Louisiana Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

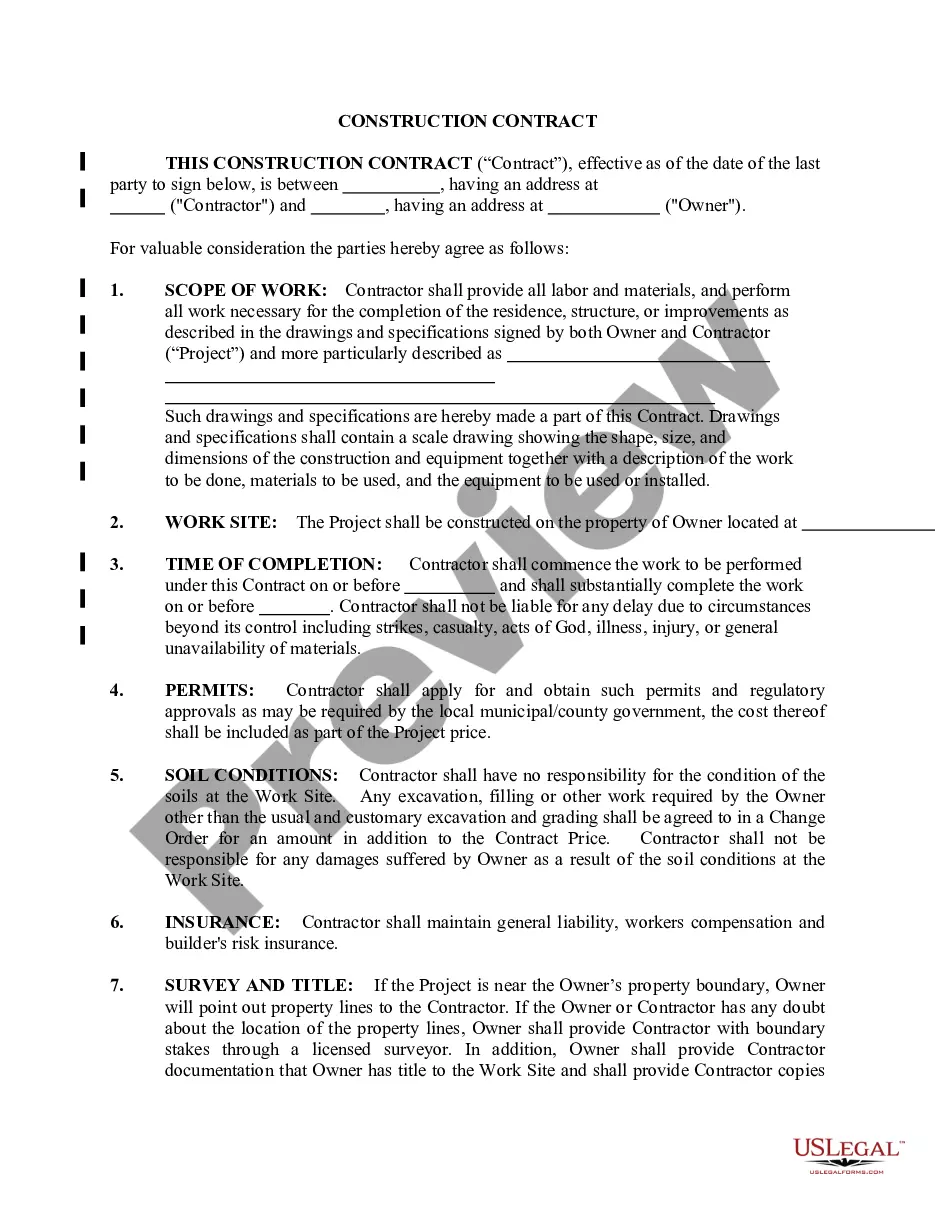

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

You might allocate time online looking for the sanctioned document template that meets the local and national requirements you will need.

US Legal Forms offers countless official forms that have been evaluated by specialists.

You can conveniently download or print the Louisiana Notice of Default under Security Agreement in Purchase of Mobile Home from our service.

To find another variation of the form, use the Search field to locate the template that satisfies your needs and requirements.

- If you currently possess a US Legal Forms account, you can sign in and select the Obtain option.

- After that, you can complete, modify, print, or sign the Louisiana Notice of Default under Security Agreement in Purchase of Mobile Home.

- Every official document template you obtain is yours indefinitely.

- To get another copy of the purchased form, navigate to the My documents tab and click the relevant option.

- If you are accessing the US Legal Forms site for the first time, follow the basic instructions below.

- First, ensure you have selected the correct document template for the state/region of your choice.

- Review the form details to confirm you have chosen the right template.

Form popularity

FAQ

Mortgage. A security agreement provides a legal title transfer from the borrower to the lender in while leaving equitable rights of the property with the debtor. The lender then provides the loan.

A security interest in a manufactured home that is or becomes a fixture (defined in UCC § 9-102 as goods that have become so related to particular real property that an interest in them arises under real property law) is perfected by one of three methods: making a fixture filing, noting the secured party's lien on

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

A security agreement refers to a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Terms and conditions are determined at the time the security agreement is drafted.

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.