Louisiana Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

Are you in a situation where you occasionally require documents for either business or personal use almost every day.

There are numerous legal document templates available online, but locating those you can rely on can be challenging.

US Legal Forms provides thousands of template forms, such as the Louisiana Minimum Checking Account Balance - Corporate Resolutions Form, which are designed to comply with state and federal regulations.

Once you find the correct form, simply click Get now.

Choose the pricing plan you prefer, complete the required information to create your account, and process the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Louisiana Minimum Checking Account Balance - Corporate Resolutions Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/region.

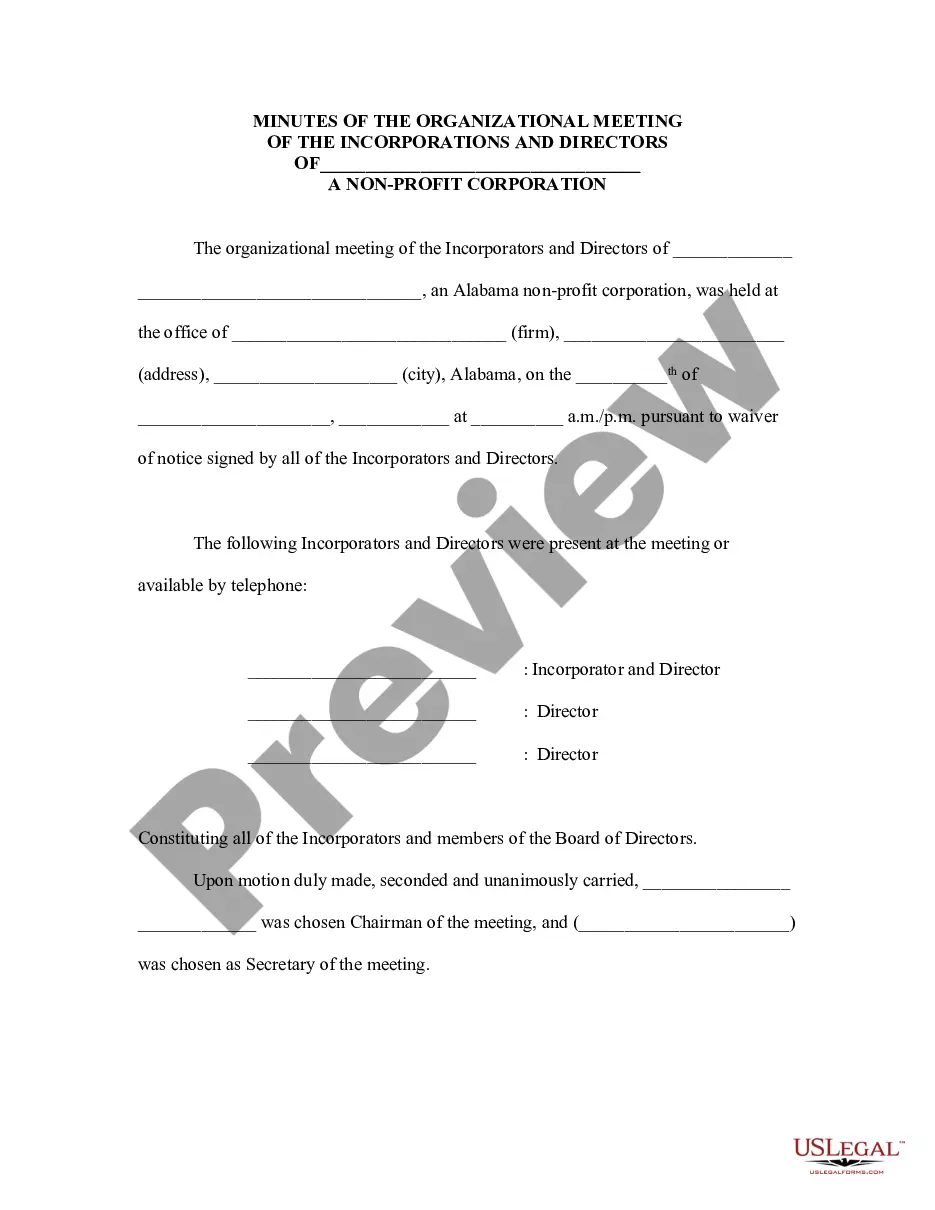

- Utilize the Review button to examine the document.

- Check the details to confirm you have selected the correct form.

- If the form is not what you need, use the Search field to find a form that meets your needs.

Form popularity

FAQ

The initial franchise tax in Louisiana is calculated based on the capital used or rendered in the state during the initial filing period. This tax forms a part of your corporate responsibilities when starting a business in Louisiana. To navigate these requirements smoothly, maintaining the Louisiana Minimum Checking Account Balance - Corporate Resolutions Form will facilitate proper financial management.

In Louisiana, the Net Operating Loss (NOL) can be carried forward for up to 20 years, but it cannot exceed the amount of income that can be offset. This limitation ensures that businesses remain compliant while also taking advantage of their operational losses. When creating your corporate resolutions, remember to consider the implications of the Louisiana Minimum Checking Account Balance - Corporate Resolutions Form.

Louisiana does not impose a specific tax on S Corporations. Instead, S Corporations are generally subject to income tax at the individual level for shareholders. If you operate an S Corporation, be sure to keep track of your finances, as managing the Louisiana Minimum Checking Account Balance - Corporate Resolutions Form is crucial for maintaining your business's financial health.

The primary form for corporate income tax returns in Louisiana is Form CIFT-620. This form allows corporations to report their taxable income and calculate their tax liability. Completing this form accurately is essential for any corporation, especially when maintaining the Louisiana Minimum Checking Account Balance - Corporate Resolutions Form during the process.

Yes, Louisiana imposes a minimum franchise tax on corporations. This tax is based on the company's capital employed in the state, not its income. As you handle your business's financial obligations, keeping in mind the Louisiana Minimum Checking Account Balance - Corporate Resolutions Form can help you maintain compliance and manage your funds effectively.

A corporate resolution for a bank account is a formal document that authorizes a specific individual or individuals to act on behalf of the corporation regarding its banking activities. This document outlines the powers granted, ensuring clarity and compliance with banking regulations. If you are concerned about establishing your Louisiana Minimum Checking Account Balance - Corporate Resolutions Form, this resolution is crucial for opening and managing corporate accounts. US Legal Forms offers templates and guidance to simplify this process.

Yes, you can set up a payment plan for Louisiana state taxes to help manage your tax obligations. The Louisiana Department of Revenue allows eligible taxpayers to schedule monthly payments to bring their tax accounts up to date. When addressing financial concerns, like your Louisiana Minimum Checking Account Balance - Corporate Resolutions Form, having a structured payment plan can provide peace of mind. US Legal Forms can assist you in finding the necessary documentation for your tax payments.

In Louisiana, you can typically go up to three years without paying property taxes before the property may be sold at a tax sale. However, it's essential to stay informed about local regulations, as the rules can vary by parish. If you are concerned about the impact on your Louisiana Minimum Checking Account Balance - Corporate Resolutions Form, consider taking proactive steps to manage your finances. Platforms like US Legal Forms can help you access resources and forms to stay compliant.

As previously mentioned, the corporate tax rate for 2025 in Louisiana will likely mirror current rates unless changes are enacted. The structure remains important for budgeting and financial planning for your business. Utilizing the Louisiana Minimum Checking Account Balance - Corporate Resolutions Form will help clarify your corporate tax situation as you move forward.

To determine your outstanding balance with Louisiana revenue, you can access the Louisiana Department of Revenue's online services. By entering basic information, you can quickly obtain details on your tax liabilities. Additionally, incorporating the Louisiana Minimum Checking Account Balance - Corporate Resolutions Form can help you keep accurate records and ensure timely payments.