This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Louisiana Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

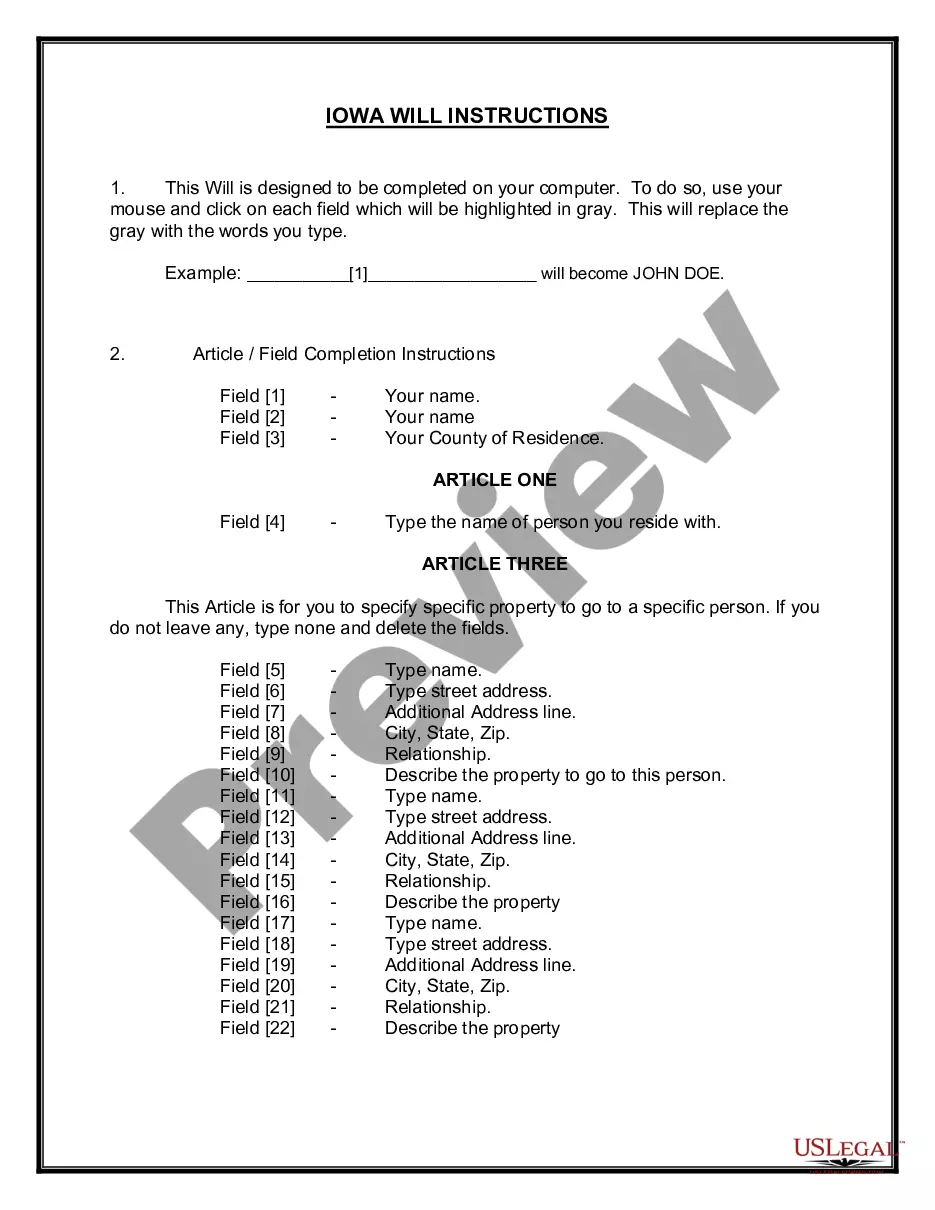

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

Are you presently in a situation where you will require documentation for either business or personal purposes almost every time.

There are numerous authentic document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers a vast array of form templates, such as the Louisiana Application for Release of Right to Redeem Property from IRS After Foreclosure, which are designed to meet state and federal standards.

If you find the right form, simply click Purchase now.

Choose the pricing plan you want, fill in the required information to create your account, and complete your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Louisiana Application for Release of Right to Redeem Property from IRS After Foreclosure template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

- Use the Preview button to check the form.

- Examine the details to ensure that you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that meets your needs and requirements.

Form popularity

FAQ

The Form 14135 is a crucial document used to apply for a certificate of discharge of property from a federal tax lien. This form is essential for individuals seeking to remove a tax lien from their property, which can be particularly helpful in situations involving the Louisiana Application for Release of Right to Redeem Property from IRS After Foreclosure. By obtaining this certificate, you can clear your property title, allowing for better financial opportunities and peace of mind. Uslegalforms can assist you in preparing and submitting this form correctly, ensuring you navigate the process smoothly.

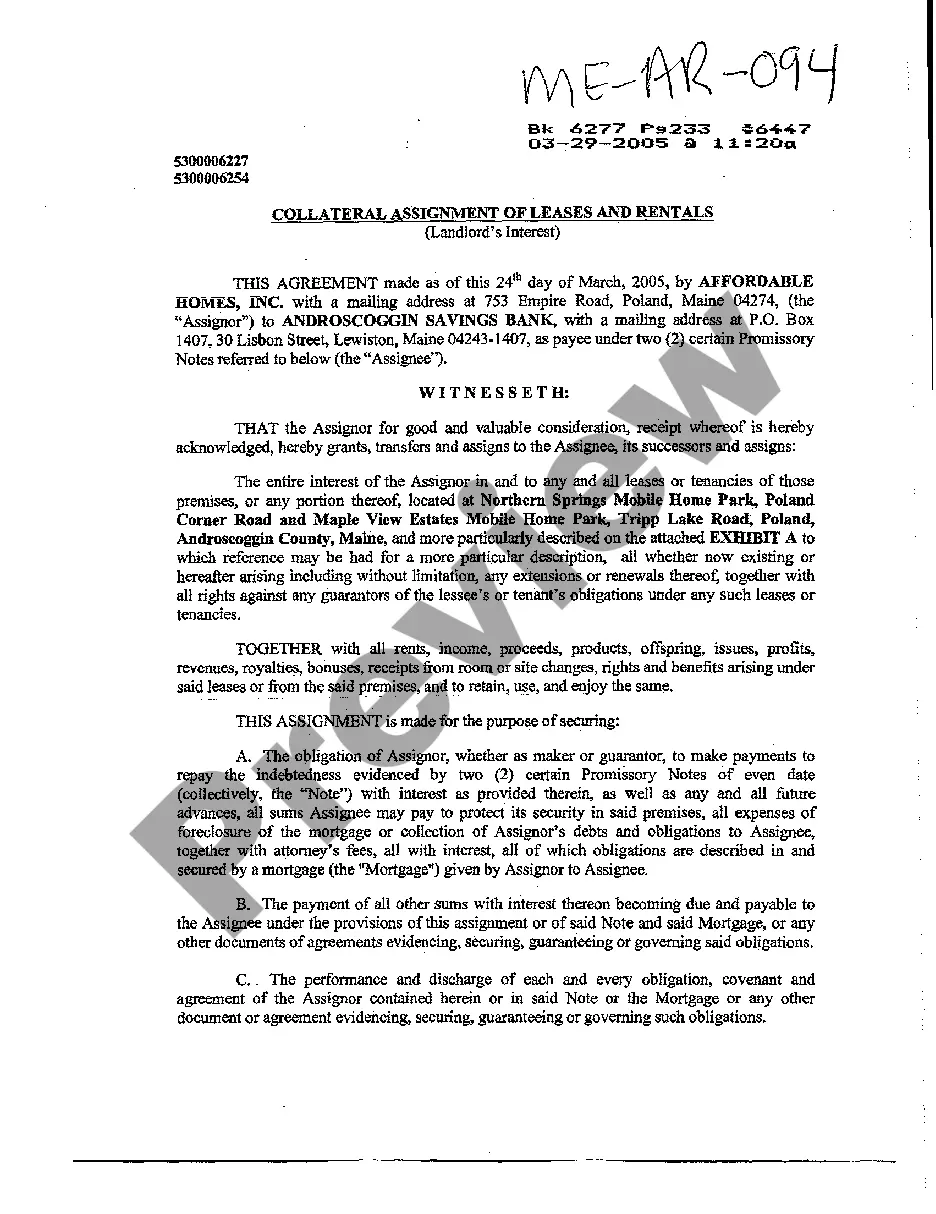

After a foreclosure, the federal tax lien typically remains attached to the property unless it is formally released. This means that even after the property is sold, the IRS can still pursue the lien holder for any outstanding tax obligations. For those dealing with a Louisiana Application for Release of Right to Redeem Property from IRS After Foreclosure, knowing how to handle the lien is vital to protect your interests. Consulting with experts or using services like USLegalForms can help clarify the process.

To obtain a lien payoff from the IRS, you need to request a payoff amount for your federal tax lien. Start by contacting the IRS directly or submitting Form 668(Z), which is the Request for a Certificate of Release of Federal Tax Lien. This process is crucial if you are considering a Louisiana Application for Release of Right to Redeem Property from IRS After Foreclosure. Utilizing platforms like USLegalForms can simplify the paperwork and ensure you have the correct forms.

If your real estate was seized and sold, you have redemption rights. You or anyone with an interest in the property may redeem your real estate within 180 days after the sale. This includes: your heirs, executors, administrators.

Completing Form 14135 Your personal information: Be sure to enter the information as it appears on the Notice of Federal Tax Lien. Your representative's information (attach Form 2848, Power of Attorney) Information about your lender or finance company. A description and appraisal of the property.

Equity of redemption (also termed right of redemption or equitable right of redemption) is a defaulting mortgagor's right to prevent foreclosure proceedings on the property and redeem the mortgaged property by discharging the debt secured by the mortgage within a reasonable amount of time (thereby curing the default).

Help Resources. Centralized Lien Operation ? To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

If the IRS tax lien is junior to the mortgage being foreclosed, the IRS tax lien will be foreclosed through the judicial sale and the lien on the property will be extinguished after the judicial deed is issued.

The right of redemption allows homeowners to keep their homes if they pay back what they owe even after their lender starts the foreclosure process or puts the home up for sale at public auction.

Discharge means the IRS removes the lien from property so that it may transfer to the new owner free of the lien. Use Form 14135. Subordination means the IRS gives another creditor the right to be paid before the tax lien is paid.