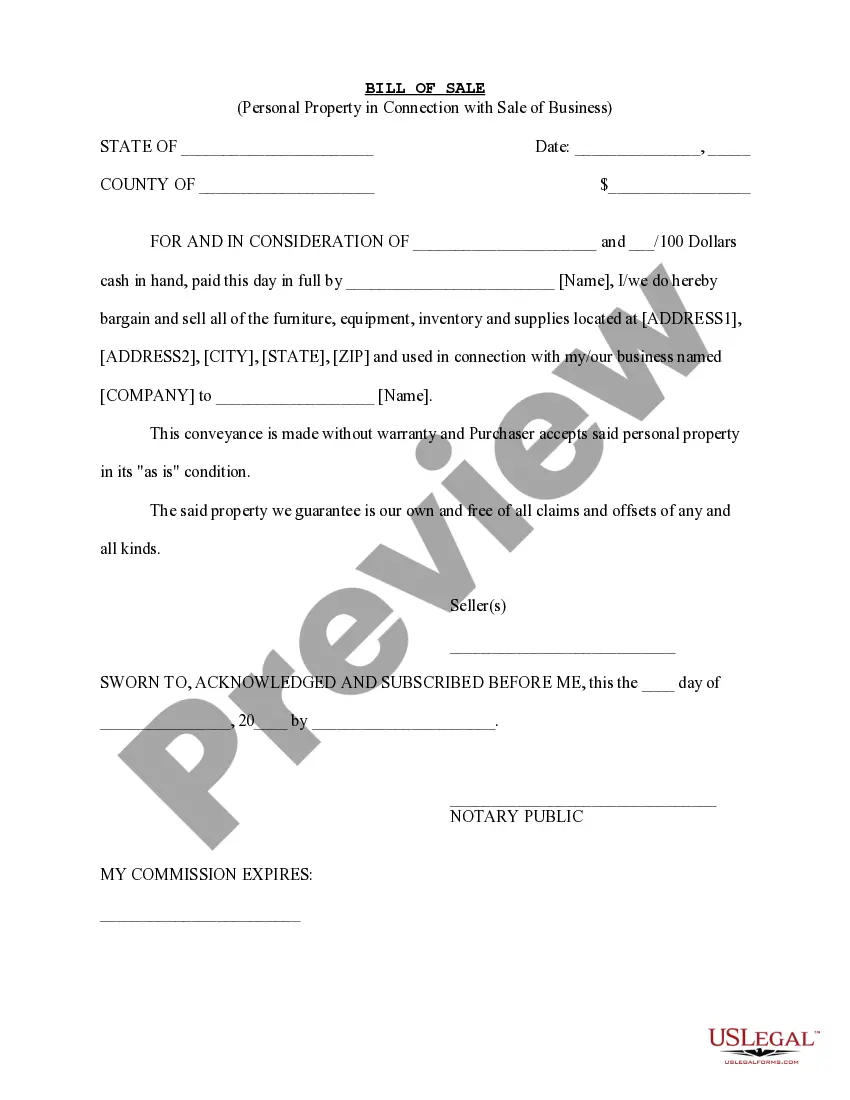

Louisiana Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

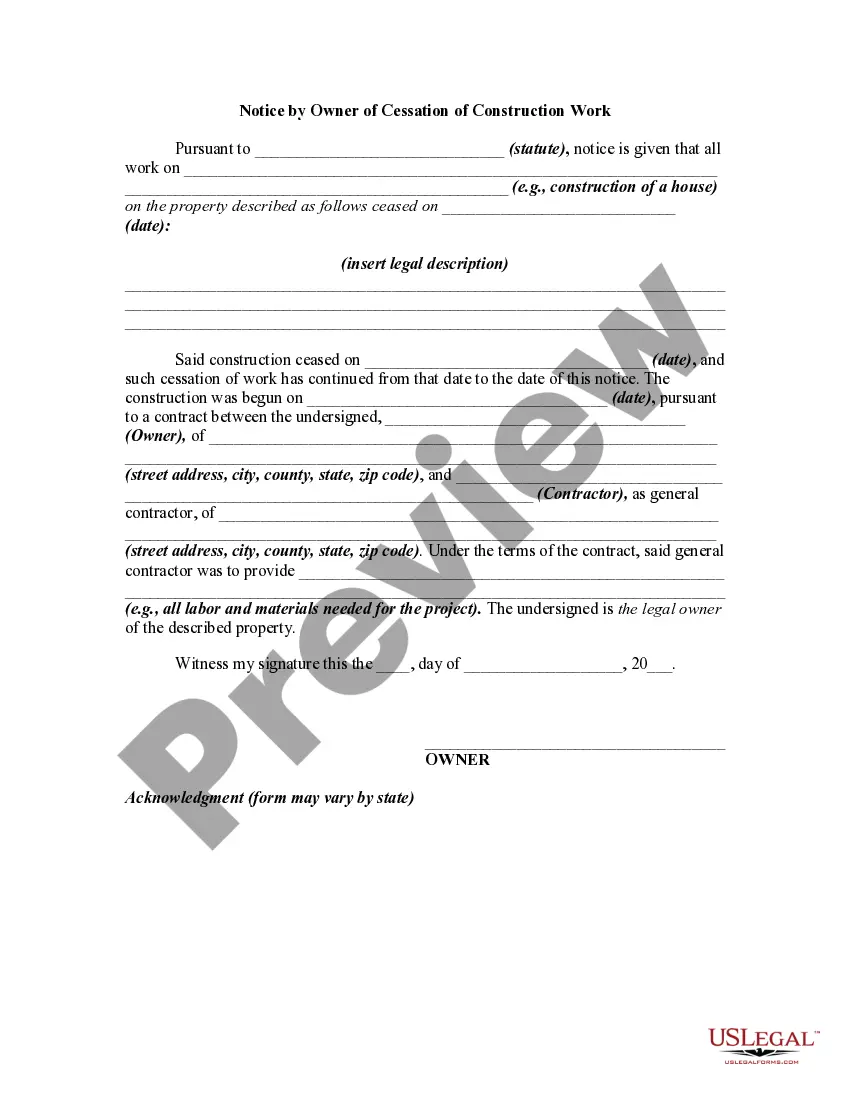

How to fill out Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

US Legal Forms - one of the foremost collections of legal documents in the USA - offers a vast selection of legal document templates you can purchase or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest forms such as the Louisiana Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction within moments.

Read the form description to ensure you have chosen the correct form.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have a subscription, sign in and obtain the Louisiana Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction from your US Legal Forms library.

- The Download option will be available for every form you view.

- You can access all previously saved forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your city/state. Click on the Review option to examine the form's details.

Form popularity

FAQ

Yes, Louisiana does impose a sales tax on out-of-state purchases, particularly for goods brought into the state for use. If you buy an item from another state and bring it back to Louisiana, you may owe sales tax on that item. Understanding these rules can help you avoid unexpected costs, especially during a Louisiana sale of business involving significant assets.

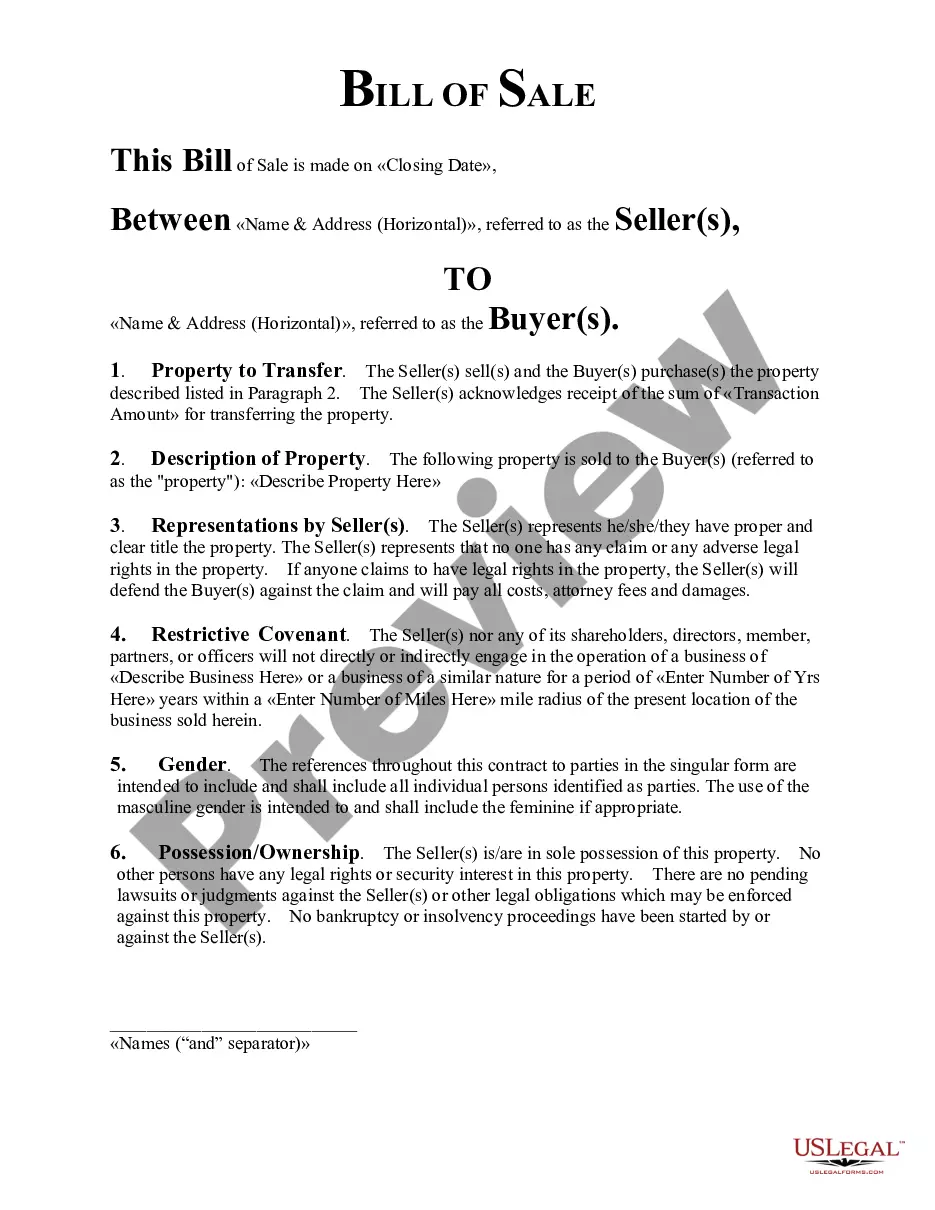

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

An asset sale involves the purchase of some or all of the assets owned by a company. Examples of common assets which are sold include; plant and equipment, land, buildings, machinery, stock, goodwill, contracts, records and intellectual property (including domain names and trademarks).

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

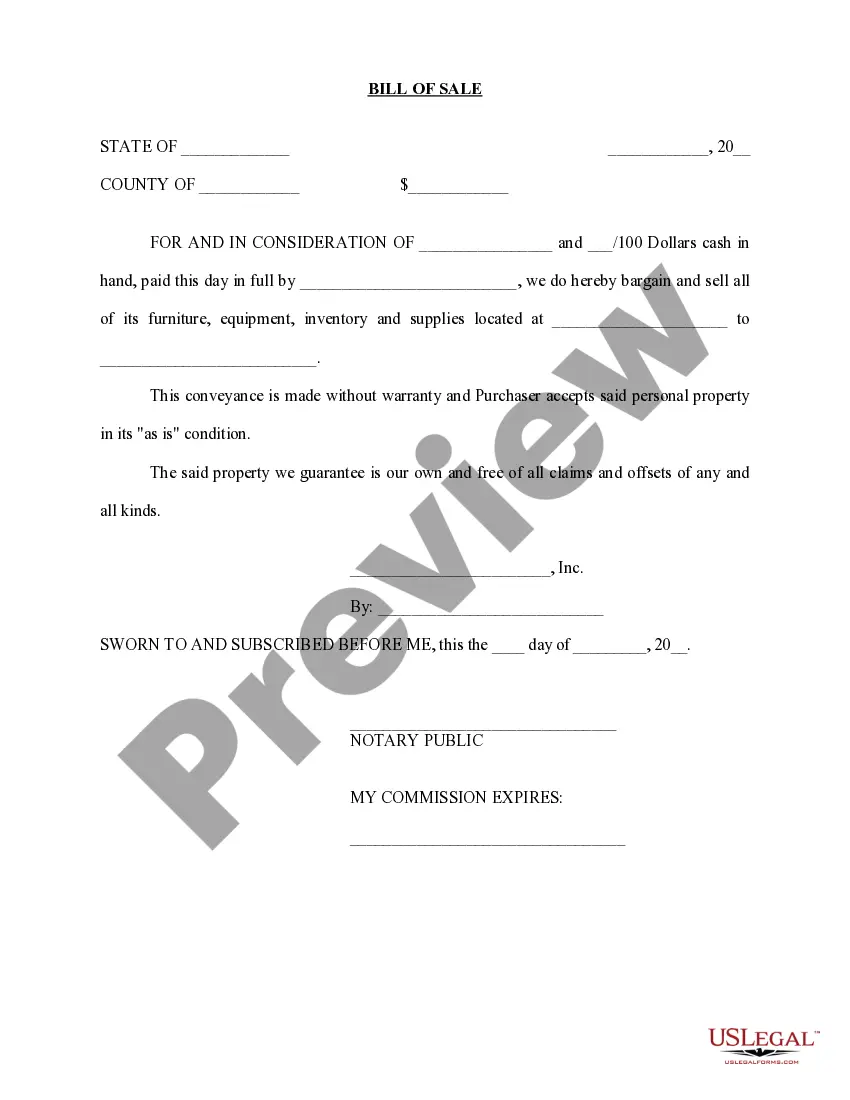

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

A business usually has many assets. When sold, these assets must be classified as capital assets, depreciable property used in the business, real property used in the business, or property held for sale to customers, such as inventory or stock in trade. The gain or loss on each asset is figured separately.