Louisiana Assignment of Partnership Interest

Description

How to fill out Assignment Of Partnership Interest?

You can allocate time on the internet attempting to locate the valid document format that meets the federal and state requirements you desire.

US Legal Forms provides thousands of valid templates that are reviewed by experts.

It is easy to acquire or print the Louisiana Assignment of Partnership Interest from our platform.

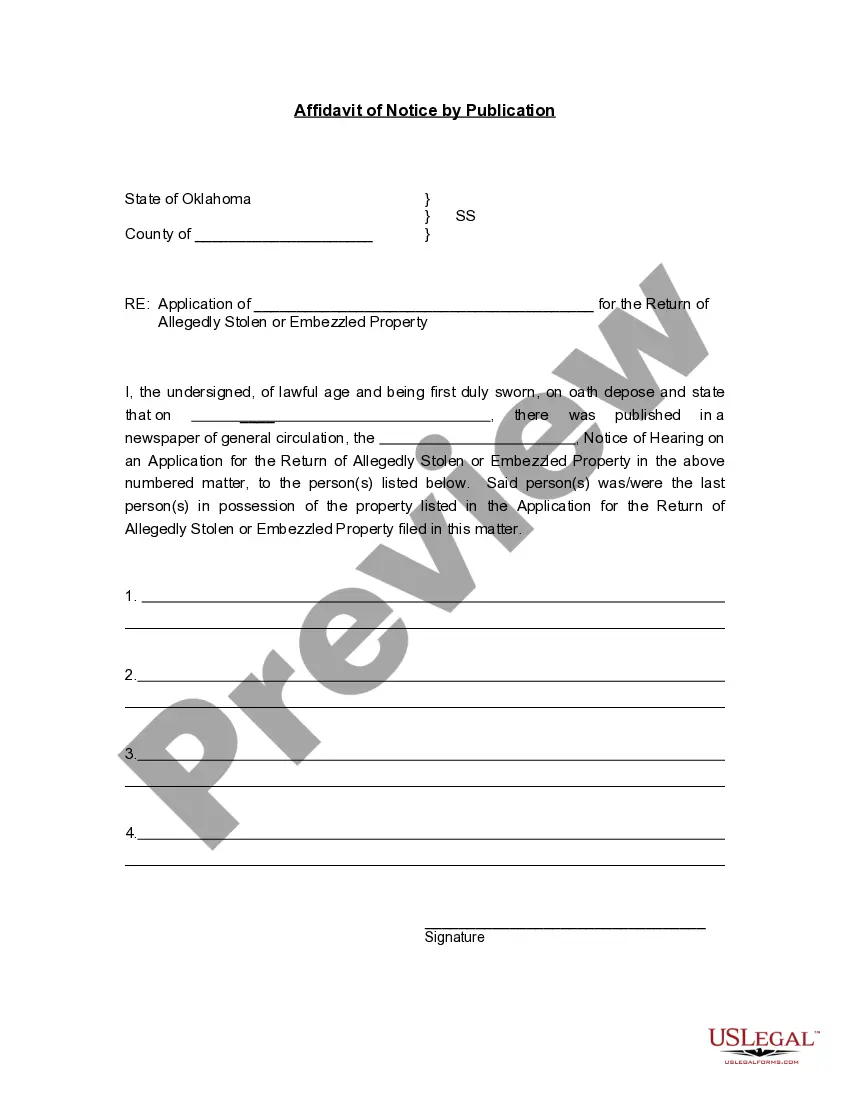

If available, utilize the Review button to view the document format at once.

- If you already possess a US Legal Forms account, you may Log In and then hit the Obtain button.

- Subsequently, you may complete, edit, print, or sign the Louisiana Assignment of Partnership Interest.

- Every valid document format you purchase is yours permanently.

- To secure another copy of the acquired form, go to the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document format for the county/city that you choose.

- Review the form information to confirm you have selected the appropriate form.

Form popularity

FAQ

Yes, Louisiana requires partnerships to file an informational tax return, known as Form IT-565. This return provides details about the partnership's income, deductions, and credits but is generally not subject to state income tax at the partnership level. Each partner reports their share of income on their personal tax returns. Properly managing your tax obligations can be easier with tools like the Louisiana Assignment of Partnership Interest, which helps clarify ownership changes and financial reporting.

Certain types of income in Louisiana may be exempt from state income tax, including social security benefits and certain pensions. Additionally, some interest earned from municipal bonds is generally not taxable. Always consider your personal financial situation and consult a tax advisor to know what qualifies as exempt income. This knowledge can be vital when evaluating your partnership's financial strategies under the Louisiana Assignment of Partnership Interest.

In Louisiana, any individual, partnership, corporation, or other entity that receives income is typically required to file a tax return. This includes partnerships, which may need to file information returns, even if they do not owe any tax. It’s crucial to consult with a tax professional to understand your specific obligations. Understanding how the Louisiana Assignment of Partnership Interest affects your income may also help clarify your tax responsibilities.

To form a partnership in Louisiana, you need to choose a unique name for your business and file a registration with the Louisiana Secretary of State. It is essential to draft a partnership agreement that outlines roles, responsibilities, and profit-sharing. Additionally, you should obtain any necessary licenses or permits based on your business activities. The Louisiana Assignment of Partnership Interest can help facilitate the transfer of ownership if needed in the future.

An assignment of membership interest involves transferring a member's rights in an LLC to another individual or entity. This process typically includes legal documentation and may require approval from other members. It ensures that the new member can participate in the benefits and responsibilities of the LLC. This action is integral in managing ownership in businesses operating under Louisiana regulations.

Yes, a transfer of partnership interest can trigger tax obligations for the transferring partner. The tax implications depend on various factors, including the nature of the interest transferred and prevailing tax laws. Engaging with a tax professional familiar with Louisiana Assignment of Partnership Interest can ensure that you understand these potential tax liabilities and plan accordingly.

Assignment of interest refers to the process of transferring ownership rights from one individual to another in a legal entity. This transfer can apply to partnerships, LLCs, or other business structures. In Louisiana, this concept is vital for partners looking to change their investment or exit the partnership. Understanding the implications of this assignment is crucial for all parties involved.

An assignment of a member's interest pertains to Limited Liability Companies (LLCs) where a member transfers their stake in the company to another party. This transfer grants the assignee the right to receive distributions and vote on certain matters. It's a critical element in managing member relationships and holdings, especially for LLCs that operate within Louisiana. Properly documenting this assignment is essential to ensure compliance in a Louisiana Assignment of Partnership Interest.

Yes, the sale of partnership interest is reported on Schedule K-1, which the partnership issues to each partner. It reflects the gain or loss realized on the sale, affecting the individual partner's tax obligations. Understanding how to navigate this process is key for anyone involved in a Louisiana Assignment of Partnership Interest, ensuring you report accurately to the IRS.

To transfer ownership interest in a partnership, follow the agreement terms outlined in your partnership agreement. This usually involves completing an assignment form and obtaining consent from other partners. Proper documentation is necessary to ensure that the transfer complies with the regulations governing the Louisiana Assignment of Partnership Interest. Consider legal consultation if unsure about the requirements.