Louisiana Inventory Report

Description

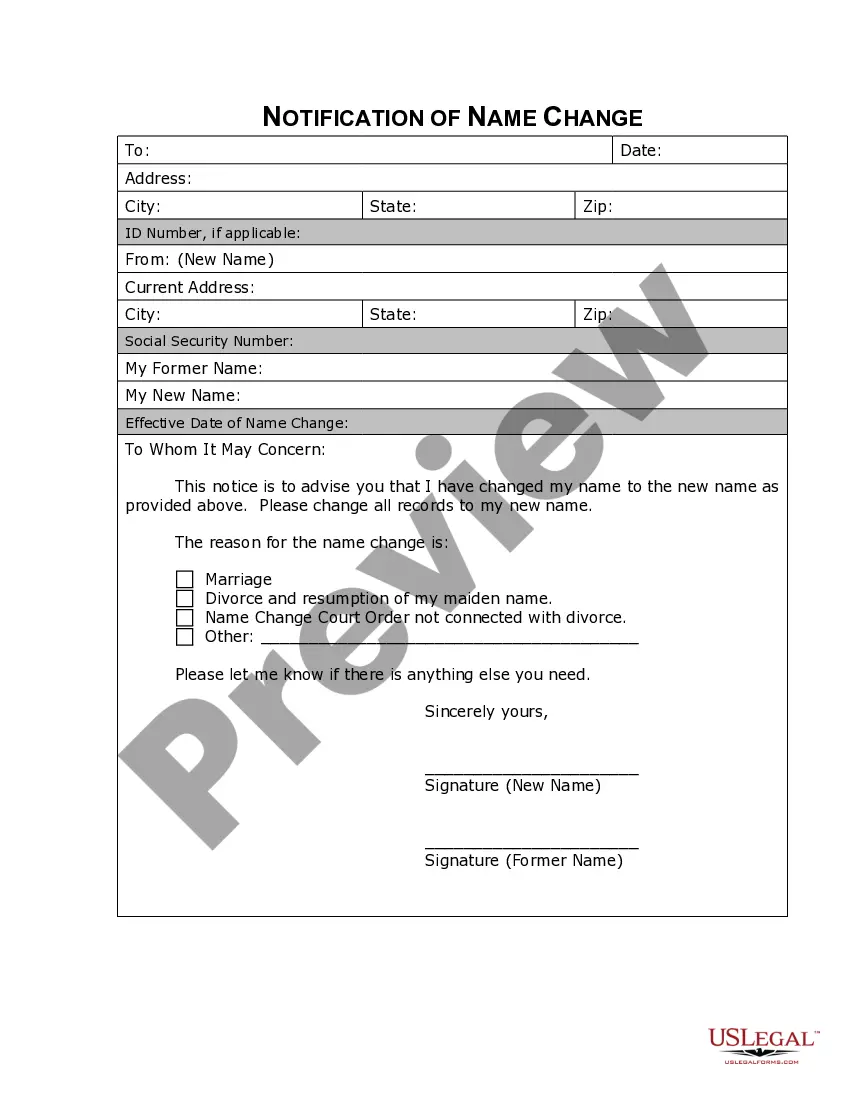

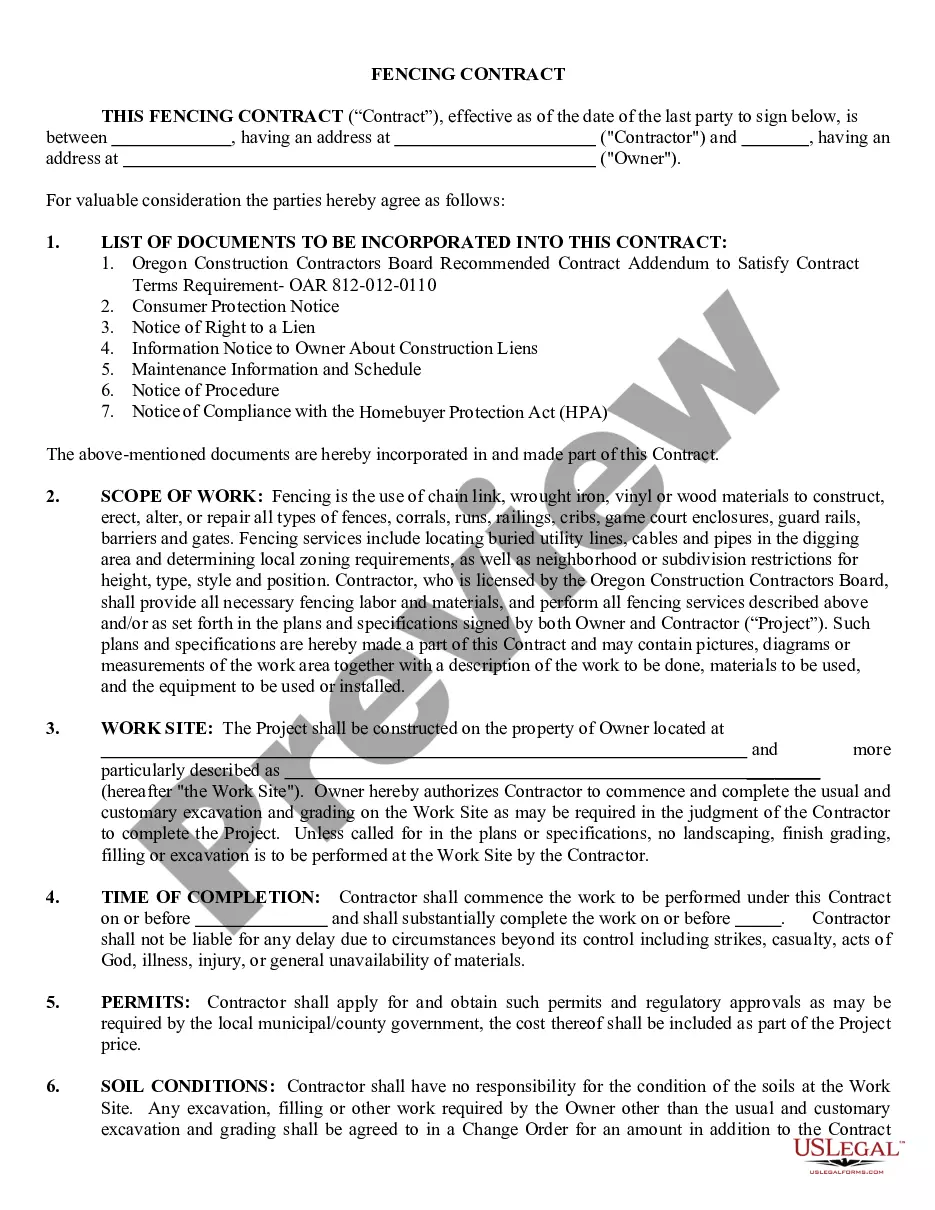

How to fill out Inventory Report?

Are you currently in a condition where you require documents for either business or personal purposes almost all the time.

There are numerous legal document templates available online, but locating trustworthy ones isn’t simple.

US Legal Forms provides a vast array of form templates, such as the Louisiana Inventory Report, that are designed to meet federal and state regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and pay for the transaction using your PayPal or Visa/MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, just sign in.

- Then, you can download the Louisiana Inventory Report template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it corresponds to your specific city/region.

- Utilize the Preview button to review the form.

- Check the information to confirm that you have chosen the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that satisfies your needs and specifications.

Form popularity

FAQ

The Louisiana inventory credit is a specific tax credit aimed at alleviating the financial burden on businesses holding unsold inventory. This credit reduces the amount of state taxes owed based on the value of your inventory. Properly documenting your inventory in your Louisiana Inventory Report can help you take advantage of this credit, ensuring your business benefits from available tax savings.

The credit for inventory refers to the tax benefits associated with maintaining significant inventory levels. In Louisiana, businesses may receive credits that reduce their overall tax burden based on their inventory management practices. Ensure that your Louisiana Inventory Report accurately reflects your inventory value to maximize these potential credits.

Obtaining an inventory report involves documenting all goods and materials a business holds. You can create this report through systematic tracking of your assets, often supported by inventory management software. Utilizing our platform, USLegalForms, can simplify this process and help you generate an accurate Louisiana Inventory Report.

The inventory tax aims to generate revenue for local government entities in Louisiana by taxing business inventory. This tax ensures that businesses contribute to community services and infrastructure. When filing your Louisiana Inventory Report, be sure to accurately account for all inventory to determine your tax obligations correctly.

The $1,200 energy tax credit is a financial incentive for homeowners to invest in energy-efficient upgrades to their properties. This credit reduces your tax liability, making it more affordable to improve your home's energy efficiency. When preparing your Louisiana Inventory Report, consider any eligible improvements that may qualify you for this beneficial credit.

Filling out an estate inventory requires a thorough assessment of all assets owned by the deceased. Start with real property, then list personal property, financial accounts, and debts. Document each item with detailed descriptions and appraised values for accuracy. A Louisiana Inventory Report can provide a structured format to follow, ensuring all necessary information is included.

In Louisiana, inventory itself is not subject to tax, but there may be taxes associated with other estate assets. The state does not impose a separate inventory tax, allowing estates to focus on asset distribution. However, it is essential to consult a tax professional for specific guidance regarding estate taxes in Louisiana. Completing a Louisiana Inventory Report can help in understanding your estate’s overall tax obligations.

Filling out inventory for a decedent's estate involves documenting all assets and liabilities. Begin by gathering all financial records and property details, then create the inventory in a structured format. Be sure to categorize items for clarity, listing everything from real estate to personal items. Utilizing a Louisiana Inventory Report template can streamline this process.

To fill out an inventory sheet, start by listing all assets owned by the decedent as of the date of death. Include real estate, bank accounts, personal belongings, and any other valuable items. Ensure that you provide accurate descriptions and assign fair market values to each item. A well-prepared Louisiana Inventory Report can simplify the estate settlement process.

You can obtain Louisiana state tax forms online from the Louisiana Department of Revenue's official website or by visiting local government offices. For a more comprehensive solution, you might want to explore US Legal Forms. This platform offers a variety of Louisiana tax forms, including the Louisiana Inventory Report, making it easy to fulfill your filing requirements.