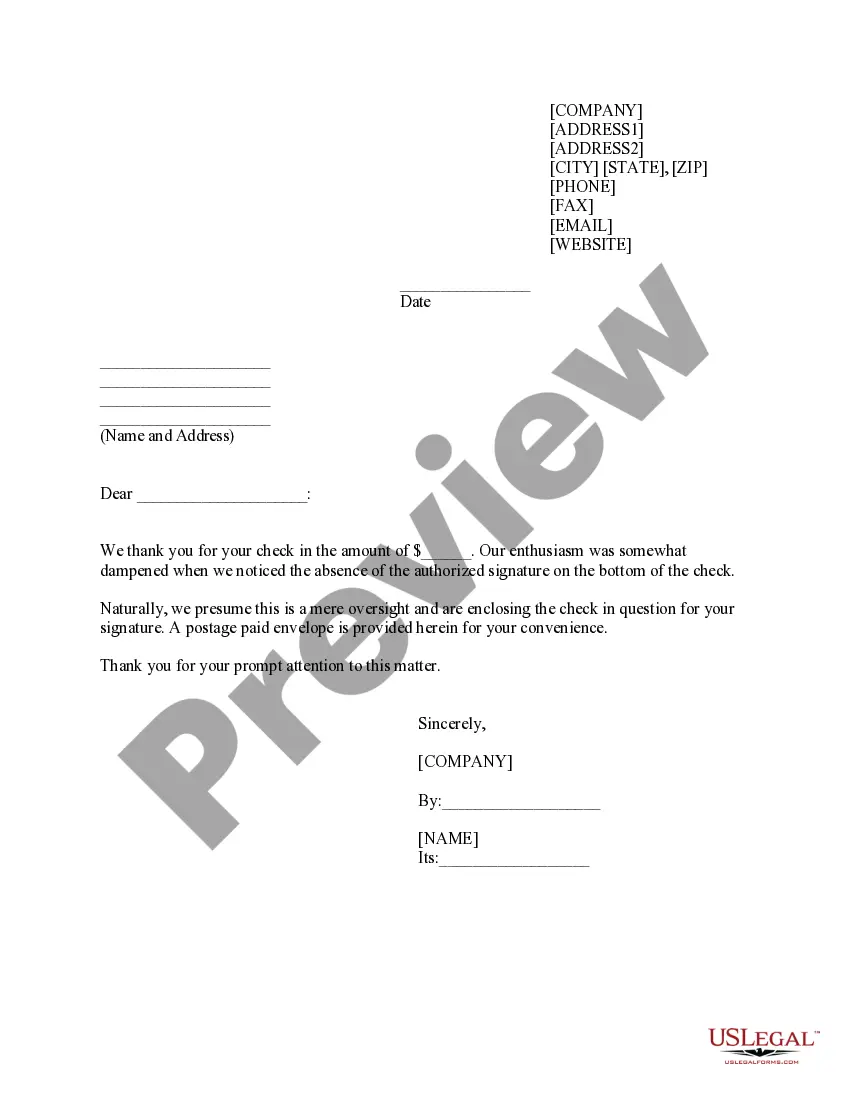

Louisiana Sample Letter for Return of Check Missing Signature

Description

How to fill out Sample Letter For Return Of Check Missing Signature?

Selecting the appropriate legal document format can be a challenge. Of course, there are numerous templates available online, but how do you acquire the legal document you need.

Visit the US Legal Forms website. The platform offers an extensive array of templates, such as the Louisiana Sample Letter for Return of Check Missing Signature, suitable for both business and personal purposes.

All templates are verified by experts and comply with state and federal standards.

Once you are sure that the form is accurate, click the Get now button to obtain the document. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document format to your device. Finally, edit, print, and sign the received Louisiana Sample Letter for Return of Check Missing Signature. US Legal Forms is the largest collection of legal documents where you can find various record templates. Utilize the service to download professionally crafted documents that comply with state requirements.

- If you are currently registered, sign in to your account and click the Get button to obtain the Louisiana Sample Letter for Return of Check Missing Signature.

- Utilize your account to search for the legal documents you have previously ordered.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct document for your city/state. You can preview the form using the Preview button and read the form description to confirm it is the correct one for you.

- If the document does not satisfy your needs, utilize the Search field to find the appropriate form.

Form popularity

FAQ

Notify your customer that the check he or she used for payment has been returned. Specifically mention the check number and amount. Request immediate payment. Be specific about the type of payment you now require, such as a cashier's check or a money order.

What should I do if I have a check returned?Make a deposit to cover the payment and any bank fees. Merchants may submit bounced checks for payment more than once.Communicate with the payee. Hopefully, you can tell the payee you've made a deposit to cover the returned check and any associated fees.Address bank fees.

RE: Notice of Dishonored Check Dear Name of Bounced-Check Writer: I am writing to inform you that check #Check Number dated Date on Bounced Check, in the amount of $Amount of Bounced Check made payable to Your Name/Payee's Name has been returned to me due to insufficient funds, a closed account, etc..

I am writing to inform you that check #Check Number dated Date on Bounced Check, in the amount of $Amount of Bounced Check made payable to Your Name/Payee's Name has been returned to me due to insufficient funds, a closed account, etc..

Your completed letter should include the following information:The name and address of the customer who wrote the returned check.The check number of the returned check.The amount of the returned check.The amount of the returned check fee.More items...?

Dear (Client name), I am writing this letter to inform you that the cheque which you allotted to (Company name) on behalf of (Concern Authority name) published on (Date: DD/MM/YY) got bounced due to some error of writing in it. (Describe in your own words). It was issued on the total amount of (Money Amount) only.

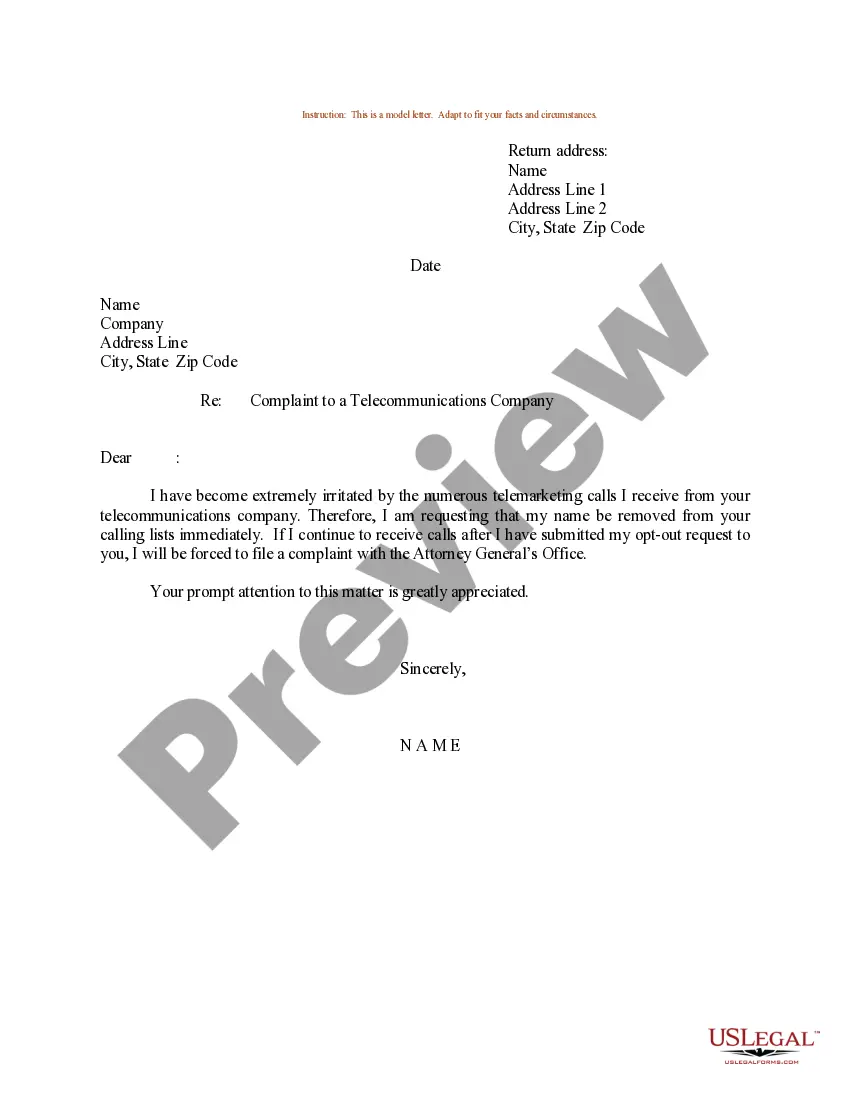

Include a letter in your postal mail or a note in your email recapping the date of purchase, when you were notified of the bounced check and the extra fees charged to your account. Respectfully request payment by a reasonable date. Do not exhibit anger or threats to your customer.

What happens if you deposit a bad check? If you deposit a check that never clears because it was fraudulent or bounces, then the funds will be removed from your account. If you spent the funds, you will be responsible for repaying them. Some banks may charge an additional fee for depositing a bad check.

Include a letter in your postal mail or a note in your email recapping the date of purchase, when you were notified of the bounced check and the extra fees charged to your account. Respectfully request payment by a reasonable date. Do not exhibit anger or threats to your customer.