Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement

Description

How to fill out Resolutions Of Shareholders And Directors Approving Liquidating Trust Agreement?

You have the capacity to dedicate numerous hours online searching for the appropriate legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

You can effortlessly download or print the Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement from the platform.

If available, utilize the Review button to browse through the document template as well. If you wish to find another version of the document, use the Lookup field to locate the template that meets your requirements and needs. Once you have found the template you desire, click on Buy now to proceed. Select your preferred payment plan, enter your details, and register for an account on US Legal Forms. Complete the transaction using either your credit card or PayPal account to purchase the legal document. Choose the format of the document and download it to your device. Make modifications to your document as needed. You can fill out, edit, sign, and print the Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. Obtain and print thousands of document layouts using the US Legal Forms website, which provides the largest collection of legal documents. Utilize professional and state-specific layouts to address your business or personal requirements.

- If you already possess a US Legal Forms account, you may sign in and click on the Acquire button.

- Then, you can fill out, modify, print, or sign the Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

- Every legal document template you obtain is yours permanently.

- To obtain an additional copy of any purchased document, navigate to the My documents section and click on the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document template for your county/city of choice.

- Review the document summary to confirm you've selected the right template.

Form popularity

FAQ

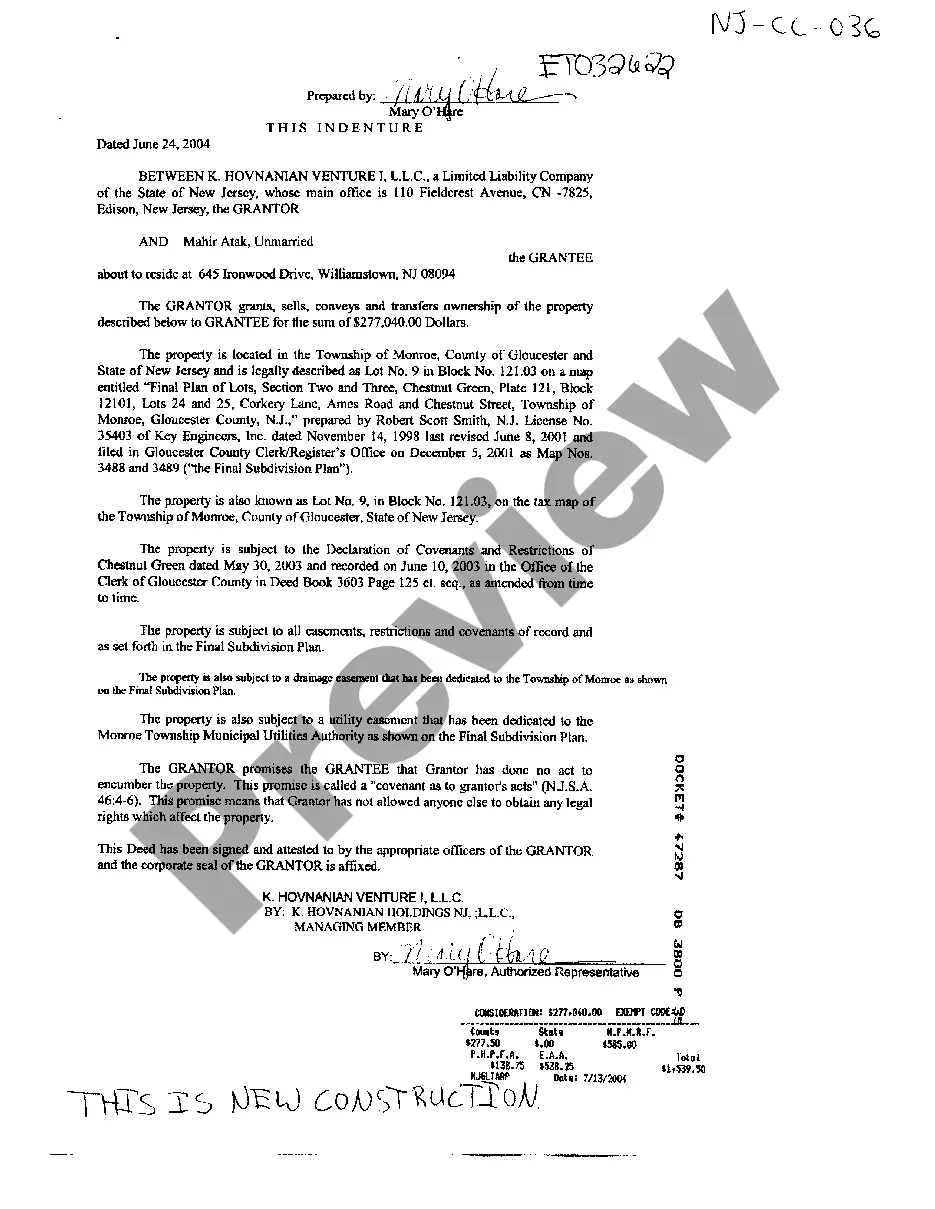

To place your house in a trust in Louisiana, you will need to execute a deed transferring ownership from yourself to the trust. This involves completing the necessary paperwork and adhering to state regulations. Once in the trust, your property is better protected and managed according to your wishes. The Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement can guide you in structuring this effectively.

Absolutely, a trust can hold personal property in Louisiana. This includes items like vehicles, jewelry, and bank accounts. By transferring personal property to a trust, you can manage and distribute these assets more effectively. Understanding the Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement can aid in this process.

Yes, a trust can own property in Louisiana. When structured correctly, this allows the trust to hold real estate and other assets. This can provide benefits such as asset protection and estate planning. To ensure compliance with legal requirements, consider the Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

A shareholder resolution serves as a tool for shareholders to voice their opinions and make formal decisions regarding the company's direction. It can cover various subjects, including liquidating a company or making strategic changes. By utilizing Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, shareholders can ensure that their resolutions are compliant, clear, and impactful.

The purpose of a shareholder resolution is to document significant decisions made by shareholders collectively, such as approving a liquidation plan. This resolution provides clarity and accountability for the actions taken in the best interest of the company and its stakeholders. In Louisiana, creating Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement ensures that decisions follow legal protocols and protect shareholder interests.

A resolution to liquidate a company is a formal document that indicates the approval of shareholders to terminate the company's operations and distribute its assets among stakeholders. This type of resolution is essential for initiating the legal steps involved in liquidation. Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement help ensure that all legal requirements are met throughout this process.

A shareholder resolution to liquidate outlines the decision by shareholders to dissolve a company and sell its assets. This process often leads to the creation of a liquidating trust agreement, specifically designed to manage the assets during the liquidation. In Louisiana, Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement play a crucial role in formalizing this decision and guiding the liquidation process.

To liquidate a trust, first identify the trust assets and determine their value. The trustee then sells the assets in accordance with the terms outlined in the Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. After selling, the proceeds are distributed to beneficiaries as specified. Using a reliable platform like uslegalforms can simplify this process and provide the necessary forms and guidance for effective trust liquidation.

Yes, a liquidating trust requires an Employer Identification Number (EIN) for tax purposes, similar to a corporation. When establishing a liquidating trust, obtaining an EIN is vital for filing tax returns and reporting income. The process is straightforward and is typically initiated once the Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement is executed. This ensures the trust complies with federal regulations and avoids potential tax issues.

In Louisiana, trusts, including liquidating trusts, are typically recorded at the local parish's Clerk of Court office. This involves filing the Louisiana Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement for public record. While specific trust documents are not always filed, various legal obligations related to taxation and property transfers may require documentation to be recorded. This practice safeguards the trust's interests and protects beneficiaries.