Louisiana Aging of Accounts Payable

Description

How to fill out Aging Of Accounts Payable?

US Legal Forms - one of the most important collections of legal templates in the United States - offers a diverse selection of legal document templates that you can download or print.

By utilizing the site, you will obtain thousands of templates for business and personal applications, categorized by type, state, or keywords. You can find the latest versions of forms like the Louisiana Aging of Accounts Payable in just moments.

If you already hold a monthly subscription, Log In and access the Louisiana Aging of Accounts Payable from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms under the My documents section of your account.

Make adjustments. Fill out, modify, and print and sign the downloaded Louisiana Aging of Accounts Payable.

Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the form you need. Access the Louisiana Aging of Accounts Payable with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, here are simple steps to get you underway.

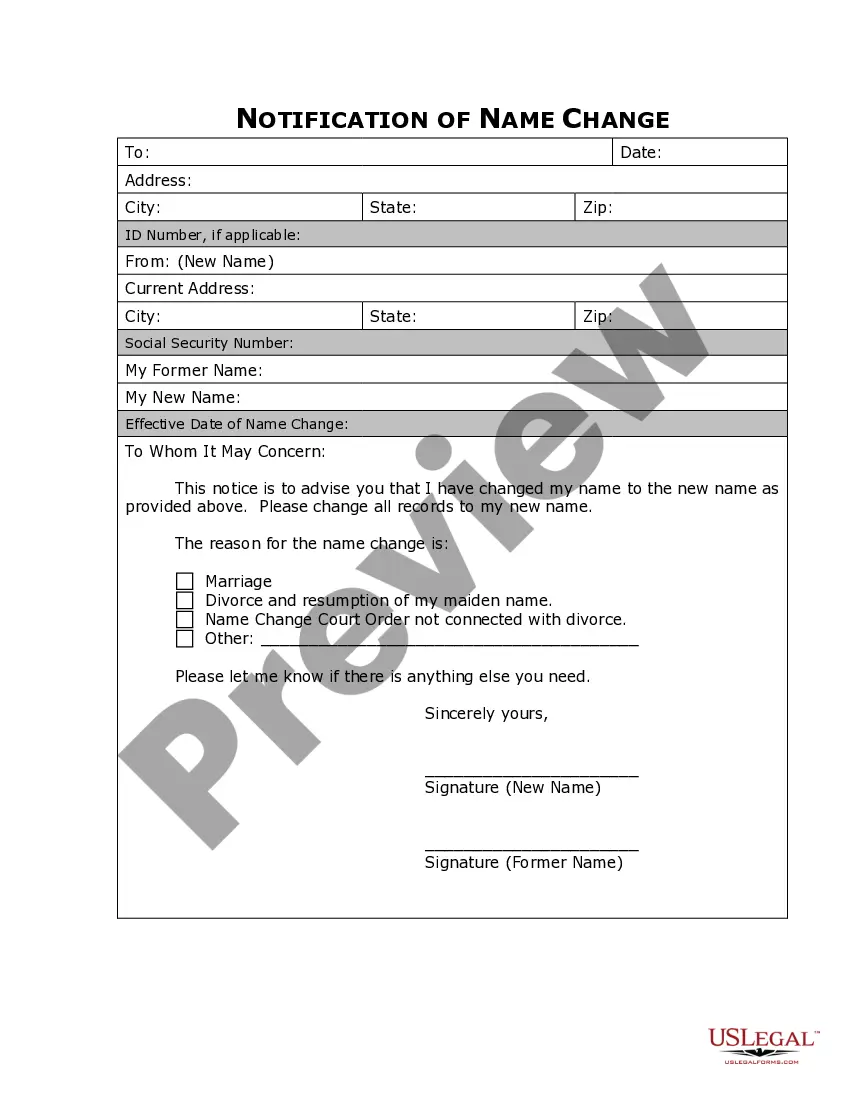

- Ensure you select the correct form for your city/state. Click on the Preview button to examine the form's details. Review the form information to confirm you have chosen the right document.

- If the form does not fulfill your needs, utilize the Search field at the top of the page to find one that does.

- Once you are satisfied with the document, finalize your choice by clicking the Buy now button. Then, select the payment plan you wish, and provide your information to create an account.

- Process the transaction. Use a credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Preparing an accounts payable aging report begins with gathering all unpaid invoices and organizing them by due date. Next, categorize these invoices into groups based on their age to identify outstanding debts effectively. Finally, summarize the information in a clear format, providing insights to guide payment strategies. For businesses in Louisiana, focusing on Aging of Accounts Payable simplifies financial management.

To calculate accounts payable (AP) aging, start by listing all outstanding invoices and their due dates. Then, categorize these invoices based on how long they have been overdue, like 0-30 days, 31-60 days, and beyond. This clear breakdown allows businesses to prioritize payments and improve vendor relationships. Utilizing effective tools can help streamline the process, especially when addressing Louisiana Aging of Accounts Payable.

Calculating the aging of an account involves reviewing the account's outstanding invoices and determining how long each invoice has been overdue. Group these based on the payment terms to assess their age. This analysis helps inform your financial strategy and payment priorities. For Louisiana businesses, tools that simplify this calculation can enhance efficiency and accuracy.

To calculate accounts payable aging, start by identifying all unpaid invoices and their respective due dates. Categorize these according to the time they have been overdue. This method provides clarity on which liabilities require immediate attention. Many businesses in Louisiana find beneficial tools, like those from US Legal Forms, to aid in this calculation process.

An aging schedule for accounts payable outlines unpaid bills and sorts them based on how long they have been due. This schedule typically includes categories like current, 30 days past due, 60 days past due, and so on. It helps businesses maintain clear visibility on what they owe and when payments are due. Utilizing tools available on platforms such as US Legal Forms can enhance your scheduling process in Louisiana.

Creating an aging report begins with compiling all outstanding invoices. Use your accounting system to generate a report that categorizes payables into time brackets, such as 0-30 days, 31-60 days, and over 60 days. This report provides a clear view of your company’s financial obligations. Utilizing platforms like US Legal Forms can streamline this process, offering templates and resources for accurate reporting in Louisiana.

To age accounts payable, begin by listing all unpaid invoices in your accounting software. Next, organize them by their due dates to show how long they've been outstanding. This method allows you to see which payments are overdue and which are upcoming. Many companies in Louisiana use accounting tools that help automate this process, making it simpler to maintain financial control.

Seniors in Louisiana may benefit from several tax breaks, including a state retirement income exclusion and homestead exemption. These provisions aim to reduce the financial burden on older residents. Understanding these tax breaks is crucial for efficient management of your Louisiana Aging of Accounts Payable.

Filing an amended Louisiana tax return requires using Form R-540X, which corrects errors made on your original return. It's important to provide comprehensive details regarding the changes and ensure that you file within the required timeframe. This process can help you accurately adjust your finances associated with Louisiana Aging of Accounts Payable.

In Louisiana, income exempt from state taxes includes Social Security benefits, certain retirement income, and disability payments. These exemptions help alleviate some financial pressure for many residents. Knowing the specifics of these exemptions is essential to effectively manage your Louisiana Aging of Accounts Payable.