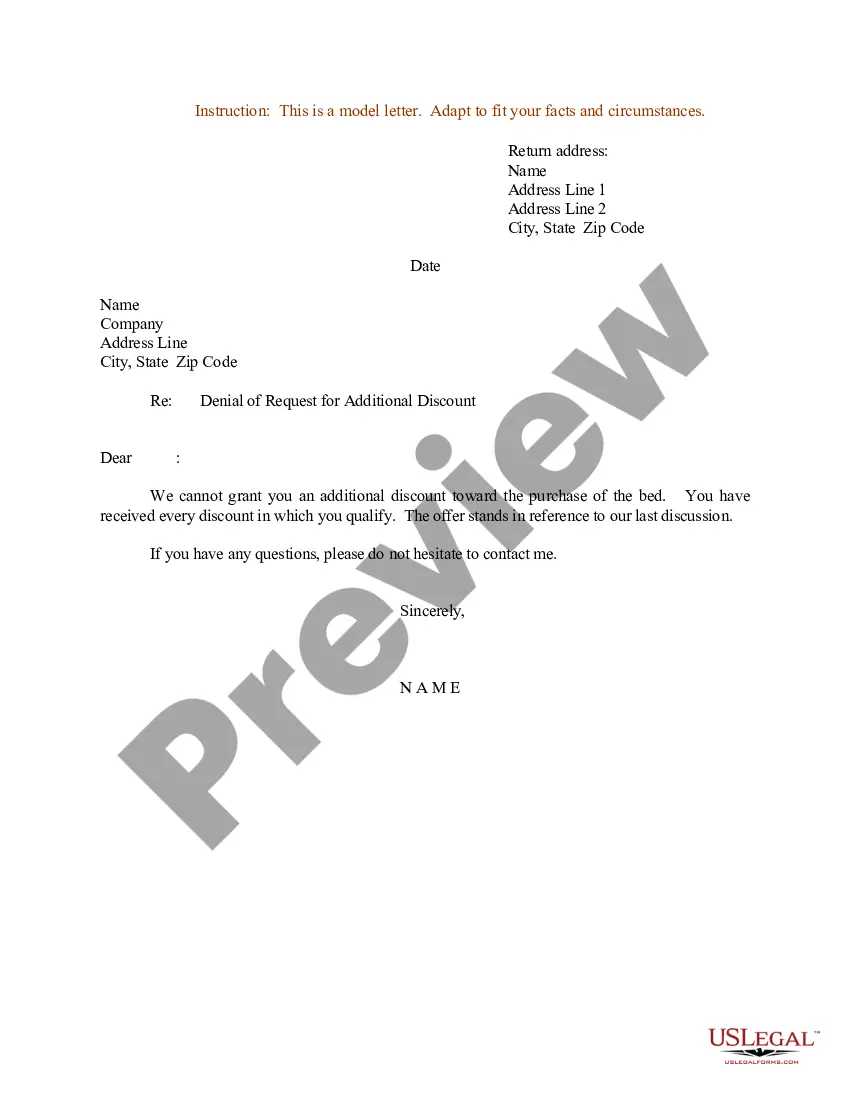

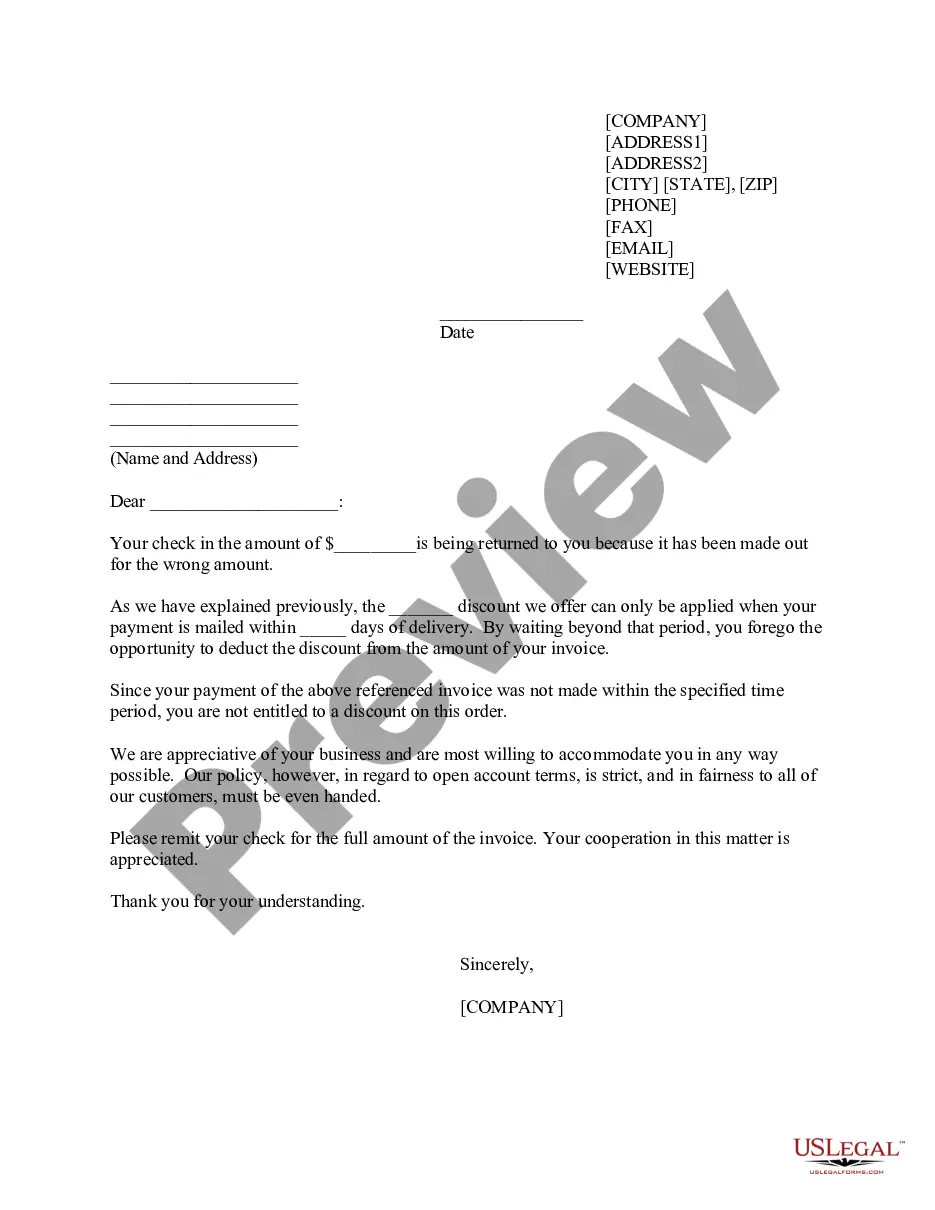

Louisiana Sample Letter for Return of Late Payment and Denial of Discount

Description

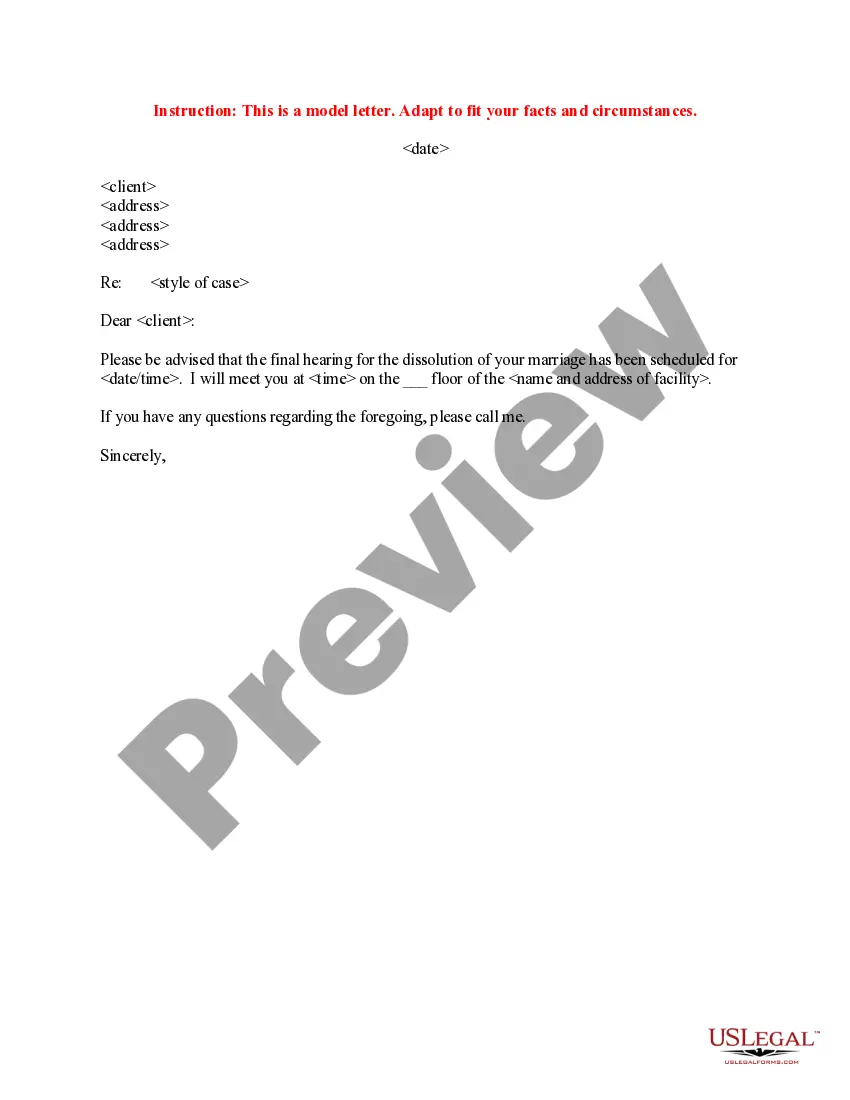

How to fill out Sample Letter For Return Of Late Payment And Denial Of Discount?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse range of legal paperwork themes you can download or generate.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms like the Louisiana Sample Letter for Return of Late Payment and Denial of Discount within moments.

If you already possess a monthly membership, Log In to download the Louisiana Sample Letter for Return of Late Payment and Denial of Discount from the US Legal Forms library. The Acquire button will appear on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Louisiana Sample Letter for Return of Late Payment and Denial of Discount. Every template you save to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you require. Access the Louisiana Sample Letter for Return of Late Payment and Denial of Discount with US Legal Forms, the most extensive library of legal document themes. Utilize numerous professional and state-specific templates that meet your business or personal needs.

- If you're looking to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your area/region.

- Click the Review button to examine the form's content.

- Check the form description to verify you have picked the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Next, select your pricing plan and provide your details to register for an account.

Form popularity

FAQ

You can be audited for up to six years by the IRS if the income you report on your return is more than 25% less than what you actually took in. State tax rules can vary by state. Most IRS audits must occur within three years, but six states give themselves four years.

Under California Revenue and Taxation Code Section 19255, the statute of limitations to collect unpaid state tax debts is 20 years from the assessment date, but there are situations that may extend the period or allow debts to remain due and payable. The stakes are particularly high in criminal tax prosecution cases.

Interest ReliefWe'll automatically reduce or remove the related interest if any of your penalties are reduced or removed. For more information about the interest we charge on penalties, see Interest on Underpayments and Overpayments.

IRS Penalty Abatement Request LetterState the type of penalty you want removed.Include an explanation of the events and specific facts and circumstances of your situation, and explain how these events were outside of your control.Attach documents that will prove your case.

After the IRS has assessed a penalty, the taxpayer can request penalty abatement, typically by writing a penalty abatement letter or by calling the IRS. Tax professionals can also request abatement using IRS e-services.

If you owe back state taxes, Louisiana has three years to come after you under the statute of limitations for tax debt. The three-year period begins to run either from the date you file your state tax return or three years from the date the return was due, whichever is later.

When a state department of revenue sends you a letter, it usually is to start a dialogue about proposed changes to your state return. You won't owe any tax to the state until you agree with the proposed changes.

You can file an appeal if all the following have occurred:You received a letter that the IRS assessed a failure to file and/or failure to pay penalty to your individual or business tax account.You sent a written request to the IRS asking them to remove the penalty.More items...?

IRS Letter to Request First-Time Penalty Abatement. To Whom It May Concern: We respectfully request that the failure-to-file/failure-to-pay/failure-to-deposit penalty be abated based on the IRS's First Time Abate administrative waiver procedures, as discussed in IRM 20.1.

Individual income tax liabilities may be paid electronically by an electronic bank account debit using the Louisiana File Online application or by credit card using Official Payments. Credit card payments may also be initiated by telephone at 1-888-272-9829. Credit card payments incur a 2.49 percent convenience fee.