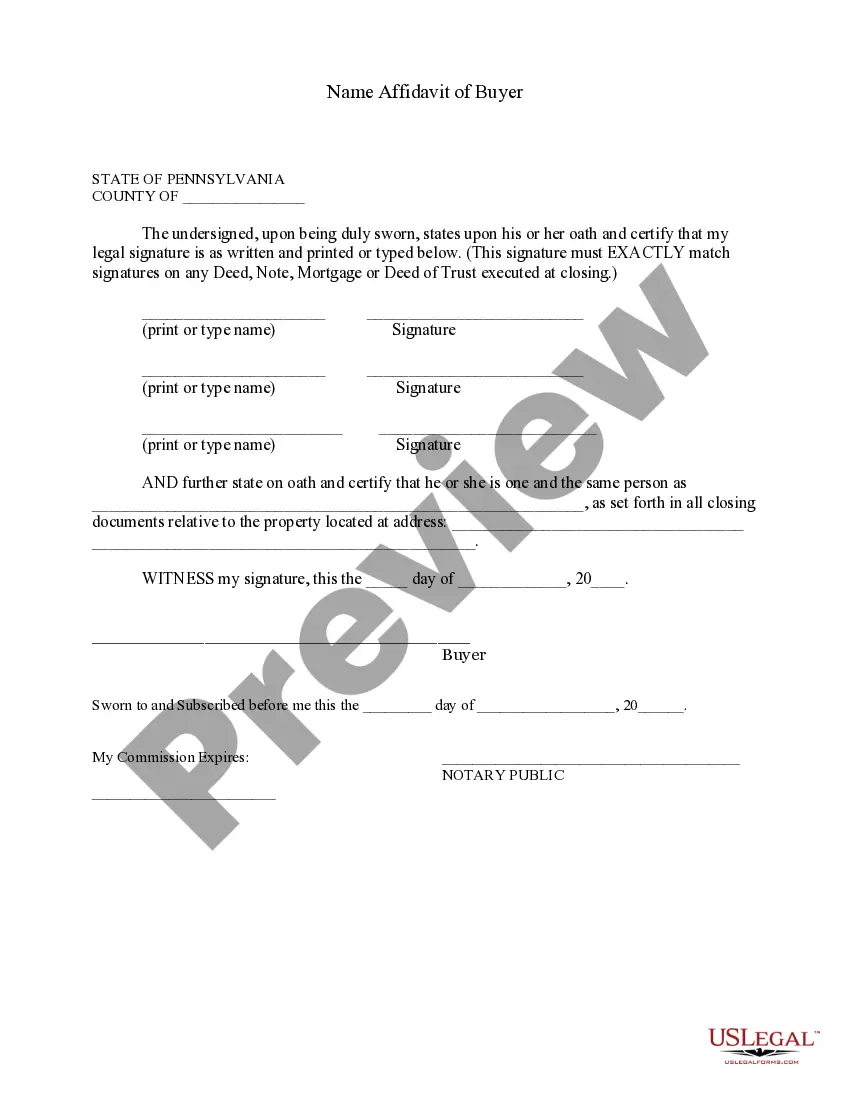

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

You might spend time online trying to locate the official document format that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by specialists.

You can easily obtain or create the Louisiana Promissory Note with Payments Amortized for a Specific Number of Years from the platform.

If you wish to find another version of the form, utilize the Search field to locate the format that suits your needs and criteria.

- If you already have a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can complete, modify, print, or sign the Louisiana Promissory Note with Payments Amortized for a Specific Number of Years.

- Every legal document you download is yours permanently.

- To retrieve another copy of any acquired form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for the county/city of your choice. Check the form description to confirm you have selected the appropriate form.

- If available, utilize the Preview button to inspect the format as well.

Form popularity

FAQ

The payment on a fully amortized installment note, such as a Louisiana Promissory Note with Payments Amortized for a Certain Number of Years, includes both principal and interest. Each monthly payment remains consistent throughout the term of the note, ensuring predictability for borrowers. This structure helps you plan your budget effectively, as you know exactly what to expect each month. Using platforms like US Legal Forms can simplify the process, allowing you to generate and manage your note with ease.

In Louisiana, a debt typically becomes uncollectible after ten years without any action taken by the lender. This applies to a Louisiana Promissory Note with Payments Amortized for a Certain Number of Years. To protect your financial interests, it is advisable to document any payments or agreements made during this period.

The validity of a Louisiana Promissory Note with Payments Amortized for a Certain Number of Years is tied to its terms and the associated statute of limitations. Typically, lenders can enforce the note for ten years after the borrower defaults. It is vital for both parties to understand this time frame to avoid misunderstandings.

A promissory note does not technically expire, but it may become unenforceable after the statute of limitations period ends. For a Louisiana Promissory Note with Payments Amortized for a Certain Number of Years, this period is often ten years. Therefore, it is wise to fulfill the terms of the note within this time frame to ensure its validity.

Yes, a Louisiana Promissory Note with Payments Amortized for a Certain Number of Years generally includes specific time limits. These limits dictate the duration before payments are due or the time until the note matures. Paying attention to these terms is crucial to ensure compliance with the payment schedule.

In Louisiana, the statute of limitations for collecting on a promissory note is typically ten years. This means that the lender has ten years from the date of default to initiate legal collection efforts. Understanding this timeframe helps both lenders and borrowers manage their financial responsibilities effectively.

A promissory note can become invalid for several reasons, such as lack of proper signatures, unclear terms, or the absence of consideration. Additionally, if the note does not comply with Louisiana state laws, it may not hold legal weight. To ensure your Louisiana Promissory Note with Payments Amortized for a Certain Number of Years is valid, consider utilizing uslegalforms for reliable templates and legal guidance.

The time period of a promissory note refers to the duration agreed upon by both parties for repayment. In the case of a Louisiana Promissory Note with Payments Amortized for a Certain Number of Years, this period is specifically defined in the document. Understanding this timeline is crucial as it sets expectations and responsibilities for both the lender and borrower.

In Louisiana, the statute of limitations for collecting on a promissory note is typically ten years. This means that a lender must enforce their rights to payment within this time frame, otherwise, the legal ability to collect may become invalid. It's essential to understand this timeframe when dealing with a Louisiana Promissory Note with Payments Amortized for a Certain Number of Years, as timely actions can ensure your rights are protected.

A Louisiana Promissory Note with Payments Amortized for a Certain Number of Years typically includes key components such as the principal amount, interest rate, payment schedule, and maturity date. It should also contain the names and addresses of the borrower and lender, as well as signatures of both parties. This format ensures clarity and legal validity, making it easier for you to understand and manage your obligations.