Louisiana Customer Invoice

Description

How to fill out Customer Invoice?

If you seek comprehensive, retrieve, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Use the site’s user-friendly and convenient search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to access the Louisiana Customer Invoice with just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

Step 6. Choose the format of the legal form and download it onto your device.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Louisiana Customer Invoice.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Verify that you have selected the form for your specific city/state.

- Step 2. Use the Review option to browse through the form’s content. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose your preferred pricing plan and enter your information to register for the account.

Form popularity

FAQ

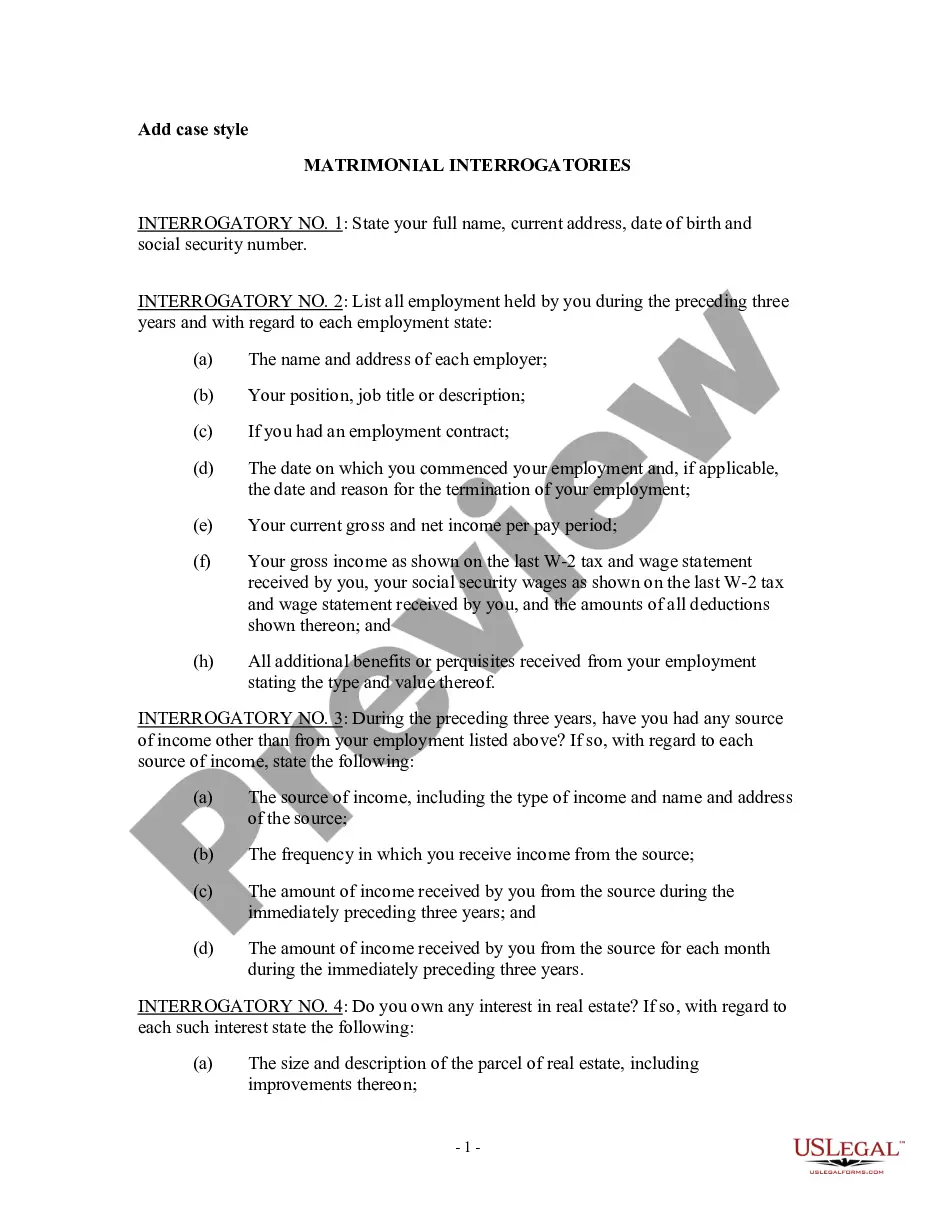

While there may not be a federal law mandating invoices for all transactions, many state laws, including those in Louisiana, require businesses to provide documentation for sales over a certain amount. Moreover, having an organized invoicing policy ensures your compliance with tax regulations. By utilizing a Louisiana Customer Invoice, your business stays aligned with the legal frameworks and standards.

In most cases, businesses do need to invoice customers to maintain clear financial records and ensure proper payment collection. Using a Louisiana Customer Invoice provides a structured way to communicate the terms of the sale and document the expectations for payment. While informal agreements may occasionally suffice, formal invoicing helps protect both the business and the customer.

A customer invoice is a document that lists the products or services provided to a customer, along with the amounts owed. This document serves as a formal request for payment and includes pertinent details like the due date and payment terms. For businesses operating in Louisiana, understanding the structure of a Louisiana Customer Invoice is vital for accurate record-keeping and financial management.

To process a Louisiana Customer Invoice, start by reviewing the invoice details for accuracy. Next, confirm that the payment terms are clear and acceptable. Finally, record the invoice in your accounting system and initiate the payment process. The US Legal Forms platform can assist you throughout these steps, ensuring that everything runs smoothly.

Recording a Louisiana Customer Invoice involves documenting the invoice details in your accounting software or ledger. This includes the invoice number, date, amount, and customer information. US Legal Forms supports this process by providing structured templates that ensure you capture all necessary information efficiently.

Managing invoicing and client billing is straightforward when using the US Legal Forms platform. Start by generating a Louisiana Customer Invoice using our templates and customize them to fit your needs. Ensure you maintain clear records of all transactions to facilitate easy follow-up and verification.

To request a Louisiana Customer Invoice, simply fill out the invoice request form available on our website. Ensure you include all necessary details such as your name, email, and service information. This process is smooth and user-friendly, especially when you utilize the US Legal Forms platform to manage your invoicing.

The typical workflow for a Louisiana Customer Invoice payment begins with you receiving the invoice, followed by reviewing it for accuracy. Once confirmed, you can proceed to make the payment via your preferred method, whether credit card, bank transfer, or other online options. The US Legal Forms solution simplifies this workflow by integrating various payment methods, making it easier for you.

You can receive a Louisiana Customer Invoice directly through email or your customer portal. Simply provide your billing information during the registration process. Furthermore, using the US Legal Forms platform streamlines this process, ensuring invoices reach you efficiently and securely.

To register to collect sales tax in Louisiana, you can complete the registration process online or by submitting a paper application through the Louisiana Department of Revenue. Once registered, you will receive a sales tax account number. With this, you can properly issue Louisiana Customer Invoices that include the correct sales tax.