Louisiana Installment Promissory Note with Bank Deposit as Collateral

Description

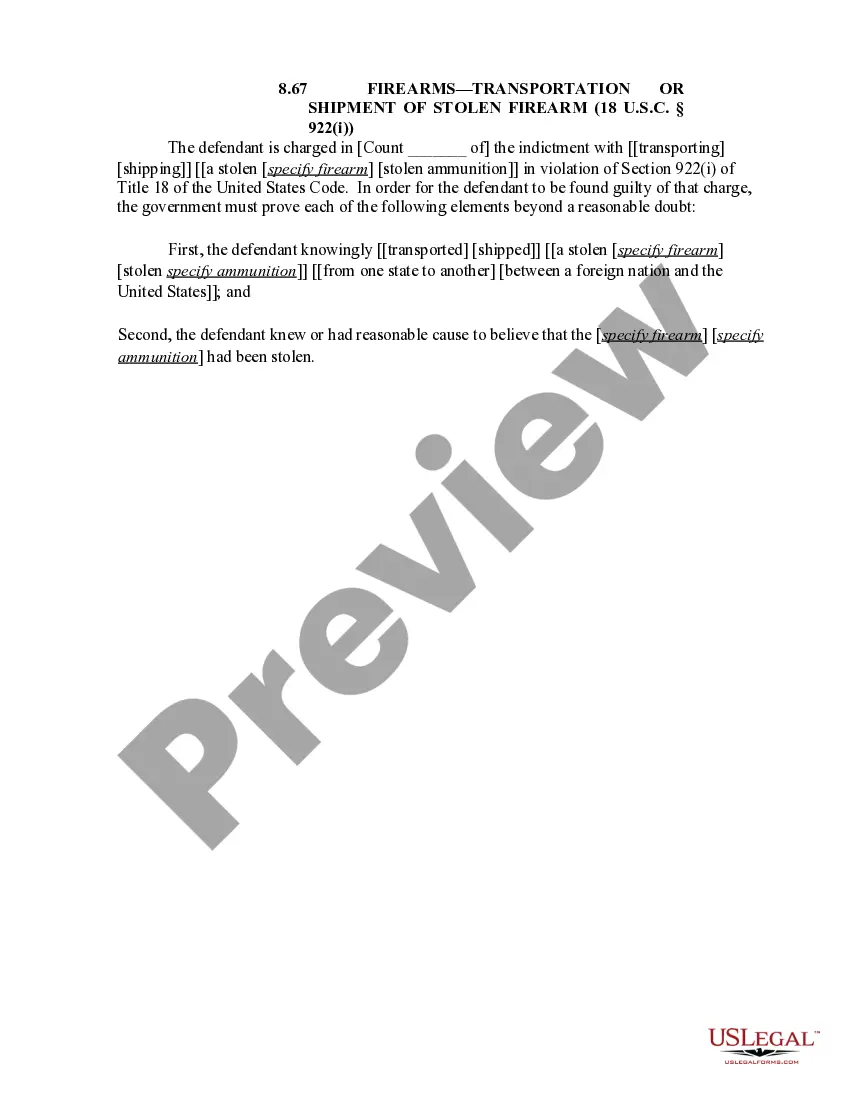

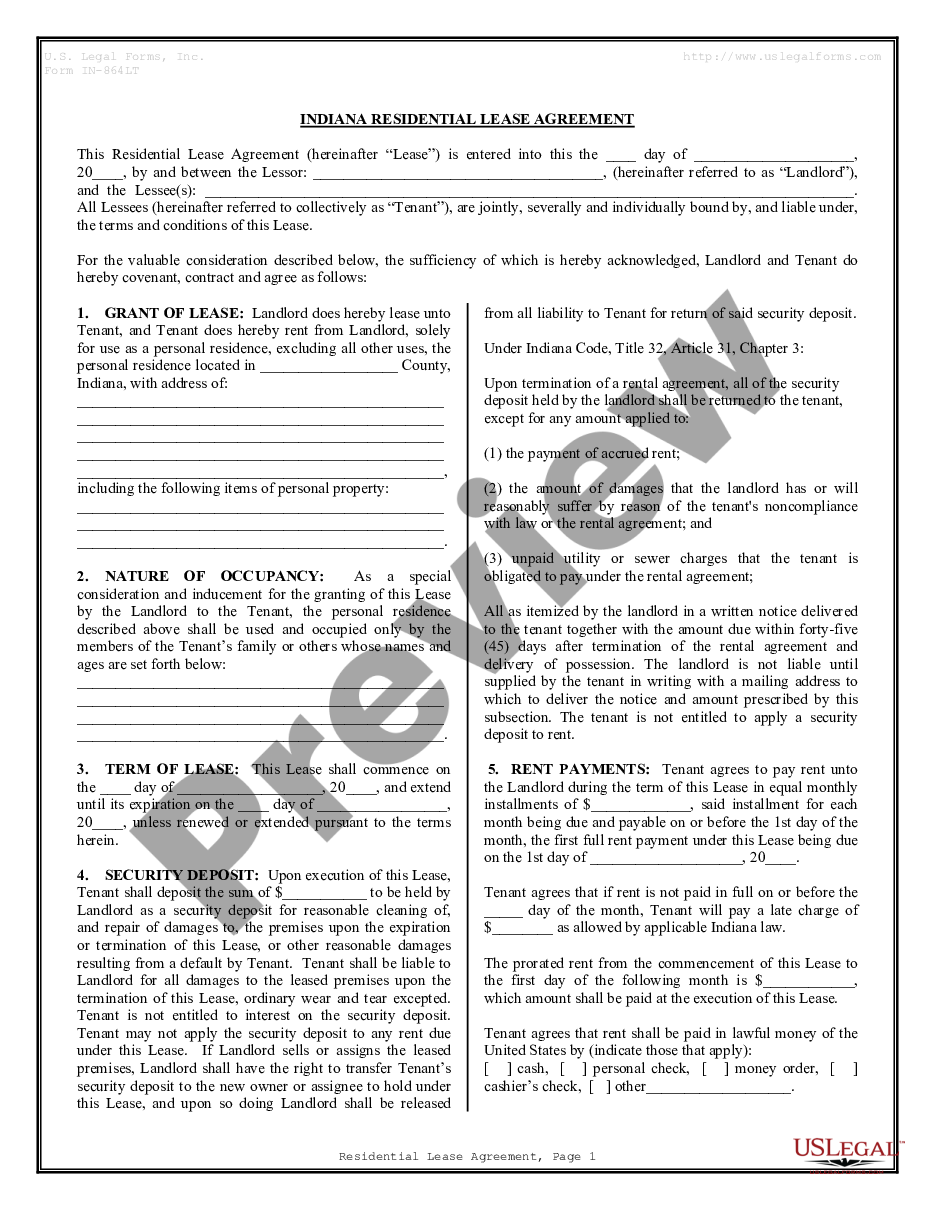

How to fill out Installment Promissory Note With Bank Deposit As Collateral?

You may spend hours online searching for the legal document template that meets the state and federal criteria you require.

US Legal Forms provides thousands of legal templates that have been evaluated by experts.

You can obtain or print the Louisiana Installment Promissory Note with Bank Deposit as Security from the service.

If you wish to find another version of the form, use the Search field to locate the template that meets your needs and specifications.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can complete, modify, print, or sign the Louisiana Installment Promissory Note with Bank Deposit as Security.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document format for the county/region of your choice.

- Review the form description to confirm you have chosen the correct template.

- If available, utilize the Preview button to view the document format as well.

Form popularity

FAQ

The conditions for a promissory note can vary based on the agreement between the parties. Generally, the note outlines repayment terms, interest rates, and consequences for default. To ensure clarity, a Louisiana Installment Promissory Note with Bank Deposit as Collateral will specify these terms explicitly. For tailored conditions, uslegalforms offers resources to help you draft a note that suits your specific needs.

In Louisiana, a promissory note must include certain essential elements to be valid. These elements typically involve the amount borrowed, the repayment terms, and the signatures of the involved parties. The Louisiana Installment Promissory Note with Bank Deposit as Collateral must specifically comply with state laws to ensure enforceability. Utilizing uslegalforms can help you create a compliant promissory note that meets these requirements.

A properly crafted promissory note can indeed hold up in court if legal disputes arise. For a Louisiana Installment Promissory Note with Bank Deposit as Collateral, the note needs to meet all legal standards to be enforceable. If the terms are clear and the document is signed by all parties, courts generally recognize its validity. Utilizing a professional platform like US Legal Forms can help you create a robust document that stands strong in legal situations.

In Louisiana, notarization is generally not a requirement for a promissory note to be considered valid. However, having a Louisiana Installment Promissory Note with Bank Deposit as Collateral notarized can strengthen its legitimacy and provide added legal protection. Notarization also provides a public record of the document and can help resolve disputes more easily. It's a prudent step, especially for significant loans.

A promissory note becomes legally binding when it contains clear terms and conditions, such as the amount borrowed, payment schedule, and the interest rate, if applicable. Both parties' signatures are vital, as they indicate consent to the terms outlined. Having a Louisiana Installment Promissory Note with Bank Deposit as Collateral filed or acknowledged by a notary can further affirm its legitimacy and enforceability. This clarity ultimately protects both lender and borrower.

Several factors can void a Louisiana Installment Promissory Note with Bank Deposit as Collateral, including fraud, duress, or lack of capacity by either party at the time of signing. If significant changes occur after signing, such as modifications to the agreement without mutual consent, this can also invalidate the note. It’s crucial to maintain clear communication and documentation to avoid these issues.

Yes, a properly drafted Louisiana Installment Promissory Note with Bank Deposit as Collateral can hold up in court. Courts recognize such documents as valid evidence of a debt and the terms agreed upon by the parties involved. However, the enforceability may depend on the note's clarity, completeness, and adherence to state laws. For added protection, consider using US Legal Forms to ensure your note complies with legal standards.

You certainly can write your own promissory note, provided it meets all necessary legal requirements. A Louisiana Installment Promissory Note with Bank Deposit as Collateral can be customized to fit your specific needs, but it's wise to make sure all key terms are clear and enforceable. Using a platform like uslegalforms can simplify this task by providing templates that ensure compliance with Louisiana laws. It's an excellent way to create a valid, effective financial document.

The document that connects the promissory note to the collateral is typically known as a collateral agreement. In the case of a Louisiana Installment Promissory Note with Bank Deposit as Collateral, this agreement specifies the terms under which the collateral backs the promissory note. This connection is crucial for ensuring that both the lender and borrower understand their rights and obligations regarding the deposit. It lays the groundwork for secure financial transactions.

Yes, a promissory note can indeed serve as a deposit, especially when structured correctly. In the context of a Louisiana Installment Promissory Note with Bank Deposit as Collateral, this arrangement can provide security for the lender. It offers the borrower a way to secure funds while still maintaining access to their bank deposit. This method can simplify transactions and build trust between both parties.