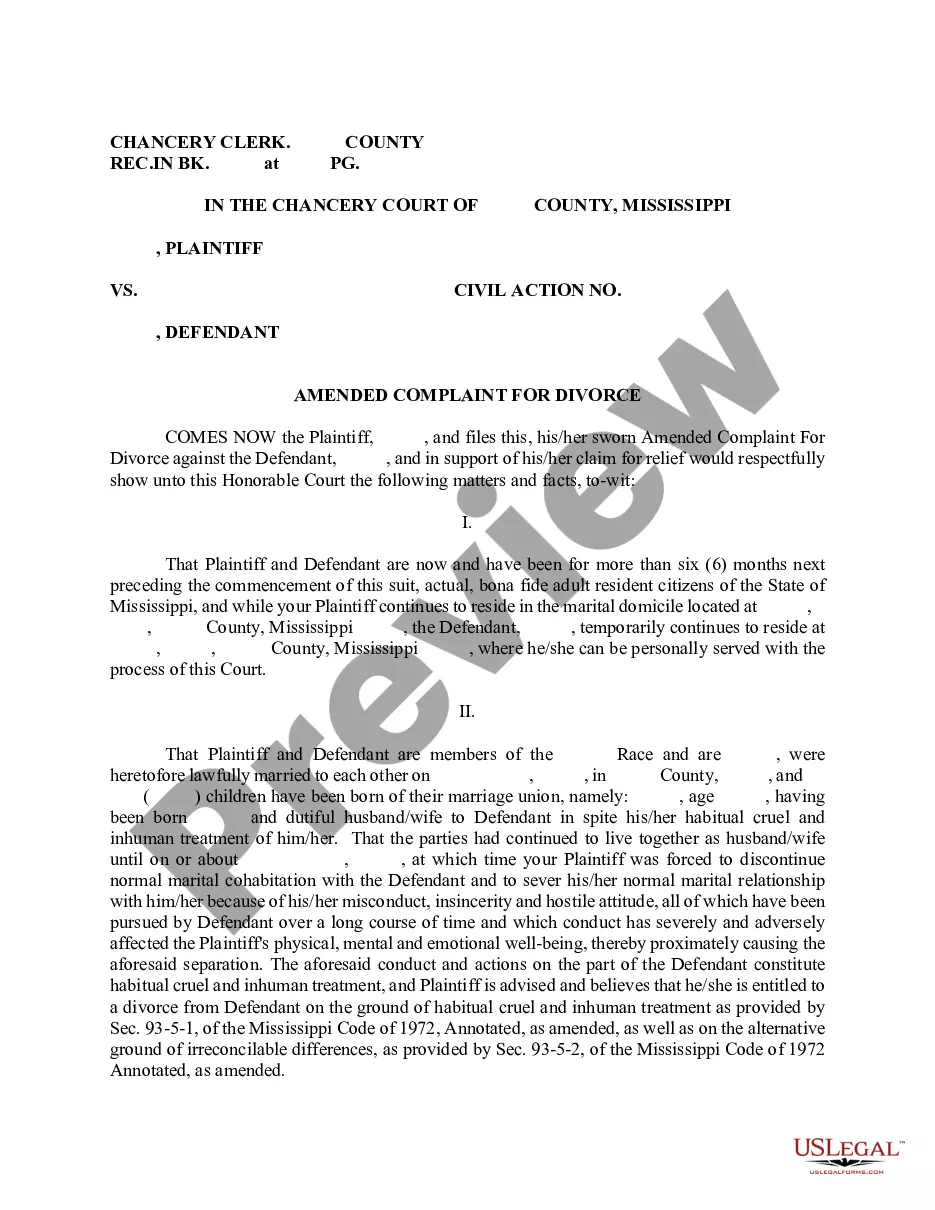

The Louisiana Order Recognizing Right To Social Security Offset is a legally binding document issued by the Louisiana Court System. This document gives permission for a state agency to reduce the amount of certain benefit payments to an individual due to their receipt of Social Security benefits. This order helps to ensure that individuals who are receiving Social Security benefits are not receiving more than their fair share of public assistance. The Louisiana Order Recognizing Right To Social Security Offset is divided into three types: 1. The Right to Claim Social Security Offset: This order gives the state agency permission to reduce the amount of benefits a person receives if they are eligible for Social Security benefits. 2. The Right to Receive Social Security Benefits: This order allows the state agency to pay a person the full amount of their Social Security benefits even if they are receiving other public benefits. 3. The Right to Appeal Social Security Offset: This order gives an individual the right to appeal the decision of the state agency if they feel they have been unfairly treated when it comes to their Social Security benefits. The Louisiana Order Recognizing Right To Social Security Offset helps to ensure that individuals who are receiving Social Security benefits are not receiving more than their fair share of public assistance.

Louisiana Order Recognizing Right To Social Security Offset

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Order Recognizing Right To Social Security Offset?

Engaging with legal documents necessitates diligence, precision, and utilizing accurately-prepared templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, ensuring that when you select your Louisiana Order Recognizing Right To Social Security Offset template from our platform, it complies with federal and state regulations.

Using our platform is straightforward and quick. To access the necessary document, all you need is an account with an active subscription. Here’s a brief guide for you to acquire your Louisiana Order Recognizing Right To Social Security Offset in just minutes.

All documents are prepared for versatile use, similar to the Louisiana Order Recognizing Right To Social Security Offset you see on this page. If you require them later, you can complete them without additional payment - simply access the My documents tab in your profile and fill out your document whenever you need it. Experience US Legal Forms and efficiently manage your business and personal paperwork while ensuring complete legal adherence!

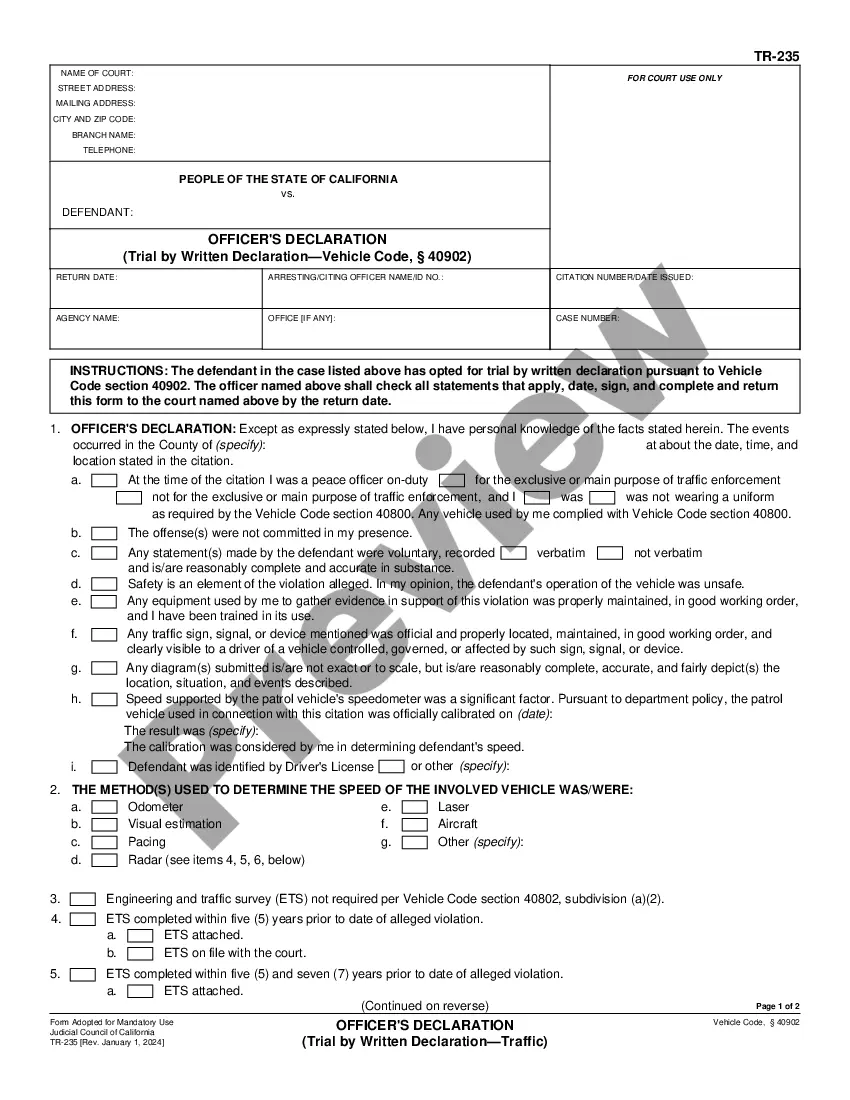

- Ensure to thoroughly review the form's content and its alignment with general and legal standards by previewing it or consulting its description.

- Look for a different official blank if the initial one does not correspond to your circumstances or state laws (the option for this is located at the top page corner).

- Sign in to your account and download the Louisiana Order Recognizing Right To Social Security Offset in your preferred format. If this is your initial experience with our service, click Buy now to continue.

- Establish an account, choose your subscription option, and make a payment using your credit card or PayPal account.

- Select the format in which you wish to receive your form and click Download. Print the document or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

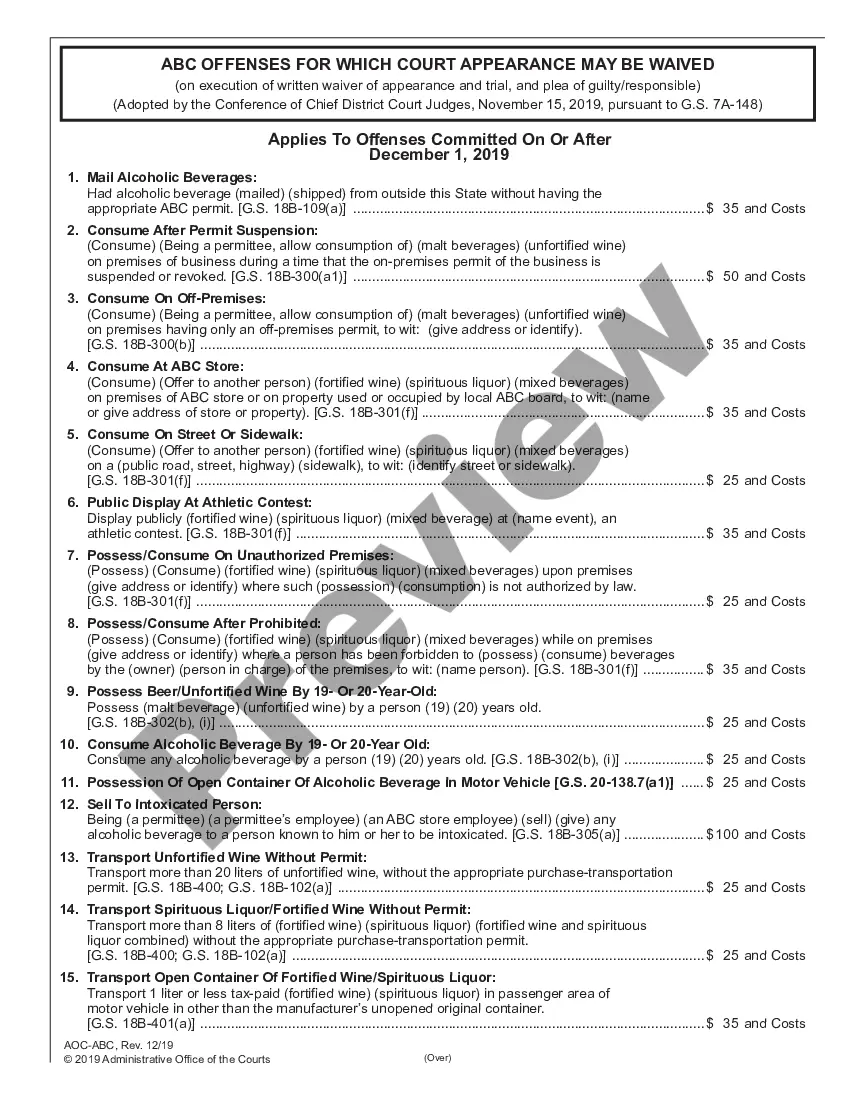

Offsets are provisions in your disability coverage that allow your insurer to deduct from your regular benefit other types of income you receive or are eligible to receive from other sources due to your disability.

Calculating the Offset After a Lump Sum Settlement The SSDI offset is fairly easy to calculate when you receive your workers' compensation in monthly installments: The total amount of each installment cannot exceed 80 percent of the worker's average pre-disability monthly wage.

Please call us at 1-800-621-3115 if you have any questions. This Statement of Financial Status form is in response to your request to stop or reduce the amount offset from your Social Security payments. In order to determine a payment amount that is affordable for you, you must complete and return the form.

We'll reduce your Social Security benefits by two-thirds of your government pension. In other words, if you get a monthly civil service pension of $600, two-thirds of that, or $400, must be deducted from your Social Security benefits.

WHAT IS WINDFALL OFFSET? If you are eligible for retroactive Supplemental Security Income (SSI) and Social Security benefits for the same month, we cannot pay you the full amount of both benefits for that month. We call this windfall offset.

80% of the worker's ?average current earnings,? or. the ?total family benefit? measured by the total amount of SSDI received by all of the members of the recipient's family in the first-month worker's compensation is received.

We'll reduce your Social Security benefits by two-thirds of your government pension. In other words, if you get a monthly civil service pension of $600, two-thirds of that, or $400, must be deducted from your Social Security benefits.

States with Reverse Offsets Aside from Louisiana, these states include: Alaska, California, Colorado, Florida, Minnesota, Montana, Nevada, New Jersey, New York, North Dakota, Ohio, Oregon, Washington, and Wisconsin. Each one of these states has its own specific laws allowing for a reduction in WCs benefits.