Louisiana Salesperson Contract - Percentage Contract - Asset Purchase Transaction

Description

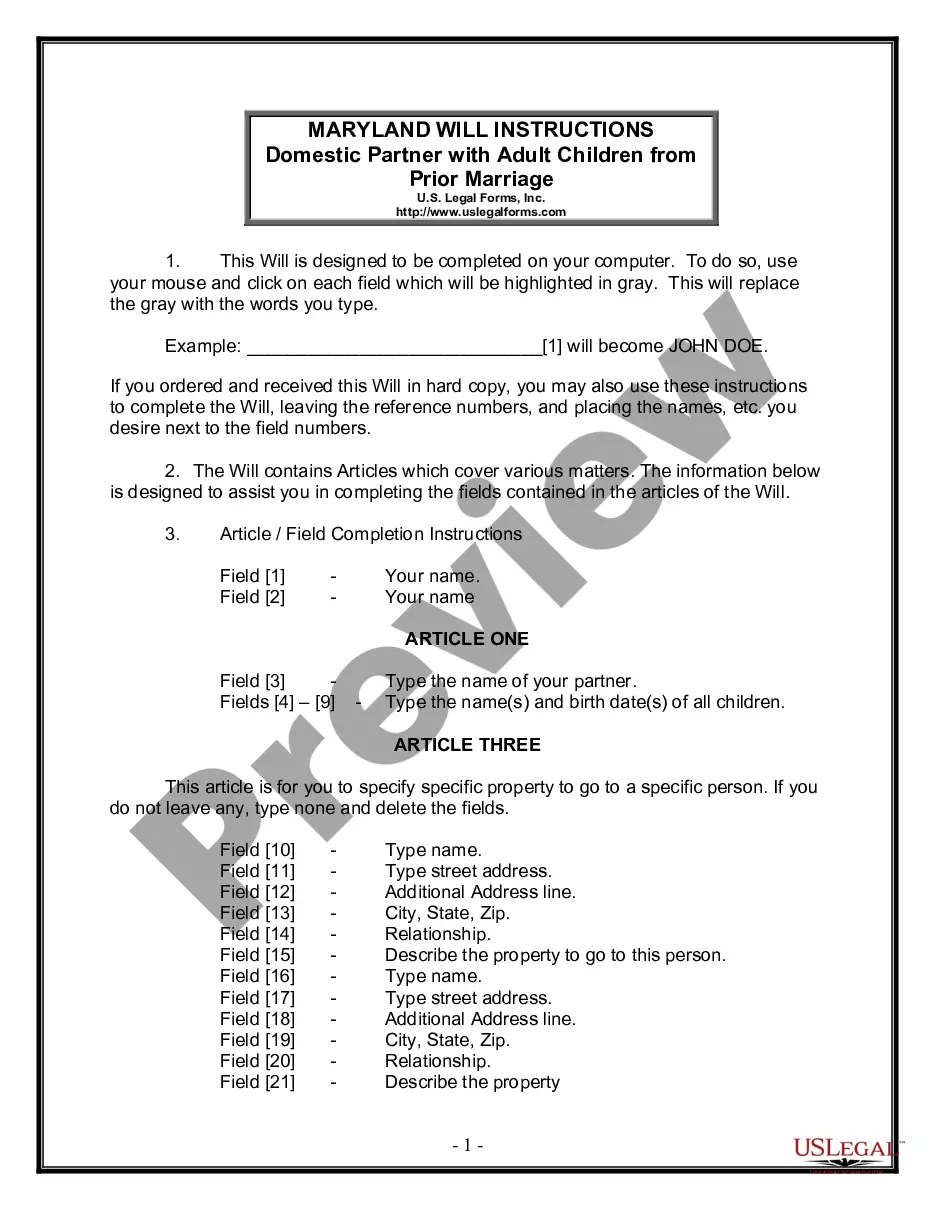

How to fill out Salesperson Contract - Percentage Contract - Asset Purchase Transaction?

Are you currently situated in a location where you need documents for either professional or personal reasons on a daily basis.

There is a variety of legal document templates accessible online, but locating reliable ones isn’t easy.

US Legal Forms offers a vast array of form templates, such as the Louisiana Salesperson Agreement - Commission Contract - Asset Acquisition Transaction, designed to comply with federal and state regulations.

Select the pricing plan you desire, complete the required information to create your account, and finalize the purchase using your PayPal or Visa or Mastercard.

Choose a suitable document format and download your copy. Retrieve all the document templates you have purchased in the My documents section. You can obtain another copy of the Louisiana Salesperson Agreement - Commission Contract - Asset Acquisition Transaction at any time if needed. Just select the required form to download or print the document template. Leverage US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Louisiana Salesperson Agreement - Commission Contract - Asset Acquisition Transaction template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/county.

- Utilize the Review option to assess the form.

- Read the description to confirm that you have selected the correct document.

- If the form is not what you need, use the Search area to find the form that fits your requirements.

- When you find the appropriate form, just click Purchase now.

Form popularity

FAQ

A comprehensive contract between a buyer and a seller should include essential components such as the identities of both parties, a thorough description of the asset, payment terms, and any contingencies. It's also important to outline dates for performance and any applicable warranties. Proper documentation ensures clarity and legal standing for the agreement. Consider leveraging uslegalforms for templates that simplify creating a Louisiana Salesperson Contract, ensuring all necessary elements are included.

To create a valid contract, five requirements must be met: offer, acceptance, consideration, mutual consent, and legality. First, one party must make an offer that proposes terms. The other party must accept those terms fully. A lawful object and cause must be present, ensuring the agreement adheres to legal standards. These requirements apply to various types of agreements, including the Louisiana Salesperson Contract and asset transactions.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

Generally, in an asset purchase, the purchasing company is not liable for the seller's debts, obligations and liabilities. But there are exceptions, such as when the buyer agrees to assume the debts, obligation or liabilities in exchange for a lower sales price, for example.

Transfer (assignment) of contracts. If shares in a company are being sold, then the contracts that the company has with third parties will not need to be changed. However, if assets are being sold, then contracts will need to be assigned or novated (different types of transfer) to the buyer.

In an asset sale the target's contracts are transferred to the buyer by means of assigning the contracts to the buyer. The default rule is generally that a party to a contract has the right to assign the agreement to a third party (although the assigning party remains liable to the counter-party under the agreement).

In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.